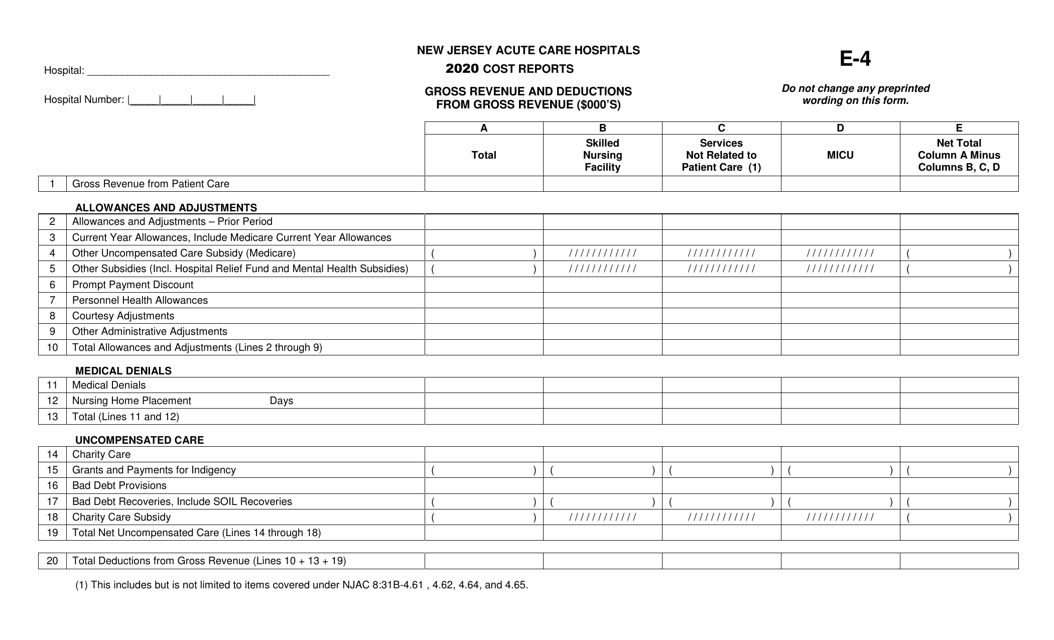

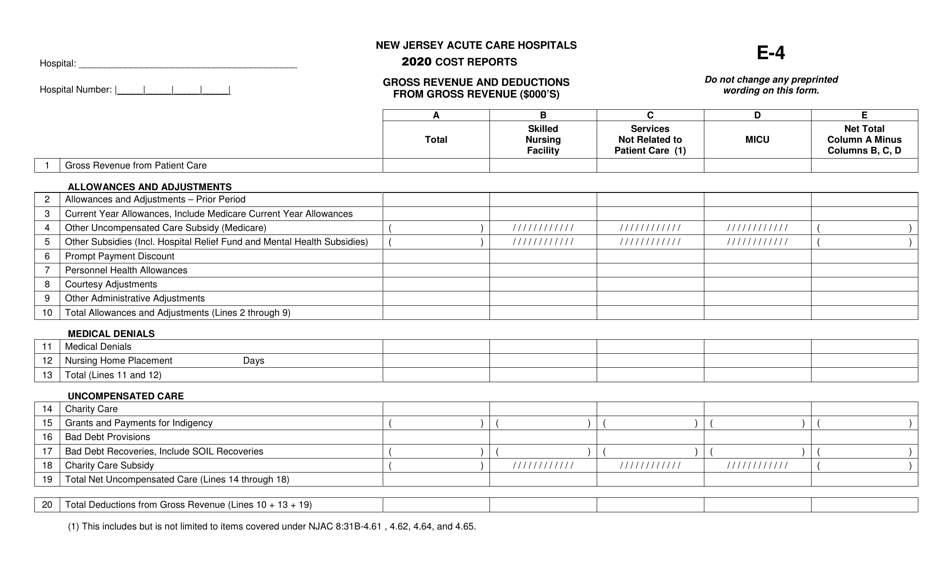

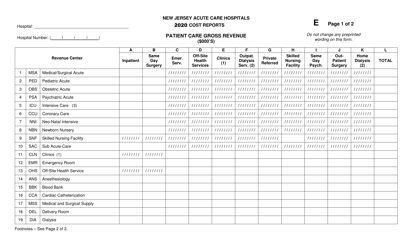

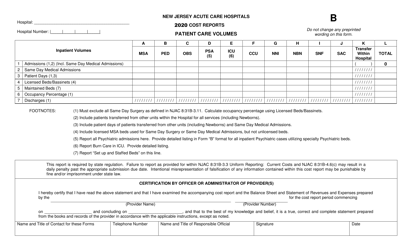

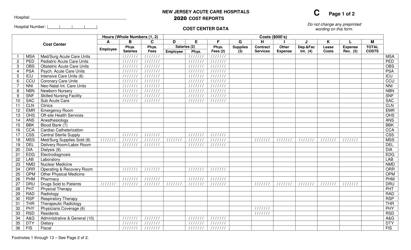

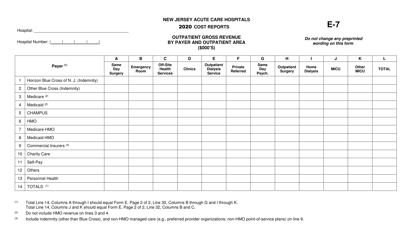

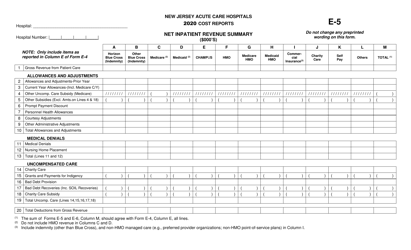

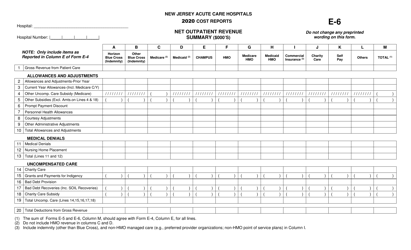

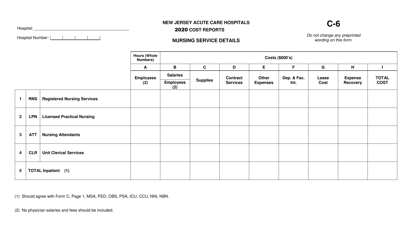

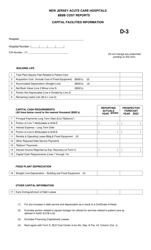

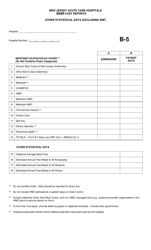

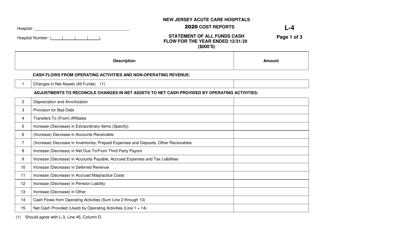

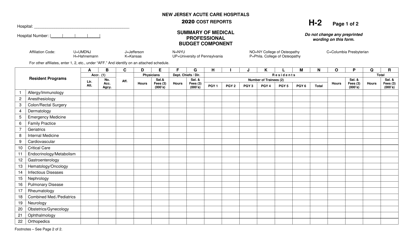

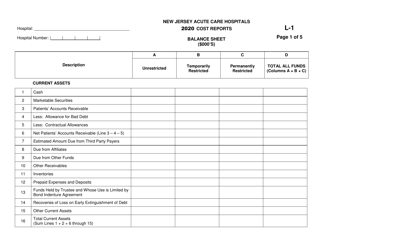

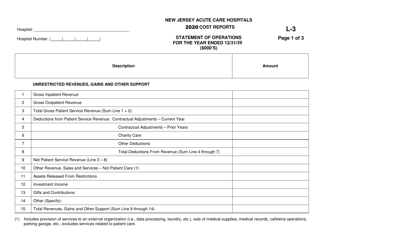

Form E-4 New Jersey Acute Care Hospitals Cost Reports - Gross Revenue and Deductions From Gross Revenue - New Jersey

What Is Form E-4?

This is a legal form that was released by the New Jersey Department of Health - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-4?

A: Form E-4 is a cost report that provides information on the gross revenue and deductions from gross revenue of New Jersey Acute Care Hospitals.

Q: What does the Form E-4 include?

A: The Form E-4 includes details about the gross revenue and deductions from gross revenue of New Jersey Acute Care Hospitals.

Q: What is gross revenue?

A: Gross revenue refers to the total revenue earned by a hospital before any deductions or expenses.

Q: What are deductions from gross revenue?

A: Deductions from gross revenue are expenses or deductions that are subtracted from the total revenue to calculate the net revenue.

Q: What types of deductions are included in the Form E-4?

A: The Form E-4 includes deductions such as bad debts, contractual adjustments, and charity care.

Form Details:

- The latest edition provided by the New Jersey Department of Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-4 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Health.