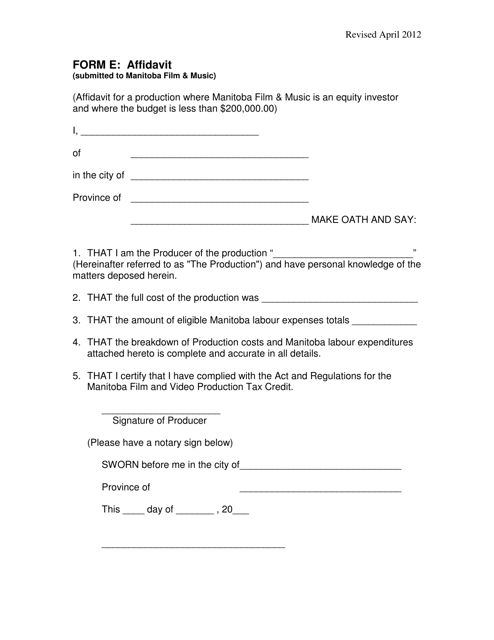

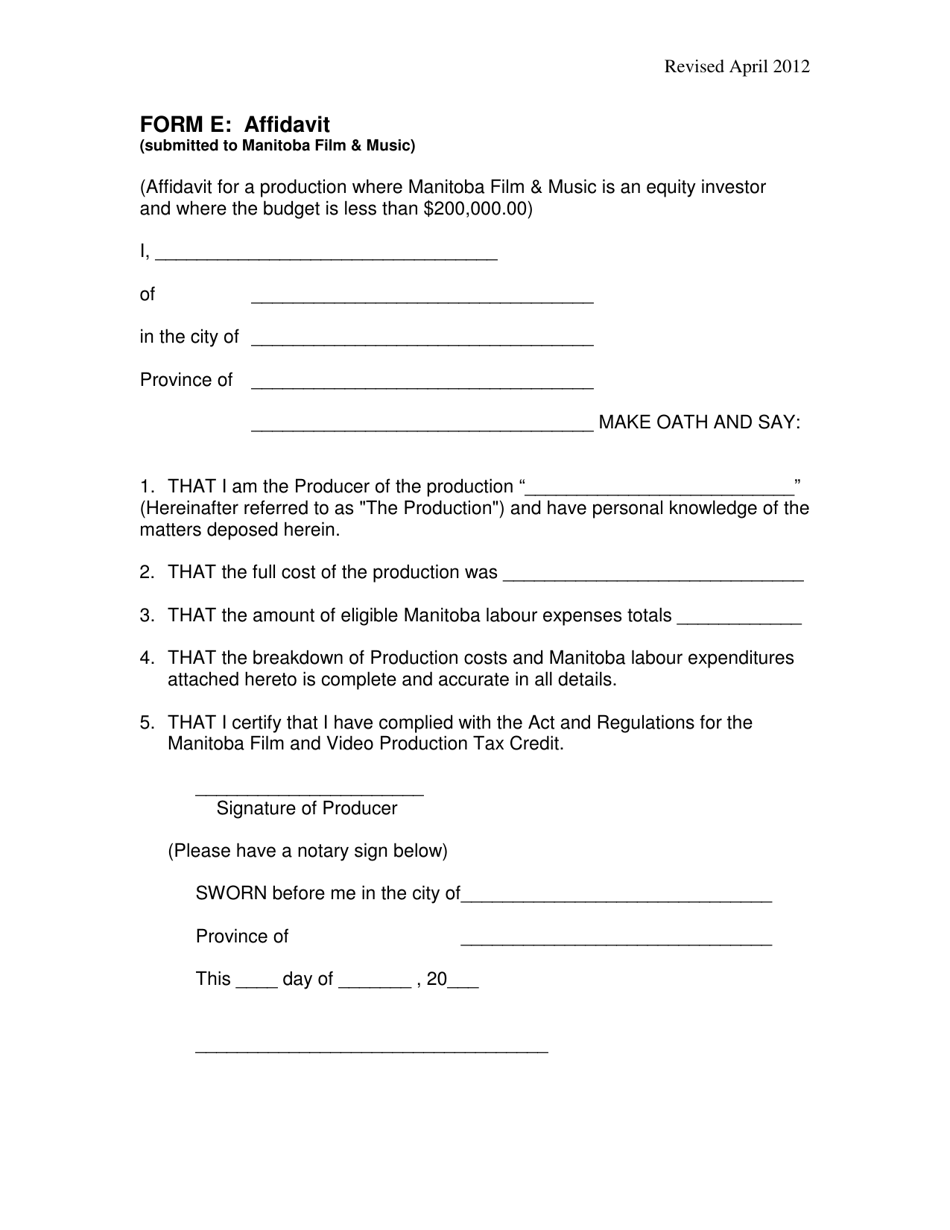

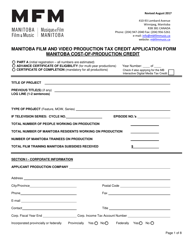

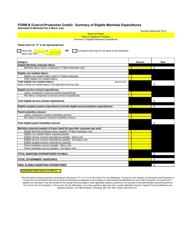

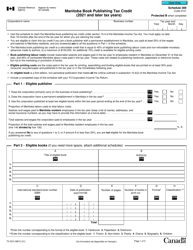

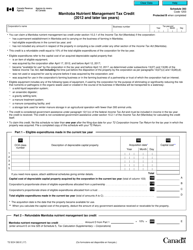

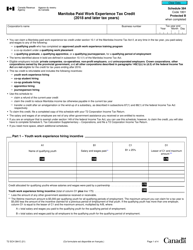

Form E Affidavit for Cost of Salaries Tax Credit - Manitoba, Canada

Form E Affidavit for Cost of Salaries Tax Credit in Manitoba, Canada is used to claim a tax credit for qualifying expenditures related to salaries and wages. It is specifically for the purpose of providing proof of the eligible costs incurred by the taxpayer.

In Manitoba, Canada, the employer files the Form E Affidavit for Cost of Salaries Tax Credit.

FAQ

Q: What is Form E Affidavit for Cost of Salaries Tax Credit?

A: Form E Affidavit for Cost of Salaries Tax Credit is a document used in Manitoba, Canada to claim a tax credit for the cost of salaries.

Q: Who can use Form E Affidavit for Cost of Salaries Tax Credit?

A: This form can be used by eligible businesses in Manitoba, Canada.

Q: What is the purpose of Form E Affidavit for Cost of Salaries Tax Credit?

A: The purpose of this form is to claim a tax credit for the cost of salaries paid to eligible employees.

Q: What expenses can be claimed using Form E Affidavit for Cost of Salaries Tax Credit?

A: Expenses related to eligible salaries can be claimed using this form. This may include wages, salaries, and other remuneration paid to employees.

Q: How to fill out Form E Affidavit for Cost of Salaries Tax Credit?

A: The form requires providing details such as the name of the business, the total eligible salaries, and supporting documentation. It is recommended to consult the official instructions provided with the form.