This version of the form is not currently in use and is provided for reference only. Download this version of

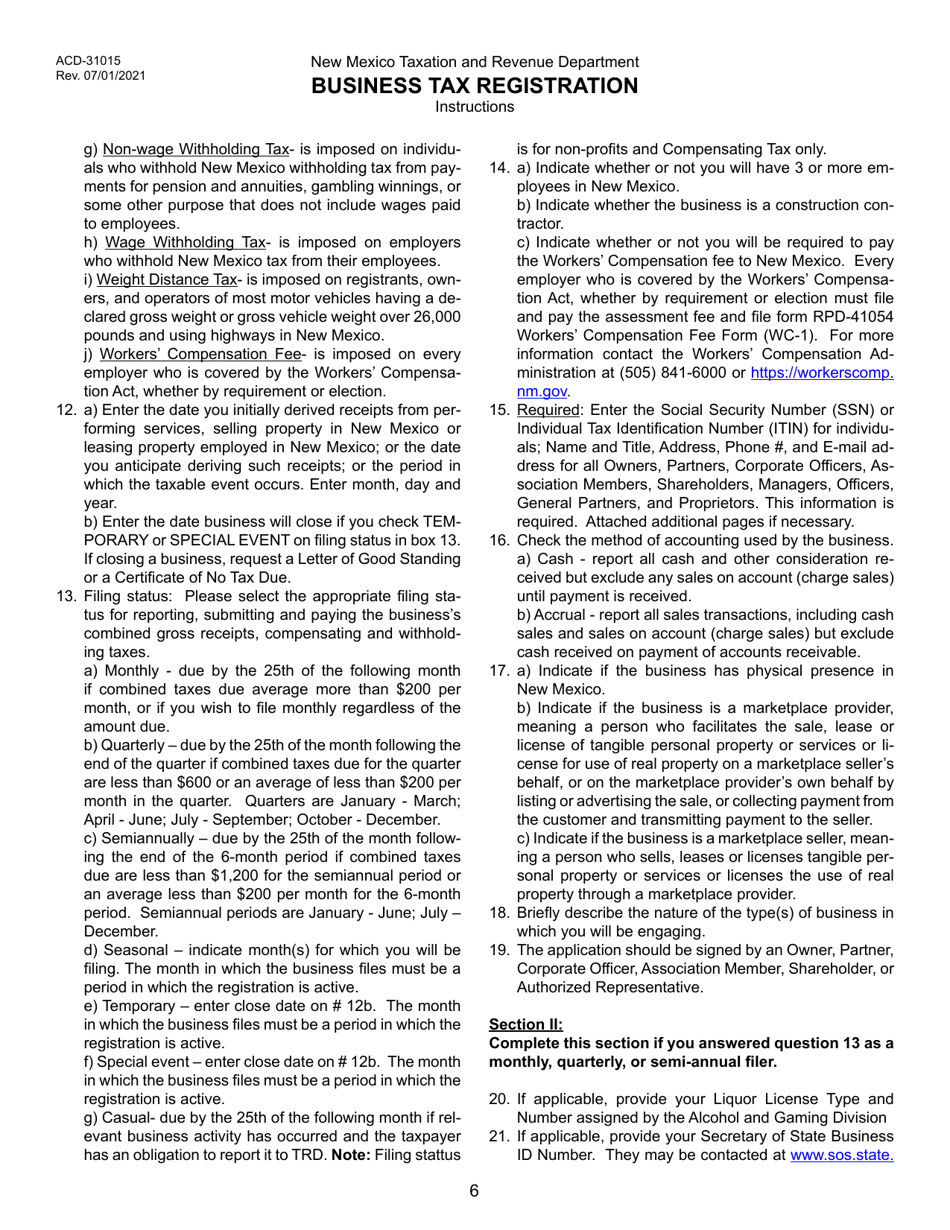

Form ACD-31015

for the current year.

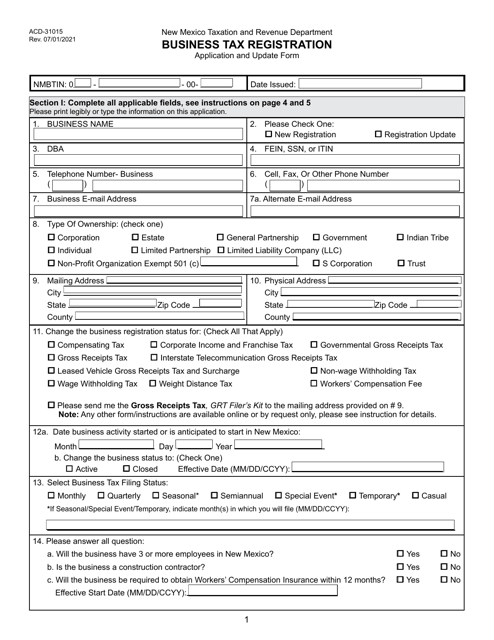

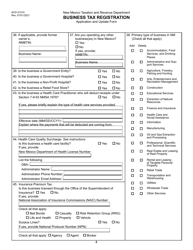

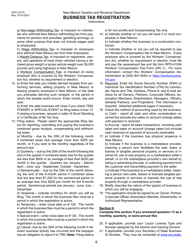

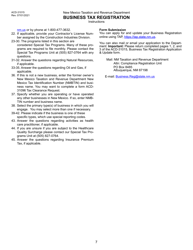

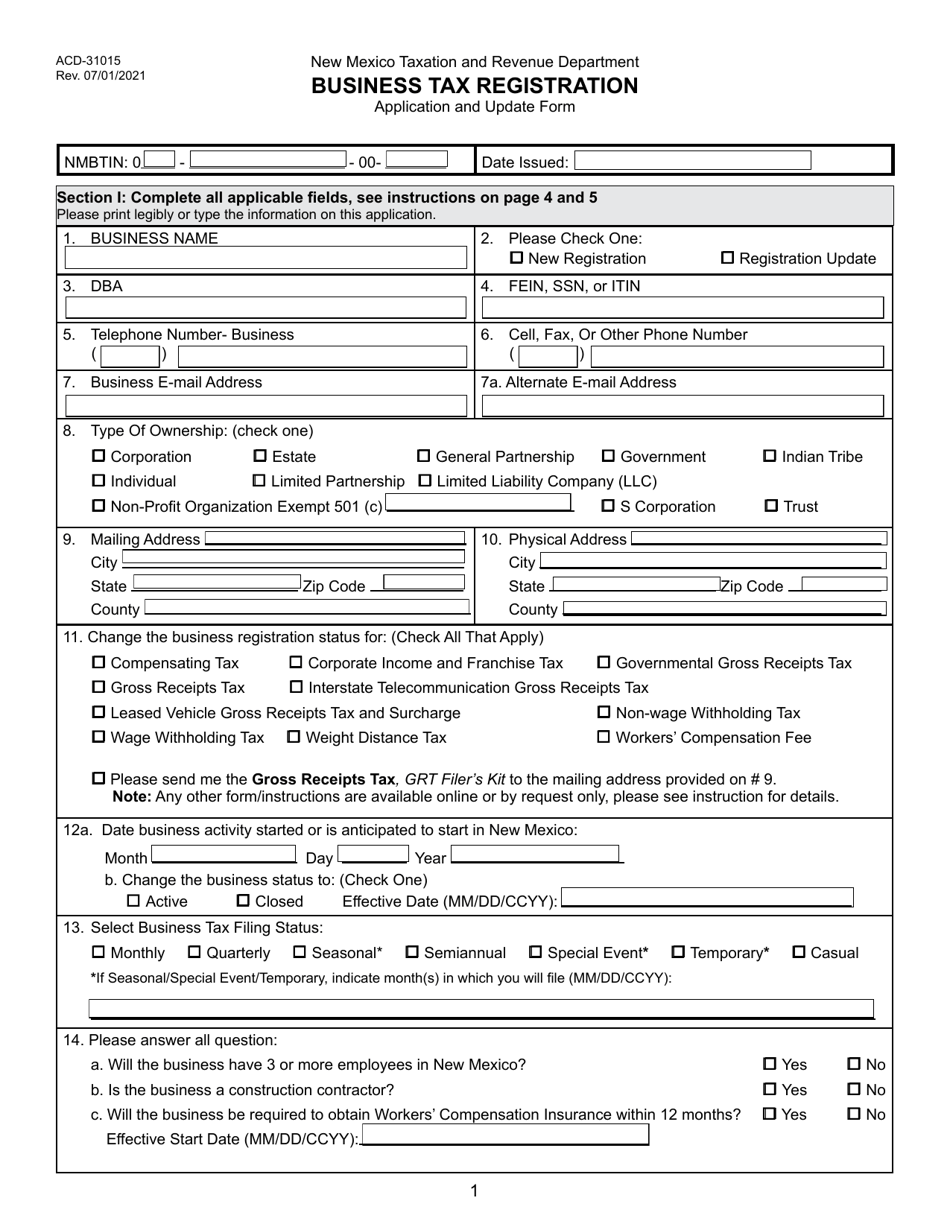

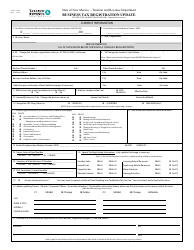

Form ACD-31015 Business Tax Registration Application and Update Form - New Mexico

What Is Form ACD-31015?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ACD-31015?

A: Form ACD-31015 is the Business Tax Registration Application and Update Form for New Mexico.

Q: What is the purpose of Form ACD-31015?

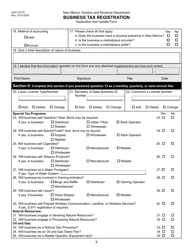

A: The purpose of Form ACD-31015 is to register a business for tax purposes and to update any changes to the business's information.

Q: Who needs to file Form ACD-31015?

A: Any business operating in New Mexico needs to file Form ACD-31015.

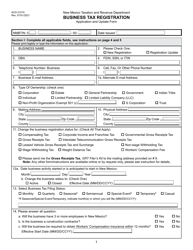

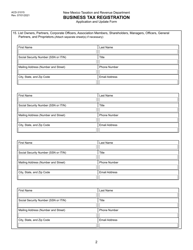

Q: What information is required on Form ACD-31015?

A: Form ACD-31015 requires basic business information, such as the business's legal name, address, and contact information.

Q: Is there a fee to file Form ACD-31015?

A: Yes, there is a fee associated with filing Form ACD-31015. The fee amount depends on the type of business.

Q: When should I file Form ACD-31015?

A: Form ACD-31015 should be filed before starting a business or within 30 days of any changes to the business's information.

Q: Are there any penalties for not filing Form ACD-31015?

A: Yes, there may be penalties for not filing Form ACD-31015 or for filing it late. It is important to meet the filing deadline.

Q: What other documents may be required along with Form ACD-31015?

A: Depending on the type of business, additional documents such as a federal Employer Identification Number (EIN) or a New Mexico CRS identification number may be required.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ACD-31015 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.