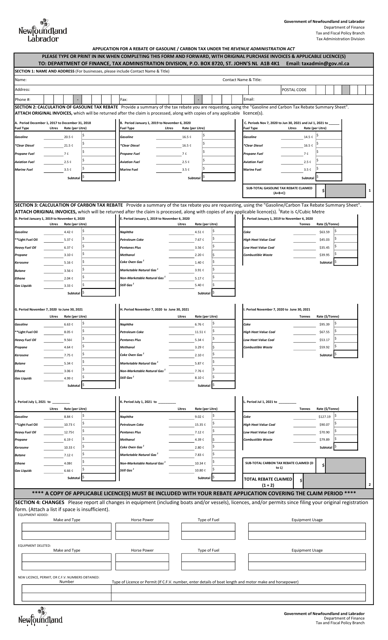

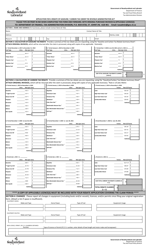

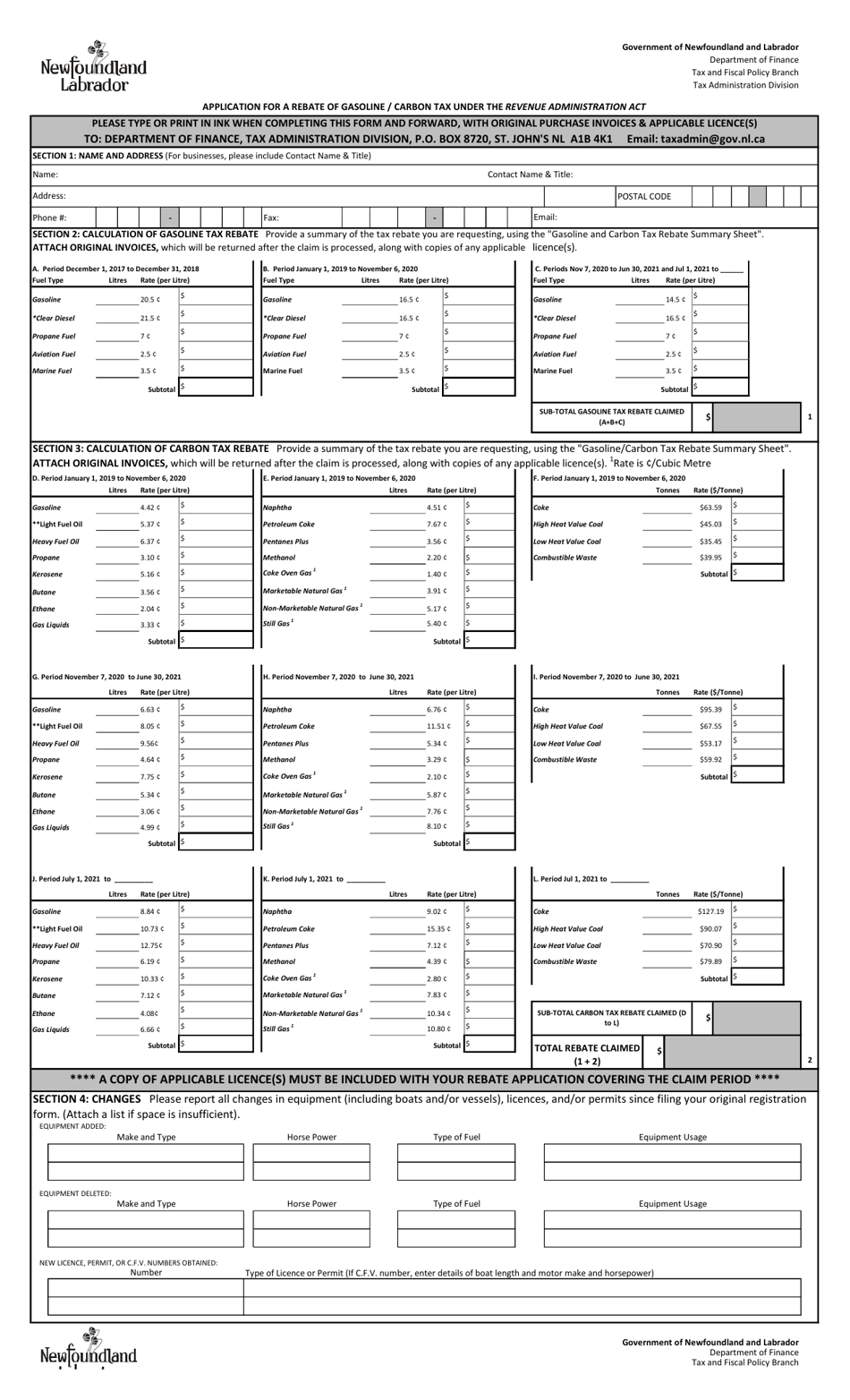

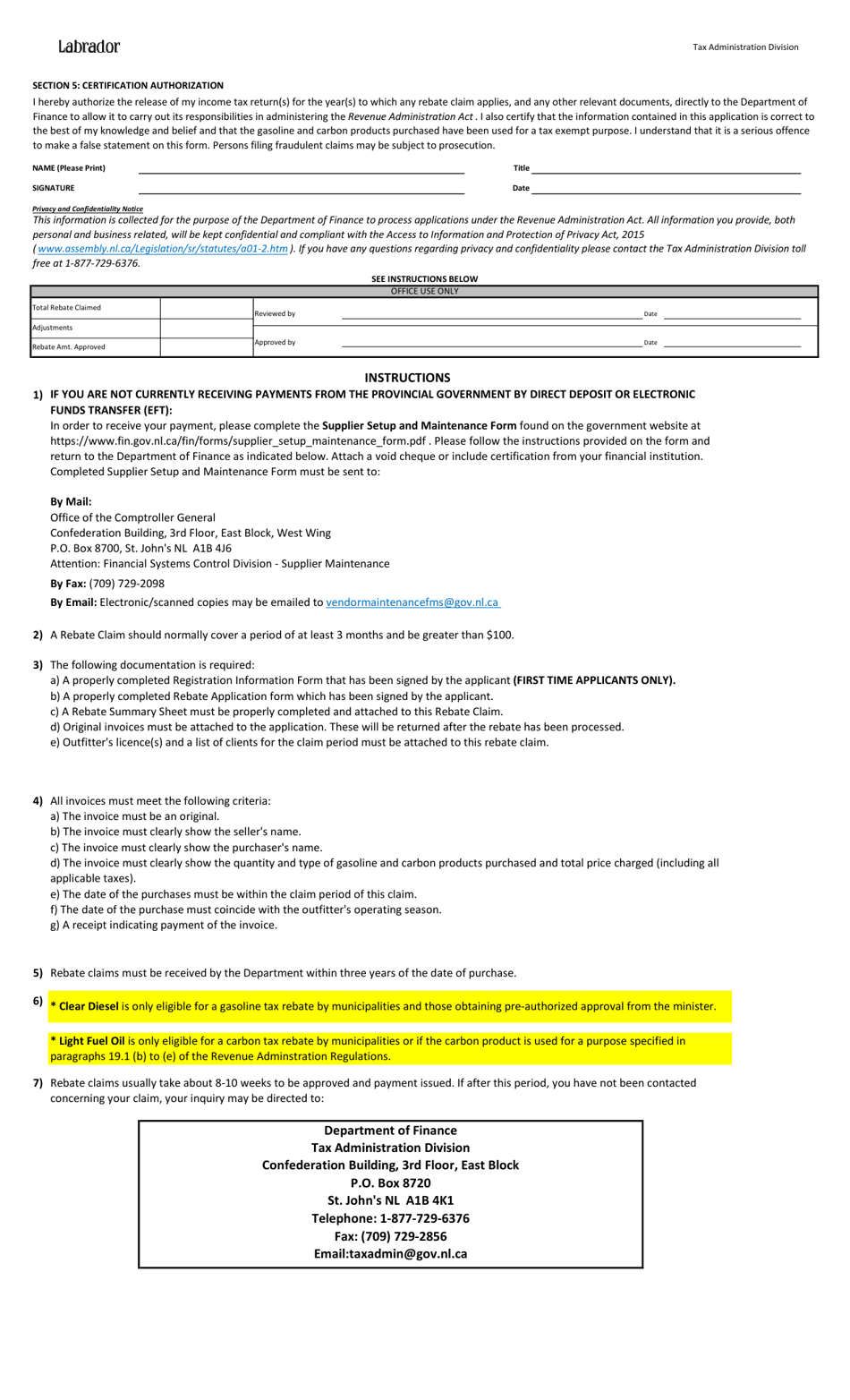

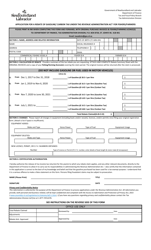

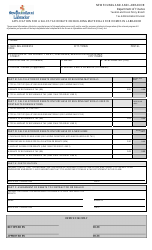

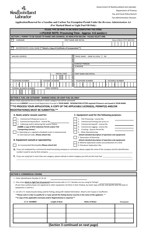

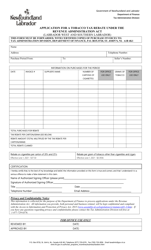

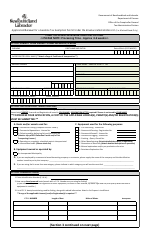

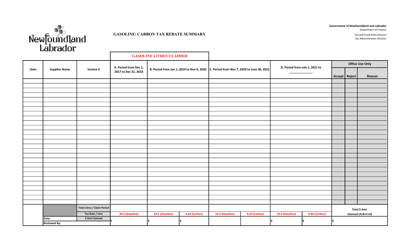

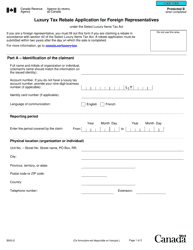

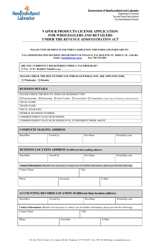

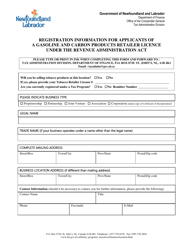

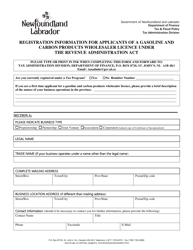

Application for a Rebate of Gasoline / Carbon Tax Under the Revenue Administration Act - Newfoundland and Labrador, Canada

The Application for a Rebate of Gasoline/Carbon Tax under the Revenue Administration Act in Newfoundland and Labrador, Canada is for individuals or businesses to claim a refund on gasoline or carbon taxes that they have paid.

The application for a rebate of gasoline/carbon tax under the Revenue Administration Act in Newfoundland and Labrador, Canada is filed by the consumer or the purchaser of the gasoline.

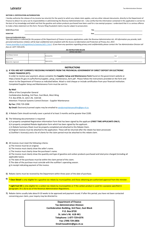

FAQ

Q: What is the rebate of gasoline/carbon tax?

A: The rebate of gasoline/carbon tax is a program in Newfoundland and Labrador, Canada that allows residents to receive a refund on the taxes paid for gasoline and carbon emissions.

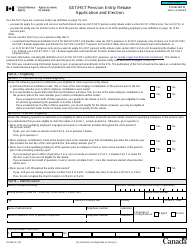

Q: Who is eligible for the rebate?

A: Residents of Newfoundland and Labrador, Canada who meet certain criteria are eligible for the gasoline/carbon tax rebate.

Q: What criteria need to be met to qualify for the rebate?

A: To qualify for the rebate, you must be a resident of Newfoundland and Labrador, Canada, and meet certain income and consumption requirements. The specific criteria can be found in the application form.

Q: How long does it take to receive the rebate?

A: The processing time for the rebate may vary. It is advisable to allow several weeks for the application to be reviewed and processed by the government.

Q: Is there a fee to apply for the rebate?

A: There is no fee to apply for the gasoline/carbon tax rebate. The application is free of charge.

Q: What documents do I need to include with my application?

A: The specific documents required may vary depending on your individual circumstances. The application form will provide instructions on the necessary supporting documentation, such as proof of residency, income statements, and receipts for gasoline purchases.

Q: Can I apply for the rebate retroactively?

A: It is generally not possible to apply for the rebate retroactively. You should submit your application within the specified timeframe for each tax period.

Q: Can I apply for the rebate if I don't own a vehicle?

A: Yes, you may still be eligible for the rebate even if you don't own a vehicle. The rebate is based on factors such as income and consumption, not vehicle ownership.