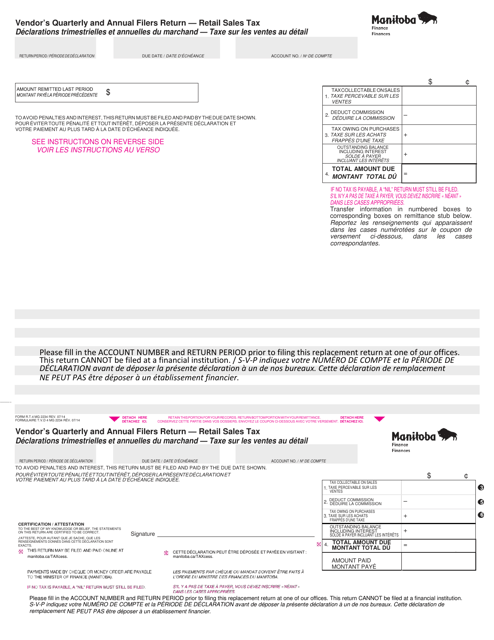

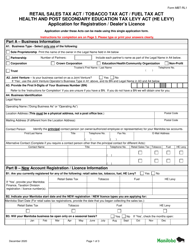

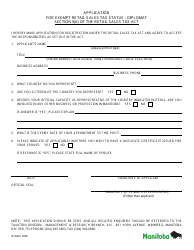

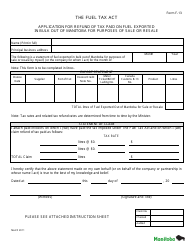

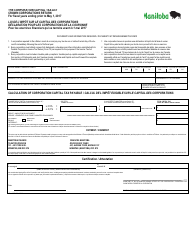

Form R.T.4 (MG2234) Vendor's Quarterly and Annual Filers Return - Retail Sales Tax - Manitoba, Canada (English / French)

Form R.T.4 (MG2234) is a tax return form used by vendors in Manitoba, Canada, to report their quarterly and annual retail sales tax. It is used to calculate and submit the amount of sales tax collected on retail sales made during the reporting period. This form is available in both English and French.

The Form R.T.4 (MG2234) Vendor's Quarterly and Annual Filers Return - Retail Sales Tax in Manitoba, Canada is filed by vendors who are required to collect and remit retail sales tax.

FAQ

Q: What is Form R.T.4 (MG2234)?

A: Form R.T.4 (MG2234) is the Vendor's Quarterly and Annual Filers Return for Retail Sales Tax in Manitoba, Canada.

Q: Who needs to file Form R.T.4 (MG2234)?

A: Vendors who are registered for retail sales tax in Manitoba and are classified as quarterly or annual filers need to file Form R.T.4 (MG2234).

Q: What is the purpose of Form R.T.4 (MG2234)?

A: The purpose of Form R.T.4 (MG2234) is to report and remit the retail sales tax collected by vendors in Manitoba.

Q: Is Form R.T.4 (MG2234) available in English and French?

A: Yes, Form R.T.4 (MG2234) is available in both English and French versions.

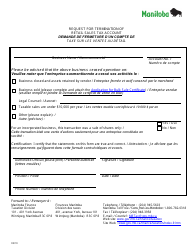

Q: When is Form R.T.4 (MG2234) due?

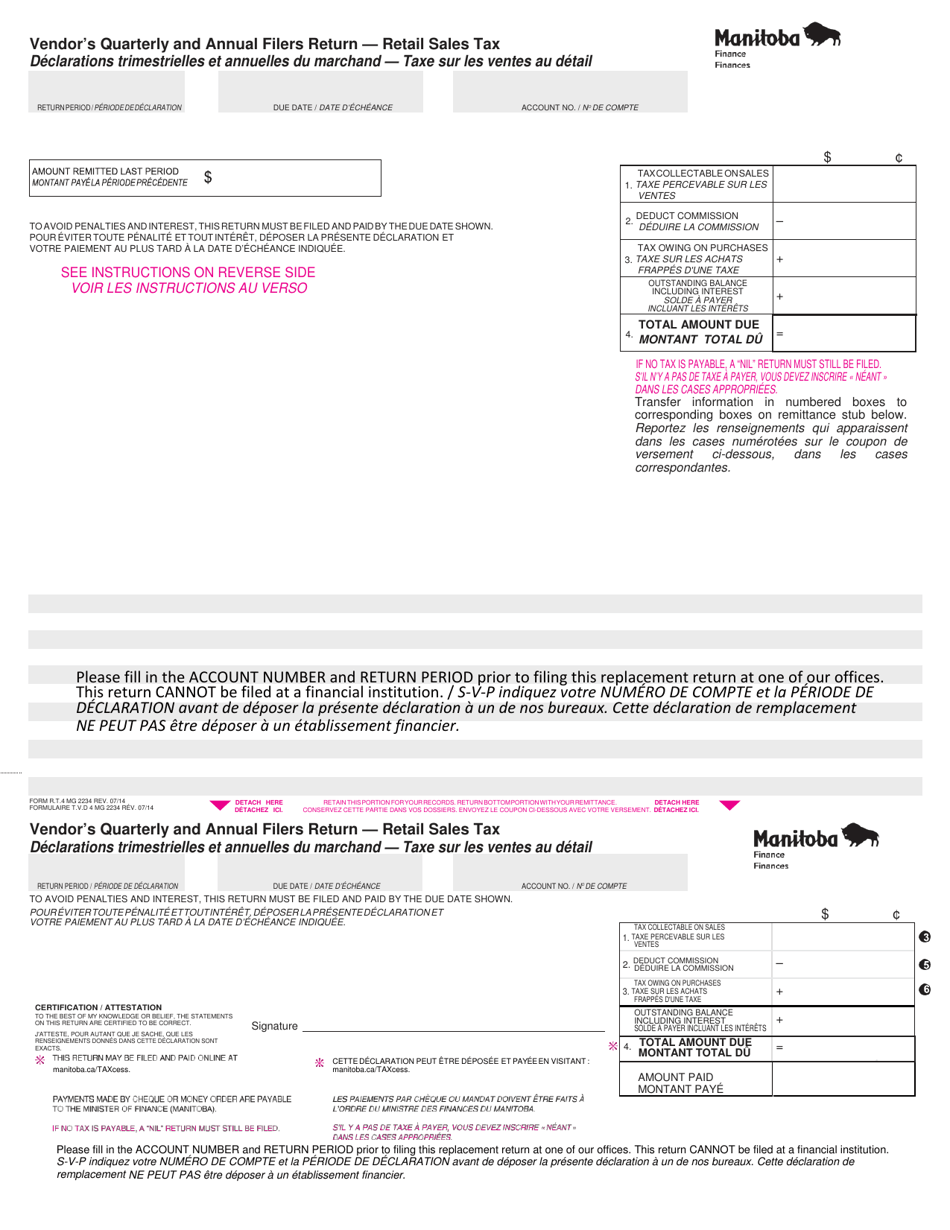

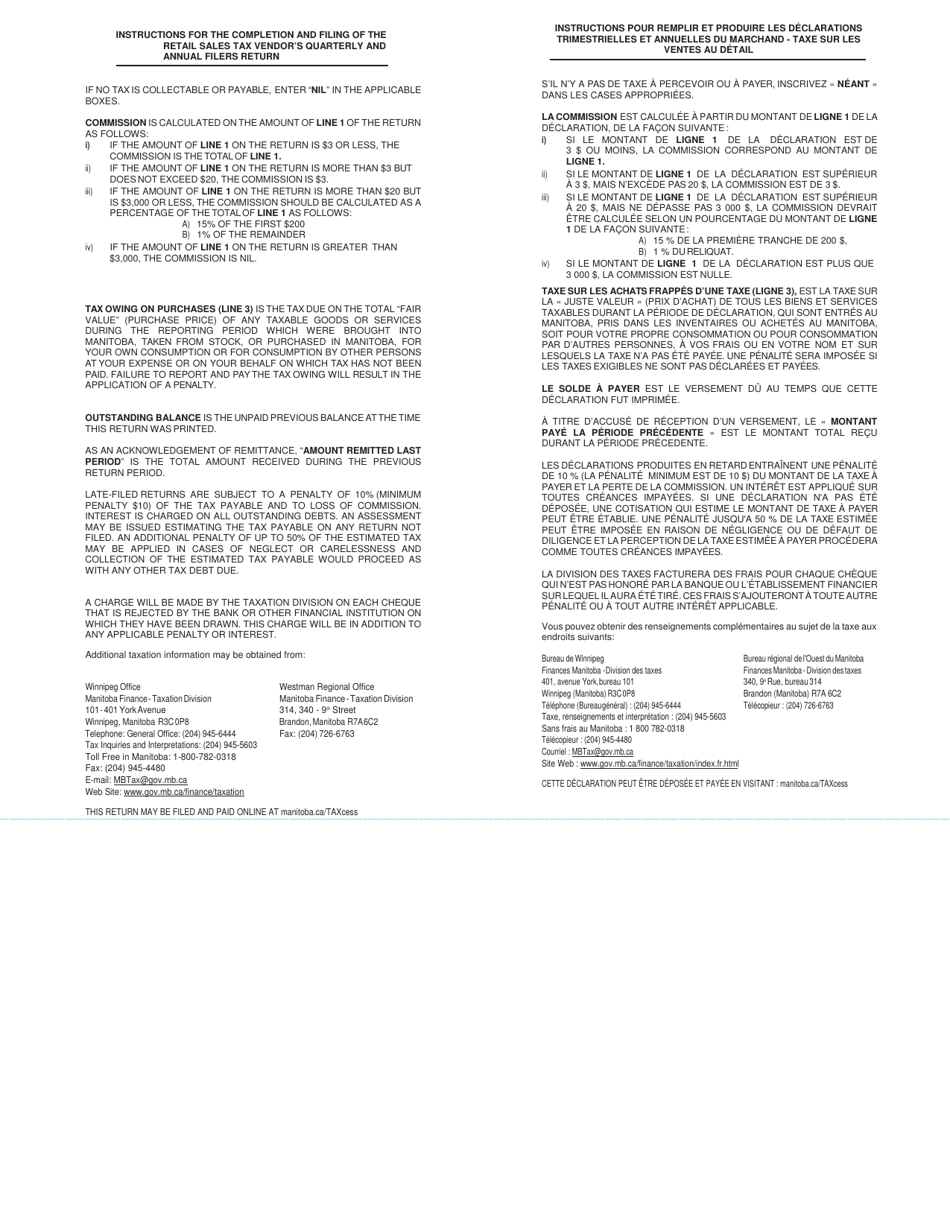

A: The due date for filing Form R.T.4 (MG2234) depends on whether you are a quarterly or annual filer. Quarterly filers must file the form on or before the 20th day of the month following the end of the quarter. Annual filers must file the form on or before the last day of February of the following year.

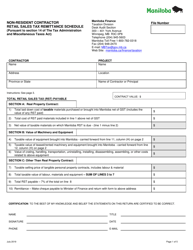

Q: What information needs to be included in Form R.T.4 (MG2234)?

A: Form R.T.4 (MG2234) requires vendors to provide details of their retail sales, including the total taxable sales and the retail sales tax collected during the reporting period.

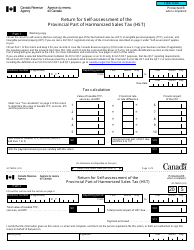

Q: Are there any penalties for late filing of Form R.T.4 (MG2234)?

A: Yes, there are penalties for late filing of Form R.T.4 (MG2234). Late filing may result in penalties and interest charges.