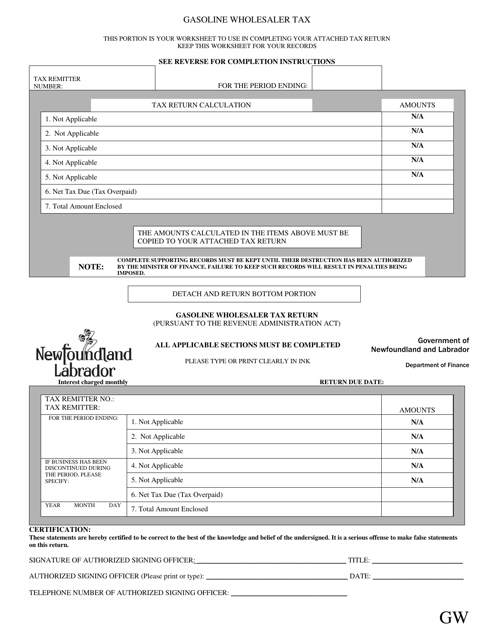

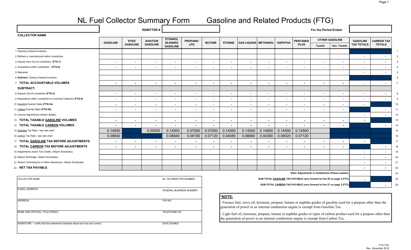

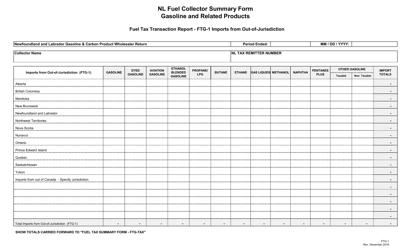

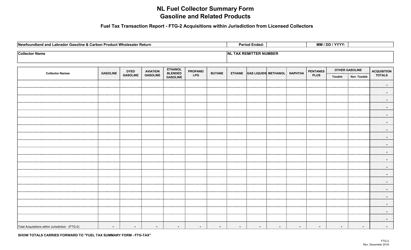

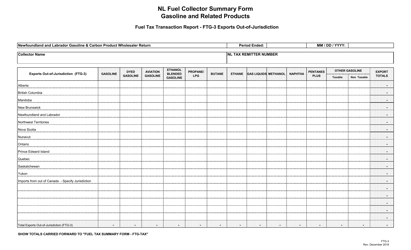

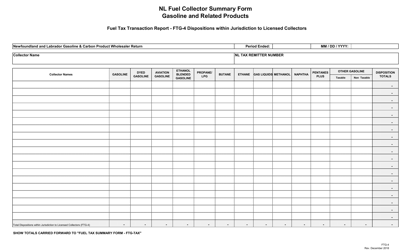

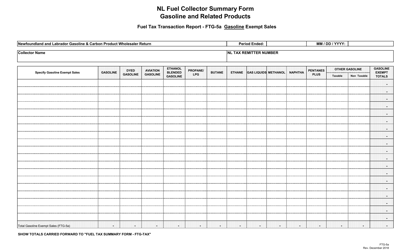

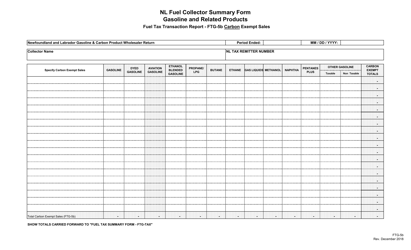

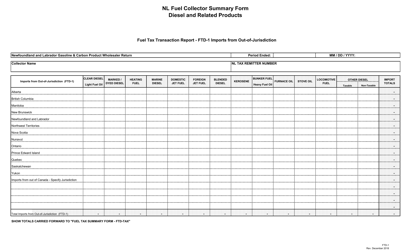

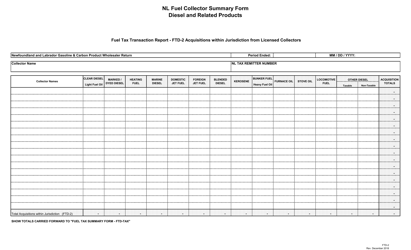

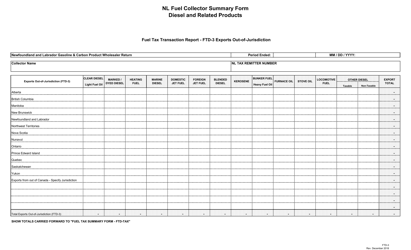

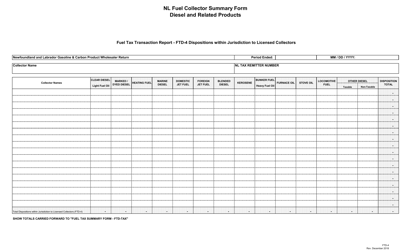

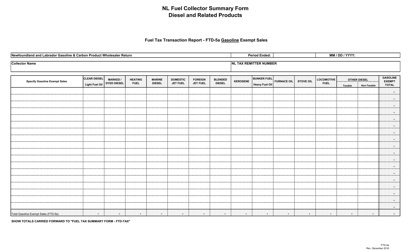

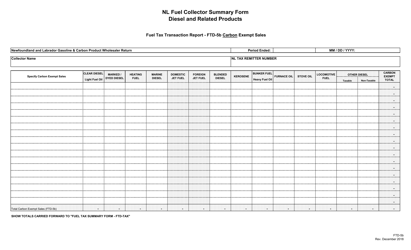

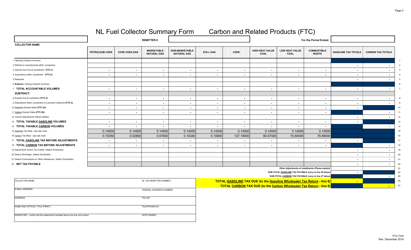

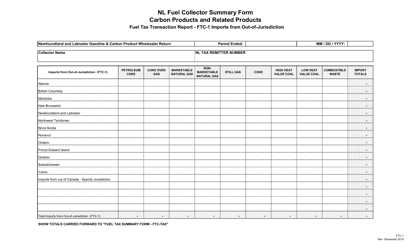

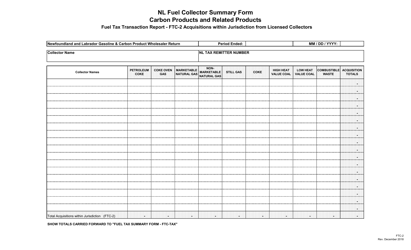

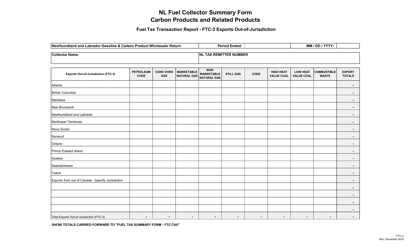

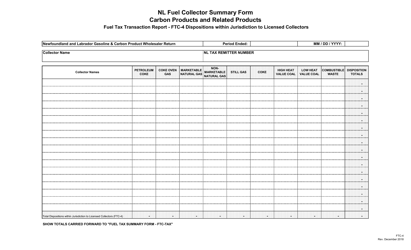

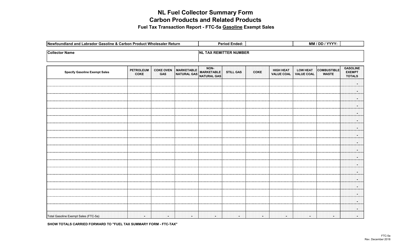

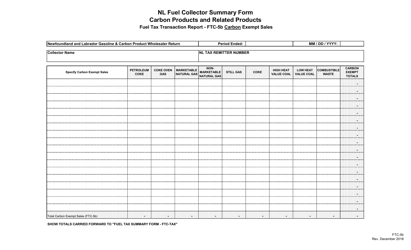

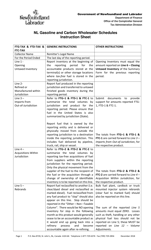

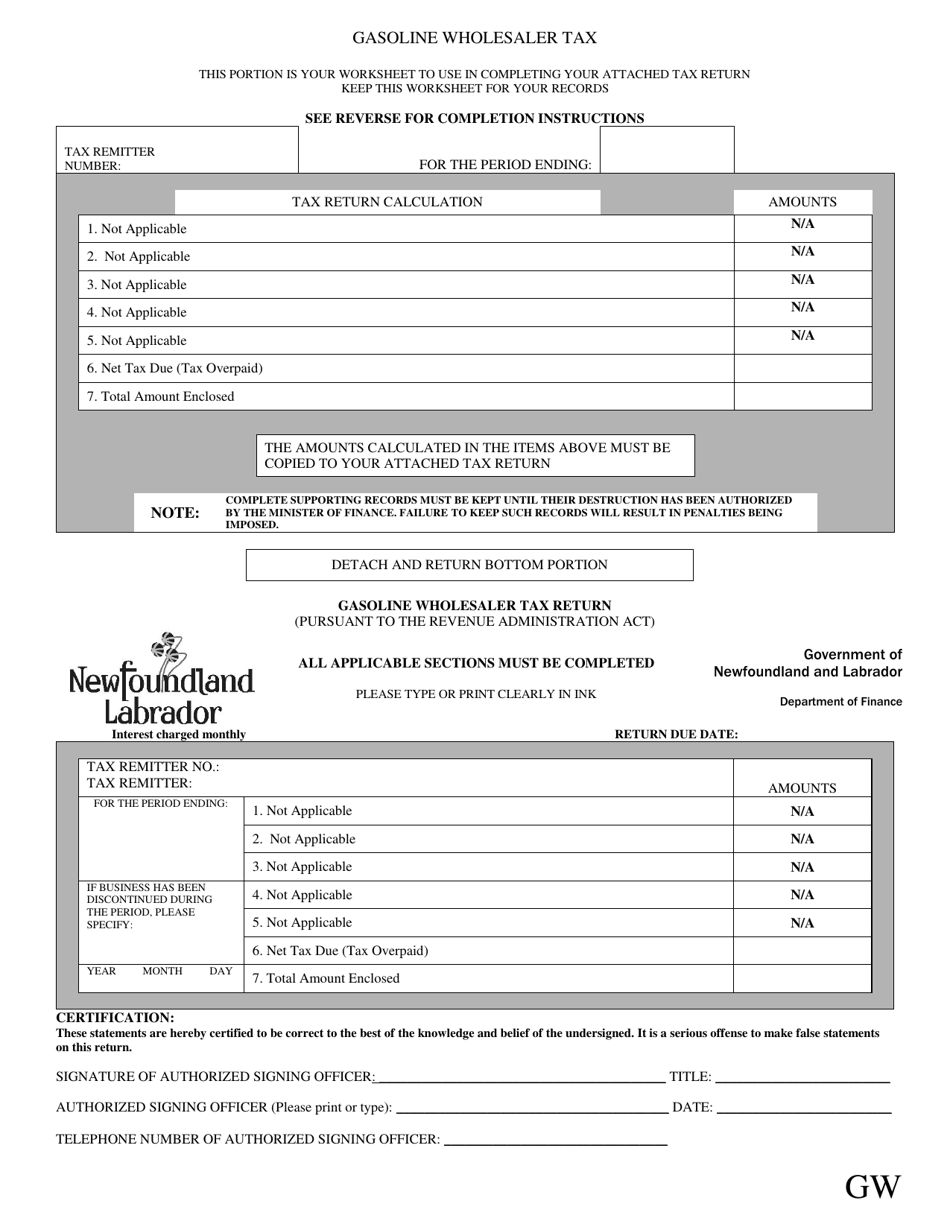

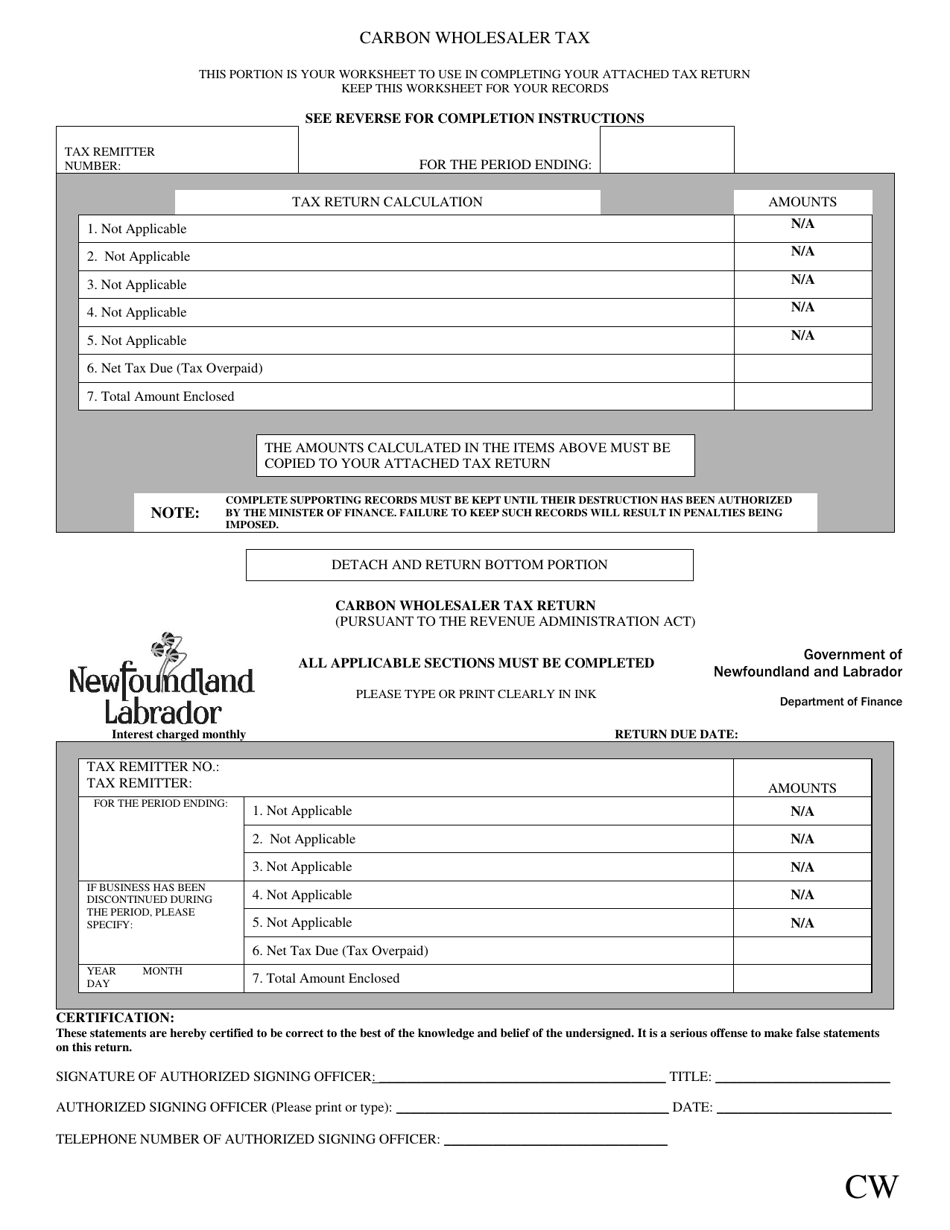

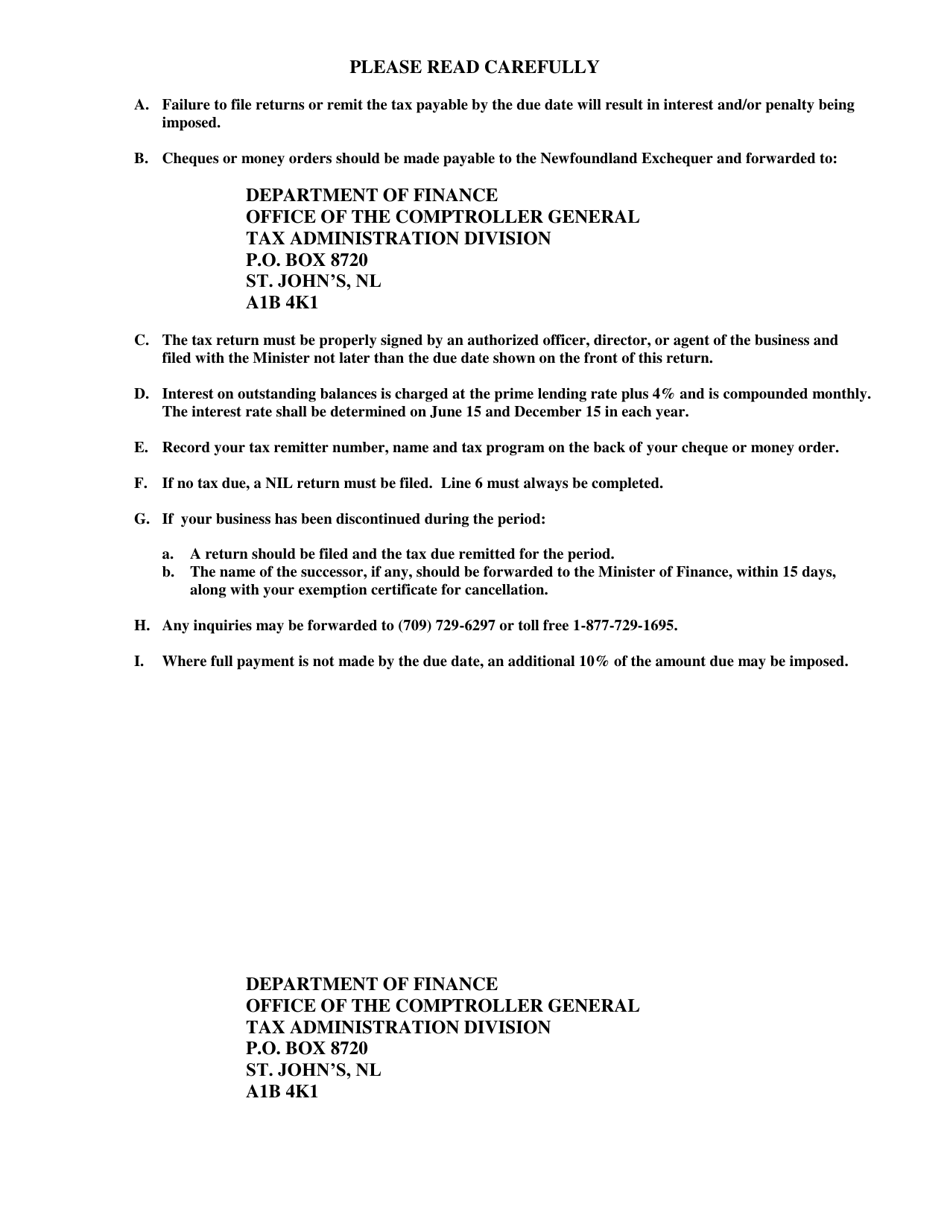

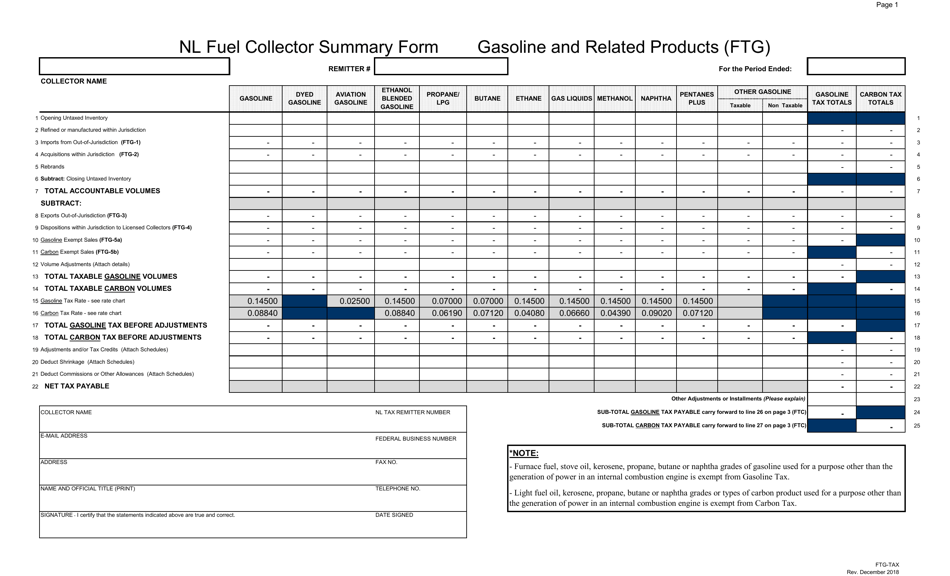

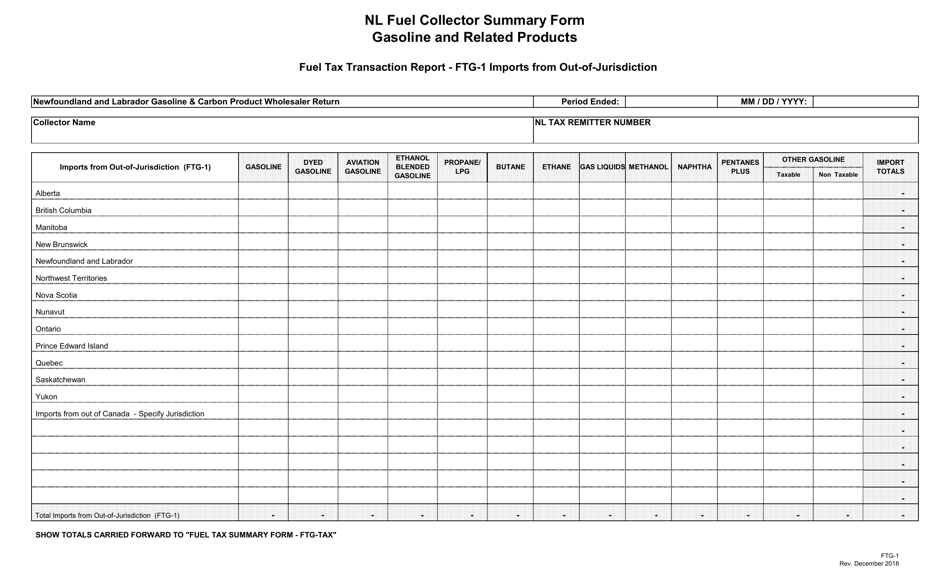

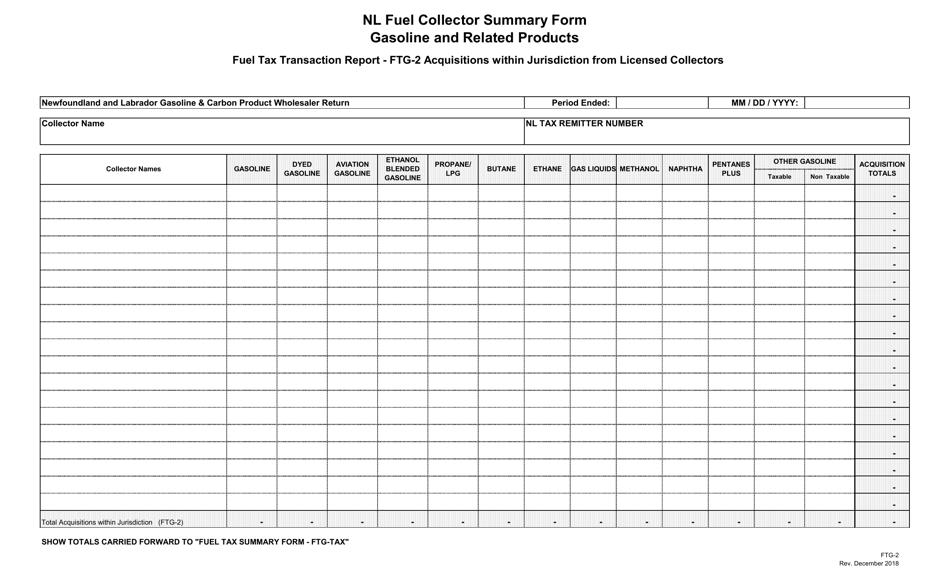

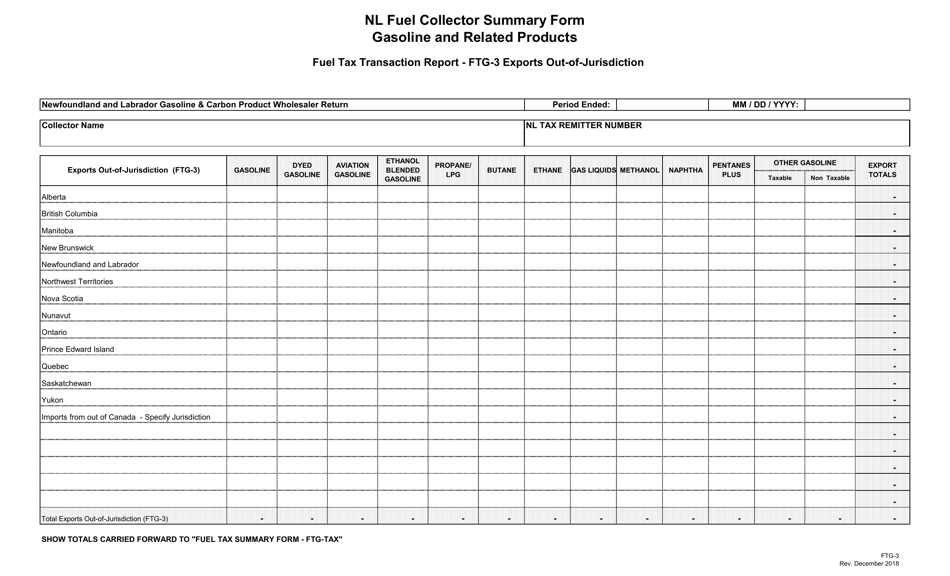

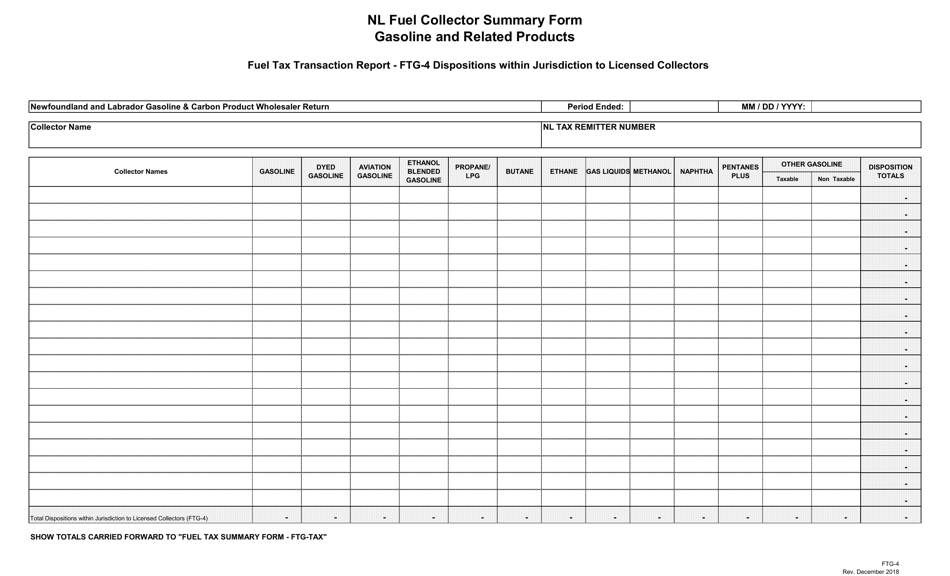

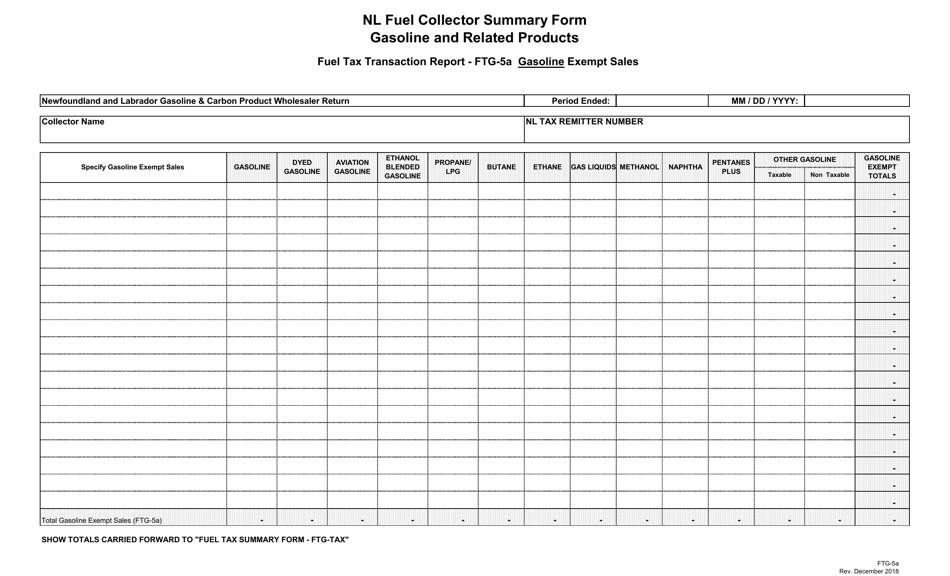

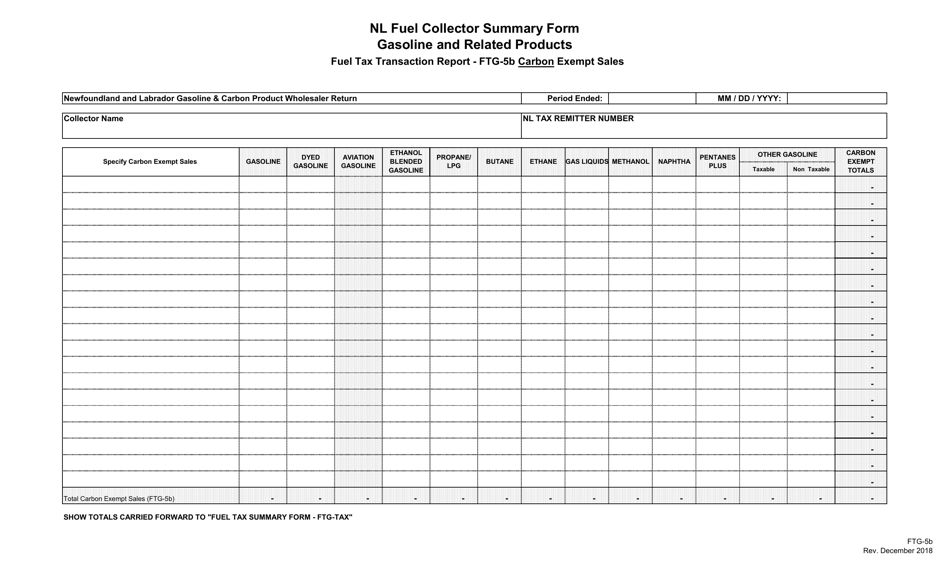

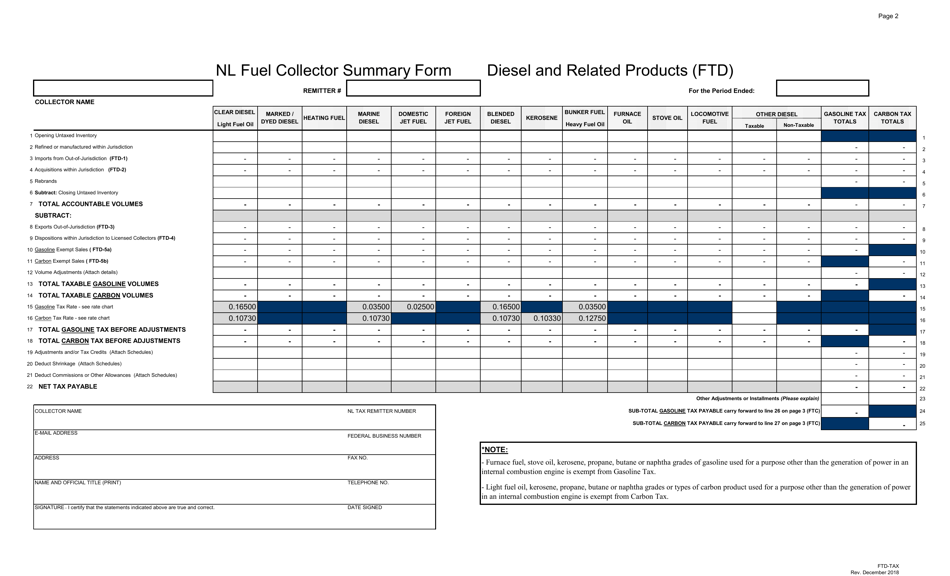

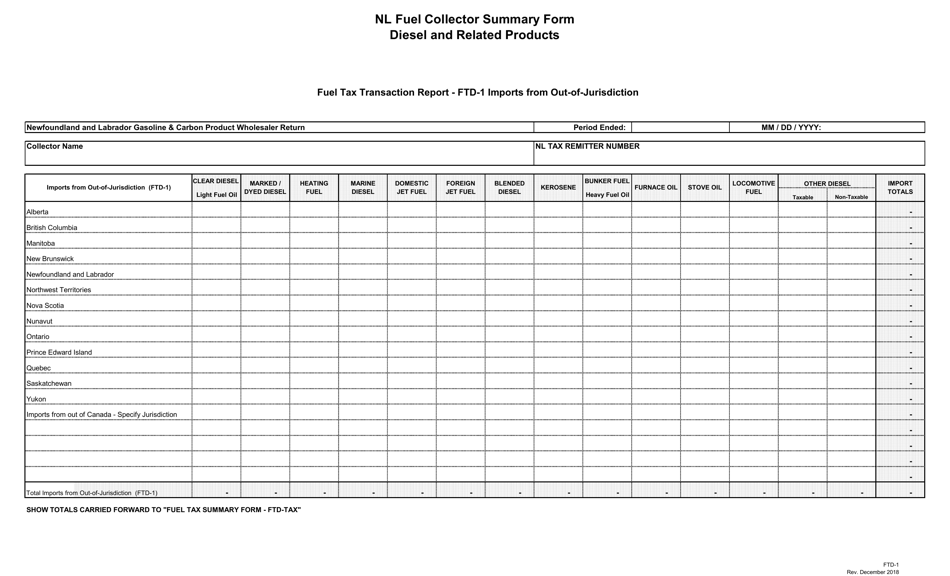

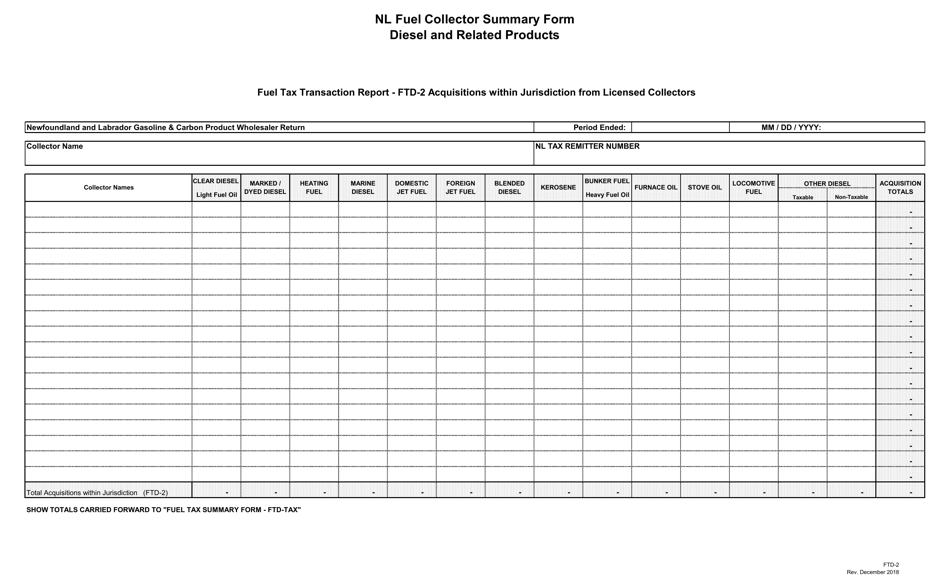

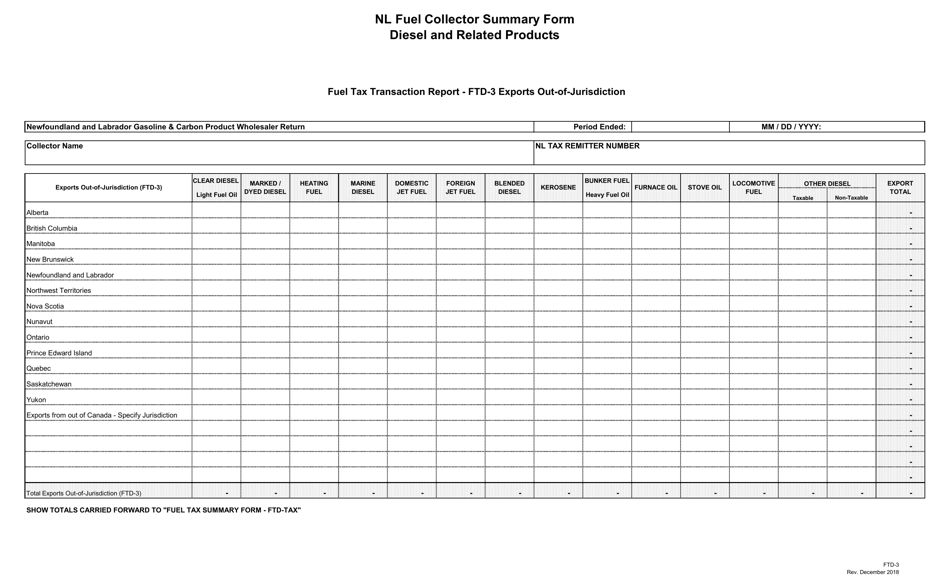

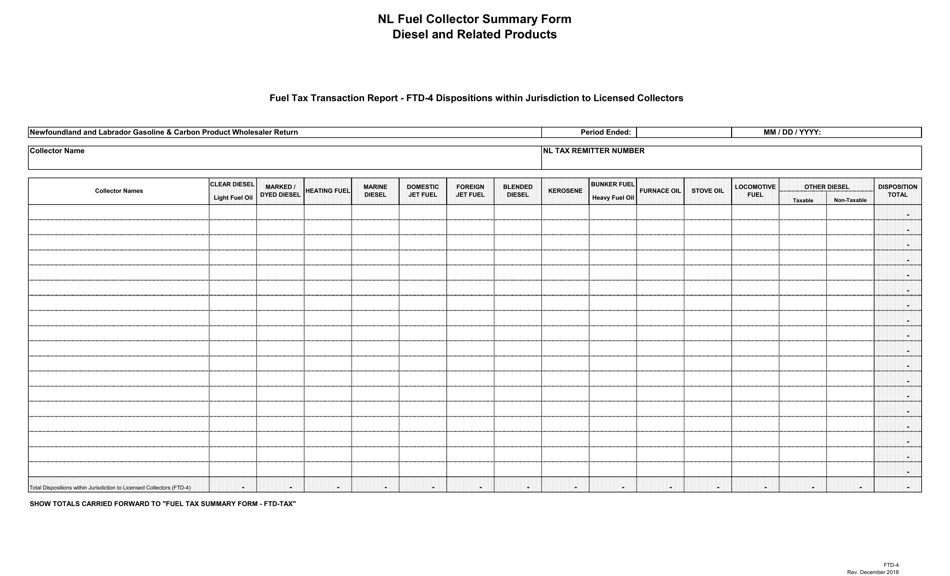

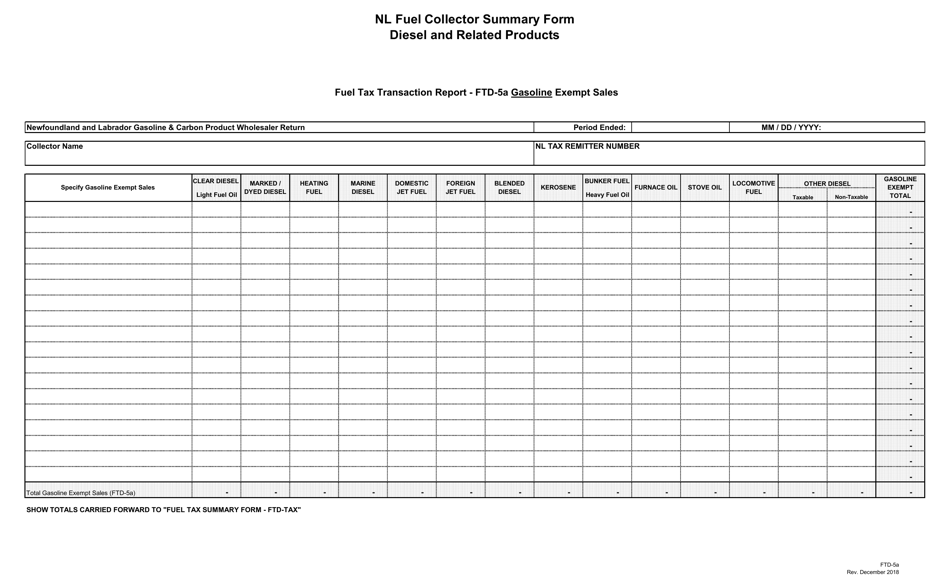

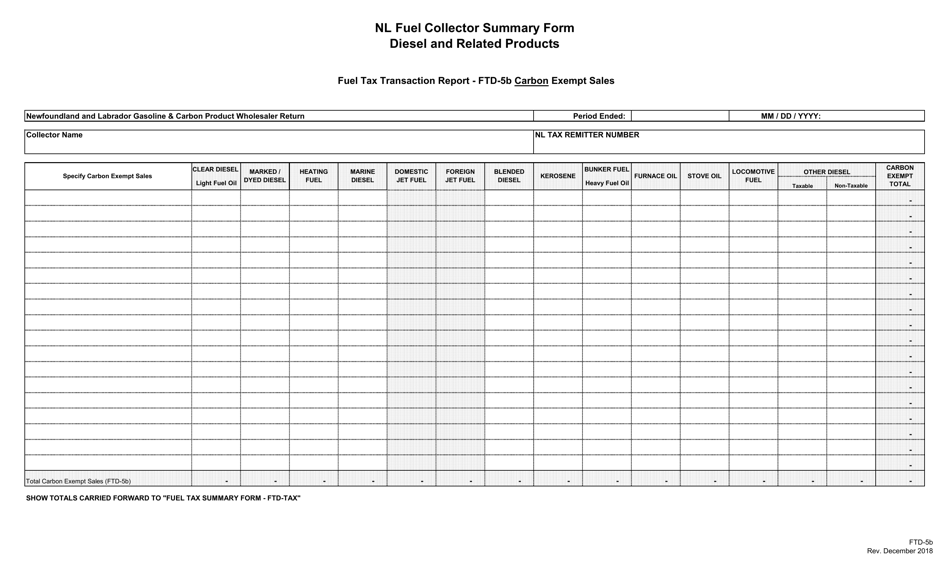

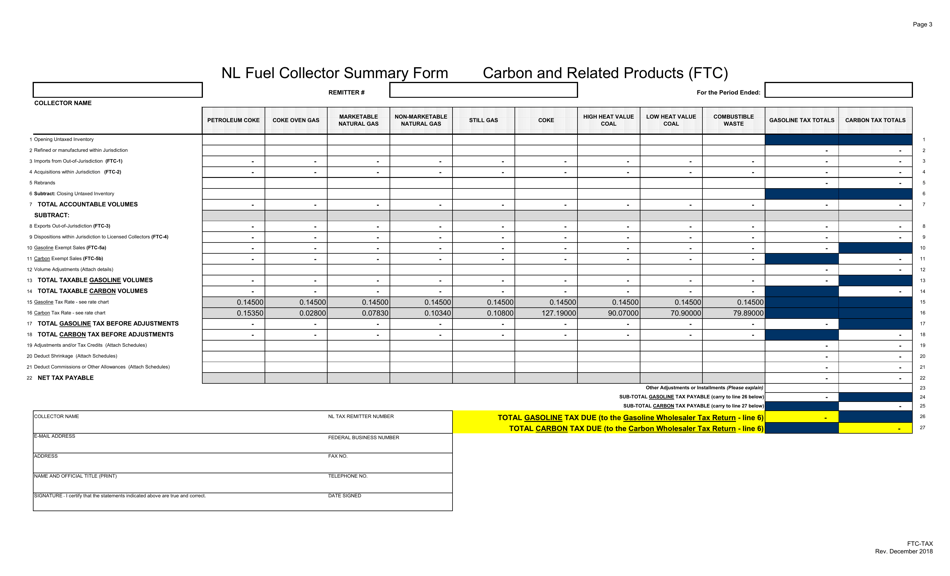

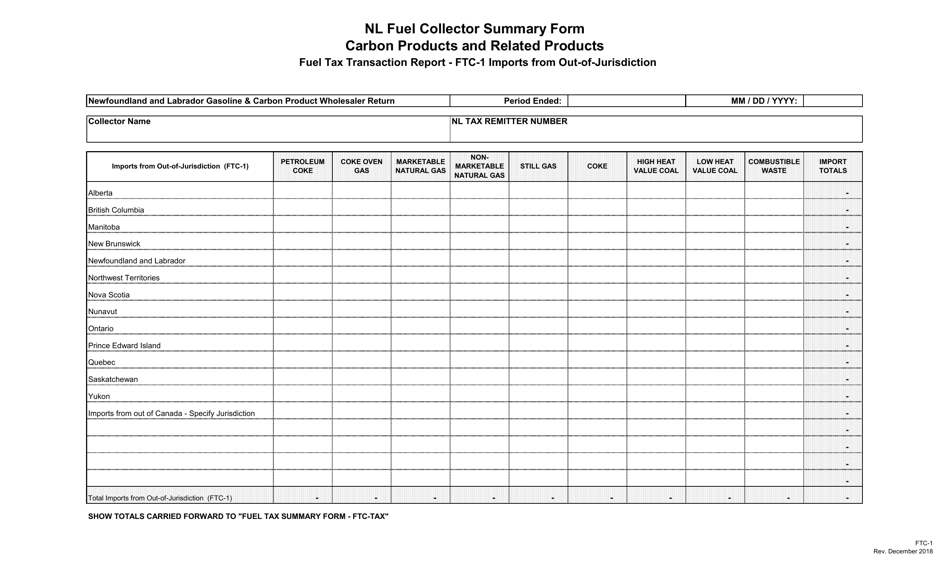

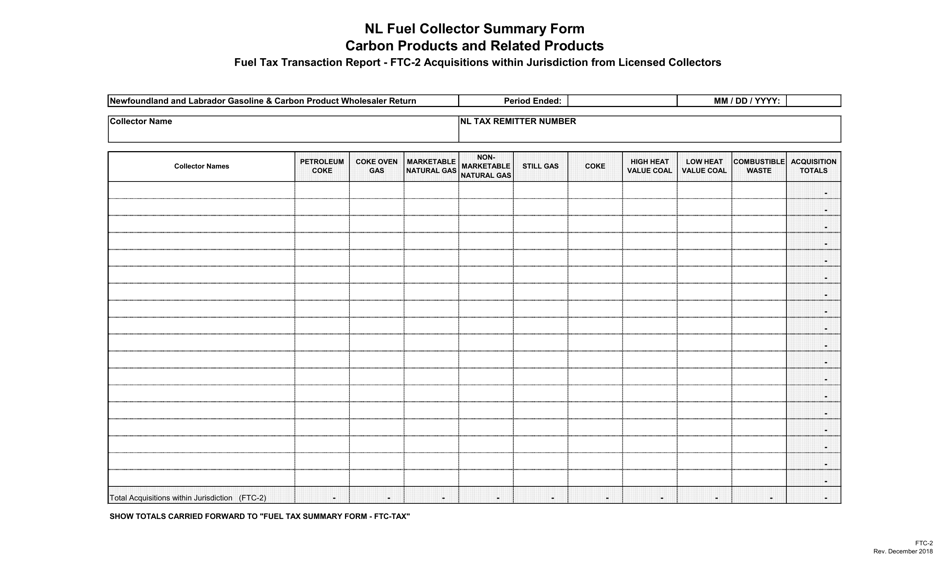

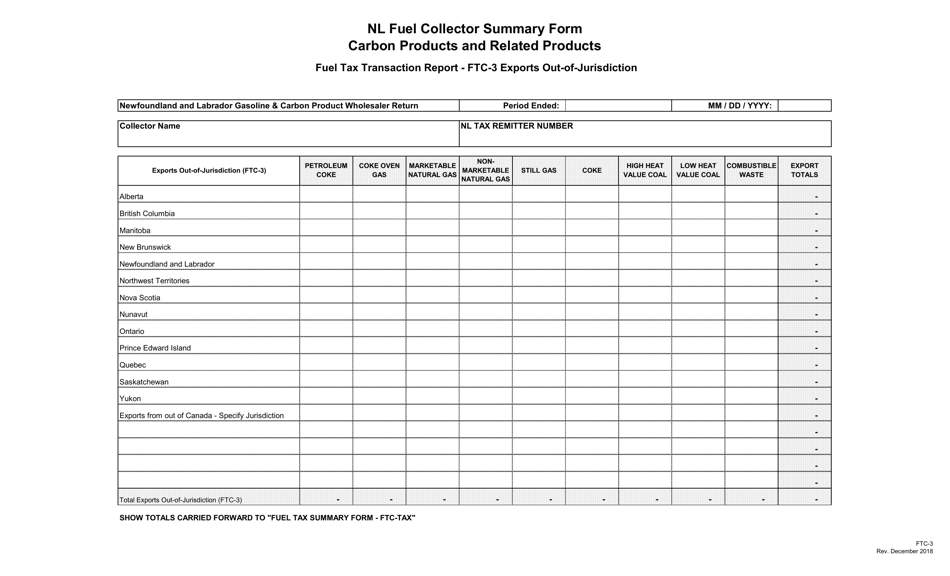

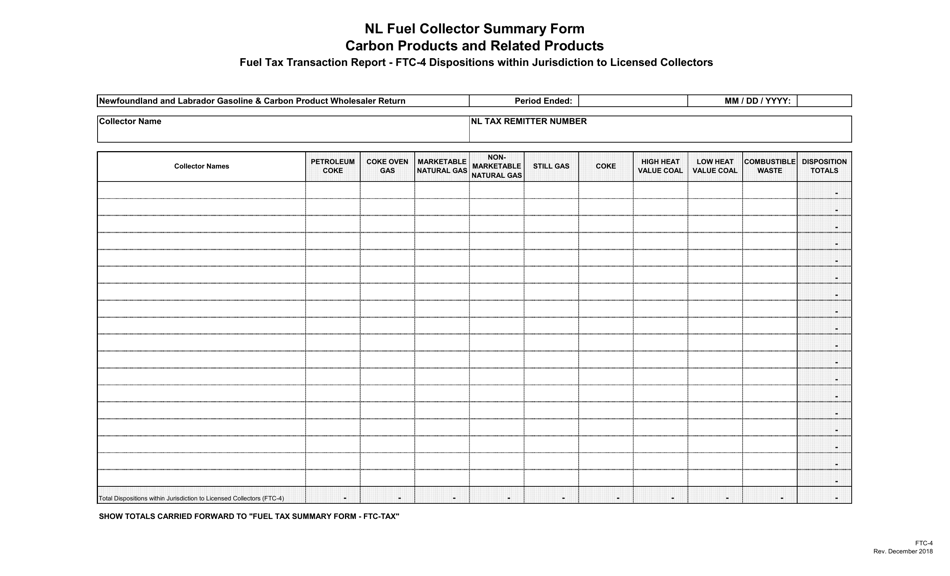

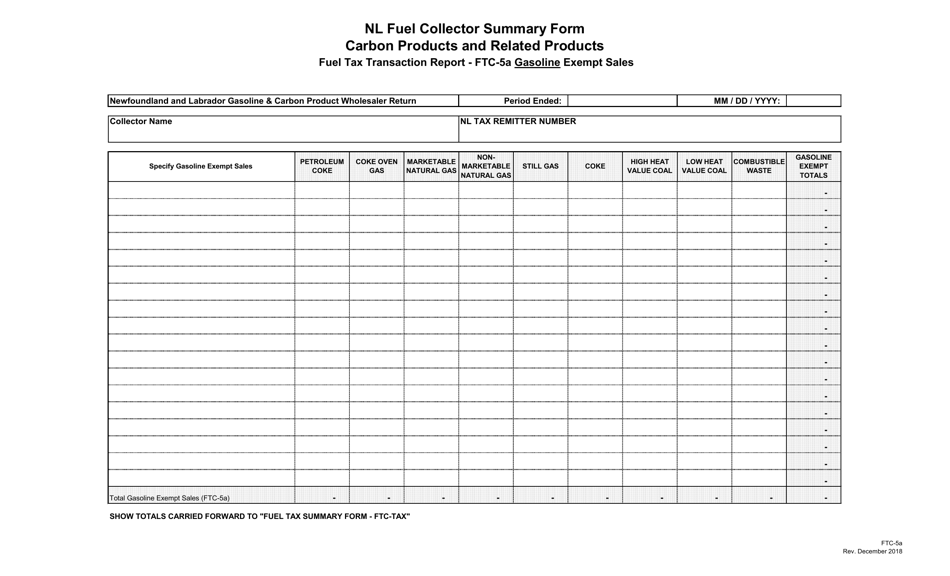

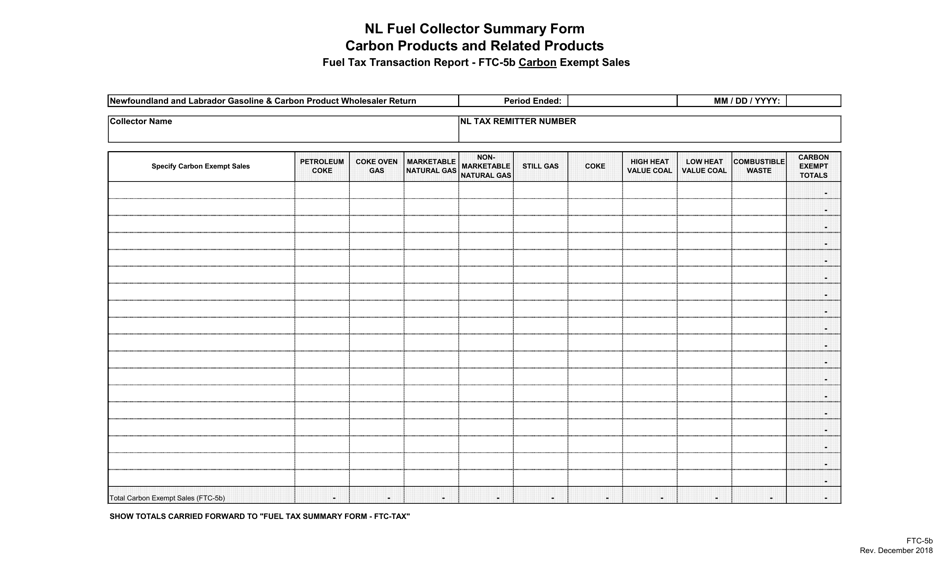

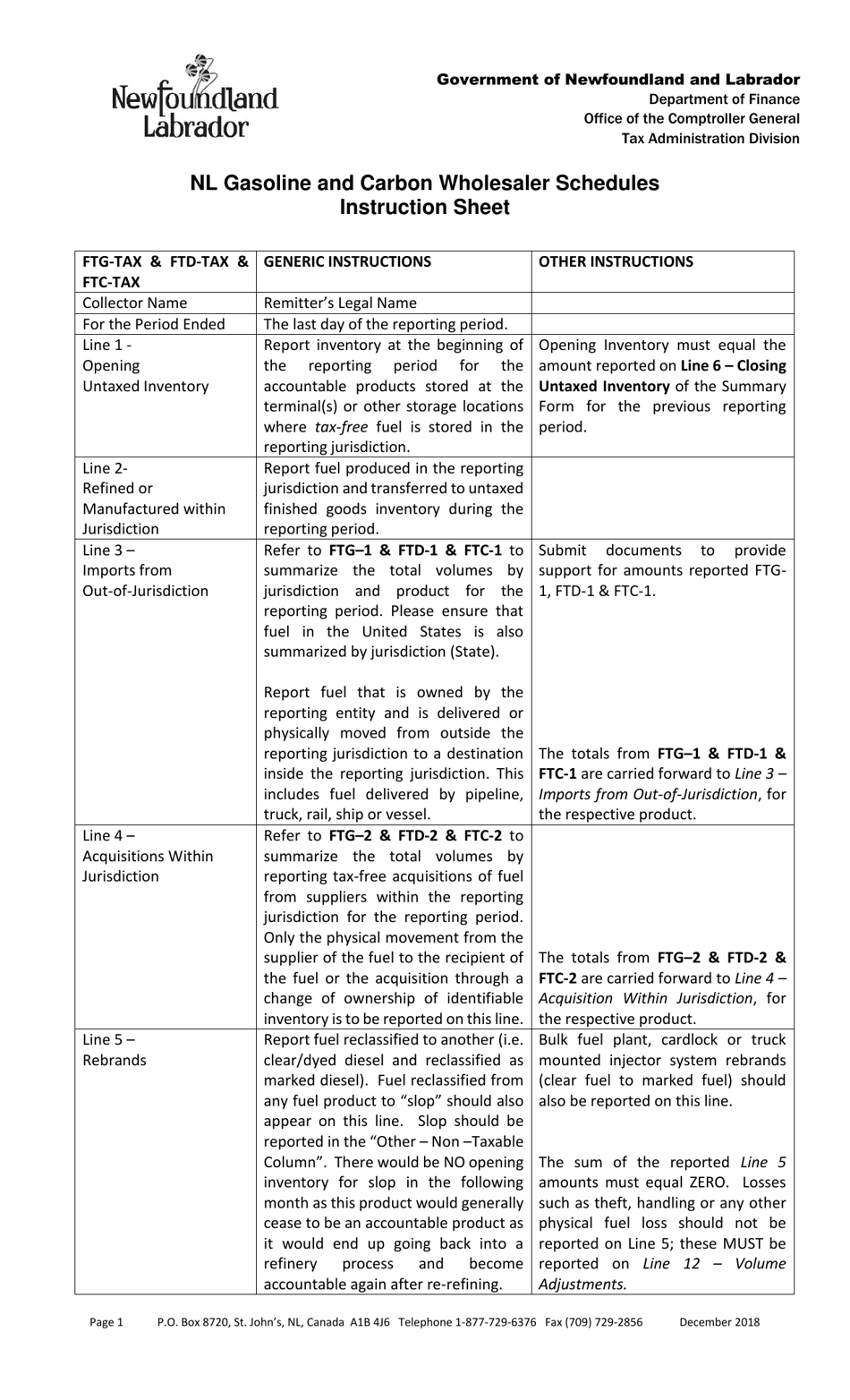

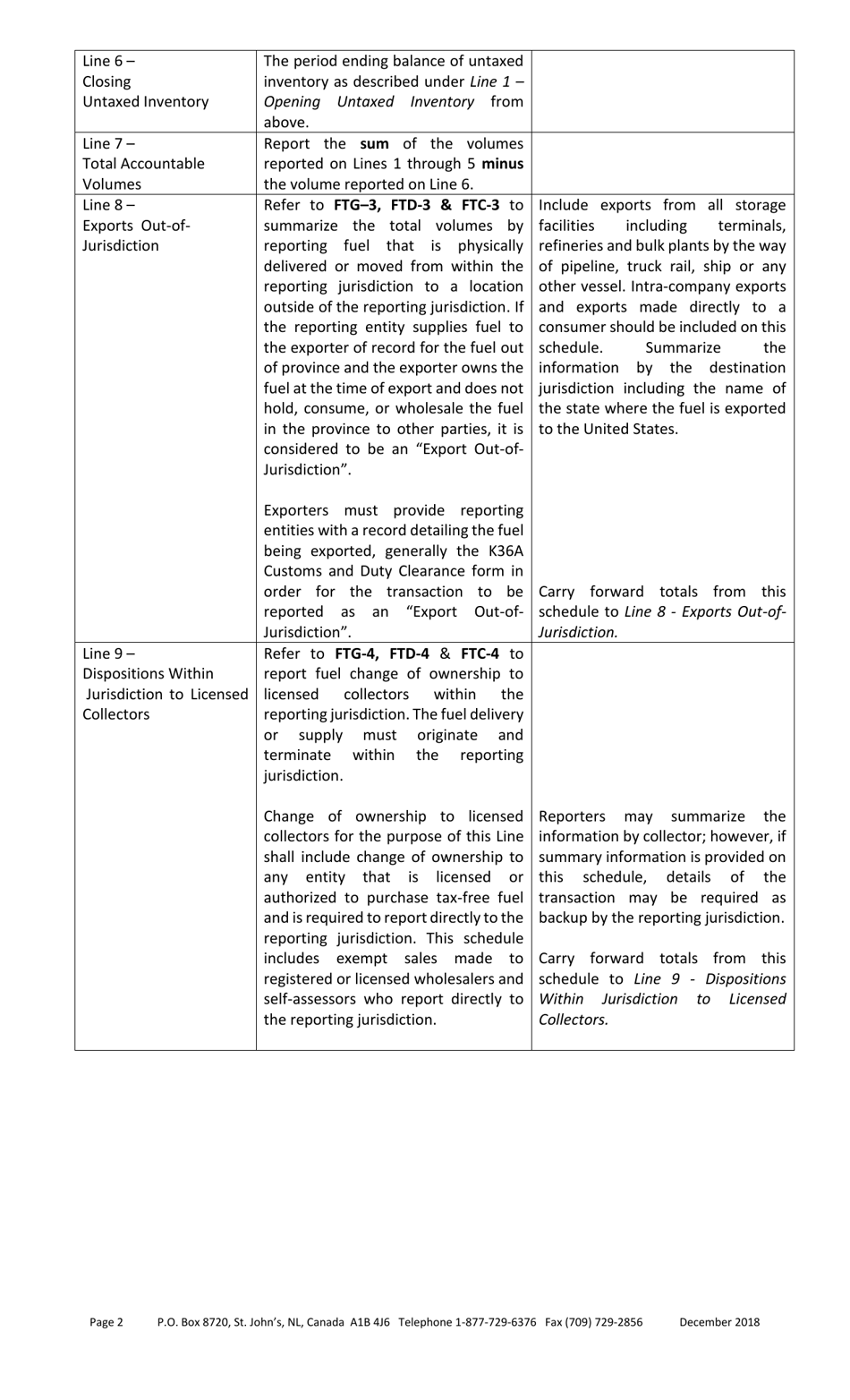

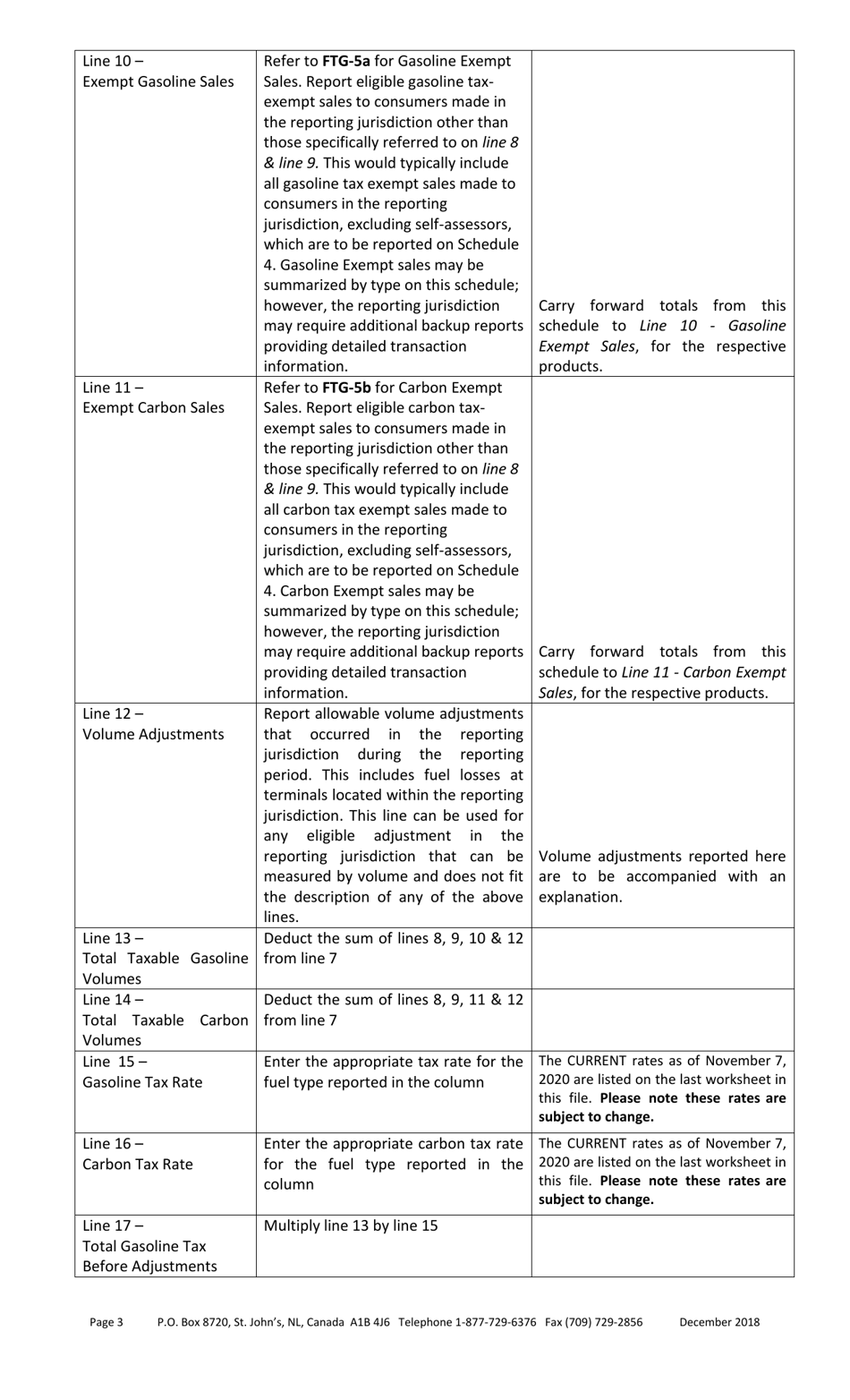

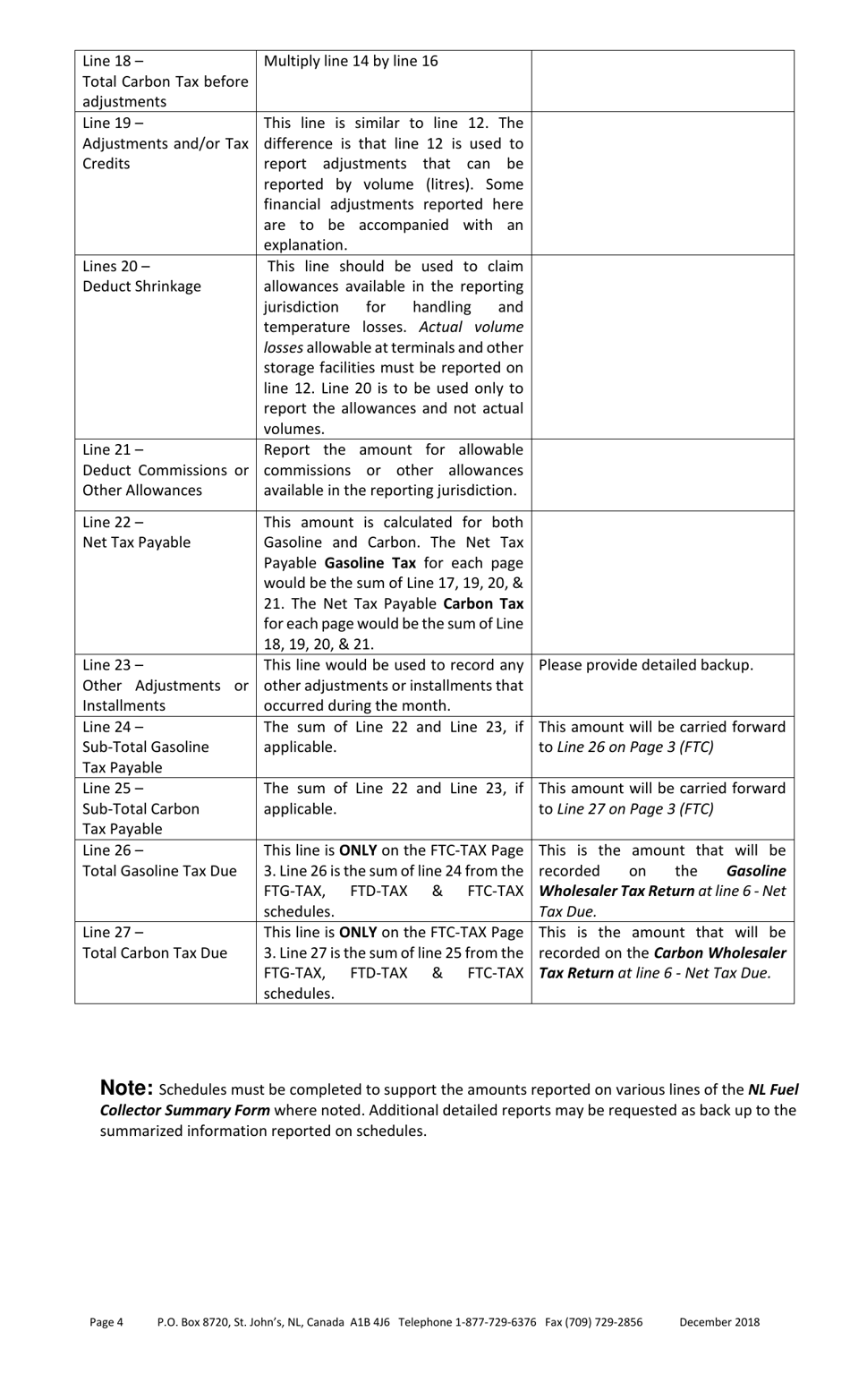

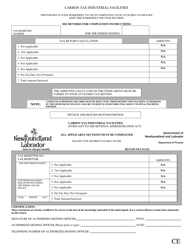

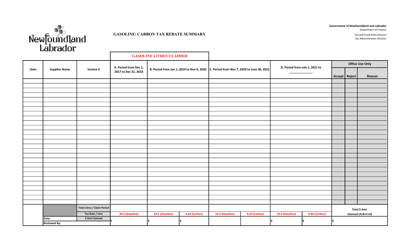

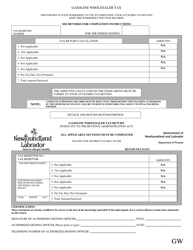

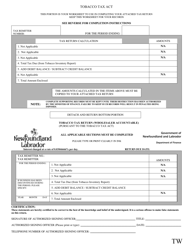

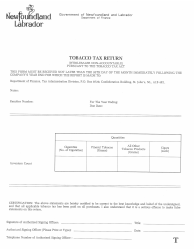

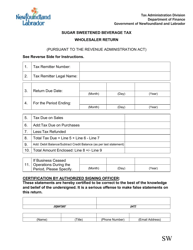

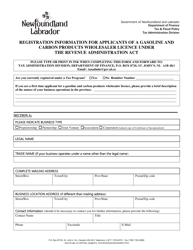

Blank Return Gasoline and Carbon Wholesaler Tax - Newfoundland and Labrador, Canada

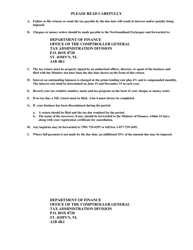

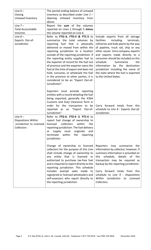

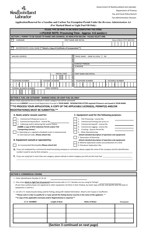

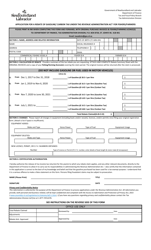

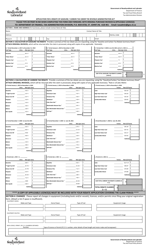

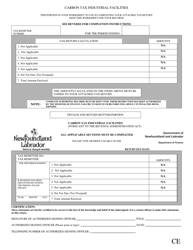

Blank Return Gasoline and Carbon Wholesaler Tax is a tax collected by the province of Newfoundland and Labrador in Canada. It is levied on wholesalers who deal in gasoline and carbon-based fuels. The purpose of this tax is to generate revenue for the government and regulate the sale and distribution of these products.

The blank return for the Gasoline and Carbon Wholesaler Tax in Newfoundland and Labrador, Canada is filed by the gasoline and carbon wholesalers themselves.

FAQ

Q: What is the Blank Return Gasoline and Carbon Wholesaler Tax?

A: The Blank Return Gasoline and Carbon Wholesaler Tax is a tax imposed in Newfoundland and Labrador, Canada.

Q: Who is responsible for paying the Blank Return Gasoline and Carbon Wholesaler Tax?

A: Gasoline and carbon wholesalers are responsible for paying this tax.

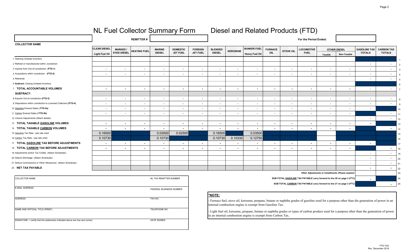

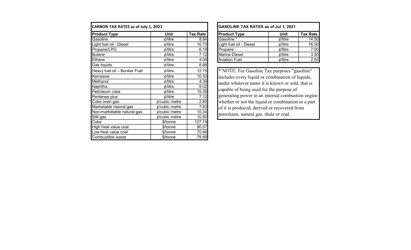

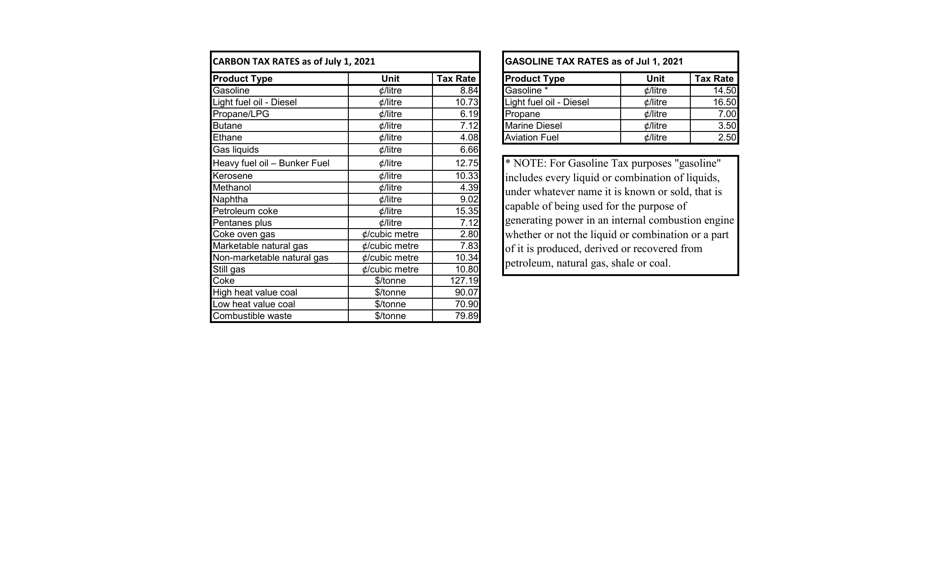

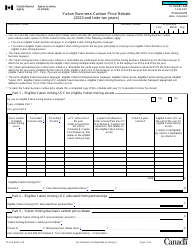

Q: How is the Blank Return Gasoline and Carbon Wholesaler Tax calculated?

A: The tax is calculated based on the volume of gasoline and carbon purchased by the wholesaler.

Q: What is the purpose of the Blank Return Gasoline and Carbon Wholesaler Tax?

A: The tax is used to generate revenue for the provincial government and support various programs and services.

Q: Is the Blank Return Gasoline and Carbon Wholesaler Tax applicable to consumers?

A: No, this tax is specific to gasoline and carbon wholesalers and does not directly impact consumers.