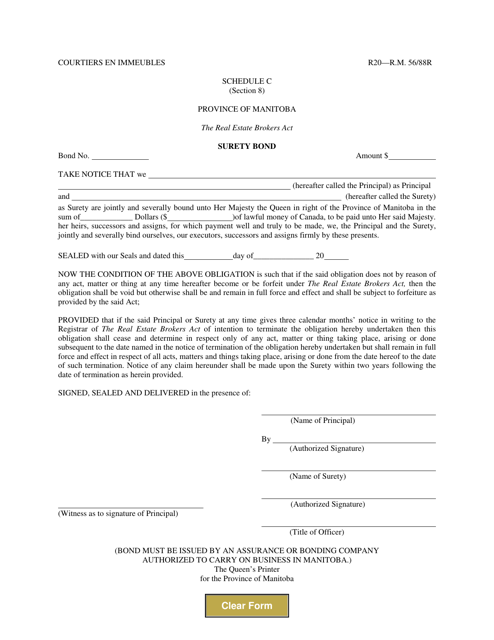

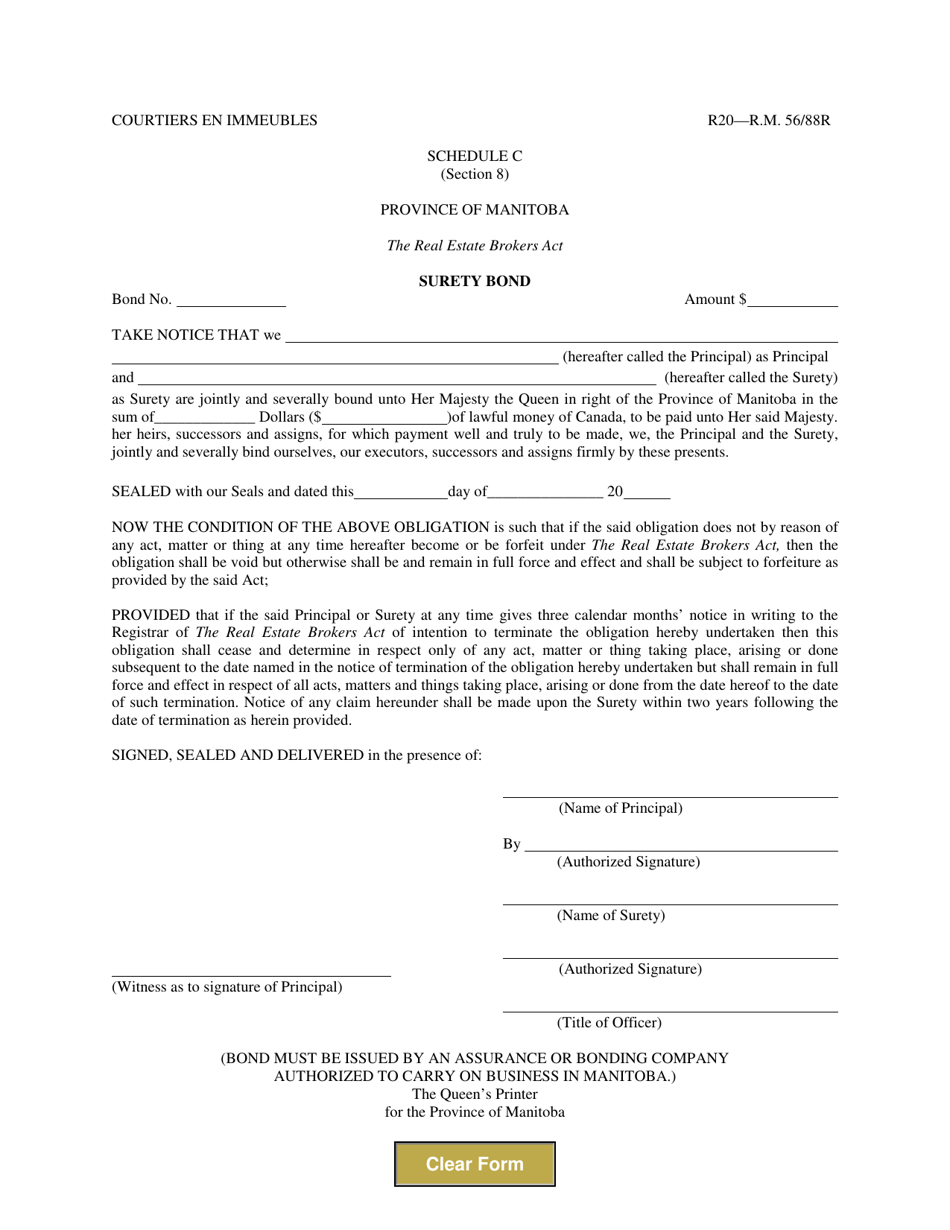

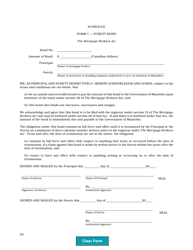

Schedule C Surety Bond - Manitoba, Canada

The Schedule C Surety Bond in Manitoba, Canada is a form of financial guarantee required for certain types of businesses. It provides protection to the government and consumers in the event that the business fails to fulfill its obligations or commitments. The bond helps ensure that businesses are accountable and financially stable.

FAQ

Q: What is a Schedule C Surety Bond?

A: A Schedule C Surety Bond is a type of legally-binding agreement that provides assurance of financial compensation for any losses or damages incurred due to the actions or omissions of a party.

Q: Who requires a Schedule C Surety Bond in Manitoba, Canada?

A: In Manitoba, Canada, individuals or businesses involved in construction projects or public works contracts may be required to obtain a Schedule C Surety Bond as a form of financial protection for project stakeholders.

Q: What is the purpose of a Schedule C Surety Bond?

A: The purpose of a Schedule C Surety Bond is to ensure that the party entering into a contract or agreement will fulfill their obligations and perform the required work in accordance with the terms and conditions of the contract.

Q: How does a Schedule C Surety Bond work?

A: If the bonded party fails to fulfill their contractual obligations or defaults on the project, the aggrieved party can make a claim against the bond to seek compensation for the losses or damages.

Q: How much does a Schedule C Surety Bond cost?

A: The cost of a Schedule C Surety Bond can vary depending on several factors, such as the bond amount required, the type of project, and the creditworthiness of the party obtaining the bond. It is best to contact a reputable surety bond provider for a quote or estimate.