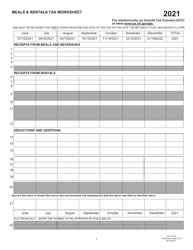

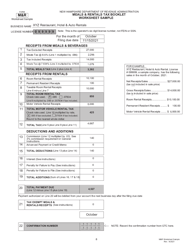

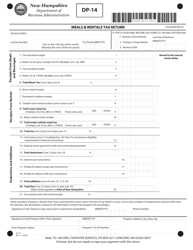

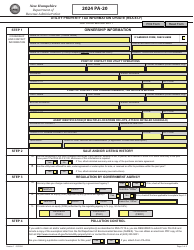

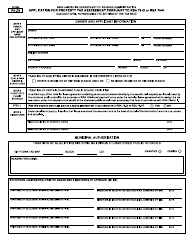

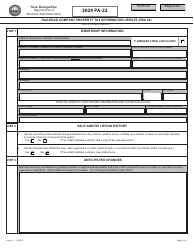

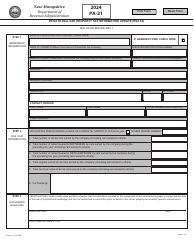

Form RSA-78A Meals & Rentals Tax Booklet - New Hampshire

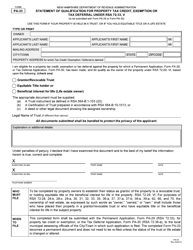

What Is Form RSA-78A?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

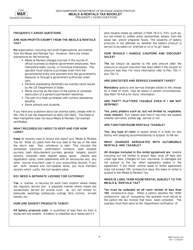

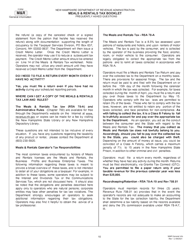

Q: What is the RSA-78A Meals & Rentals Tax Booklet?

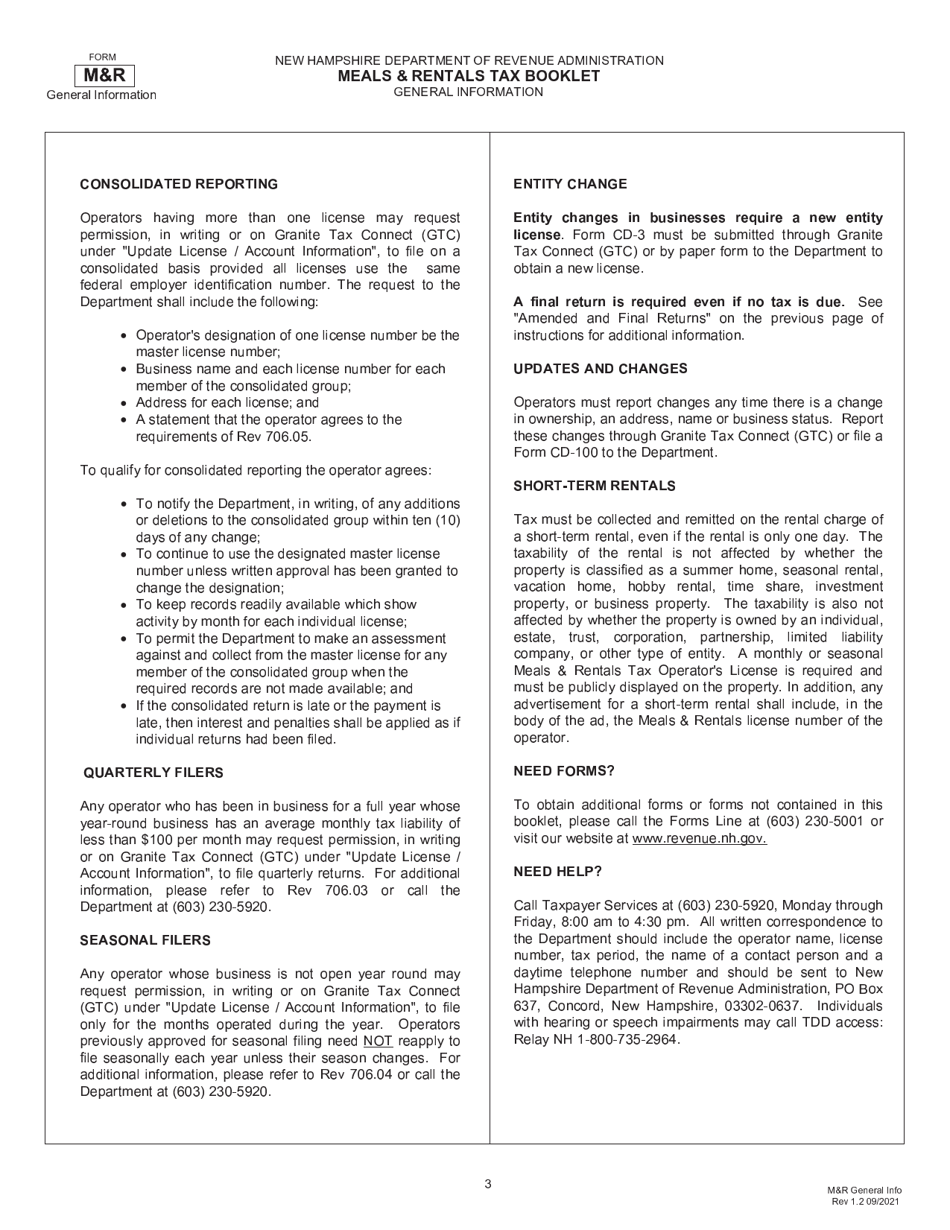

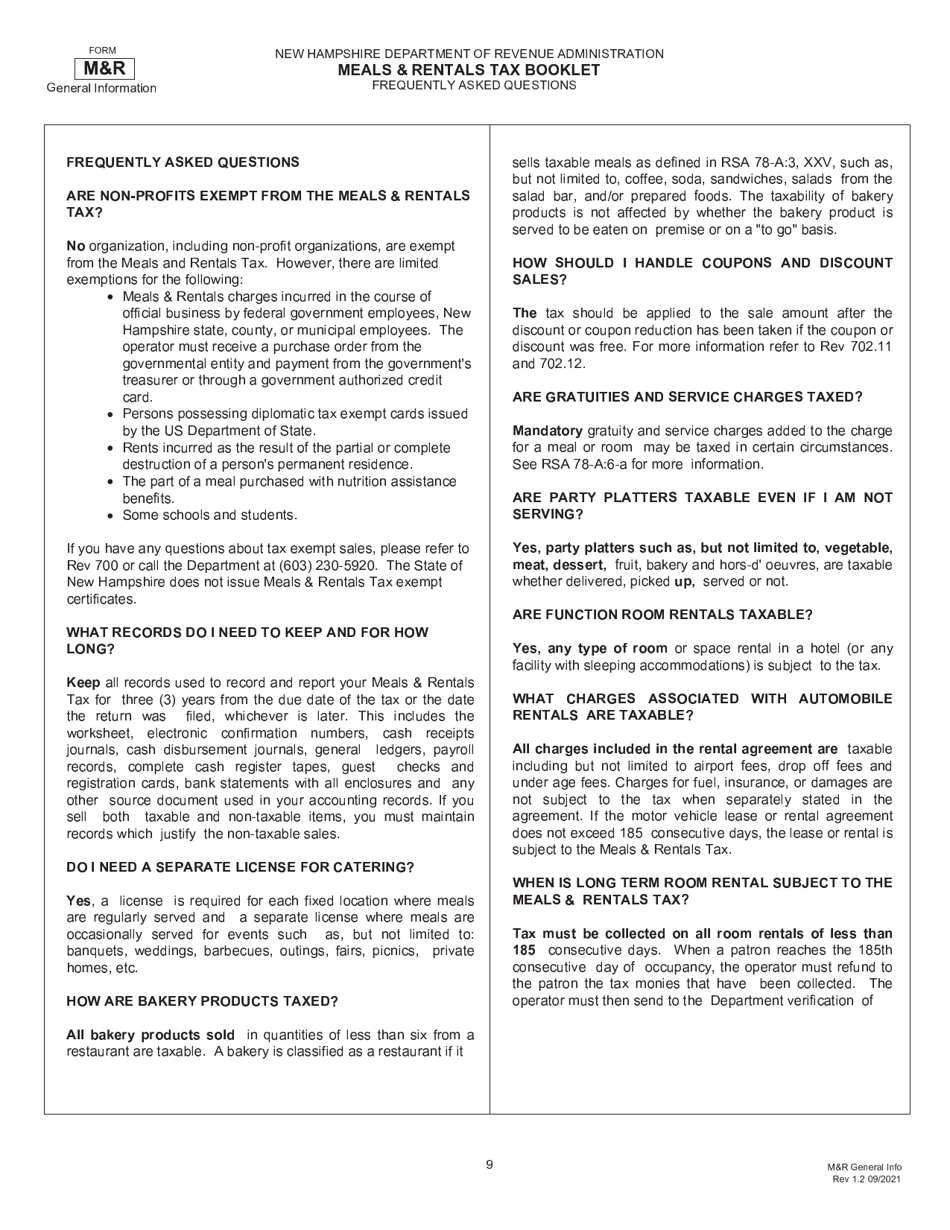

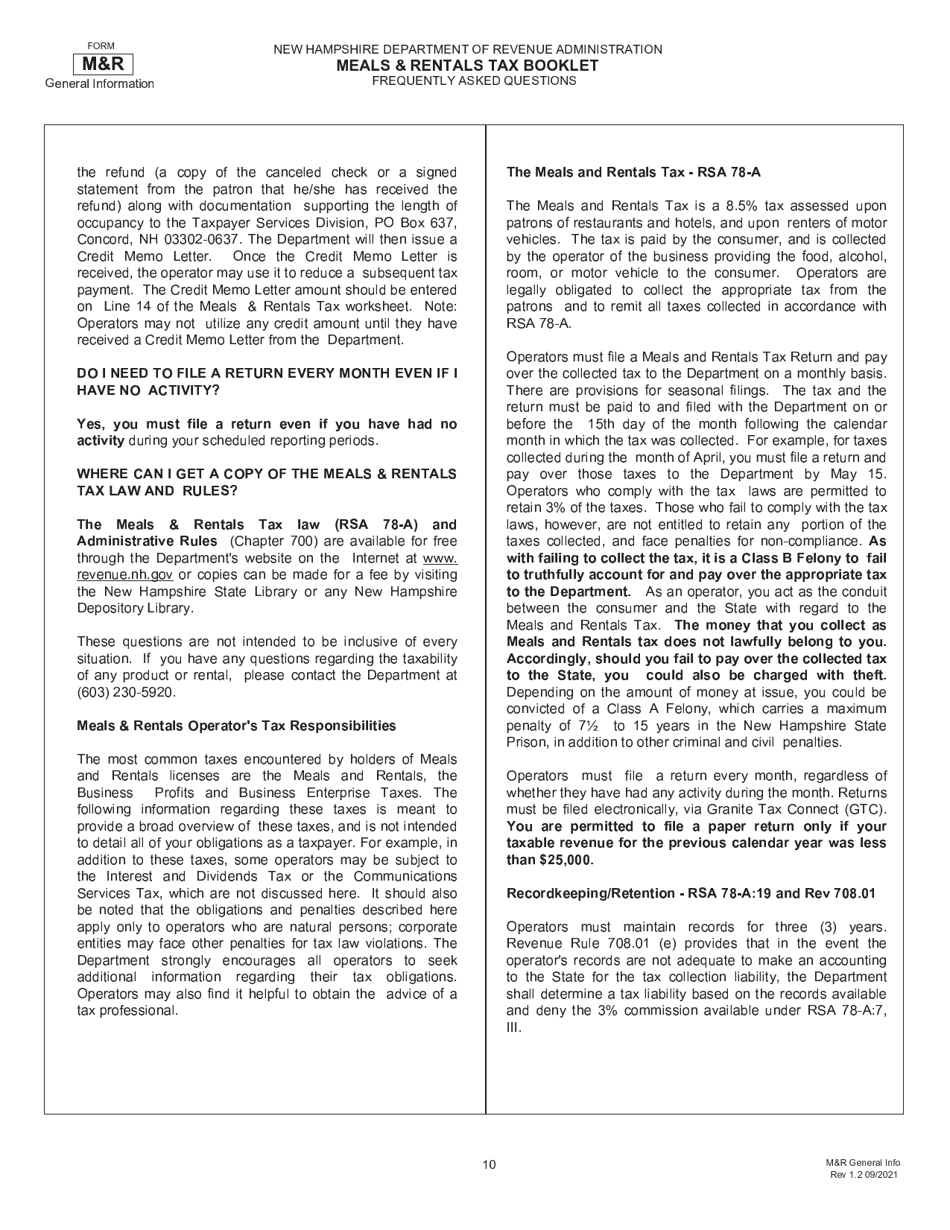

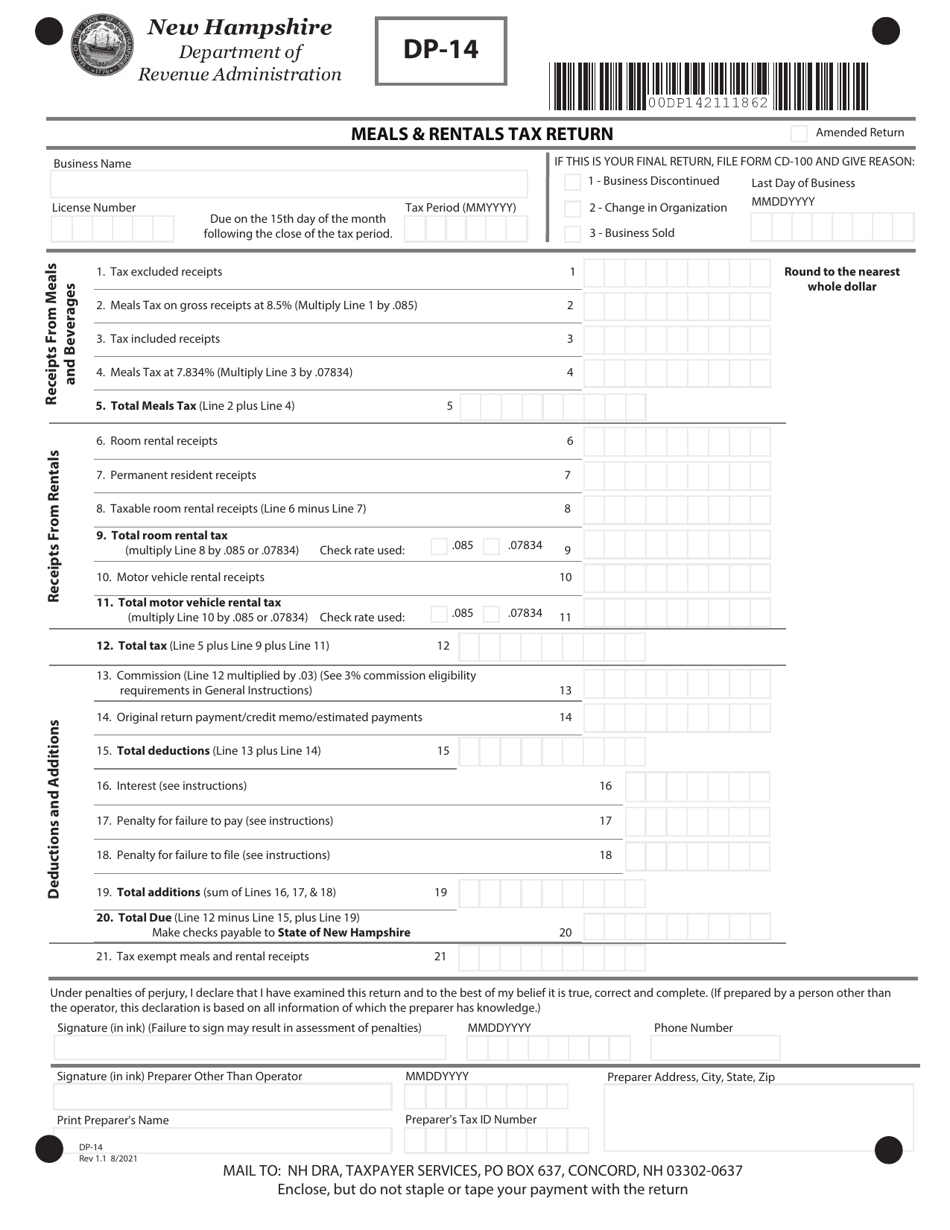

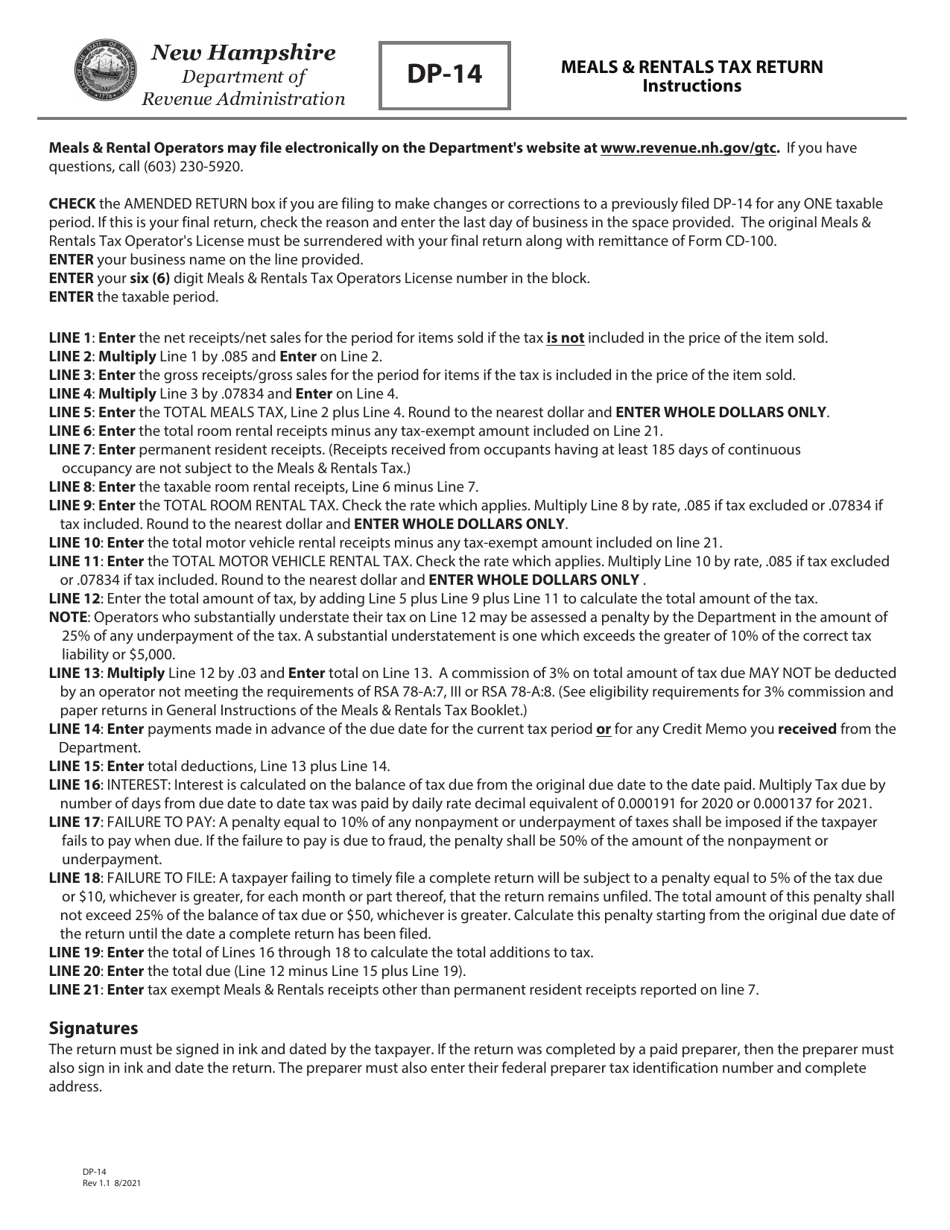

A: The RSA-78A Meals & Rentals Tax Booklet is a resource provided by the state of New Hampshire to help individuals and businesses understand and comply with the state's meals and rentals tax laws.

Q: Who needs to use the RSA-78A Meals & Rentals Tax Booklet?

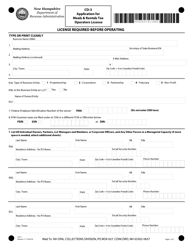

A: Anyone in New Hampshire who is involved in the sale or rental of meals or accommodations, including restaurants, hotels, campsites, and Airbnb hosts, should use the RSA-78A Meals & Rentals Tax Booklet.

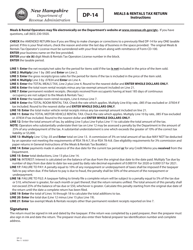

Q: What information does the RSA-78A Meals & Rentals Tax Booklet provide?

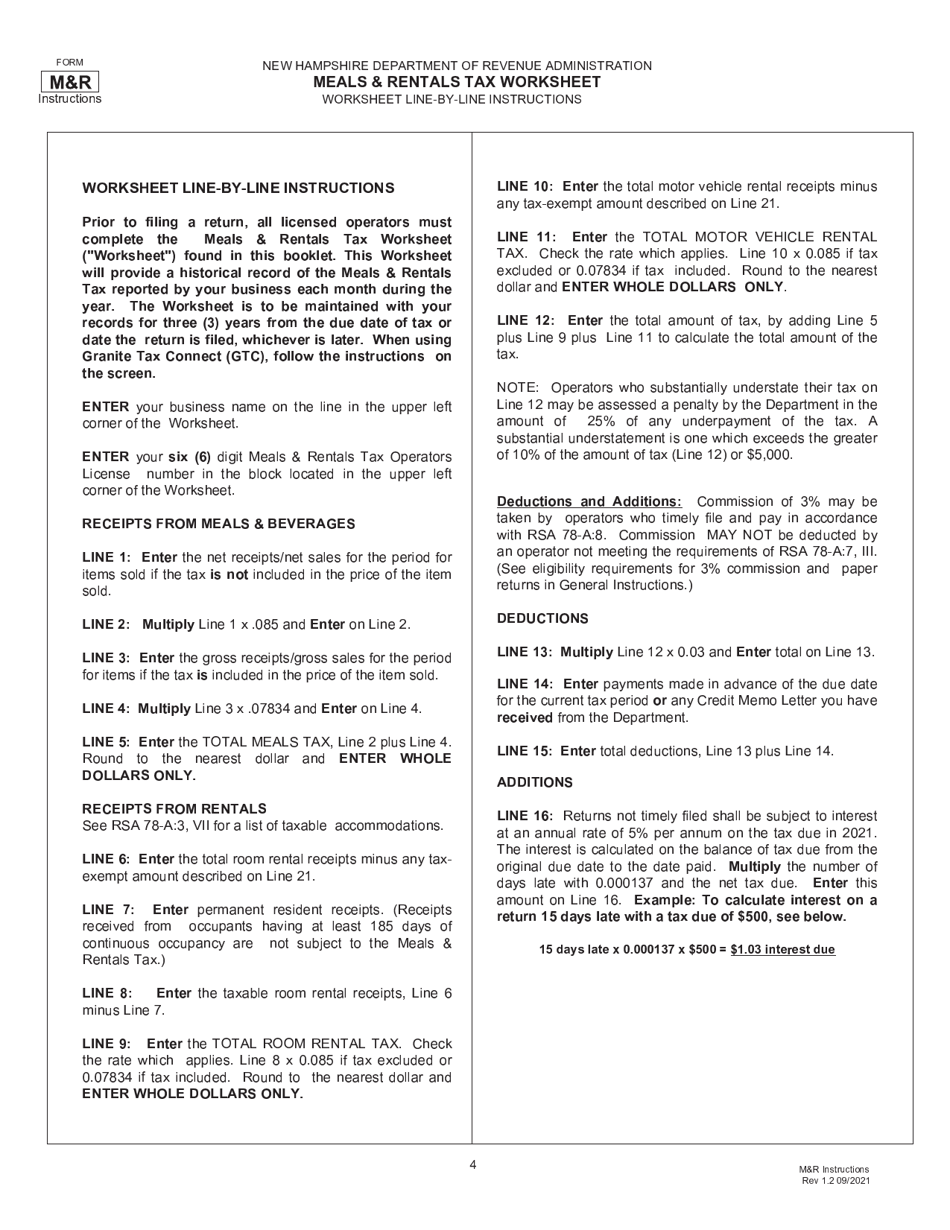

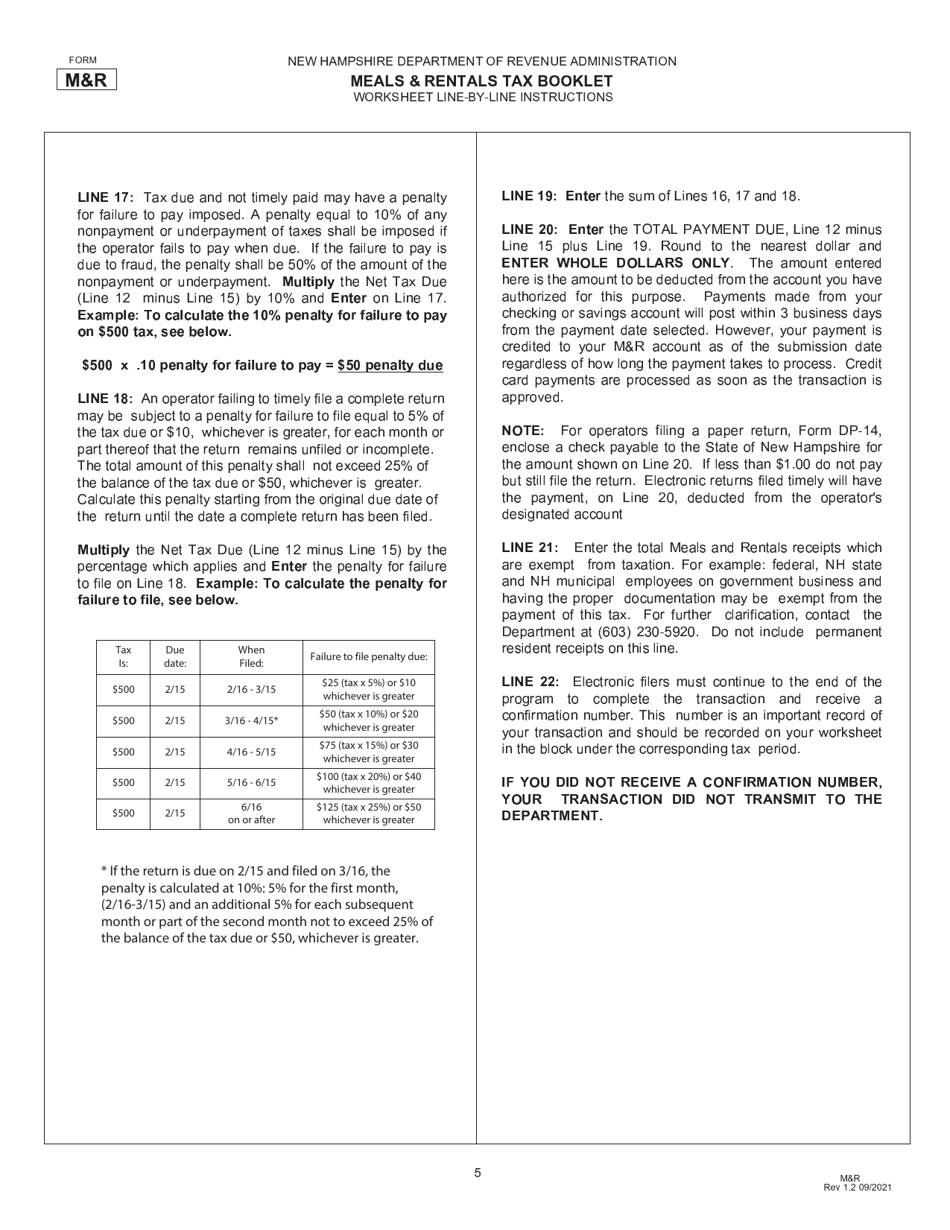

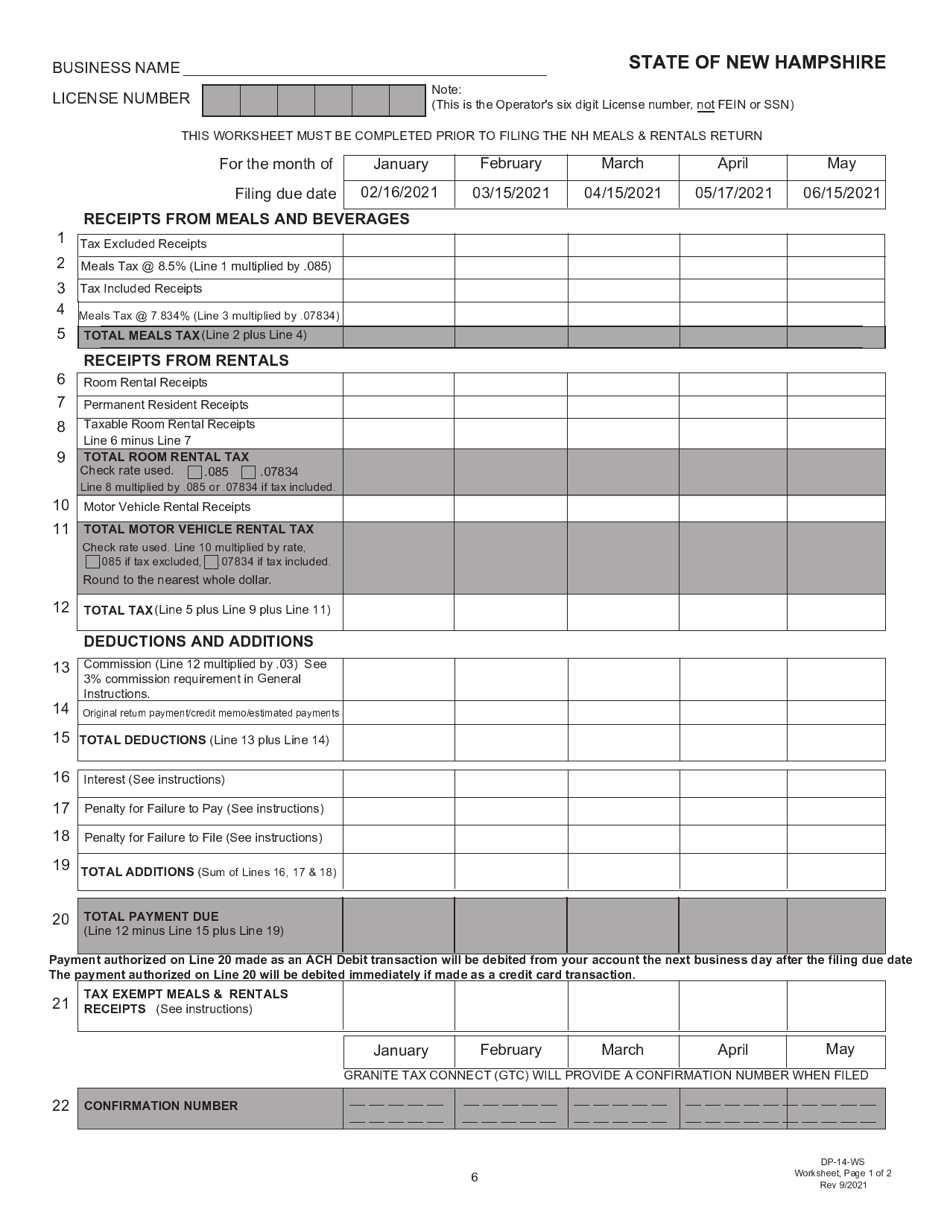

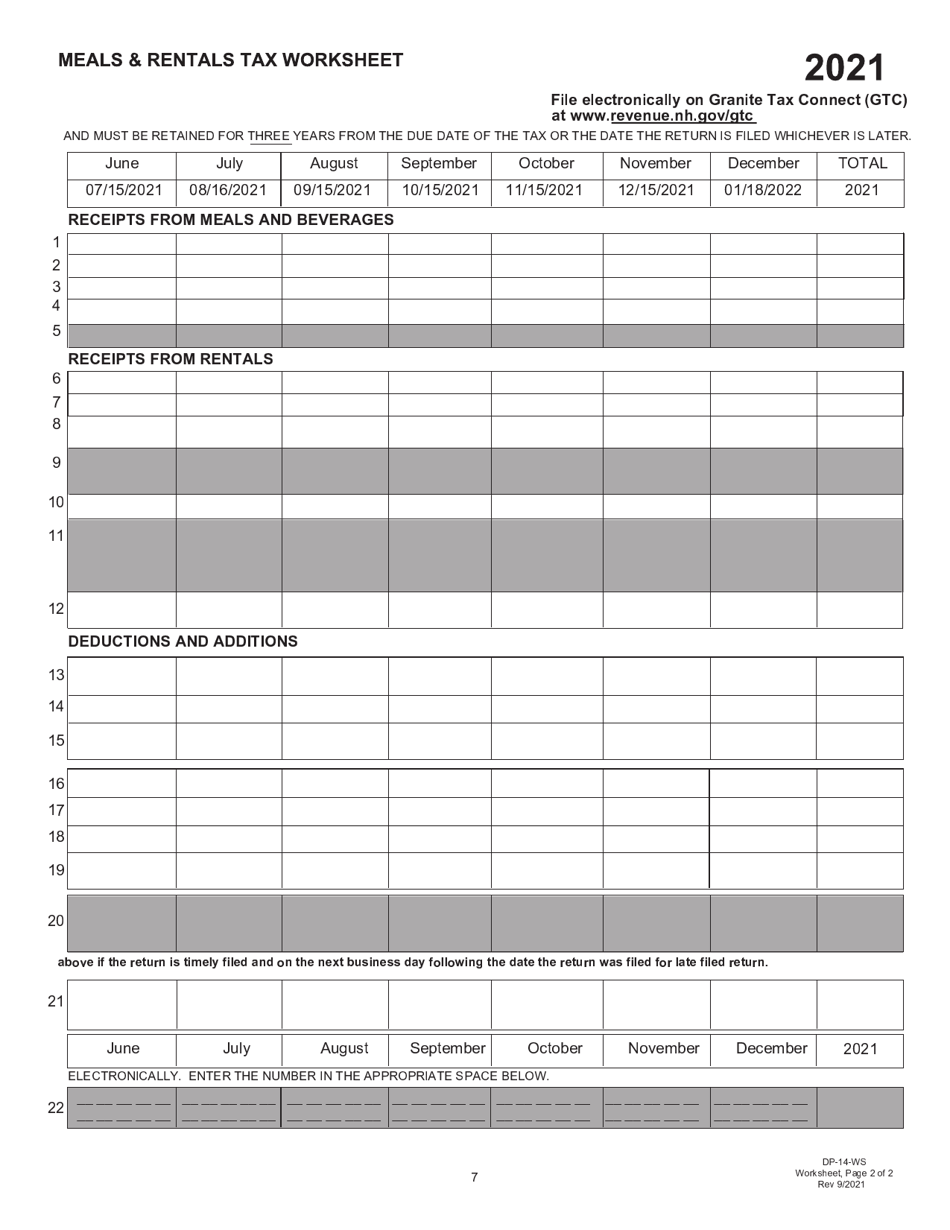

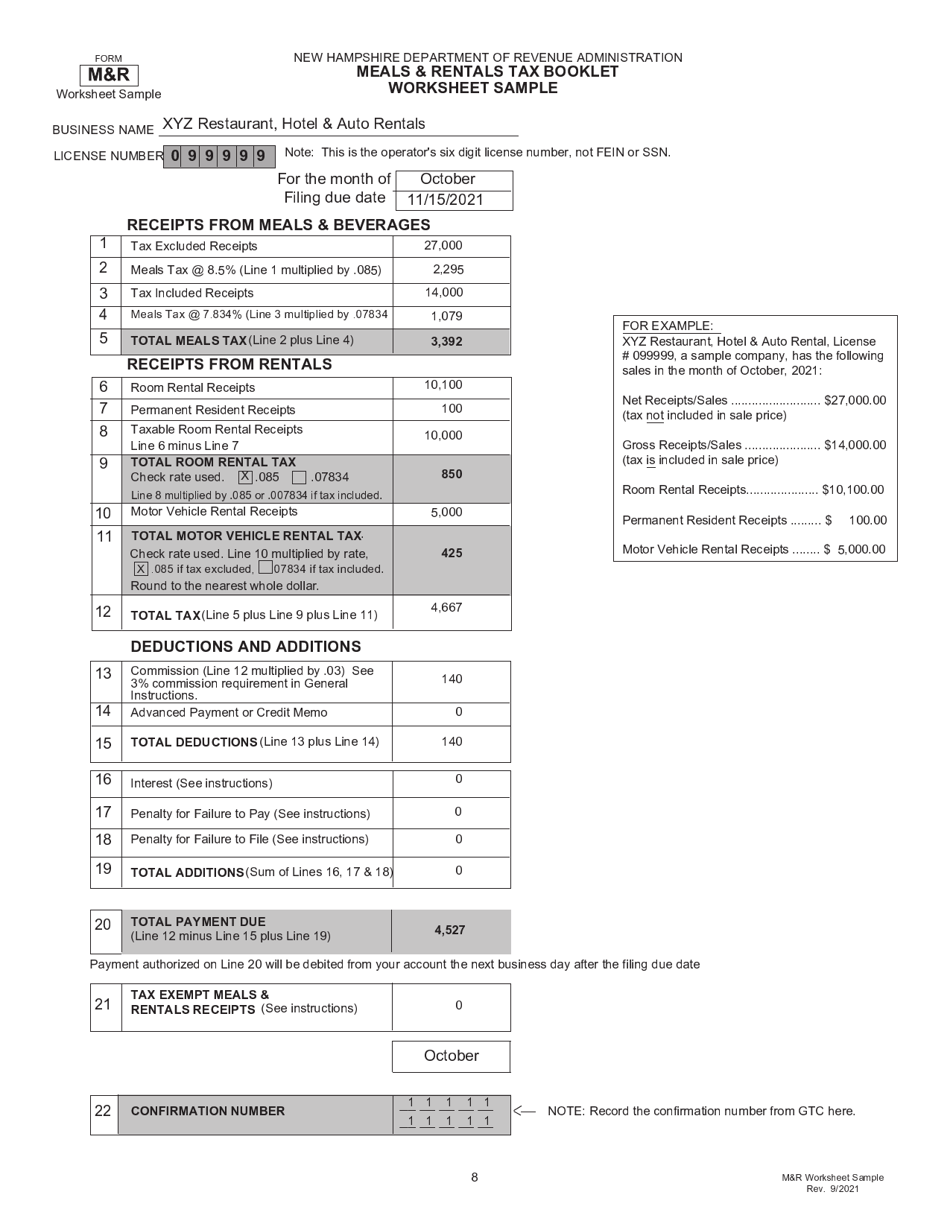

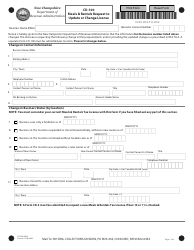

A: The RSA-78A Meals & Rentals Tax Booklet provides information on how the meals and rentals tax works, who is required to collect and remit the tax, how to register for a tax license, and how to file tax returns.

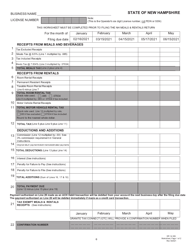

Q: Is there a deadline for filing meals and rentals tax returns?

A: Yes, meals and rentals tax returns in New Hampshire must be filed on a monthly basis. The deadline for filing the returns is the 15th day of the month following the end of the reporting period.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RSA-78A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.