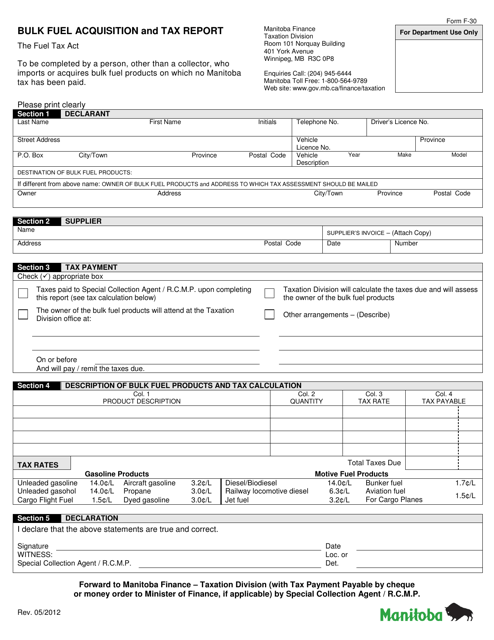

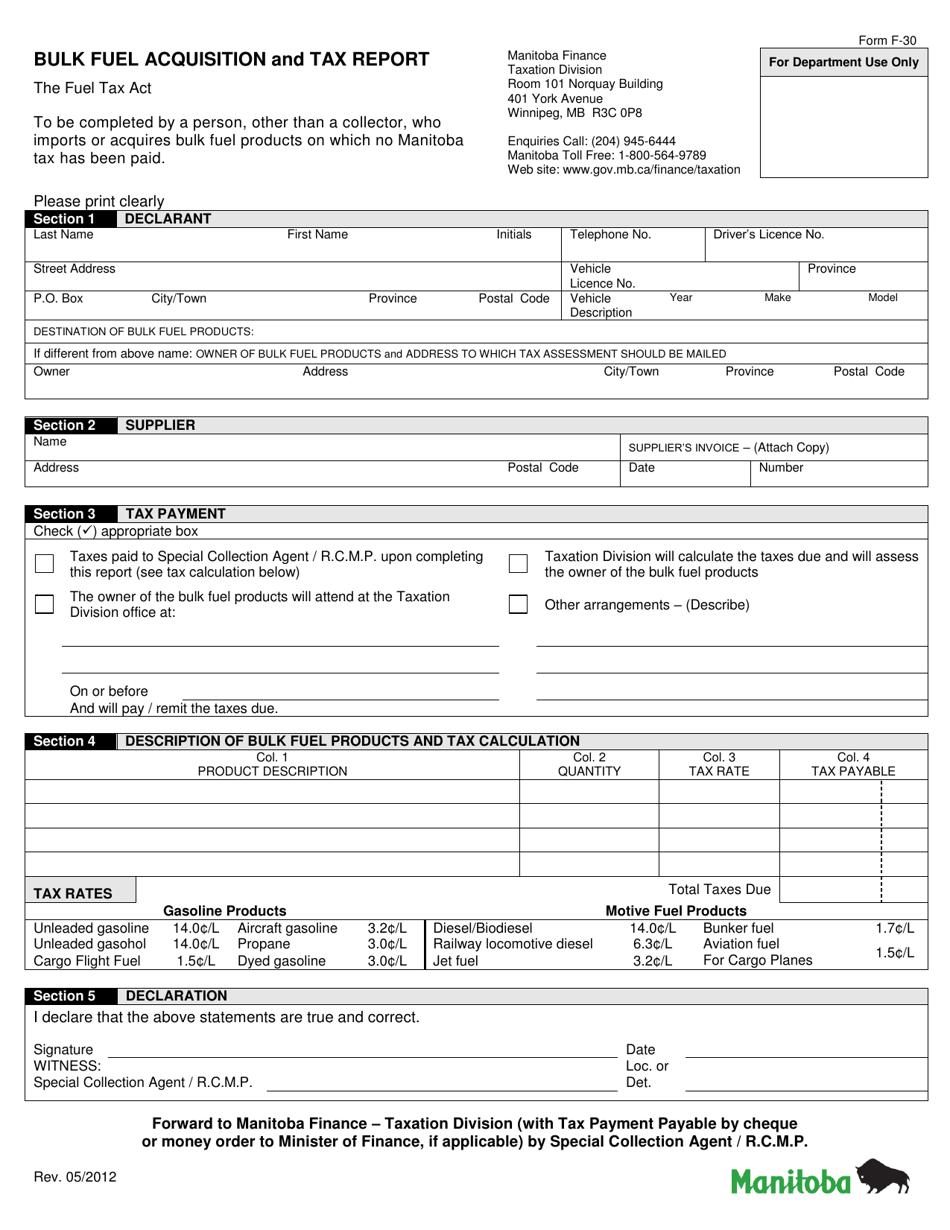

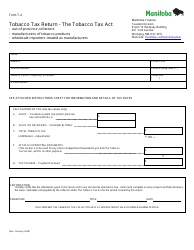

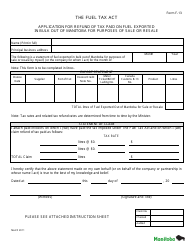

Form F-30 Bulk Fuel Acquisition and Tax Report - Manitoba, Canada

Form F-30 Bulk Fuel Acquisition and Tax Report is used in Manitoba, Canada, for reporting and tracking the acquisition and taxation of bulk fuel. It is used by businesses and individuals who purchase, store, and distribute bulk fuel in Manitoba to ensure compliance with fuel tax laws and regulations.

The Form F-30 Bulk Fuel Acquisition and Tax Report in Manitoba, Canada is typically filed by licensed fuel distributors or suppliers.

FAQ

Q: What is Form F-30 Bulk Fuel Acquisition and Tax Report?

A: Form F-30 Bulk Fuel Acquisition and Tax Report is a document used in Manitoba, Canada to report bulk fuel acquisitions and tax information.

Q: Who needs to file Form F-30 Bulk Fuel Acquisition and Tax Report?

A: Any person or business who acquires bulk fuel in Manitoba and is registered for the fuel tax program needs to file Form F-30.

Q: What information is required in Form F-30 Bulk Fuel Acquisition and Tax Report?

A: Form F-30 requires information such as the date of acquisition, supplier's name and address, type and quantity of fuel acquired, and the amount of tax paid.

Q: When is the deadline to file Form F-30 Bulk Fuel Acquisition and Tax Report?

A: Form F-30 must be filed on or before the 25th day of the month following the end of the reporting period.

Q: How can Form F-30 Bulk Fuel Acquisition and Tax Report be filed?

A: Form F-30 can be filed electronically through the Manitoba Taxation Fuel Reporting System (MTRFS).

Q: Are there any penalties for late filing of Form F-30 Bulk Fuel Acquisition and Tax Report?

A: Yes, late filing of Form F-30 may result in penalties and interest charges.