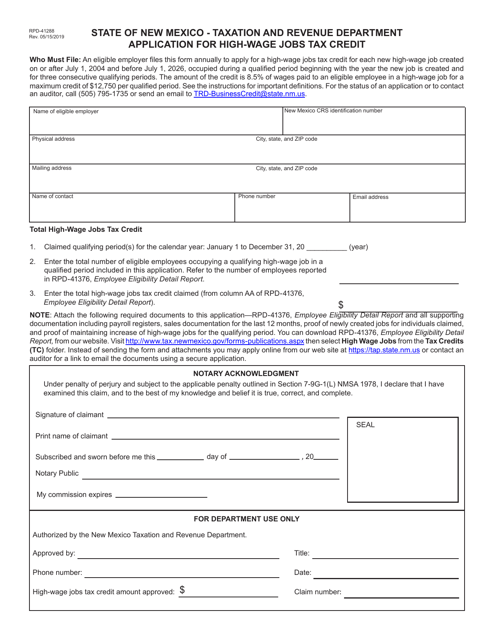

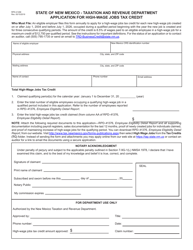

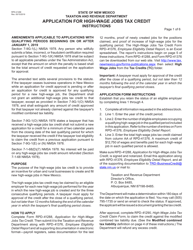

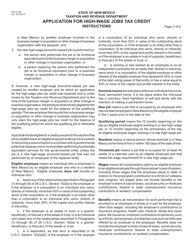

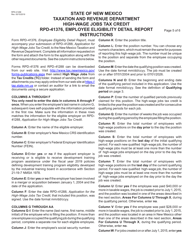

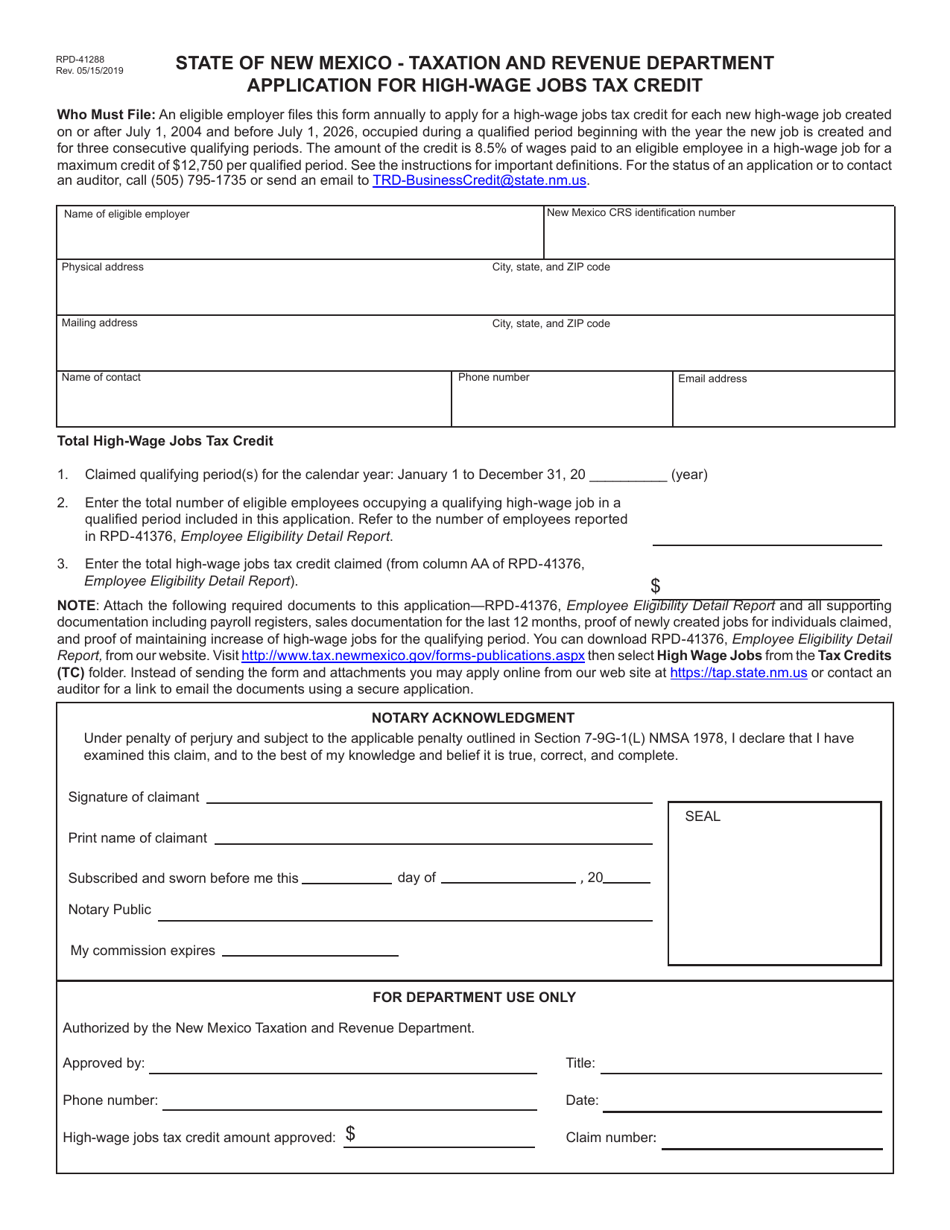

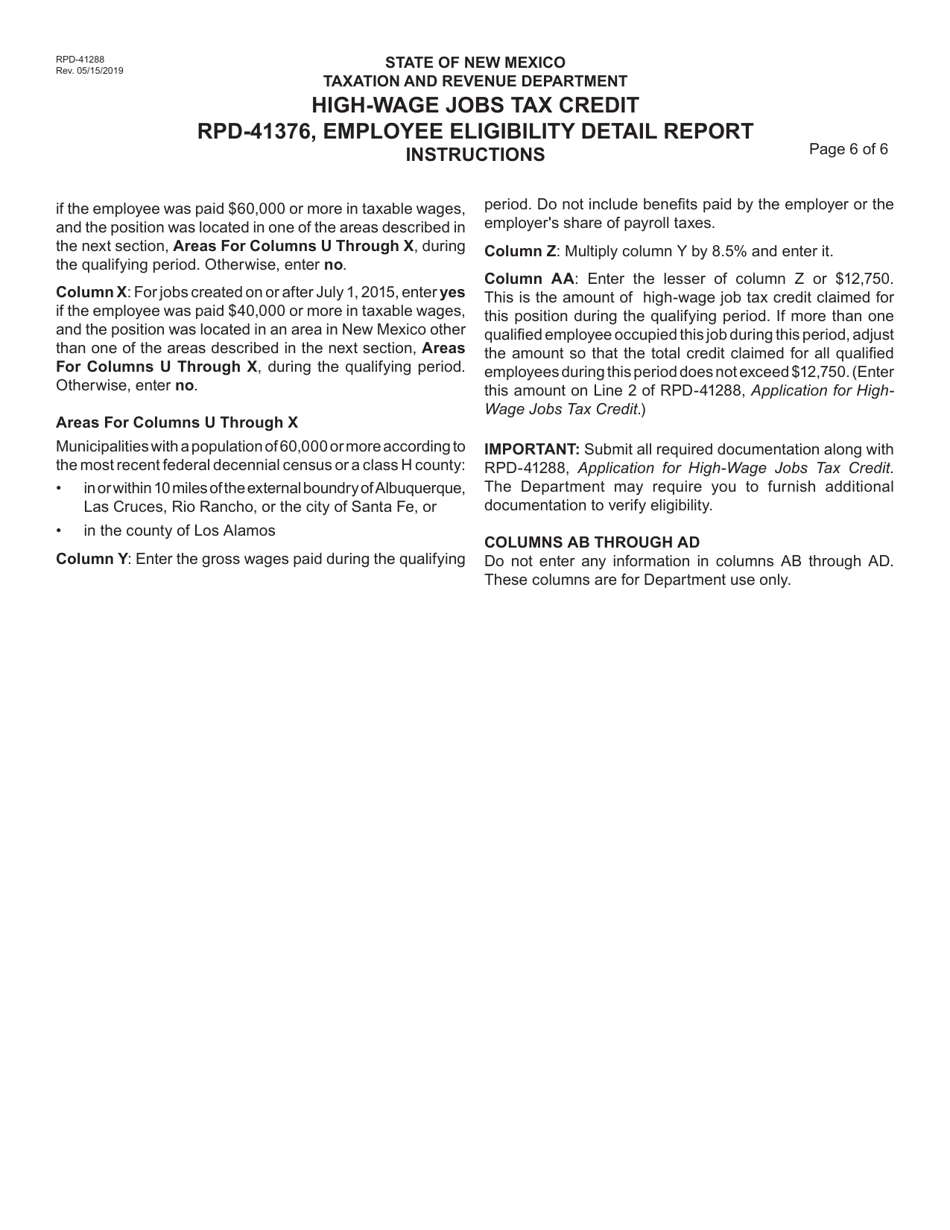

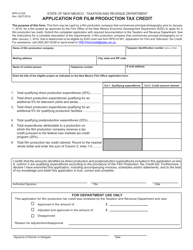

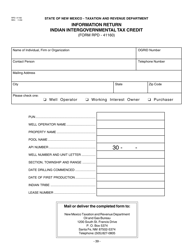

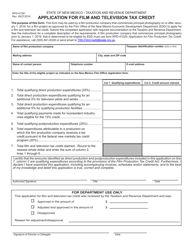

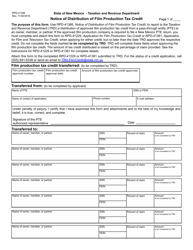

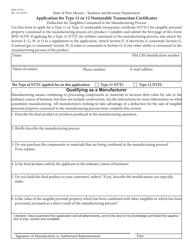

Form RPD-41288 Application for High-Wage Jobs Tax Credit - New Mexico

What Is Form RPD-41288?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

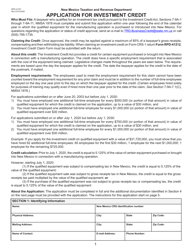

Q: What is Form RPD-41288?

A: Form RPD-41288 is the application for the High-Wage Jobs Tax Credit in New Mexico.

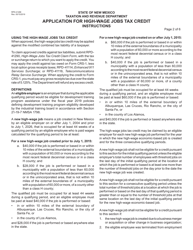

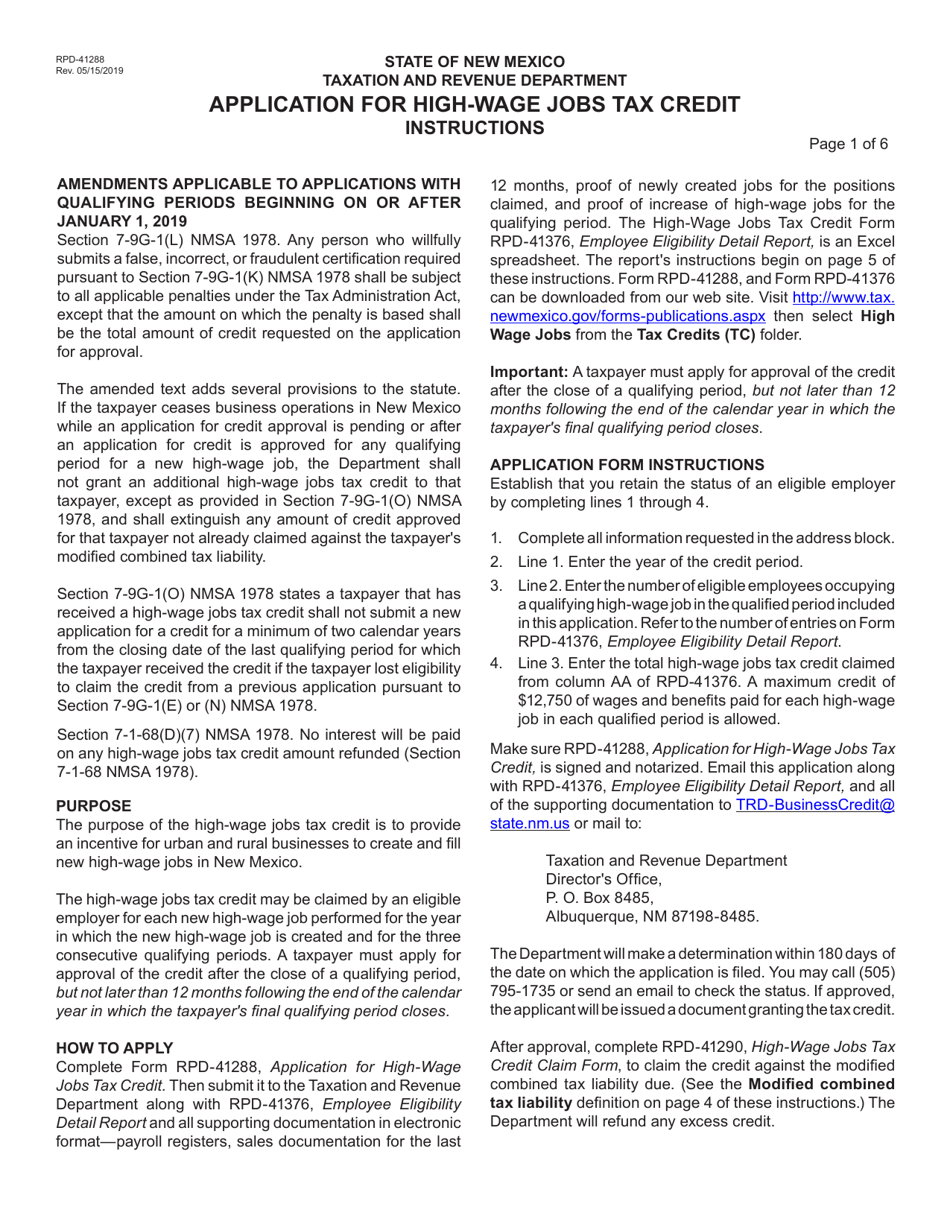

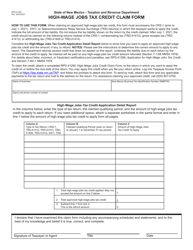

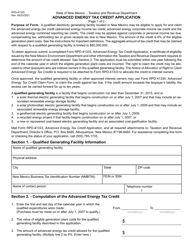

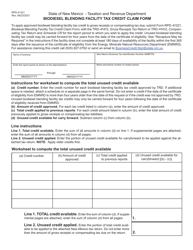

Q: What is the High-Wage Jobs Tax Credit?

A: The High-Wage Jobs Tax Credit is a tax credit offered in New Mexico to incentivize businesses to create high-wage jobs.

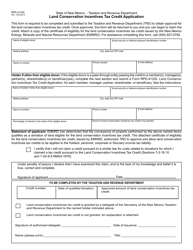

Q: Who can apply for the High-Wage Jobs Tax Credit?

A: Businesses in New Mexico that create high-wage jobs are eligible to apply for the tax credit.

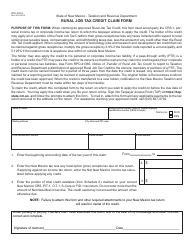

Q: What is considered a high-wage job?

A: A high-wage job is defined as a job that pays a wage higher than the average wage in the county where the job is located.

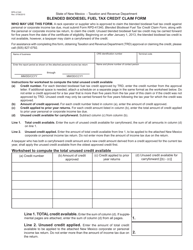

Q: How much is the High-Wage Jobs Tax Credit?

A: The tax credit is equal to a percentage of the wages paid to qualified high-wage employees.

Q: How long does the High-Wage Jobs Tax Credit last?

A: The tax credit is available for a period of up to four years for each qualified high-wage job created.

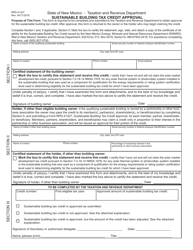

Q: What are the benefits of the High-Wage Jobs Tax Credit?

A: The tax credit can reduce a business's tax liability and lower their overall operating costs.

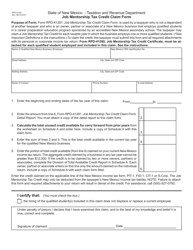

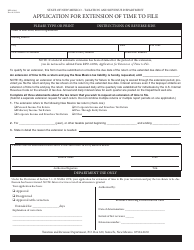

Q: Are there any deadlines for submitting Form RPD-41288?

A: Yes, there are specific deadlines for submitting the application. It is recommended to check the latest instructions for the form to determine the deadline.

Q: Are there any other requirements to qualify for the High-Wage Jobs Tax Credit?

A: Yes, there are additional requirements and criteria that businesses must meet to qualify for the tax credit. It is important to review the instructions and guidelines provided with the form.

Form Details:

- Released on May 15, 2019;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41288 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.