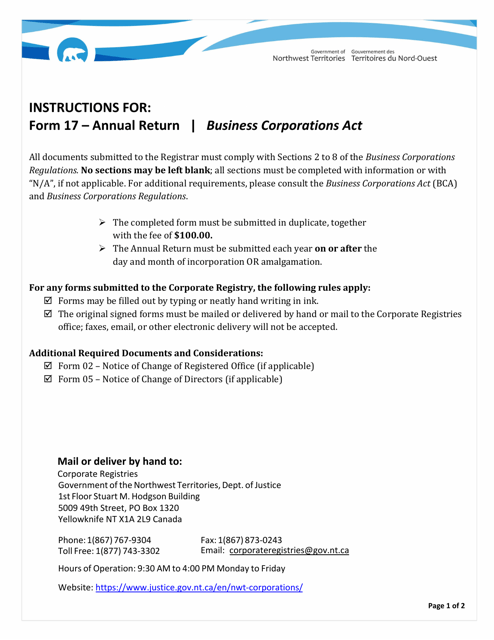

Instructions for Form 17 Annual Return - Northwest Territories, Canada

The Instructions for Form 17 Annual Return - Northwest Territories, Canada provide guidance on how to complete and file the annual return form. It includes information on what information needs to be included in the form, how to calculate and report taxes owed, and any reporting requirements specific to the Northwest Territories.

The Instructions for Form 17 Annual Return in the Northwest Territories, Canada are filed by the individual or business who is required to submit the annual return.

FAQ

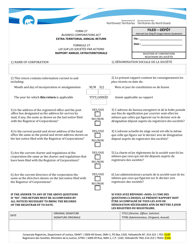

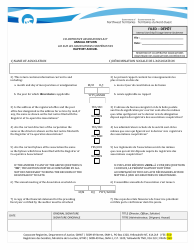

Q: What is Form 17 Annual Return?

A: Form 17 Annual Return is a document that needs to be filed by corporations registered in the Northwest Territories, Canada.

Q: Who needs to file Form 17 Annual Return?

A: Corporations registered in the Northwest Territories, Canada need to file Form 17 Annual Return.

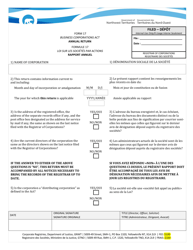

Q: What information is required in Form 17 Annual Return?

A: Form 17 Annual Return requires information such as the corporation's name, address, directors, and shareholders.

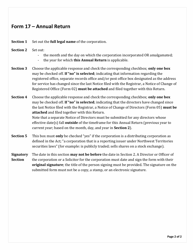

Q: When is the deadline for filing Form 17 Annual Return?

A: The deadline for filing Form 17 Annual Return is typically within 60 days of the corporation's anniversary date.

Q: Are there any fees associated with filing Form 17 Annual Return?

A: Yes, there are fees associated with filing Form 17 Annual Return. The fee amount depends on the type of corporation.

Q: What happens if Form 17 Annual Return is not filed on time?

A: If Form 17 Annual Return is not filed on time, the corporation may be subject to penalties or even dissolution.

Q: Can Form 17 Annual Return be amended?

A: Yes, Form 17 Annual Return can be amended if there are any changes to the corporation's information after it has been filed.