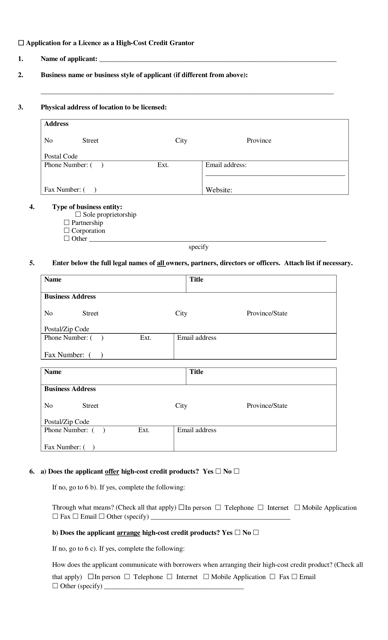

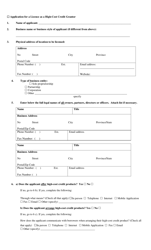

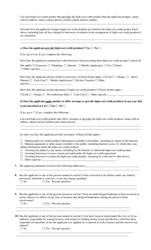

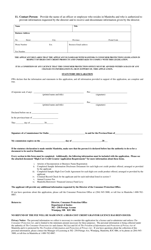

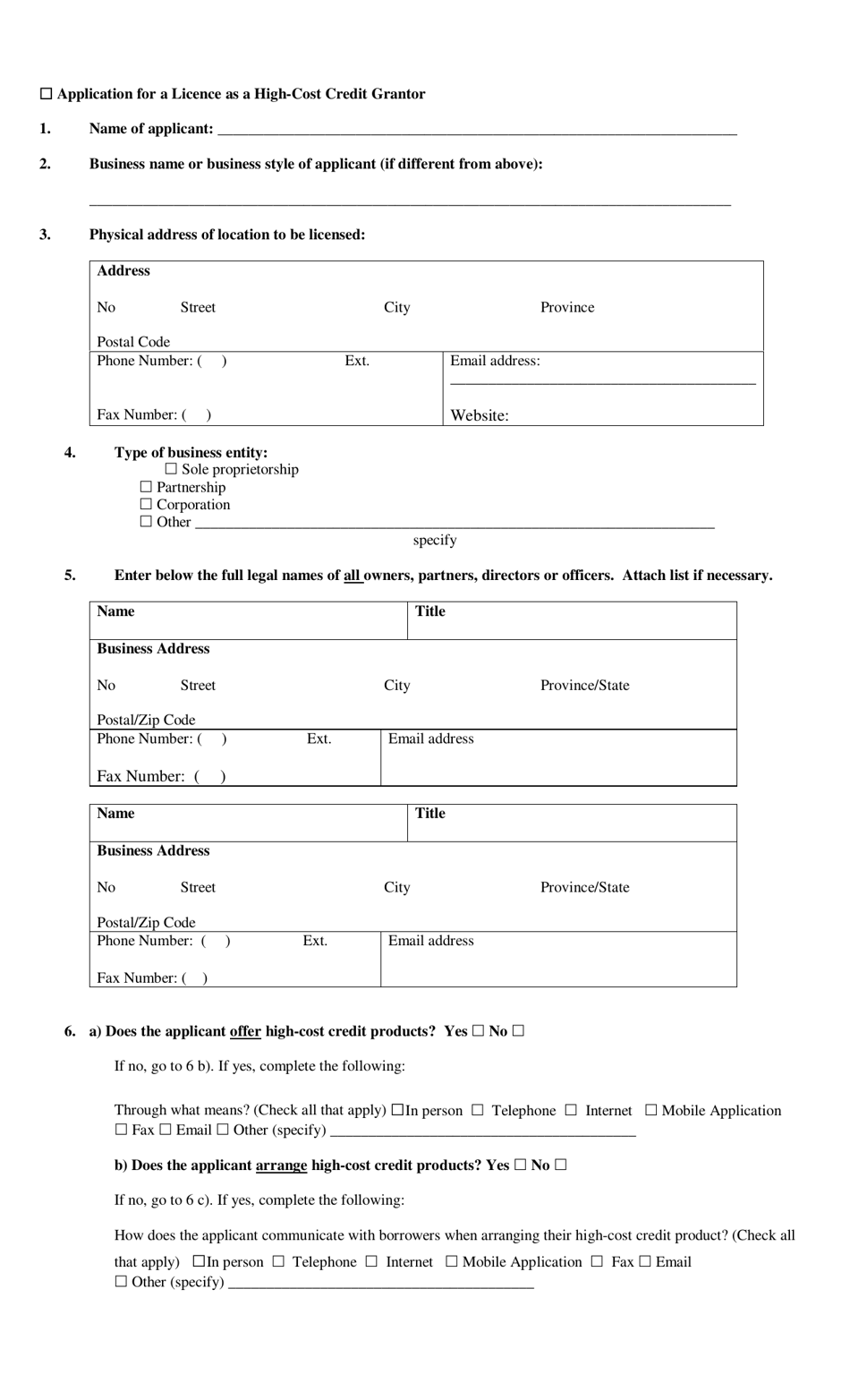

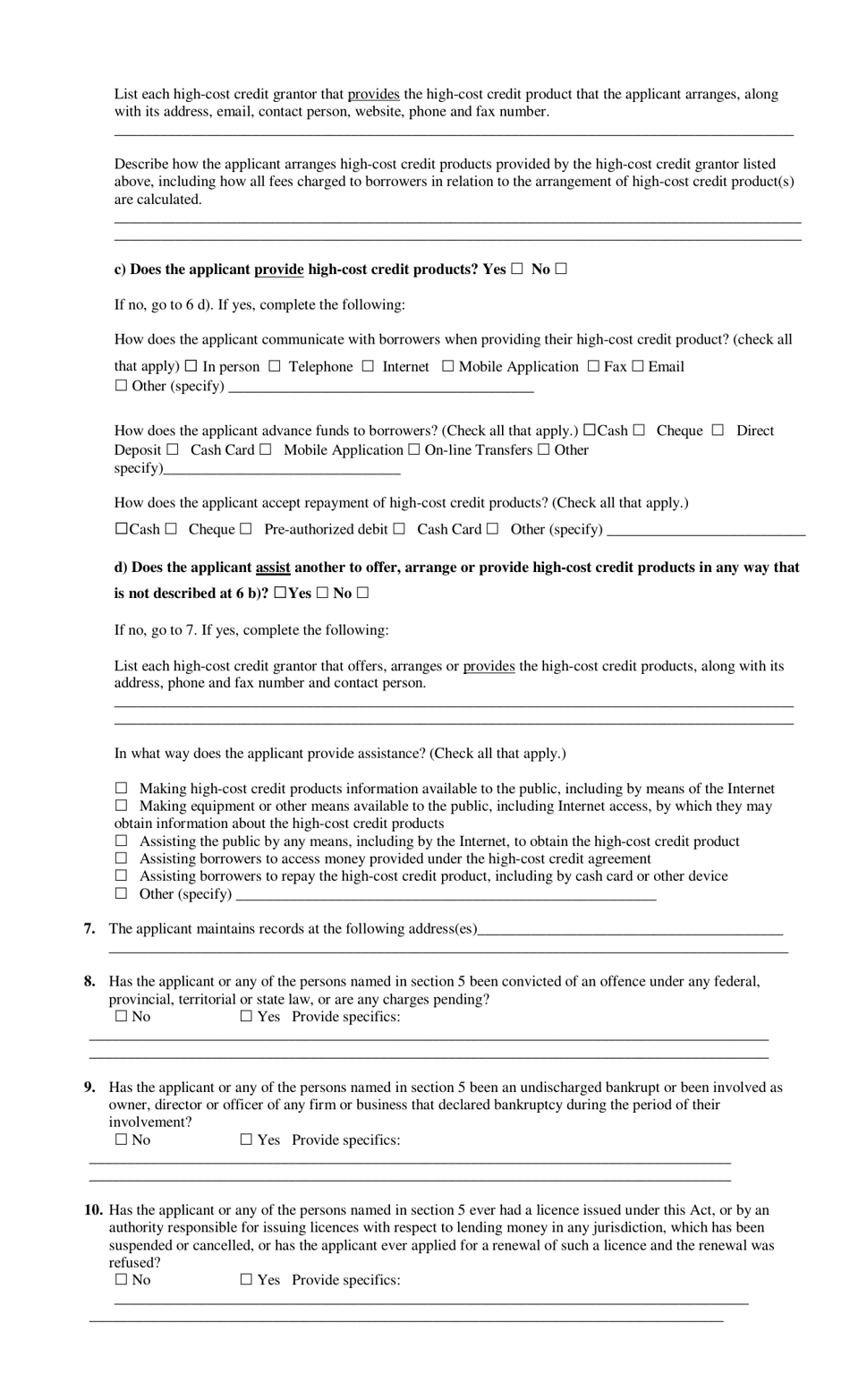

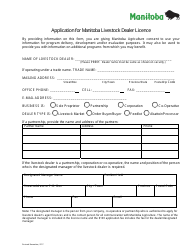

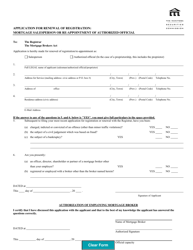

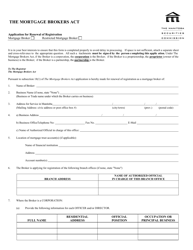

Application for a Licence as a High-Cost Credit Grantor - Manitoba, Canada

The Application for a Licence as a High-Cost Credit Grantor in Manitoba, Canada is for individuals or companies that wish to obtain a license to offer high-cost credit services in the province.

In Manitoba, Canada, the application for a license as a High-Cost Credit Grantor is filed by the company or individual seeking to become a high-cost credit grantor.

FAQ

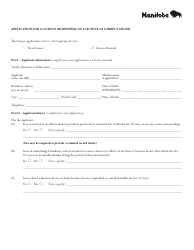

Q: What is a High-Cost Credit Grantor Licence?

A: A High-Cost Credit Grantor Licence allows a lender to offer high-interest loans in Manitoba.

Q: Who needs a High-Cost Credit Grantor Licence?

A: Any lender who wants to offer loans with high interest rates in Manitoba needs to obtain a High-Cost Credit Grantor Licence.

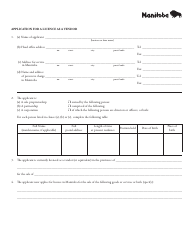

Q: What are the requirements to be eligible for a High-Cost Credit Grantor Licence?

A: Applicants must be a corporation, have a permanent establishment in Manitoba, meet specific financial requirements, and have a designated officer.

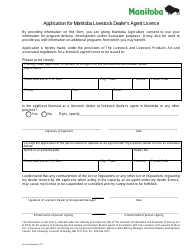

Q: What is the application process for a High-Cost Credit Grantor Licence?

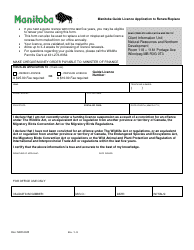

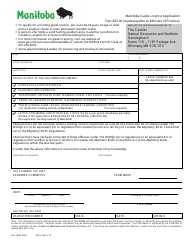

A: The application process involves completing the necessary forms, providing supporting documentation, paying the required fees, and undergoing a background check.

Q: How long does it take to obtain a High-Cost Credit Grantor Licence?

A: The processing time for a High-Cost Credit Grantor Licence application is typically 45 to 90 days.

Q: What are the fees associated with applying for a High-Cost Credit Grantor Licence?

A: The fees for a High-Cost Credit Grantor Licence application include an application fee, an examination fee, and an annual fee.

Q: What is the term of a High-Cost Credit Grantor Licence?

A: A High-Cost Credit Grantor Licence is valid for a period of one year and must be renewed annually.

Q: What are the consequences of operating without a High-Cost Credit Grantor Licence?

A: Operating without a High-Cost Credit Grantor Licence is a violation of the law and can result in penalties and legal consequences.