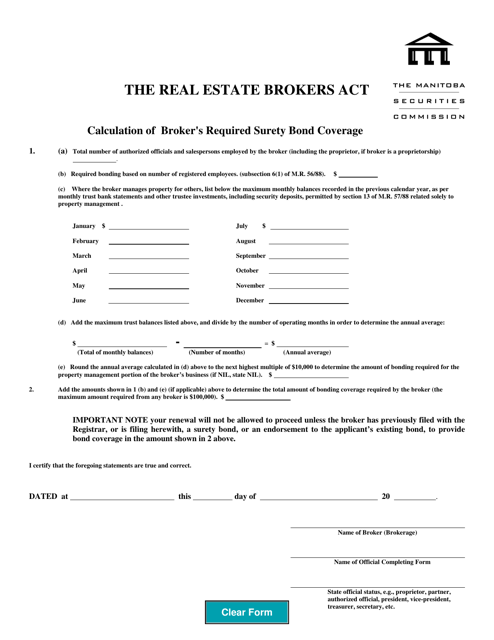

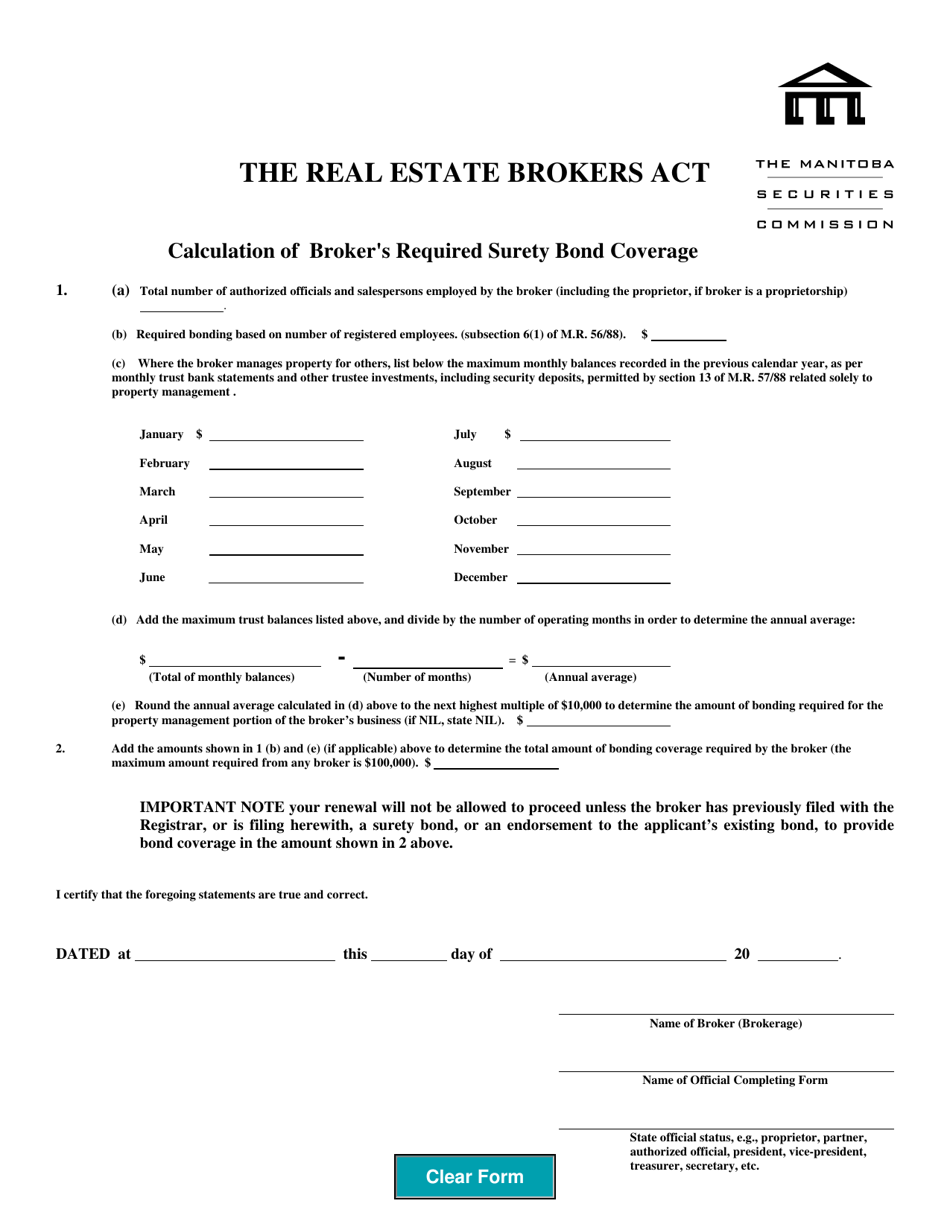

Calculation of Broker's Required Surety Bond Coverage - Manitoba, Canada

The calculation of a broker's required surety bond coverage in Manitoba, Canada is for ensuring that brokers have sufficient financial protection in place to cover potential financial losses or damages caused to their clients. This bond coverage helps protect clients and provides a safeguard in case of any problems or misconduct by the broker.

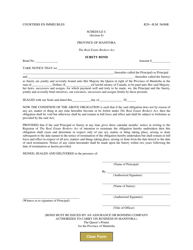

In Manitoba, Canada, the calculation of a broker's required surety bond coverage is filed by the Insurance Council of Manitoba.

FAQ

Q: What is a broker's required surety bond coverage?

A: A broker's required surety bond coverage is a type of insurance that brokers in Manitoba, Canada are required to have.

Q: Why do brokers need surety bond coverage?

A: Brokers need surety bond coverage to protect their clients in case the broker fails to fulfill their contractual obligations or commits any fraudulent activities.

Q: How is the broker's required surety bond coverage calculated?

A: The calculation of the broker's required surety bond coverage is based on the broker's annual gross premiums and varies depending on the broker's license type.

Q: Who determines the amount of the broker's required surety bond coverage?

A: The amount of the broker's required surety bond coverage is determined by the Insurance Council of Manitoba, which is the regulatory body overseeing insurance brokers in the province.

Q: What happens if a broker fails to maintain the required surety bond coverage?

A: If a broker fails to maintain the required surety bond coverage, their license may be suspended or revoked by the Insurance Council of Manitoba.