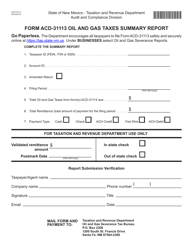

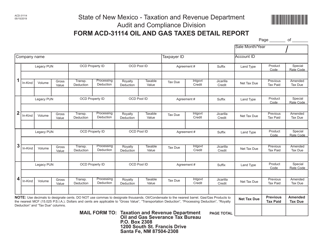

This version of the form is not currently in use and is provided for reference only. Download this version of

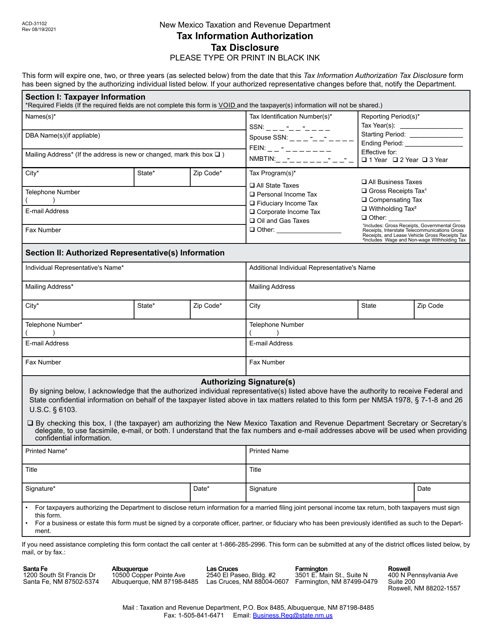

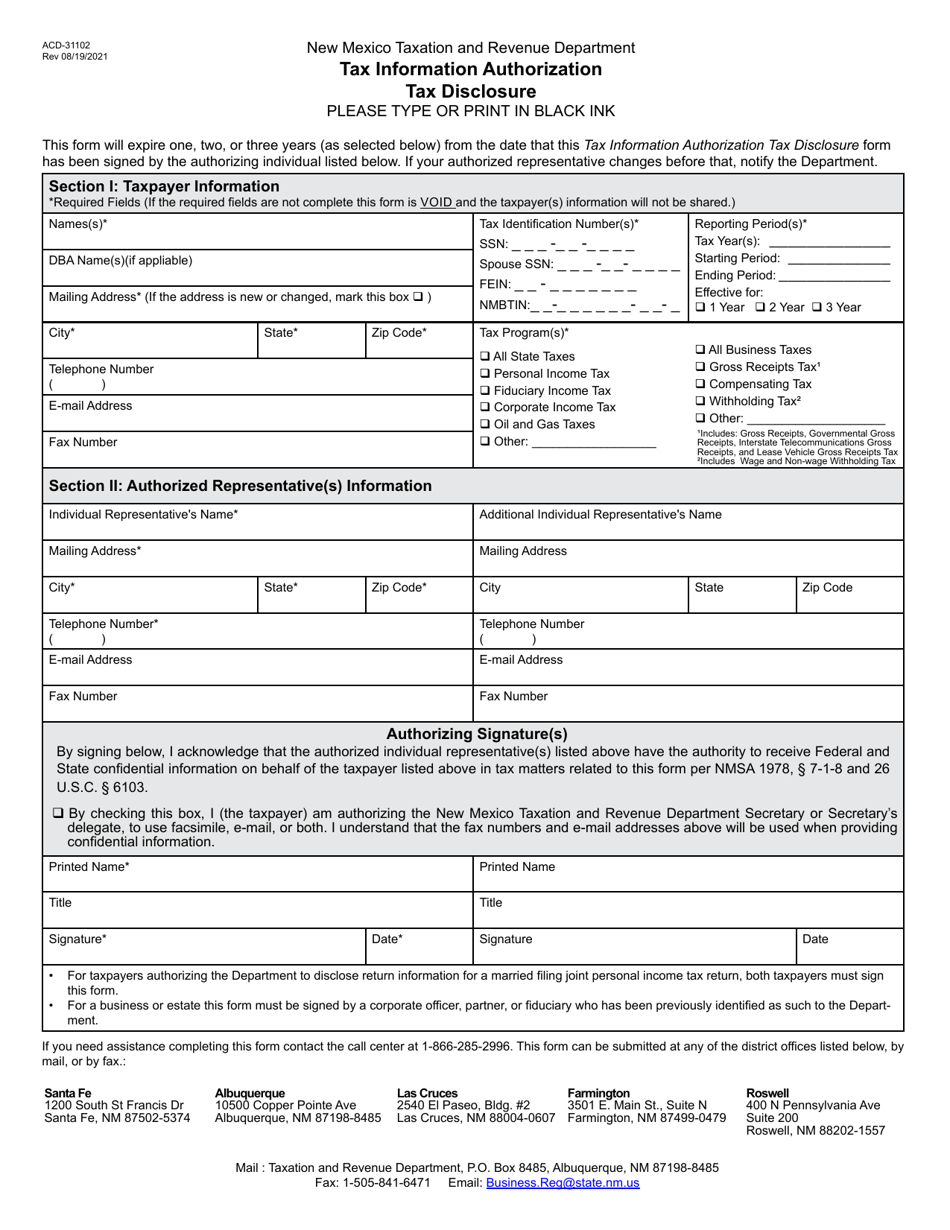

Form ACD-31102

for the current year.

Form ACD-31102 Tax Information Authorization Tax Disclosure - New Mexico

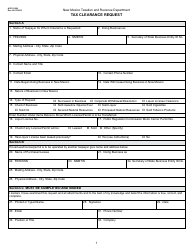

What Is Form ACD-31102?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ACD-31102?

A: Form ACD-31102 is the Tax Information Authorization Tax Disclosure form for New Mexico.

Q: What is the purpose of Form ACD-31102?

A: The purpose of Form ACD-31102 is to authorize the disclosure of tax information to a third party.

Q: Who needs to fill out Form ACD-31102?

A: Anyone who wants to authorize the disclosure of their tax information to a third party in New Mexico needs to fill out Form ACD-31102.

Q: Is Form ACD-31102 specific to New Mexico?

A: Yes, Form ACD-31102 is specific to New Mexico and is used to authorize the disclosure of tax information in the state.

Q: What information do I need to provide on Form ACD-31102?

A: You will need to provide your name, social security number, and the name of the third party you are authorizing to receive your tax information.

Q: Can I revoke the authorization on Form ACD-31102?

A: Yes, you can revoke the authorization by submitting a written request to the New Mexico Taxation and Revenue Department.

Q: Is there a deadline for submitting Form ACD-31102?

A: There is no specific deadline for submitting Form ACD-31102, but it is recommended to submit it as soon as you want to authorize the disclosure of your tax information.

Form Details:

- Released on August 19, 2021;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ACD-31102 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.