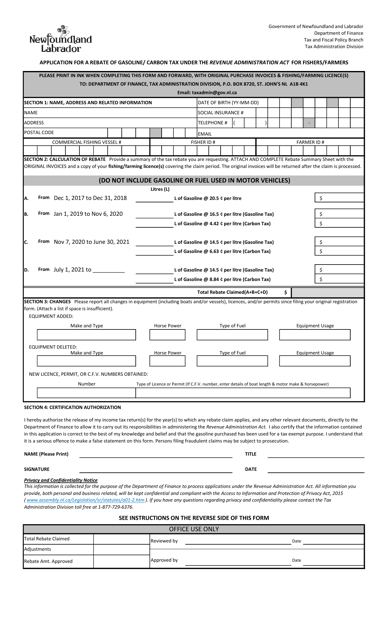

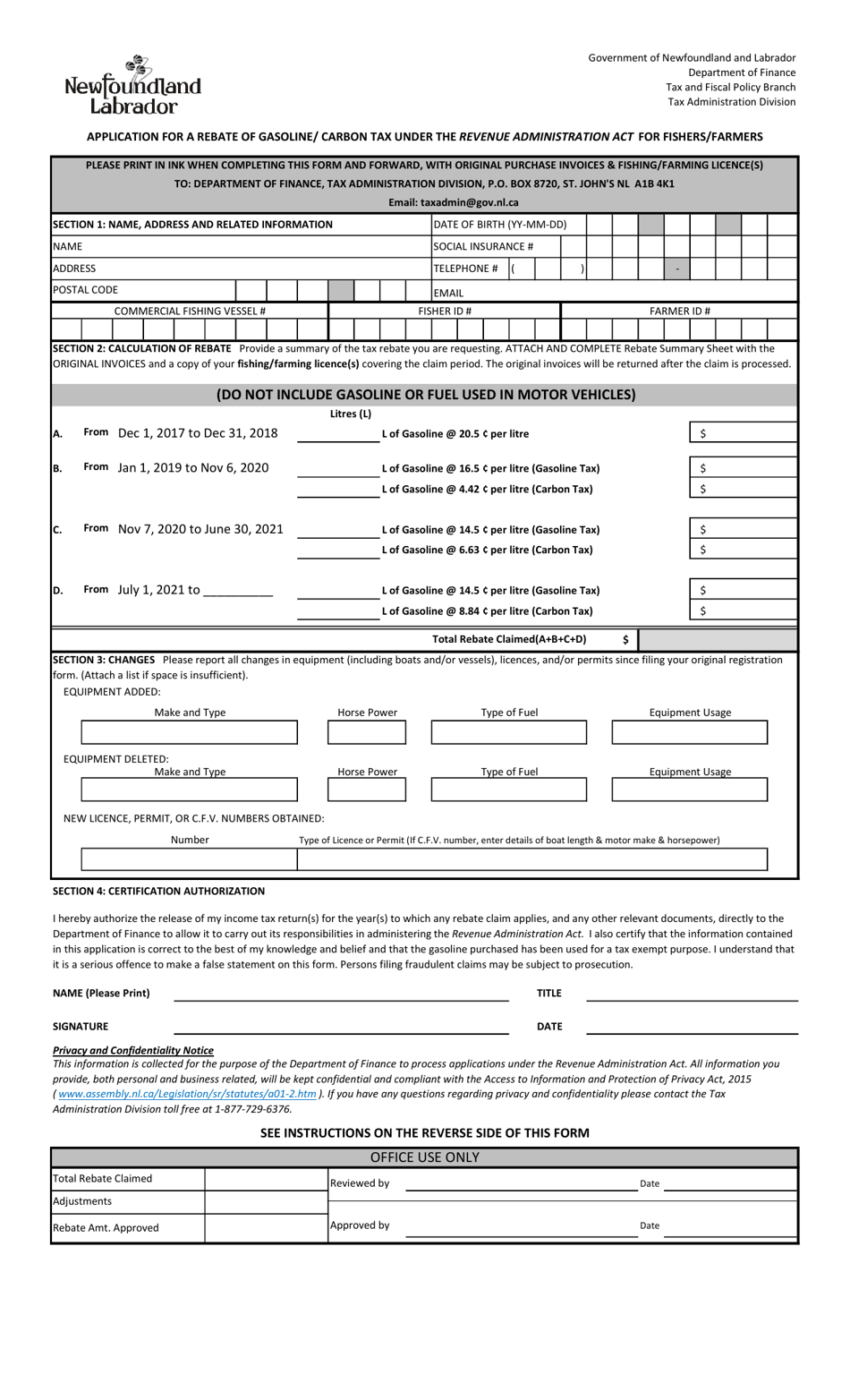

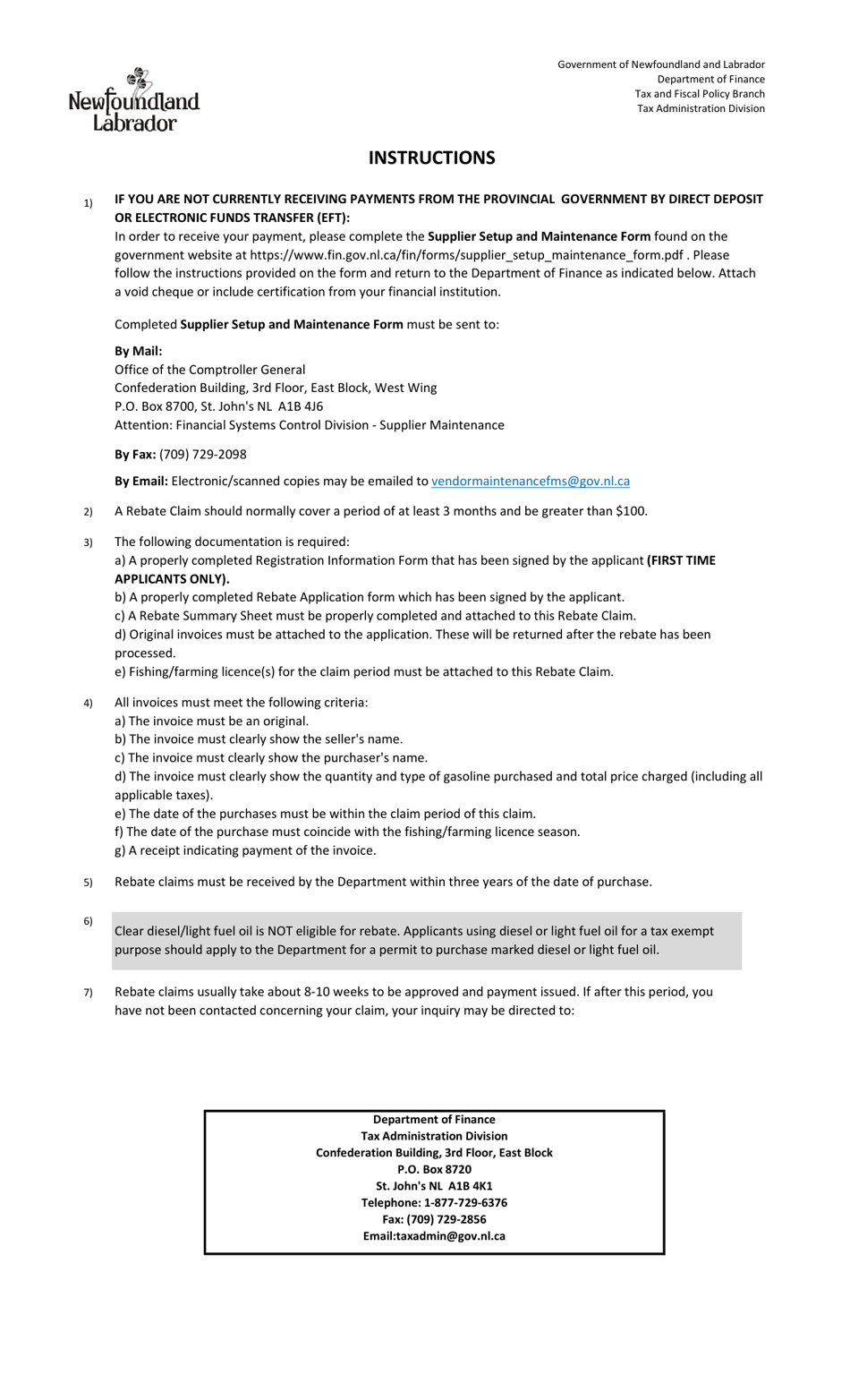

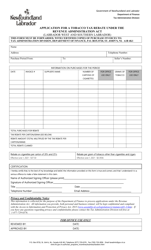

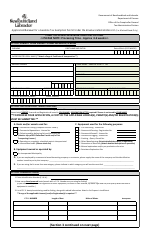

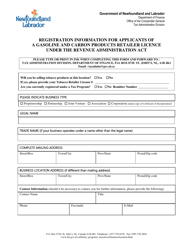

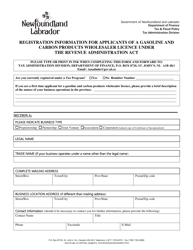

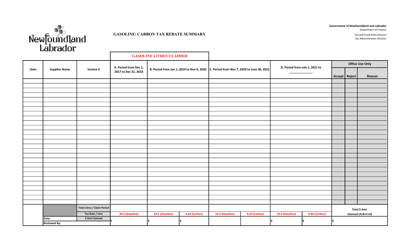

Application for a Rebate of Gasoline / Carbon Tax Under the Revenue Administration Act for Fishers / Farmers - Newfoundland and Labrador, Canada

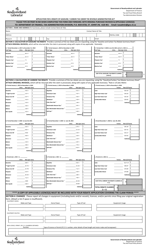

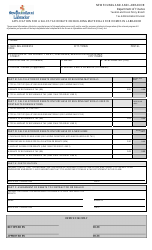

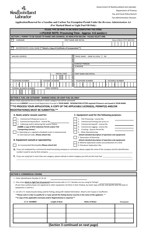

The Application for a Rebate of Gasoline/Carbon Tax Under the Revenue Administration Act for Fishers/Farmers - Newfoundland and Labrador, Canada is used by fishers and farmers in Newfoundland and Labrador to claim a refund on gasoline or carbon tax paid for their business activities.

The application for a rebate of gasoline/carbon tax under the Revenue Administration Act for fishers/farmers in Newfoundland and Labrador, Canada is typically filed by the fishers or farmers themselves.

FAQ

Q: Who is eligible to apply for a rebate of gasoline/carbon tax under the Revenue Administration Act in Newfoundland and Labrador, Canada?

A: Fishers and farmers.

Q: What is the purpose of the rebate for fishers and farmers?

A: To alleviate the financial burden of the gasoline/carbon tax.

Q: Under which act can fishers and farmers apply for this rebate?

A: Revenue Administration Act.

Q: What is the rebate specifically for?

A: Gasoline/carbon tax.