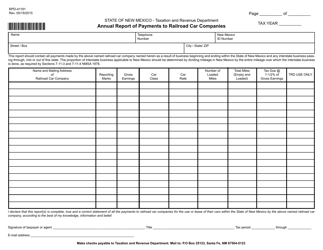

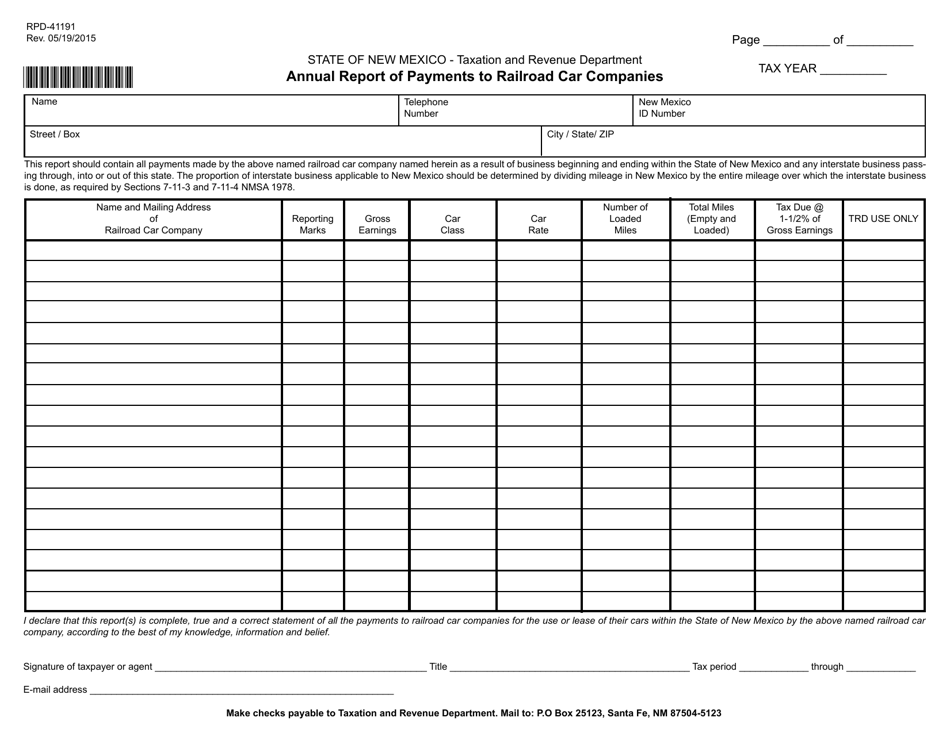

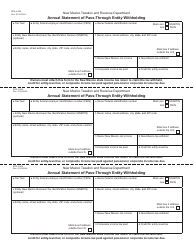

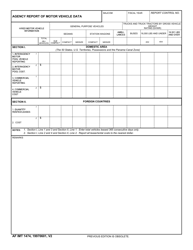

Form RPD-41191 Annual Report of Payments to Railroad Car Companies - New Mexico

What Is Form RPD-41191?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPD-41191?

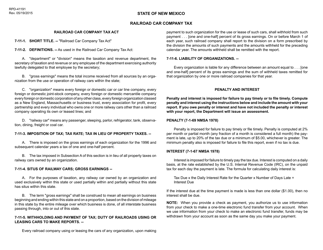

A: Form RPD-41191 is an annual report used to report payments made to railroad car companies in New Mexico.

Q: Who needs to file Form RPD-41191?

A: Any individual or business that makes payments to railroad car companies in New Mexico needs to file Form RPD-41191.

Q: What information is required on Form RPD-41191?

A: Form RPD-41191 requires the taxpayer's identification number, name, address, and total payments made to railroad car companies.

Q: When is Form RPD-41191 due?

A: Form RPD-41191 is typically due by March 1st of the following year.

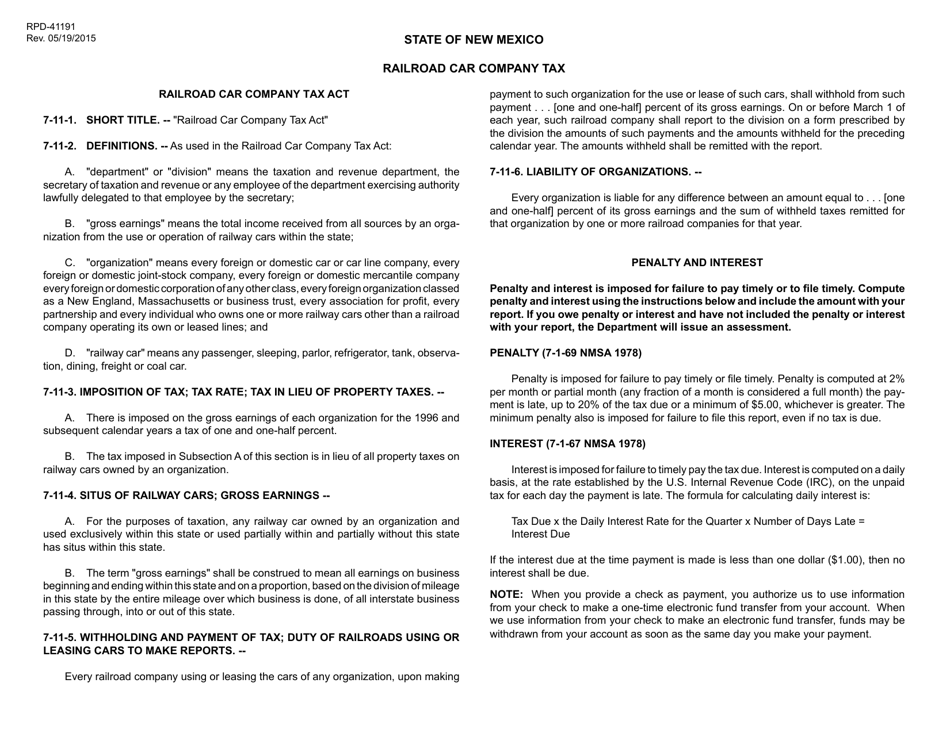

Q: Is there a penalty for late filing of Form RPD-41191?

A: Yes, there is a penalty for late filing of Form RPD-41191, and it is based on the amount of tax owed.

Form Details:

- Released on May 19, 2015;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41191 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.