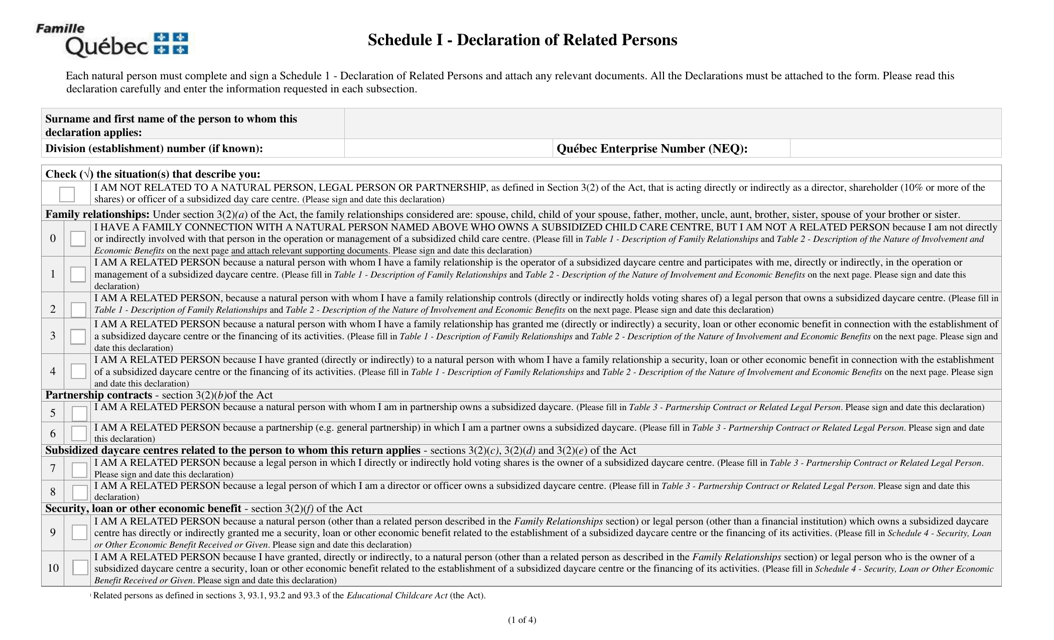

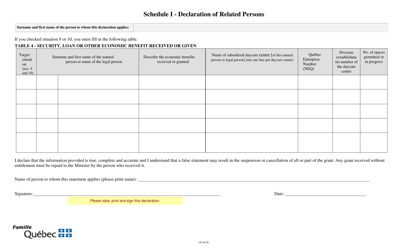

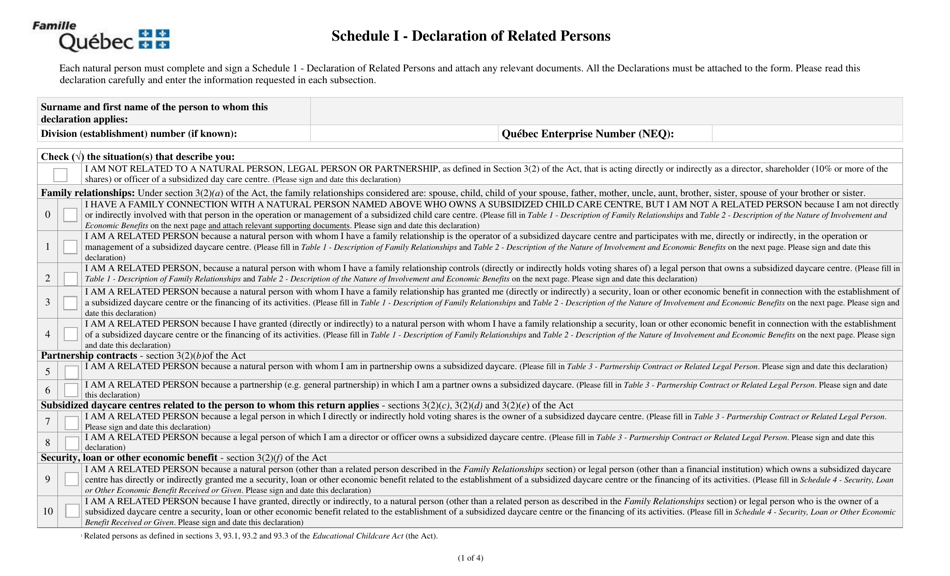

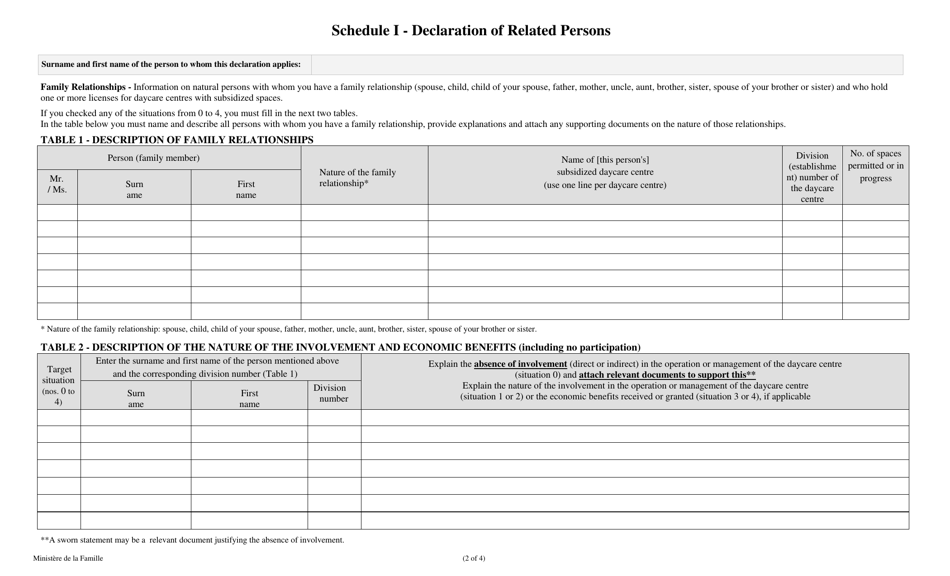

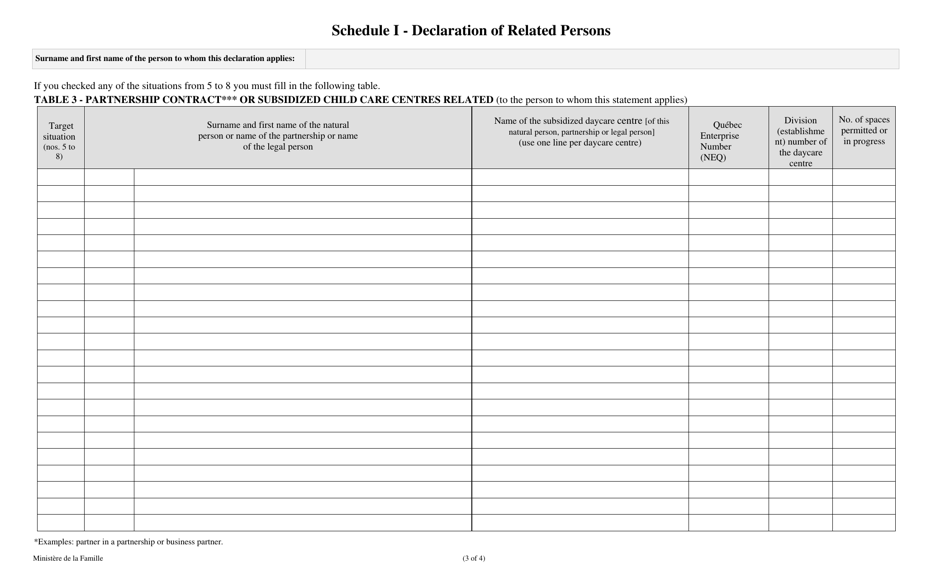

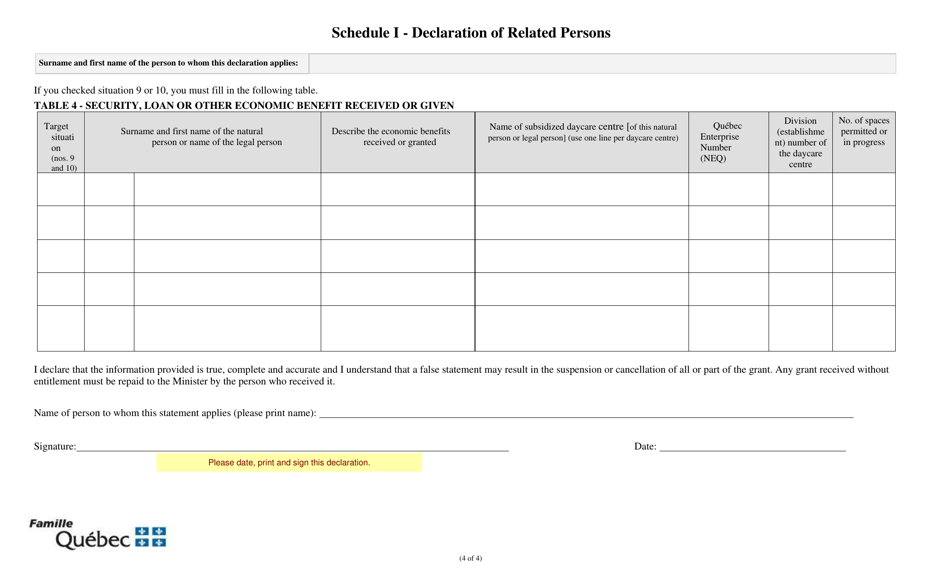

Schedule I Declaration of Related Persons - Quebec, Canada

The Schedule I Declaration of Related Persons in Quebec, Canada is used to report transactions between related persons for tax purposes. It helps ensure that transactions are properly disclosed and comply with tax laws.

In Quebec, Canada, the Schedule I Declaration of Related Persons is filed by individuals who have related persons as defined by the Quebec Sales Tax Act.

FAQ

Q: What is a Schedule I Declaration of Related Persons?

A: A Schedule I Declaration of Related Persons is a form used in Quebec, Canada for reporting relationships between certain individuals.

Q: Who needs to fill out a Schedule I Declaration of Related Persons?

A: This form is typically required to be filled out by individuals who have a specified relationship with someone who holds a public office or certain positions in Quebec.

Q: What information is required in a Schedule I Declaration of Related Persons?

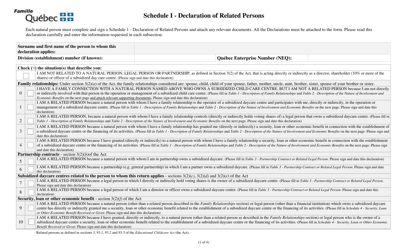

A: The form typically asks for details about the individuals involved, including their names, addresses, and the nature of their relationship.

Q: Why is a Schedule I Declaration of Related Persons important?

A: This form helps to ensure transparency and avoid conflicts of interest in certain public office positions or positions of authority.