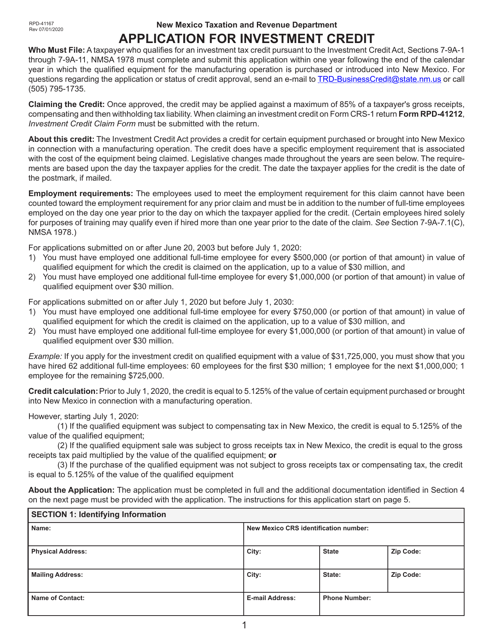

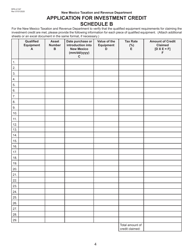

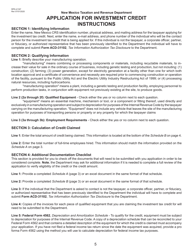

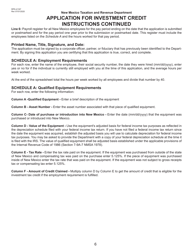

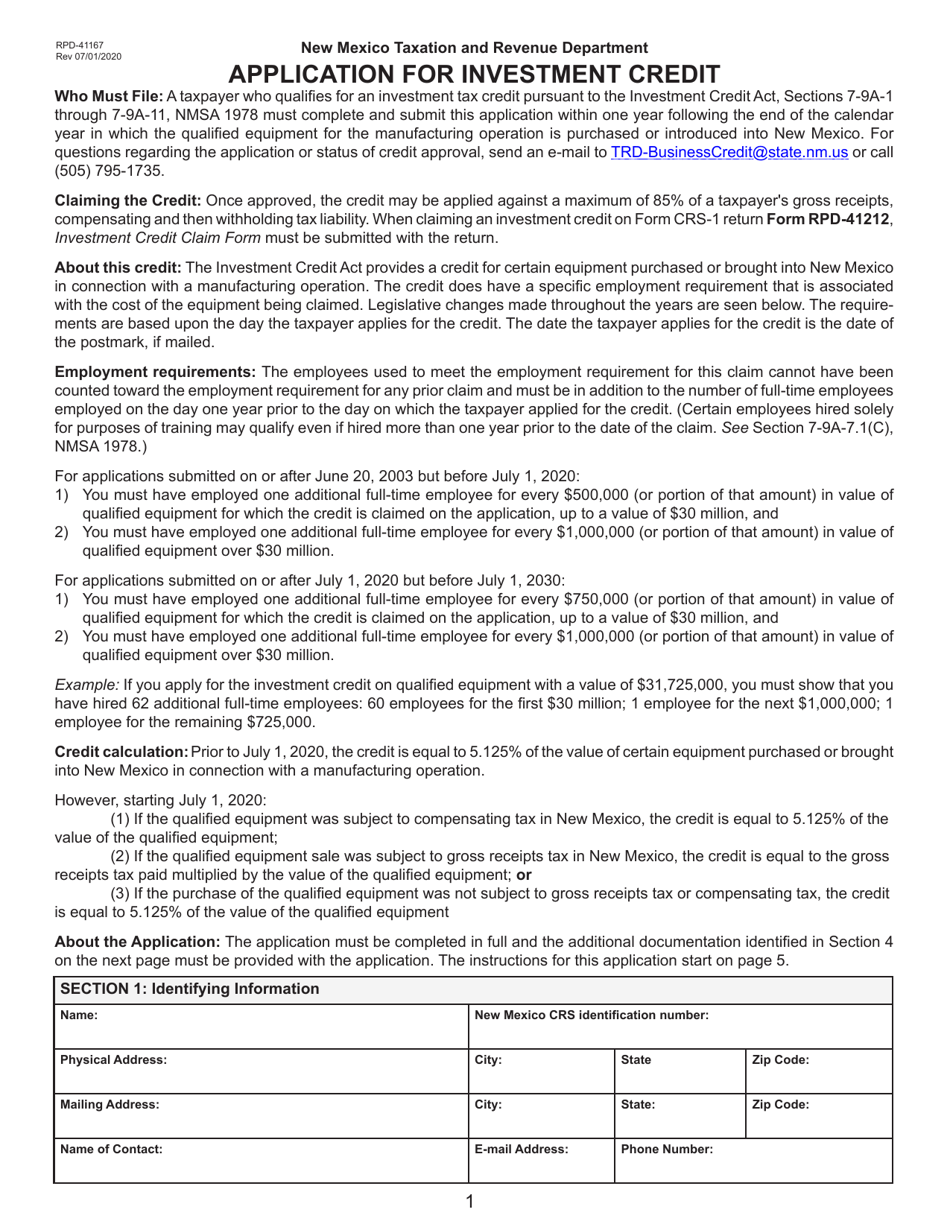

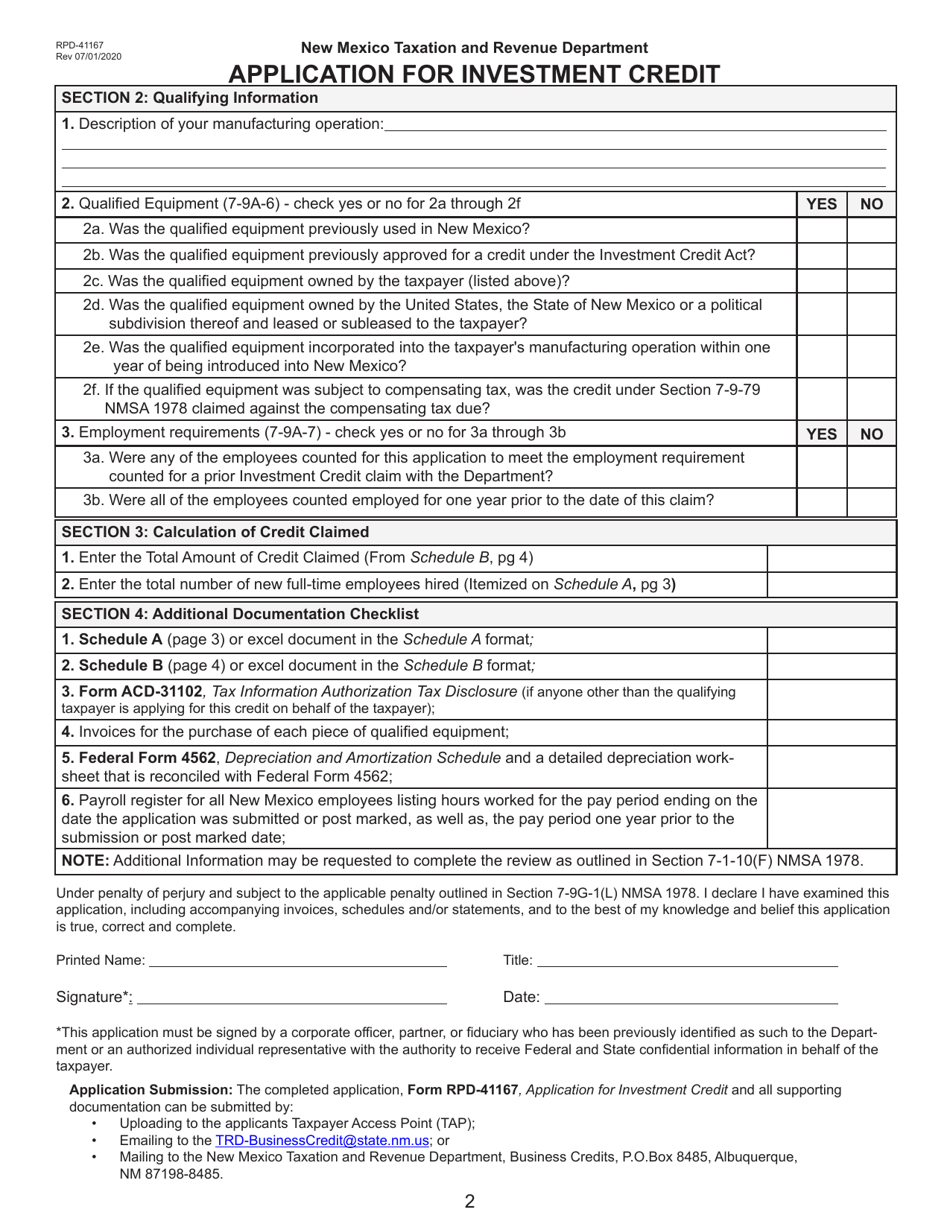

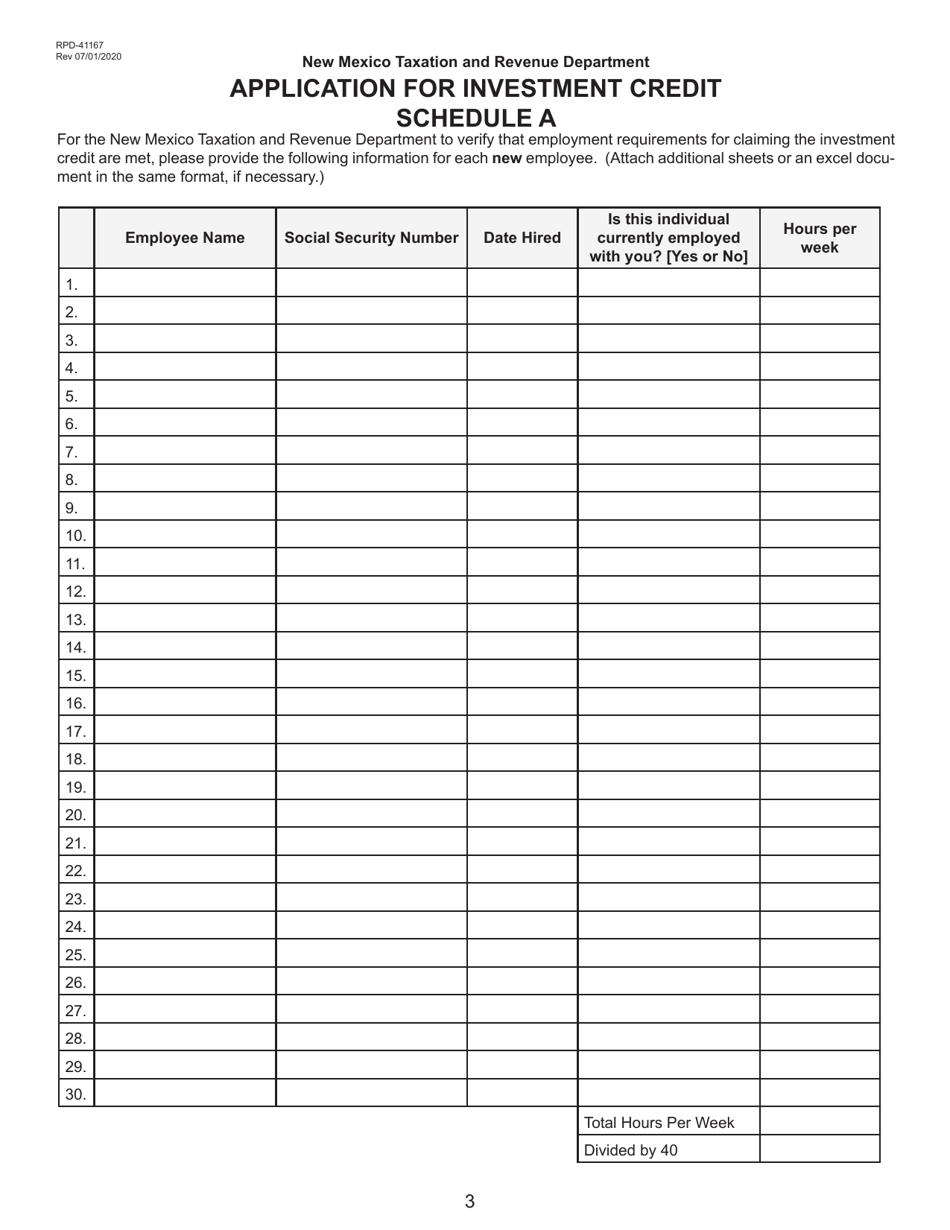

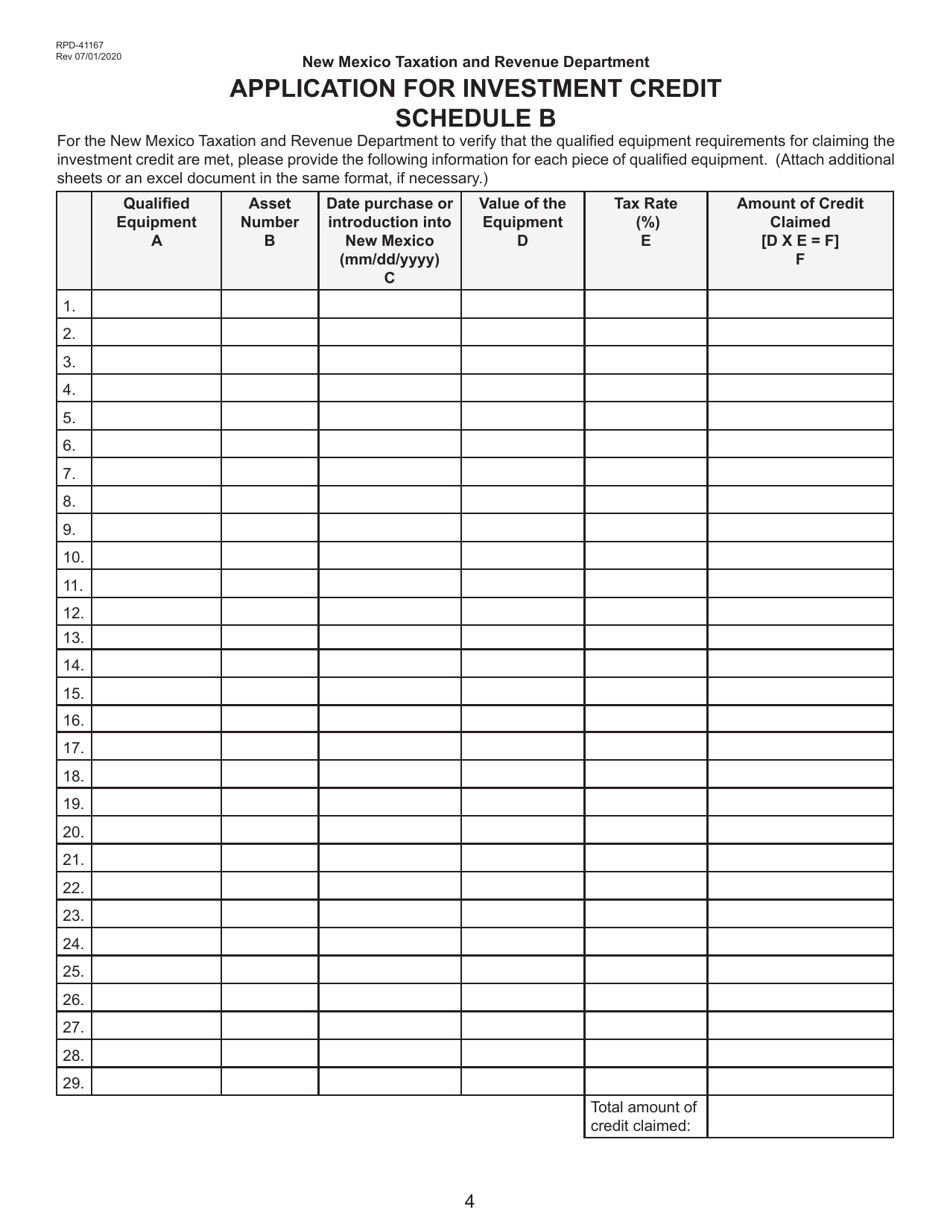

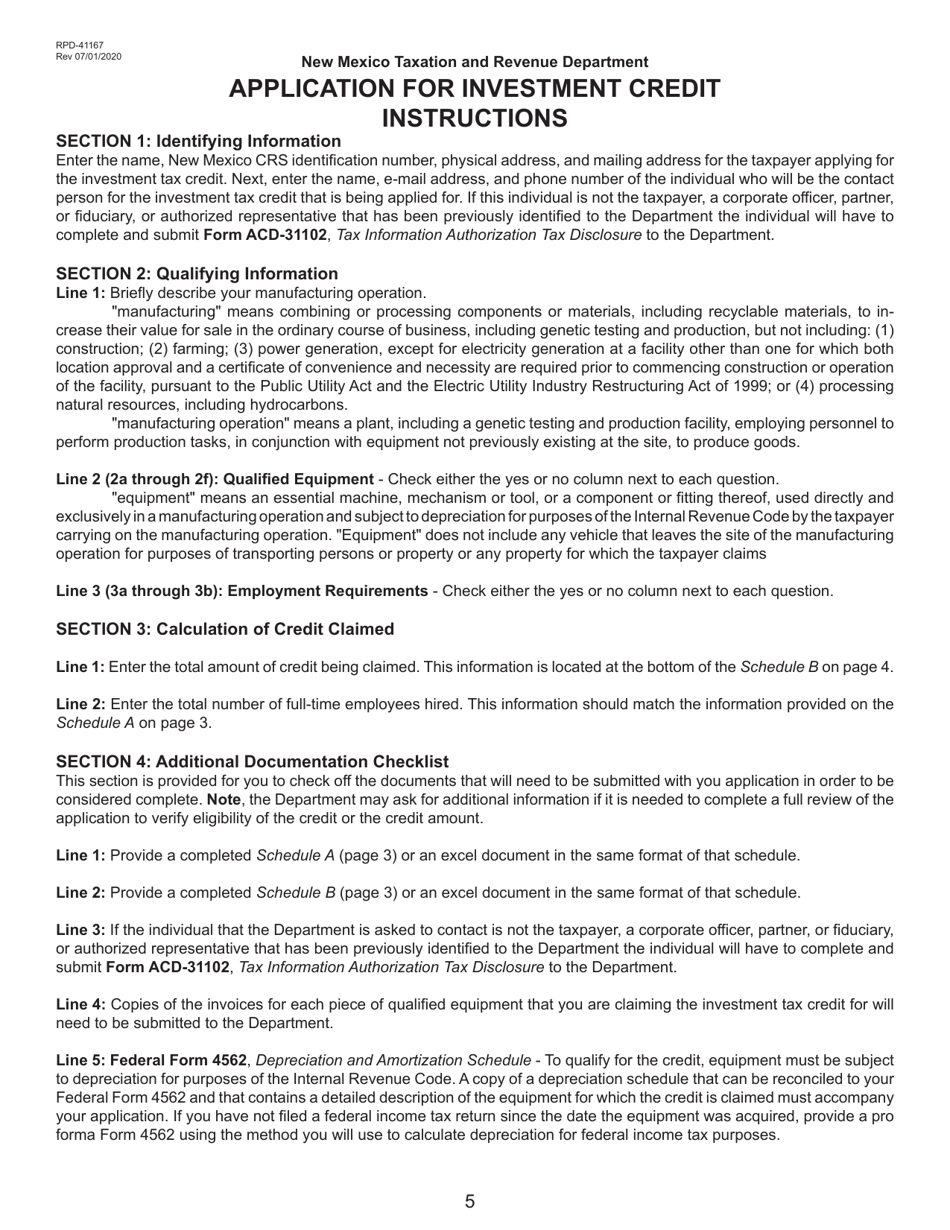

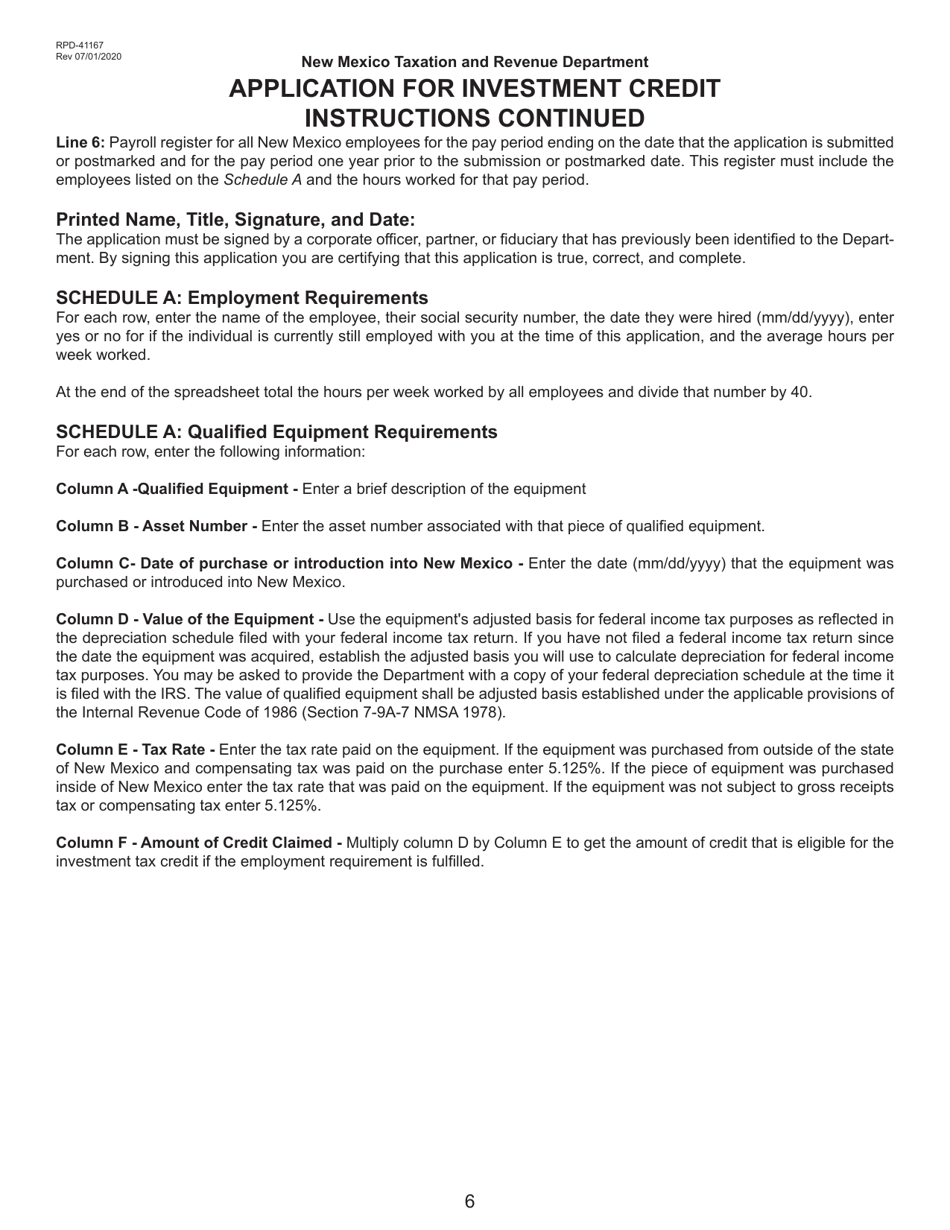

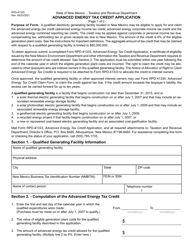

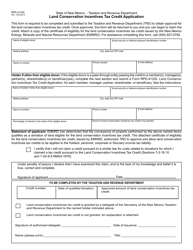

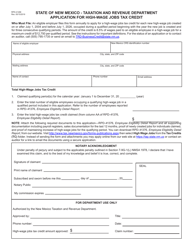

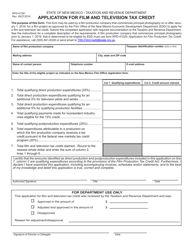

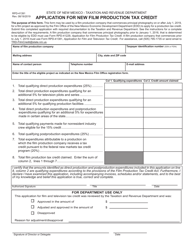

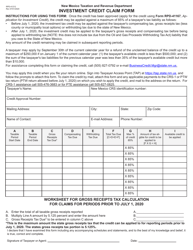

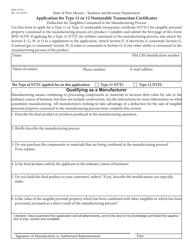

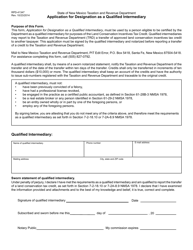

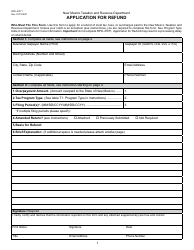

Form RPD-41167 Application for Investment Credit - New Mexico

What Is Form RPD-41167?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41167?

A: Form RPD-41167 is the application for investment credit in the state of New Mexico.

Q: What is the purpose of Form RPD-41167?

A: The purpose of Form RPD-41167 is to apply for investment credit in New Mexico.

Q: How do I obtain Form RPD-41167?

A: You can obtain Form RPD-41167 from the New Mexico Taxation and Revenue Department.

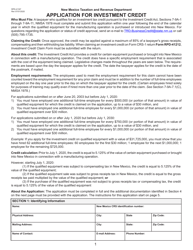

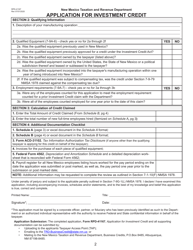

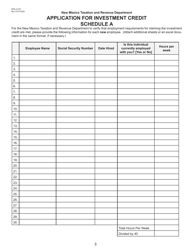

Q: What information is required on Form RPD-41167?

A: Form RPD-41167 requires you to provide information about your investment and its eligibility for the credit.

Q: Are there any fees for submitting Form RPD-41167?

A: There are no fees for submitting Form RPD-41167.

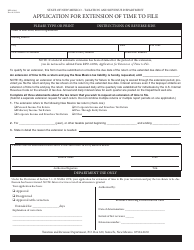

Q: Are there any filing deadlines for Form RPD-41167?

A: Yes, Form RPD-41167 must be filed by the due date specified by the New Mexico Taxation and Revenue Department.

Q: How long does it take to process Form RPD-41167?

A: The processing time for Form RPD-41167 varies and depends on the complexity of the application.

Q: Can I claim the investment credit if I don't complete Form RPD-41167?

A: No, Form RPD-41167 is required to claim the investment credit in New Mexico.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41167 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.