This version of the form is not currently in use and is provided for reference only. Download this version of

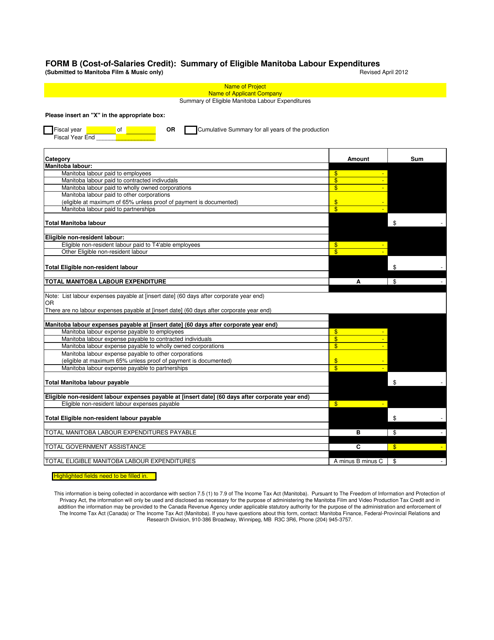

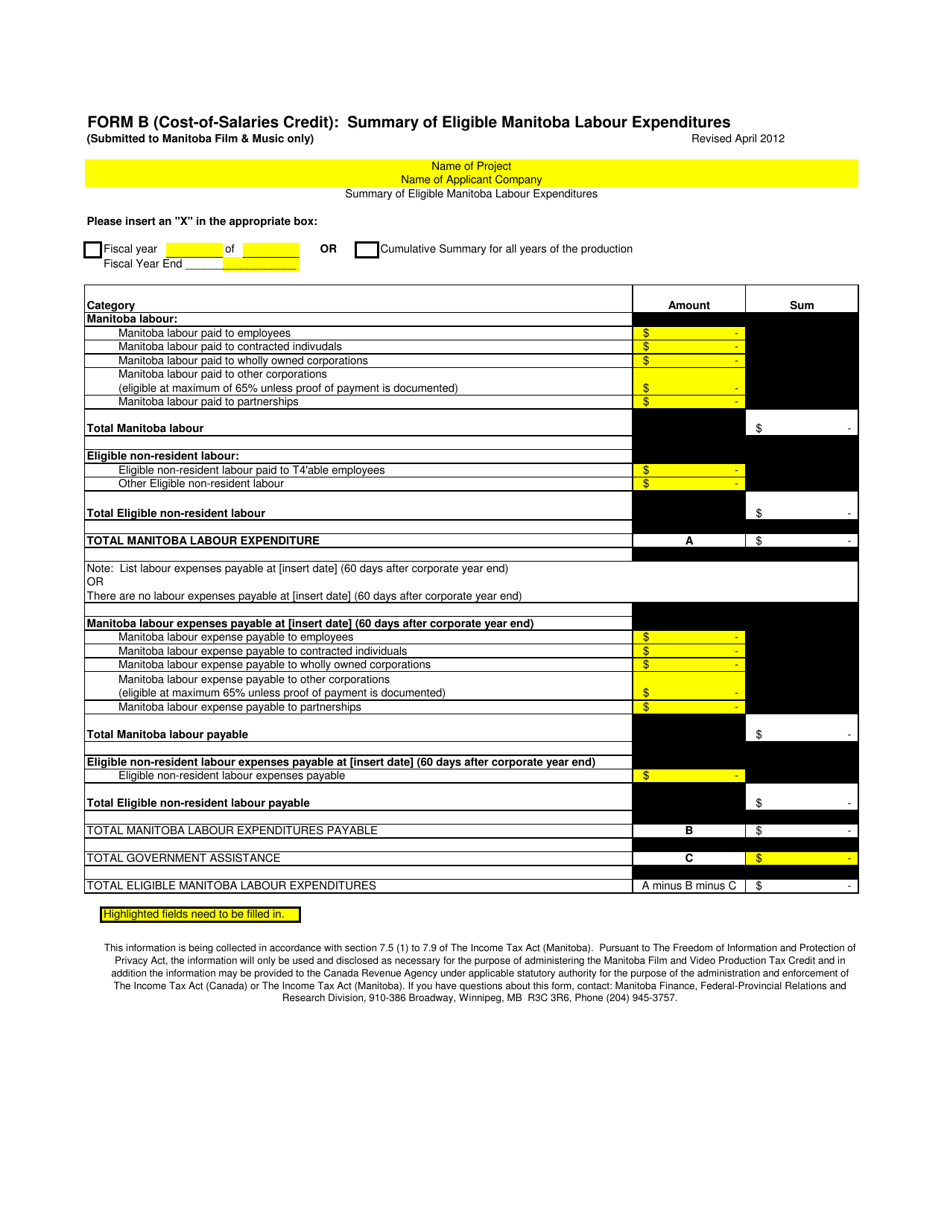

Form B

for the current year.

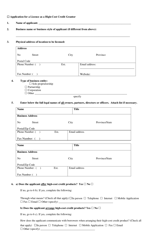

Form B Cost-Of-Salaries Credit - Summary of Eligible Manitoba Labour Expenditures - Manitoba, Canada

Form B Cost-Of-Salaries Credit - Summary of Eligible Manitoba Labour Expenditures in Manitoba, Canada is used to claim eligible labour expenditures for tax credits.

The employer or taxpayer files the Form B Cost-Of-Salaries Credit - Summary of Eligible Manitoba Labour Expenditures in Manitoba, Canada.

FAQ

Q: What is the Form B Cost-Of-Salaries Credit?

A: The Form B Cost-Of-Salaries Credit is a credit related to eligible Manitoba labour expenditures.

Q: What are eligible Manitoba labour expenditures?

A: Eligible Manitoba labour expenditures refer to wages and salaries paid to employees in Manitoba.

Q: Who is eligible for the Form B Cost-Of-Salaries Credit?

A: Businesses and individuals who have incurred eligible Manitoba labour expenditures are eligible for the credit.

Q: Is the Form B Cost-Of-Salaries Credit available in the US?

A: No, the Form B Cost-Of-Salaries Credit is specific to Manitoba, Canada.