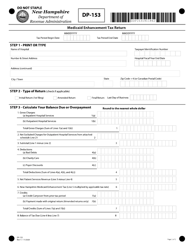

This version of the form is not currently in use and is provided for reference only. Download this version of

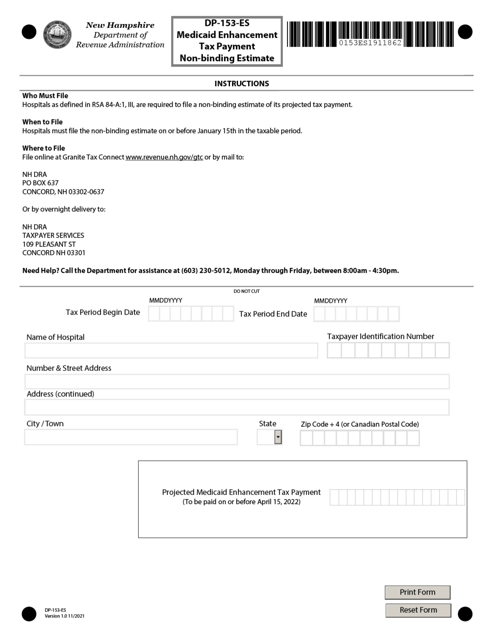

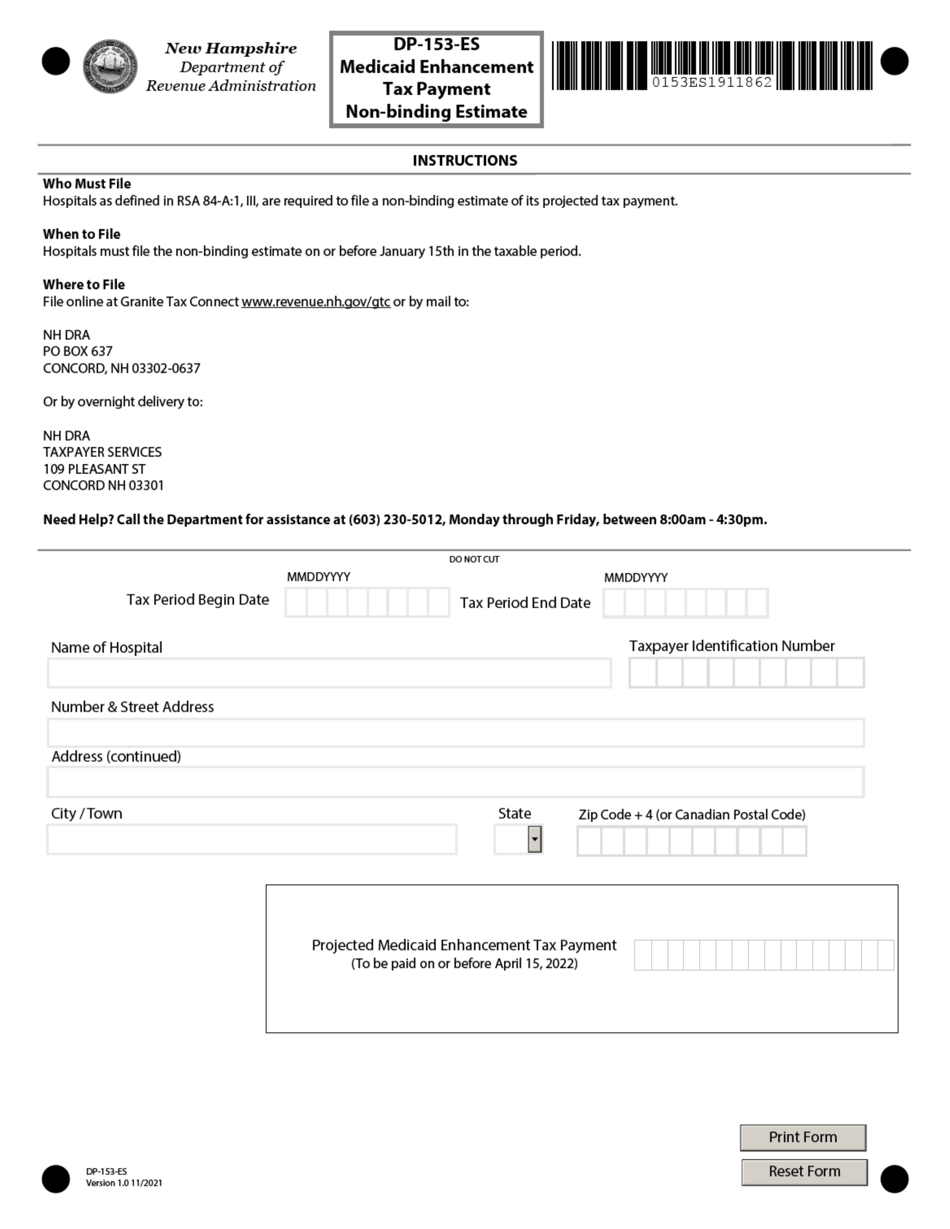

Form DP-153-ES

for the current year.

Form DP-153-ES Medicaid Enhancement Tax Payment Non-binding Estimate - New Hampshire

What Is Form DP-153-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-153-ES?

A: Form DP-153-ES is a Medicaid Enhancement Tax Payment Non-binding Estimate form.

Q: What is the Medicaid Enhancement Tax?

A: The Medicaid Enhancement Tax is a tax collected by the state of New Hampshire on certain hospitals and healthcare providers.

Q: Who needs to file Form DP-153-ES?

A: Hospitals and healthcare providers subject to the Medicaid Enhancement Tax need to file Form DP-153-ES to submit a non-binding estimate of their tax payment.

Q: Is Form DP-153-ES mandatory?

A: Filing Form DP-153-ES is not mandatory, but it is recommended for hospitals and healthcare providers subject to the Medicaid Enhancement Tax.

Q: What is the purpose of Form DP-153-ES?

A: The purpose of Form DP-153-ES is to provide hospitals and healthcare providers with a way to estimate their Medicaid Enhancement Tax payment.

Q: When is Form DP-153-ES due?

A: The due date for Form DP-153-ES is stated on the form, usually on a quarterly basis.

Q: What happens if I don't file Form DP-153-ES?

A: Failure to file Form DP-153-ES may result in penalties or interest charges.

Q: Can I make changes to my estimate after filing Form DP-153-ES?

A: Yes, you can make changes to your estimate by filing an amended Form DP-153-ES before the due date.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-153-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.