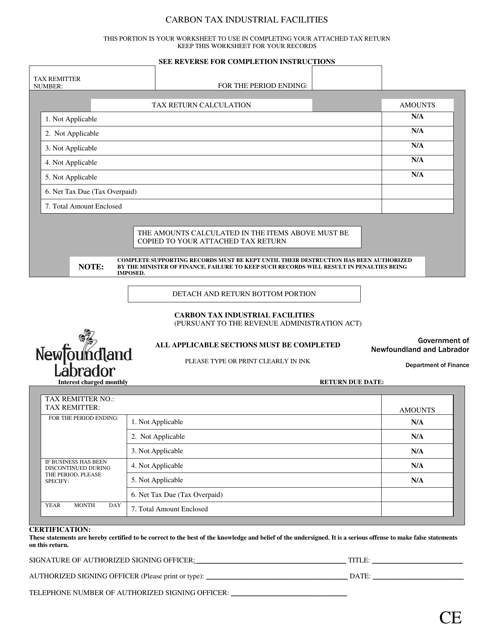

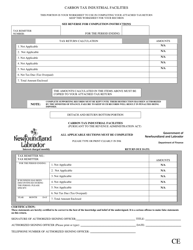

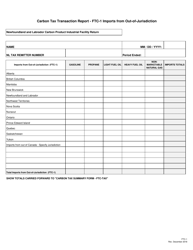

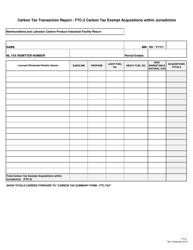

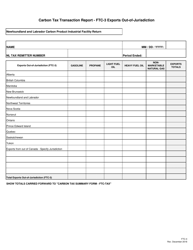

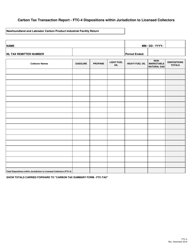

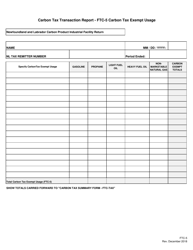

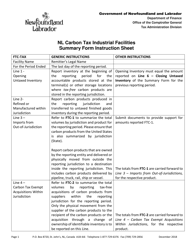

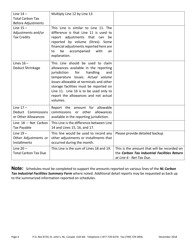

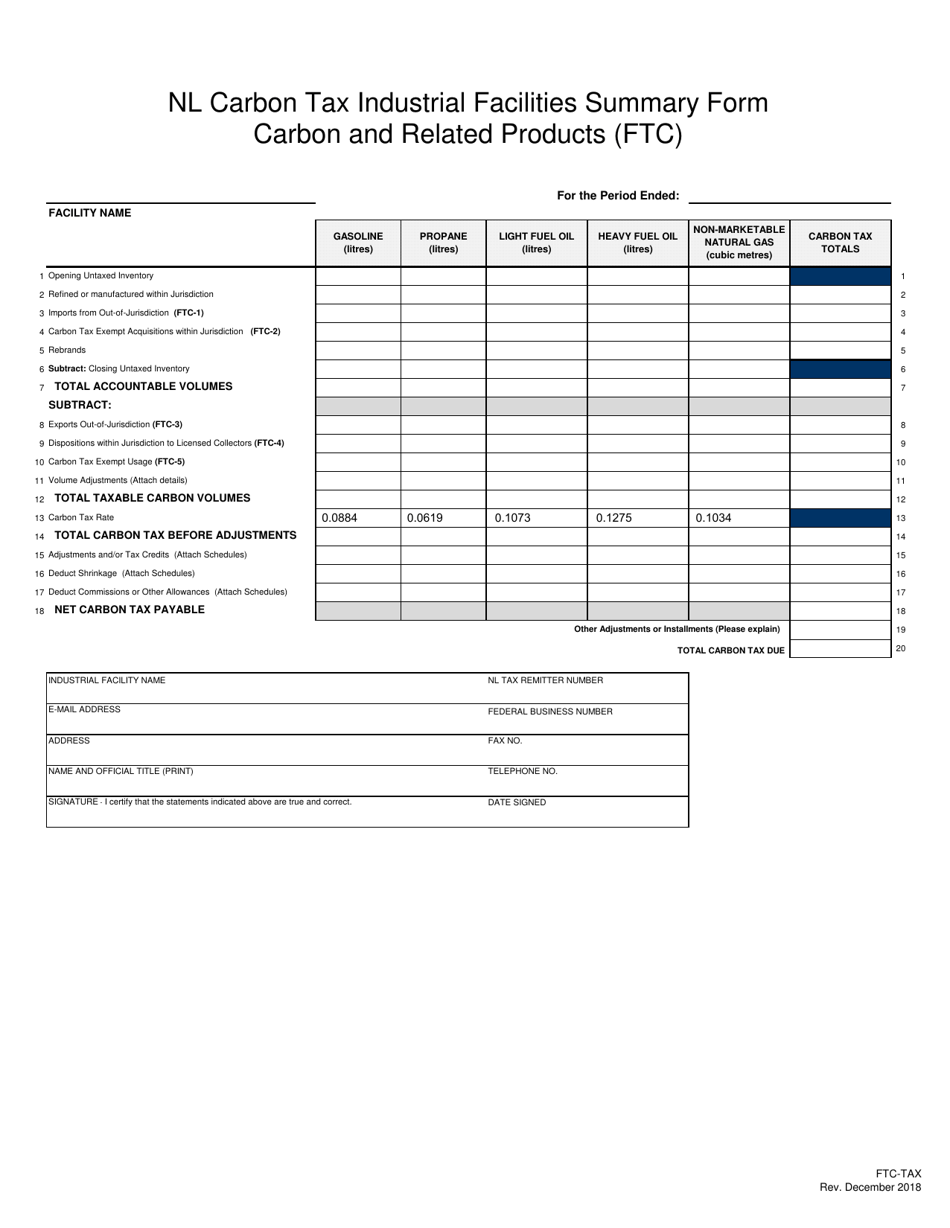

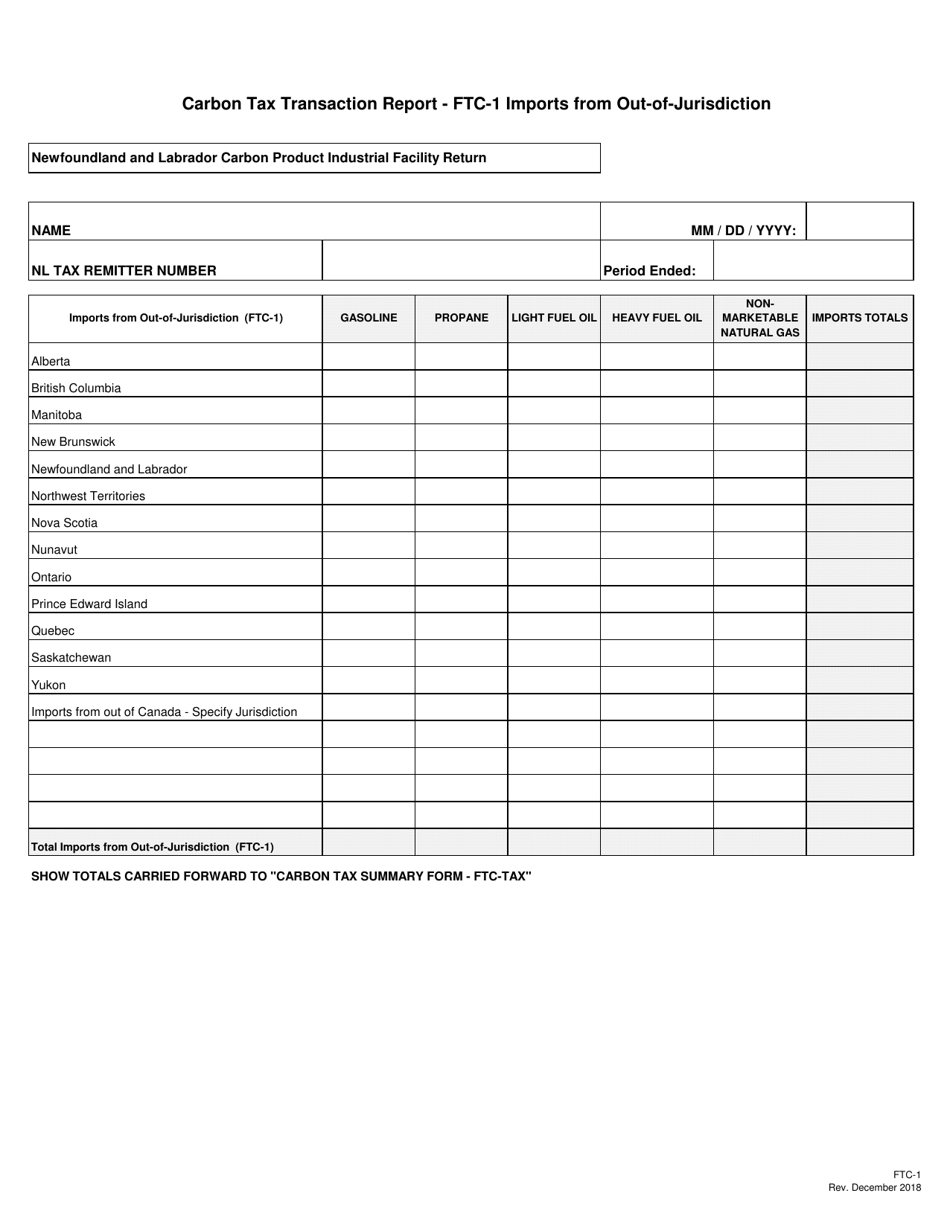

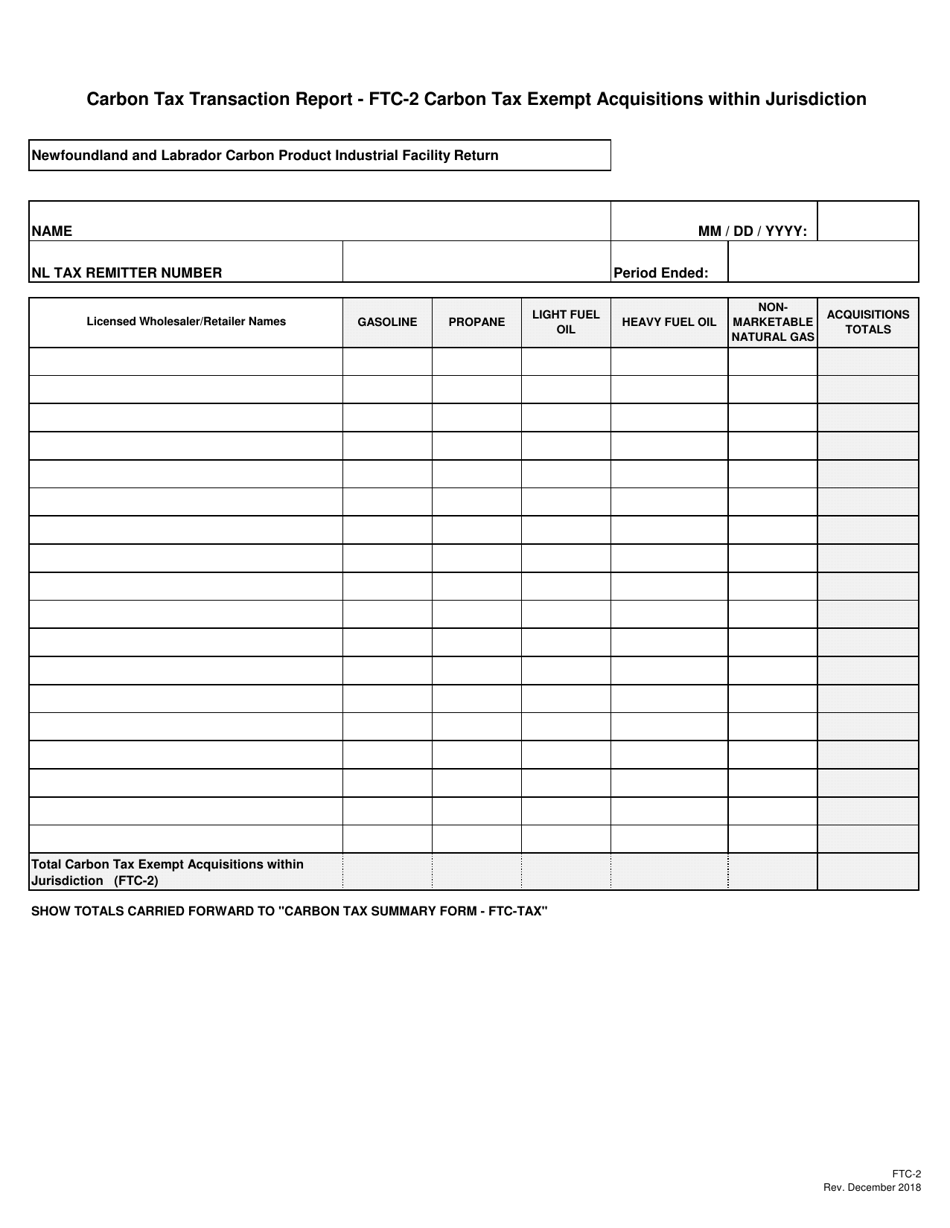

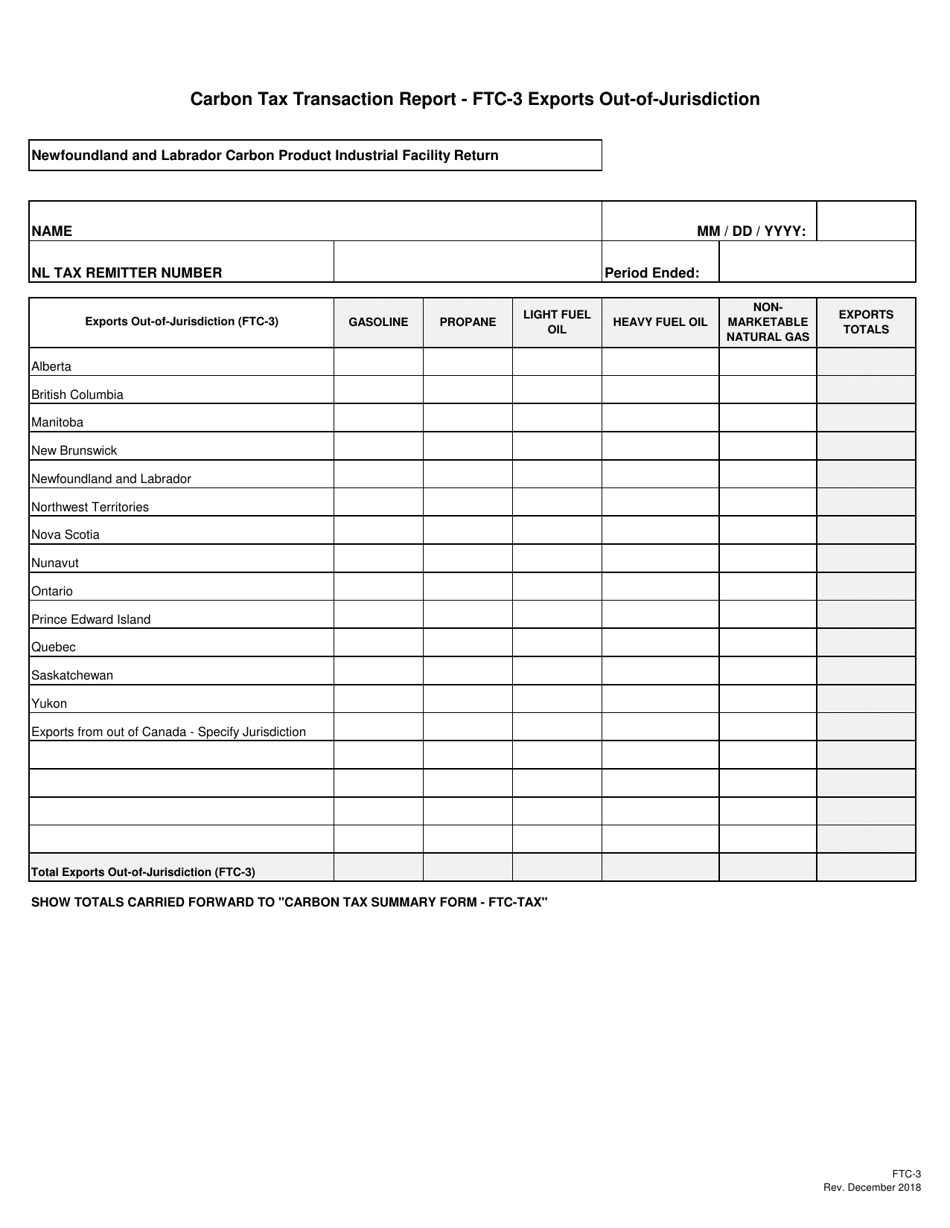

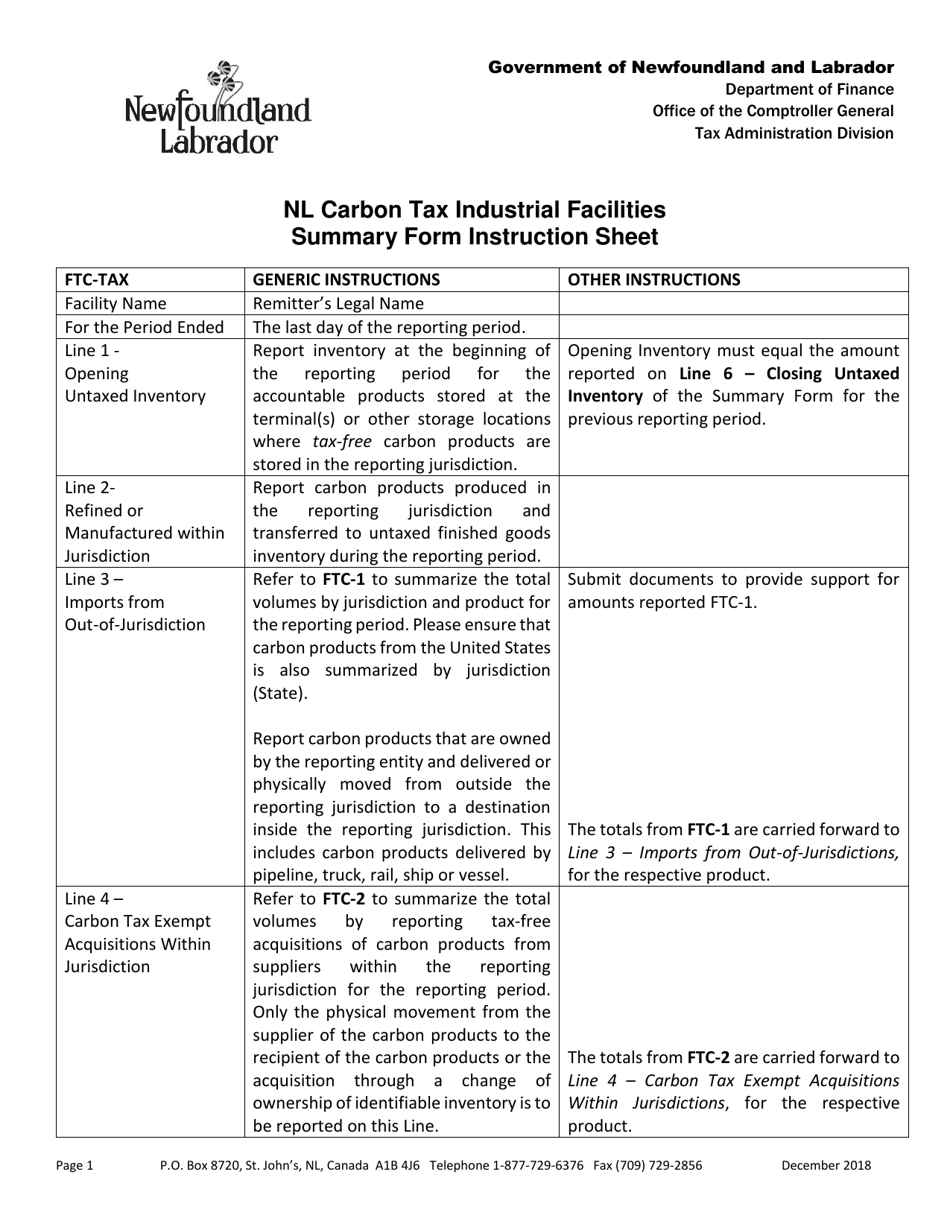

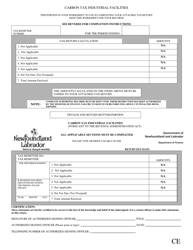

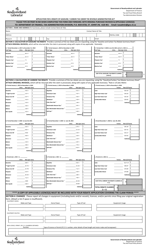

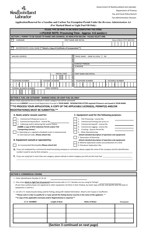

Blank Return - Carbon Industrial Facilities (Emitter) Tax - Newfoundland and Labrador, Canada

The emitter files the Blank Return - Carbon Industrial Facilities (Emitter) Tax in Newfoundland and Labrador, Canada.

FAQ

Q: What is the Carbon Industrial Facilities (Emitter) Tax?

A: The Carbon Industrial Facilities (Emitter) Tax is a tax levied on industrial facilities that emit carbon dioxide in Newfoundland and Labrador, Canada.

Q: Why was the Carbon Industrial Facilities (Emitter) Tax implemented?

A: The Carbon Industrial Facilities (Emitter) Tax was implemented to encourage industrial facilities in Newfoundland and Labrador to reduce their greenhouse gas emissions and address climate change.

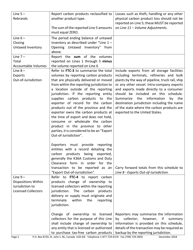

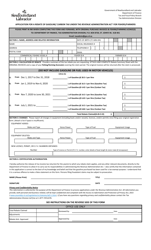

Q: Who is required to pay the Carbon Industrial Facilities (Emitter) Tax?

A: Industrial facilities that emit more than 25,000 tonnes of carbon dioxide per year are required to pay the Carbon Industrial Facilities (Emitter) Tax.

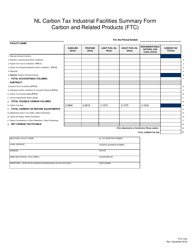

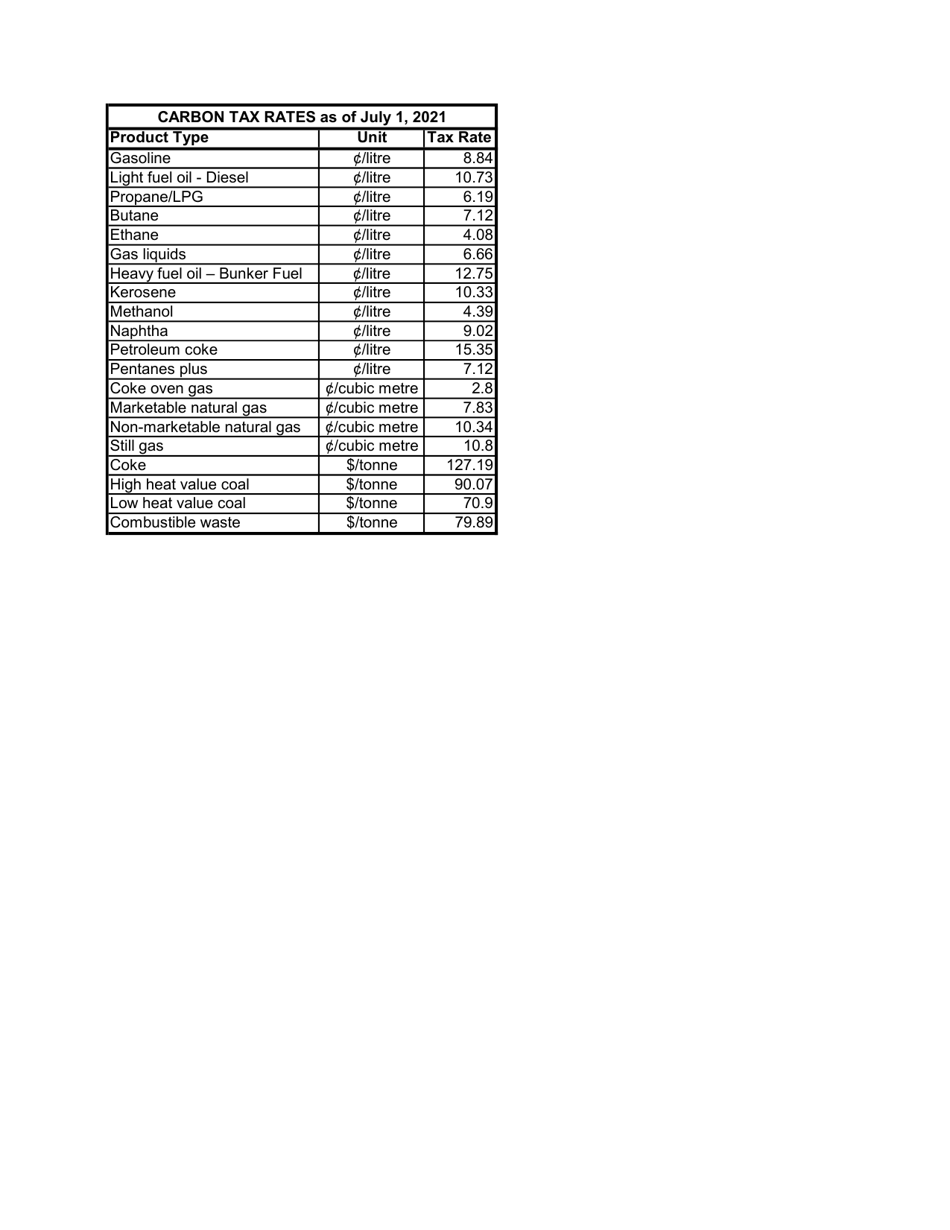

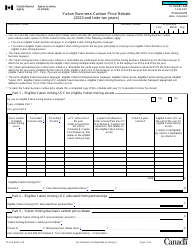

Q: How is the amount of tax determined?

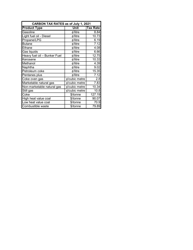

A: The amount of tax is determined based on the facility's emissions of carbon dioxide and a tax rate that is set by the government of Newfoundland and Labrador.

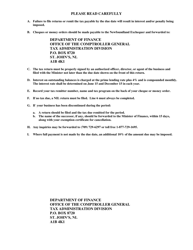

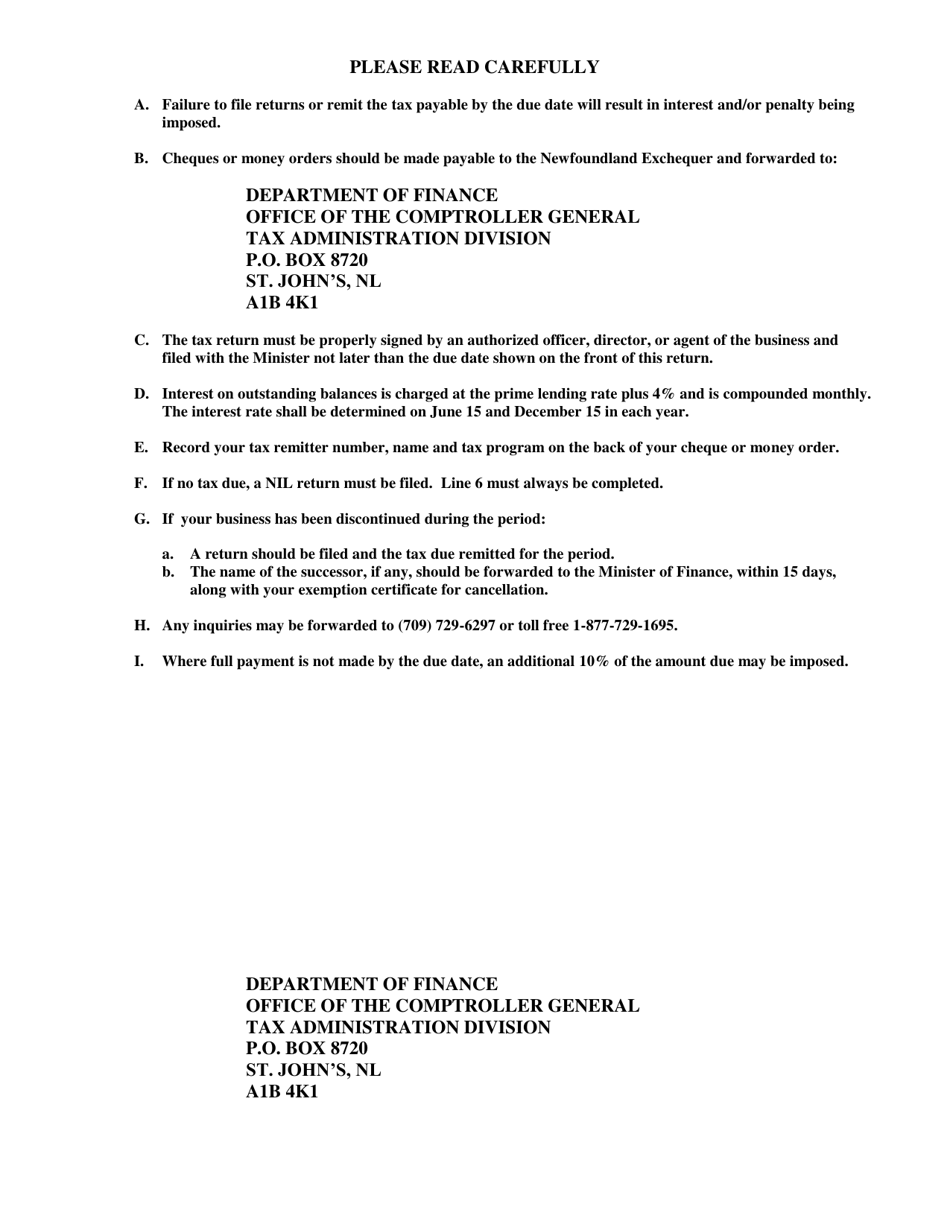

Q: What are the penalties for non-compliance with the Carbon Industrial Facilities (Emitter) Tax?

A: Facilities that fail to comply with the Carbon Industrial Facilities (Emitter) Tax may be subject to penalties, including fines and legal action.

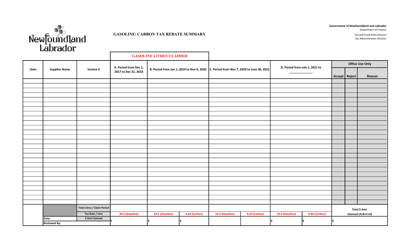

Q: What happens to the revenue collected from the Carbon Industrial Facilities (Emitter) Tax?

A: The revenue collected from the Carbon Industrial Facilities (Emitter) Tax is used to fund programs and initiatives aimed at reducing greenhouse gas emissions and supporting clean technology development in Newfoundland and Labrador.

Q: Are there any exemptions to the Carbon Industrial Facilities (Emitter) Tax?

A: Certain emissions and sectors may be exempt from the Carbon Industrial Facilities (Emitter) Tax, depending on specific criteria and regulations set by the government.

Q: Is the Carbon Industrial Facilities (Emitter) Tax in effect in other provinces or territories of Canada?

A: No, the Carbon Industrial Facilities (Emitter) Tax is specific to Newfoundland and Labrador and is not currently in effect in other provinces or territories of Canada.