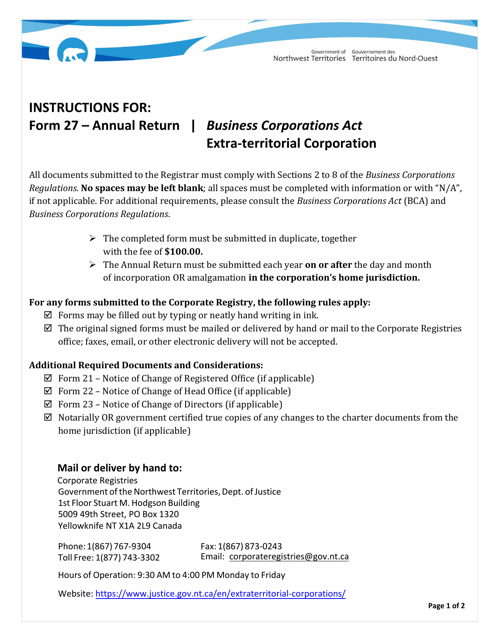

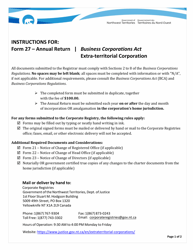

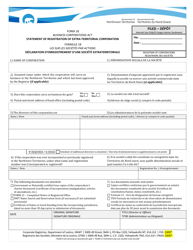

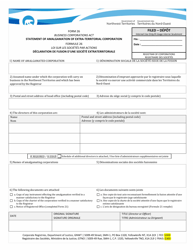

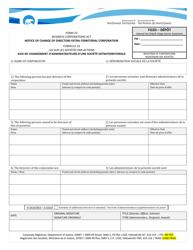

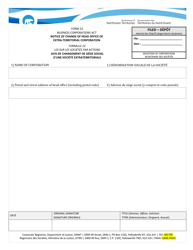

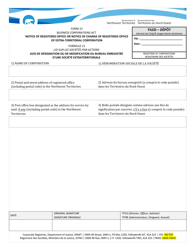

Instructions for Form 27 Extra-territorial Annual Return - Northwest Territories, Canada

The Instructions for Form 27 Extra-territorial Annual Return in Northwest Territories, Canada provide information and guidance on how to complete and file an annual return for companies or entities that operate outside of Northwest Territories but have a presence or income from activities within the territory. It is used for tax reporting purposes.

The instructions for Form 27 Extra-territorial Annual Return in the Northwest Territories, Canada are typically filed by the taxpayer or their authorized representative.

FAQ

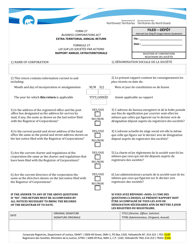

Q: What is Form 27 Extra-territorial Annual Return?

A: Form 27 Extra-territorial Annual Return is a form used in Northwest Territories, Canada.

Q: Who needs to fill out Form 27 Extra-territorial Annual Return?

A: Businesses operating outside of Northwest Territories but have a significant presence or perform activities within the territory need to fill out this form.

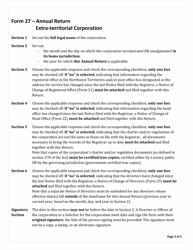

Q: When should Form 27 Extra-territorial Annual Return be filed?

A: The form should be filed annually, within 6 months after the end of the fiscal year.

Q: What information is required in Form 27 Extra-territorial Annual Return?

A: The form requires information about the business activities conducted in Northwest Territories, revenue earned within the territory, and the number of employees in the territory.

Q: Are there any penalties for not filing Form 27 Extra-territorial Annual Return?

A: Yes, businesses may be subject to penalties for failing to file the form or for providing false or misleading information.