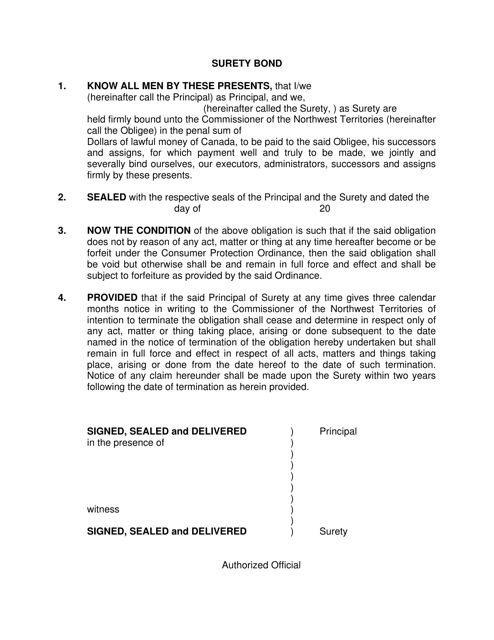

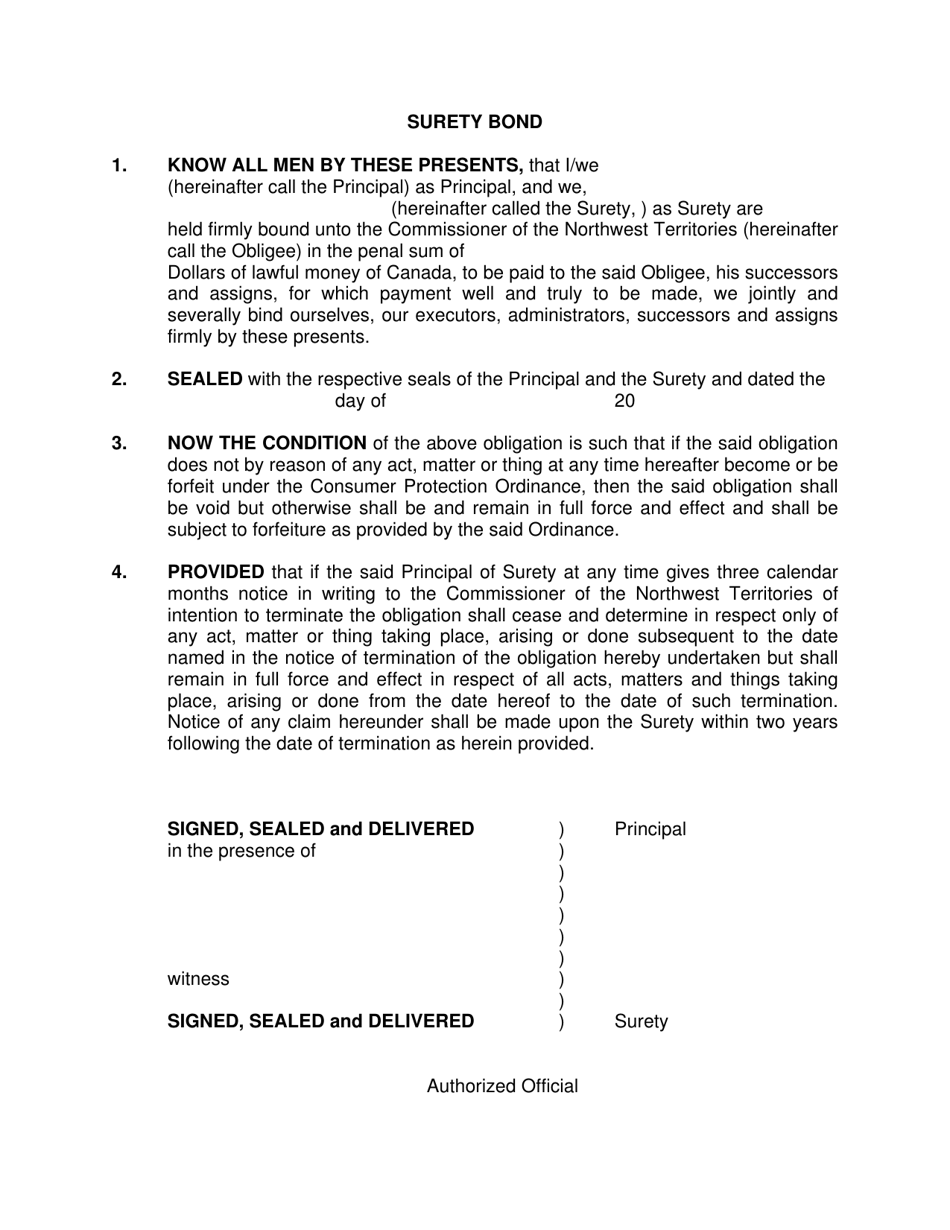

Surety Bond - Northwest Territories, Canada

A surety bond in the Northwest Territories, Canada is a type of financial guarantee that is used to ensure that certain obligations or requirements are fulfilled. It is often required when entering into contracts, obtaining licenses or permits, or participating in certain industries. The bond provides financial protection to the party who requires it and can be used to compensate them if the bonded party fails to meet their obligations.

In the Northwest Territories, Canada, the surety bond is typically filed by the party or individual who is required to provide the bond, such as a contractor or a business entity.

FAQ

Q: What is a surety bond?

A: A surety bond is a three-party agreement that provides financial protection in case one party fails to fulfill their contractual obligations.

Q: Who are the parties involved in a surety bond?

A: The parties involved in a surety bond are the principal (the party that needs the bond), the obligee (the party requiring the bond), and the surety (the company that provides the bond).

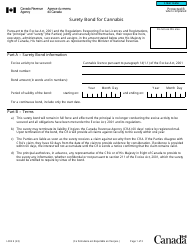

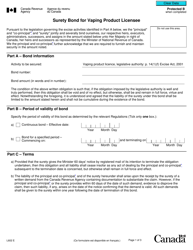

Q: What types of surety bonds are available in Northwest Territories, Canada?

A: There are various types of surety bonds available in Northwest Territories, including contract bonds, license and permit bonds, and fidelity bonds.

Q: What is the purpose of a surety bond?

A: The purpose of a surety bond is to protect the obligee against financial loss in case the principal fails to fulfill their contractual obligations or meet certain requirements.

Q: How much does a surety bond cost?

A: The cost of a surety bond varies depending on factors such as bond type, bond amount, and the principal's creditworthiness.