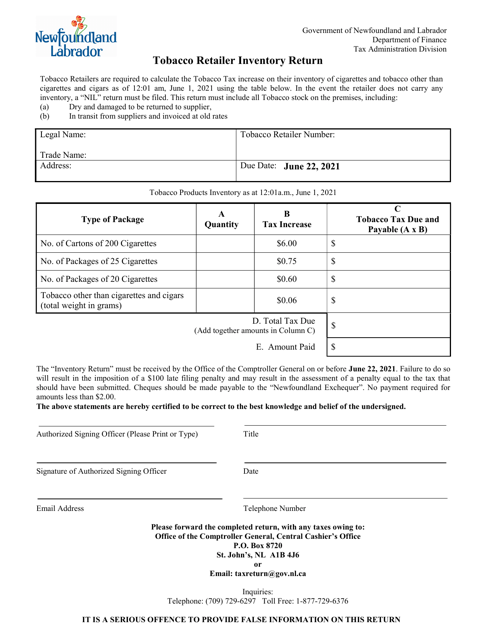

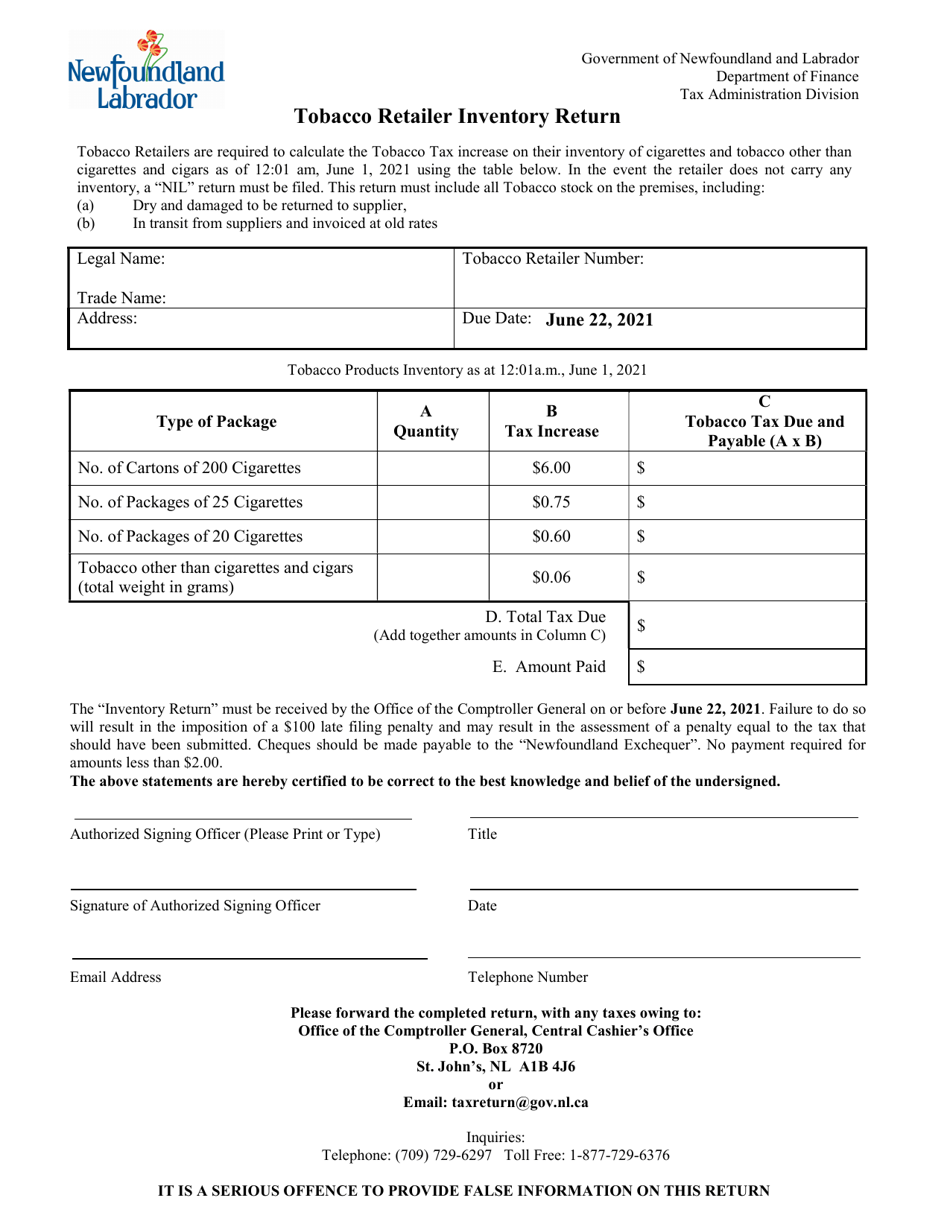

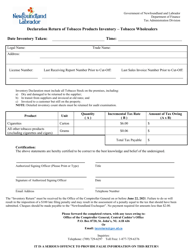

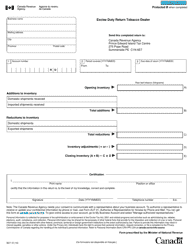

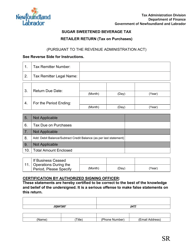

Tobacco Retailer Inventory Return - Newfoundland and Labrador, Canada

The Tobacco Retailer Inventory Return in Newfoundland and Labrador, Canada is a form that tobacco retailers use to report their current inventory of tobacco products to the provincial government. It helps the government track and regulate the sale of tobacco products in the province.

The Tobacco Retailer Inventory Return in Newfoundland and Labrador, Canada, is typically filed by tobacco retailers themselves.

FAQ

Q: What is the Tobacco Retailer Inventory Return?

A: The Tobacco Retailer Inventory Return is a requirement for tobacco retailers in Newfoundland and Labrador, Canada.

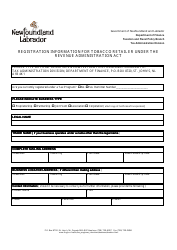

Q: Who needs to file the Tobacco Retailer Inventory Return?

A: All tobacco retailers in Newfoundland and Labrador, Canada need to file the Tobacco Retailer Inventory Return.

Q: What is the purpose of the Tobacco Retailer Inventory Return?

A: The purpose of the Tobacco Retailer Inventory Return is to track the inventory of tobacco products held by retailers in Newfoundland and Labrador, Canada.

Q: When is the Tobacco Retailer Inventory Return due?

A: The due date for the Tobacco Retailer Inventory Return varies and can change each year. Retailers should check with the Newfoundland and Labrador Liquor Corporation (NLC) for the current due date.

Q: What information do I need to provide on the Tobacco Retailer Inventory Return?

A: Retailers need to provide information on the quantity and value of tobacco products held in inventory as of the reporting date.

Q: Are there any penalties for not filing the Tobacco Retailer Inventory Return?

A: Yes, there are penalties for not filing the Tobacco Retailer Inventory Return. Retailers may be subject to fines or other enforcement actions by the NLC.