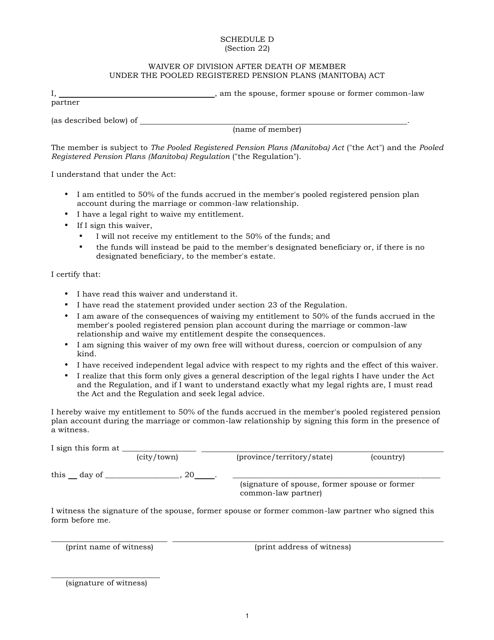

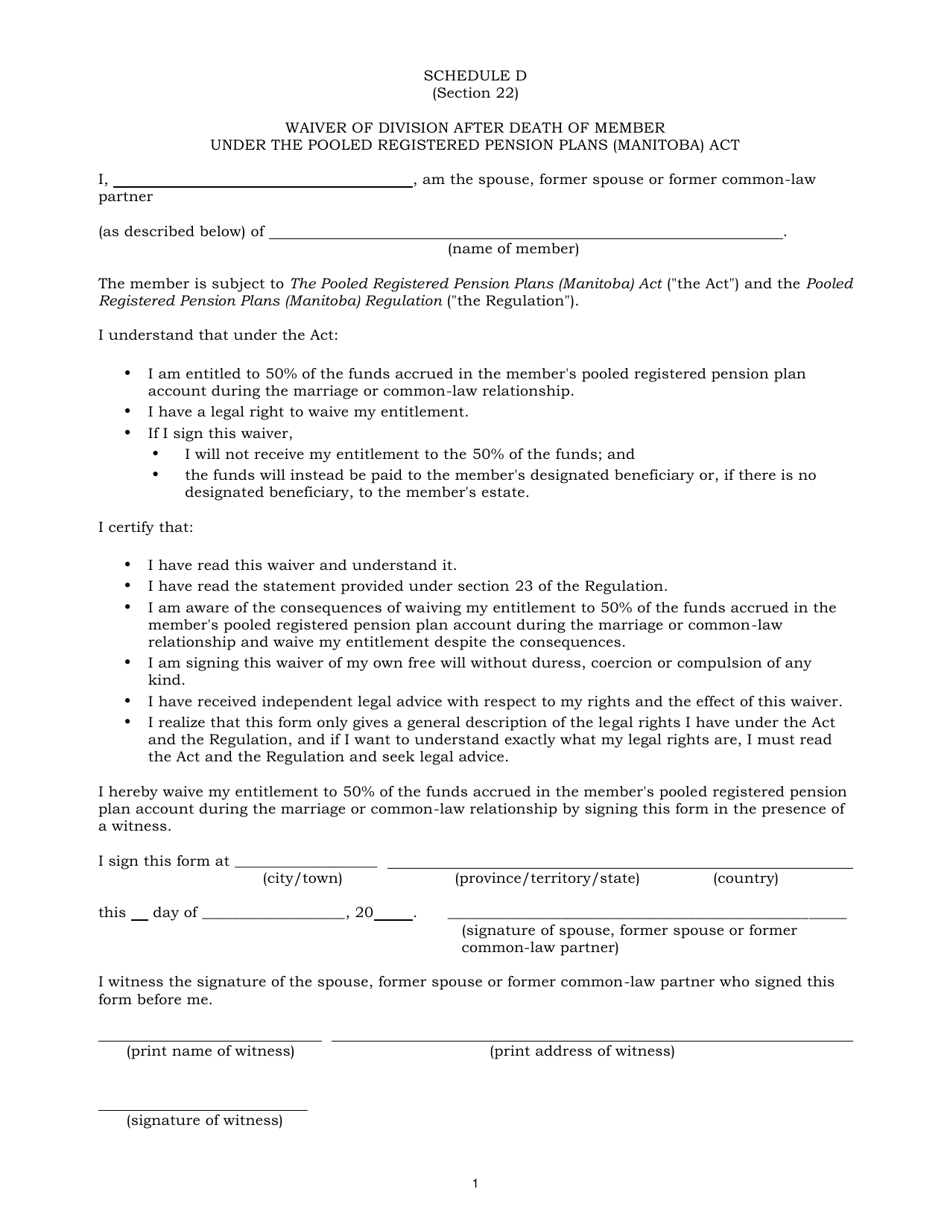

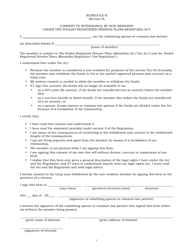

Schedule D Waiver of Division After Death of Member Under the Pooled Registered Pension Plans (Manitoba) Act - Manitoba, Canada

The Schedule D Waiver of Division After Death of Member under the Pooled Registered Pension Plans (Manitoba) Act in Manitoba, Canada, is a document that allows a member of a pooled registered pension plan to waive the division of their plan assets upon their death. It provides flexibility for the deceased member to specify their beneficiaries and distribute their pension plan assets according to their wishes, without being subject to division among their family members or dependents.

FAQ

Q: What is a Schedule D Waiver of Division After Death of Member Under the Pooled Registered Pension Plans (Manitoba) Act?

A: A Schedule D Waiver of Division After Death of Member is a provision under the Pooled Registered Pension Plans (Manitoba) Act in Manitoba, Canada.

Q: What does the Schedule D Waiver of Division After Death of Member allow?

A: It allows a member of a Pooled Registered Pension Plan to waive the division of their pension benefits after their death.

Q: Who can benefit from the Schedule D Waiver of Division After Death of Member?

A: Pooled Registered Pension Plan members in Manitoba, Canada can benefit from this provision.

Q: What does waiving the division of pension benefits mean?

A: It means that the member can choose to designate a specific beneficiary or beneficiaries who will receive their pension benefits after their death, instead of having the benefits divided among their potential beneficiaries.

Q: Why would someone choose to waive the division of their pension benefits?

A: Some people may choose to waive the division to ensure that their pension benefits go to specific individuals or organizations, instead of being divided among potential beneficiaries.

Q: Are there any conditions or restrictions to the Schedule D Waiver of Division After Death of Member?

A: Yes, there may be conditions or restrictions set by the Pooled Registered Pension Plans (Manitoba) Act regarding the implementation of the waiver.