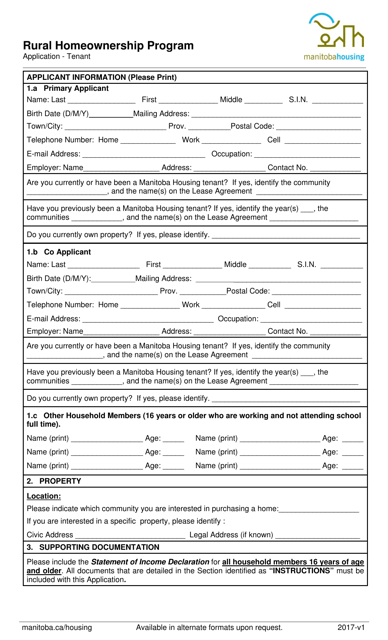

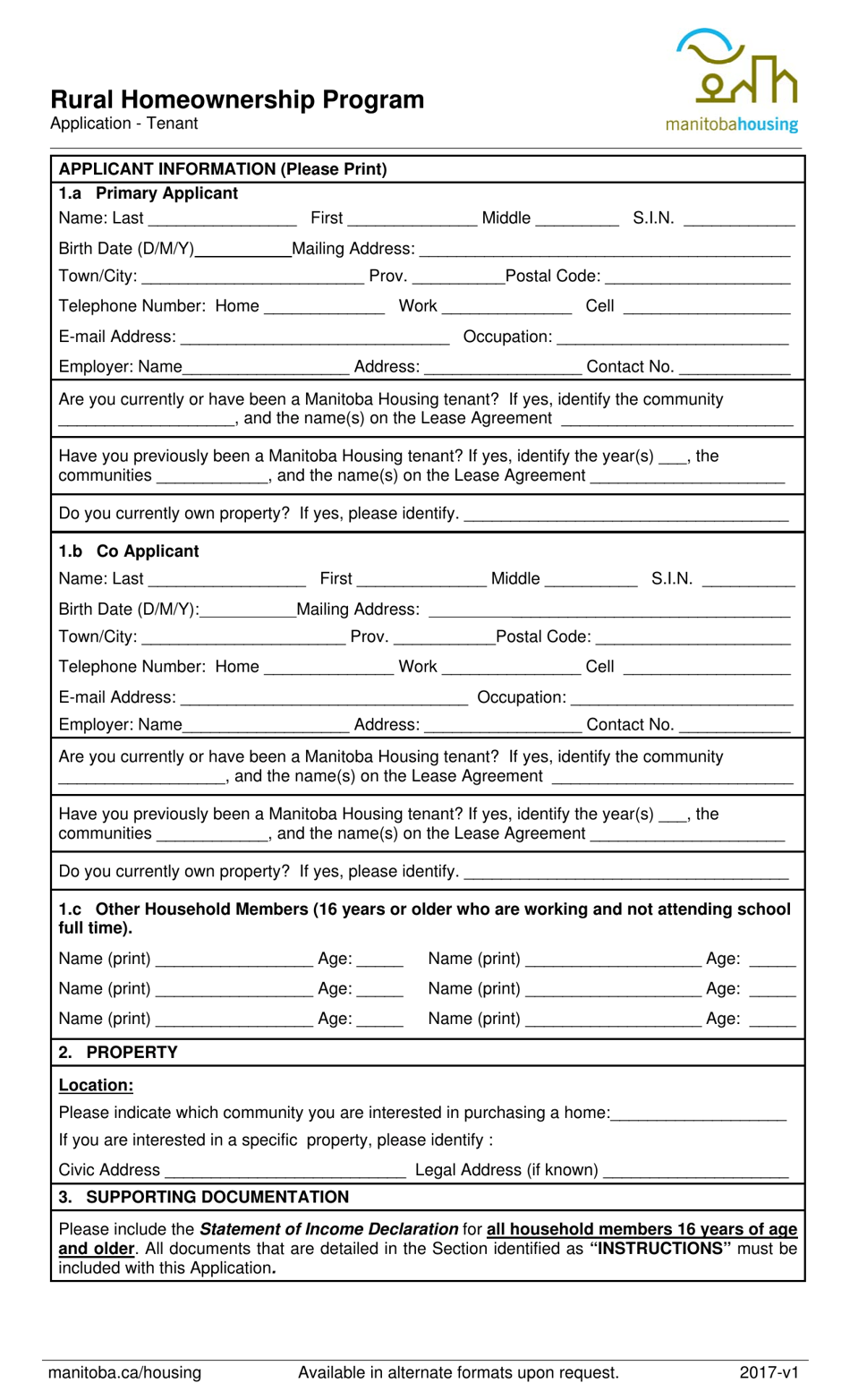

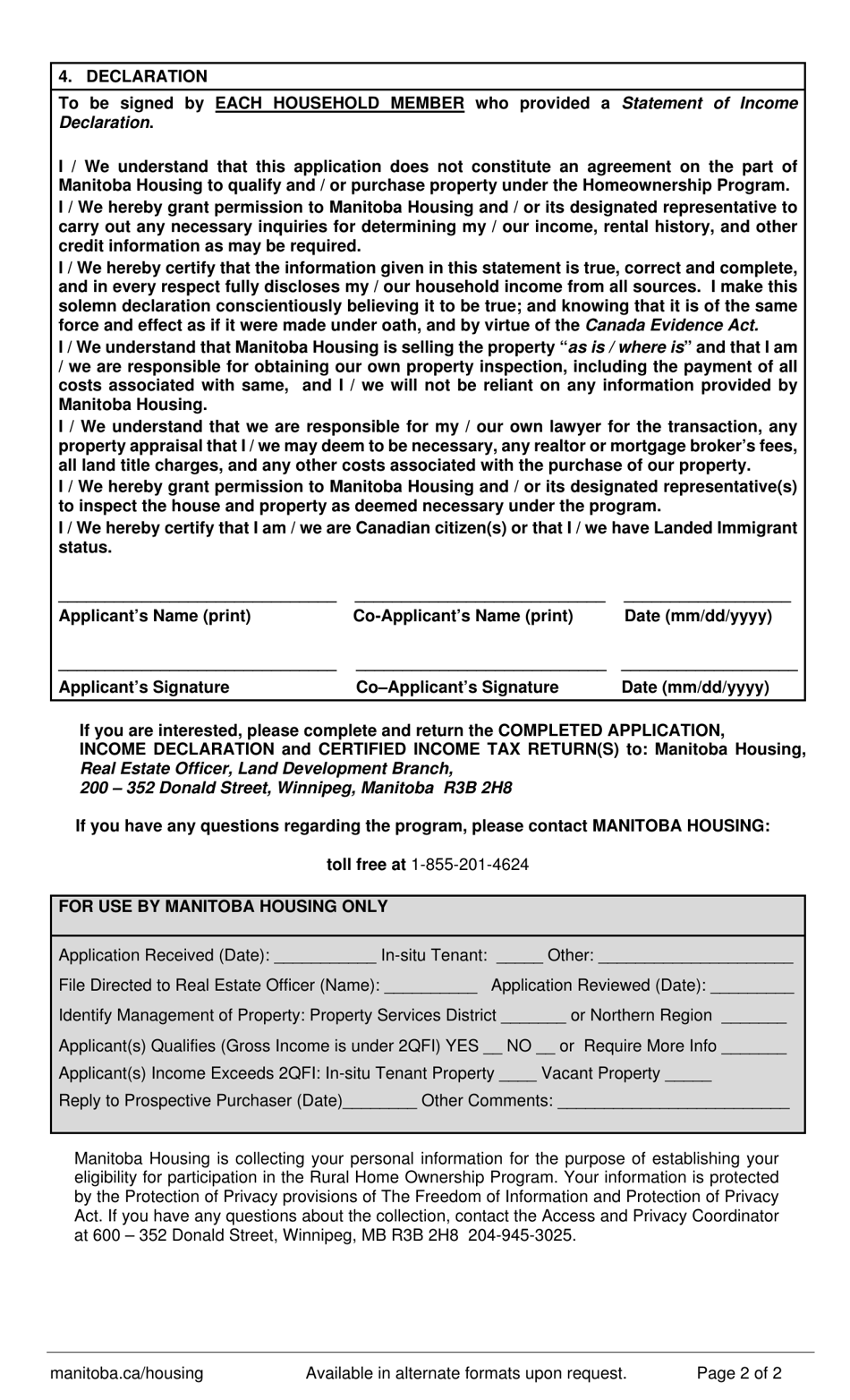

Application - Tenant - Rural Homeownership Program - Manitoba, Canada

The Application - Tenant - Rural Homeownership Program in Manitoba, Canada is a program designed to assist low to moderate-income tenants in rural areas to become homeowners. It provides financial support and resources to eligible tenants to purchase a home in a rural community in Manitoba.

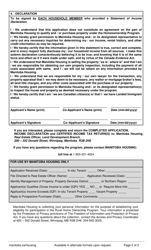

The tenant files the application for the Rural Homeownership Program in Manitoba, Canada.

FAQ

Q: What is the Rural Homeownership Program in Manitoba?

A: The Rural Homeownership Program in Manitoba is a program designed to help tenants become homeowners in rural areas of the province.

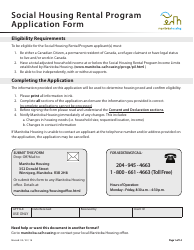

Q: Who is eligible for the program?

A: Tenants who have a steady income and are currently renting a home in a rural area of Manitoba are eligible for the program.

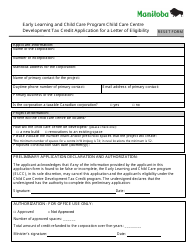

Q: What are the benefits of the program?

A: The program provides financial assistance in the form of a forgivable loan to help cover the down payment and closing costs of purchasing a home.

Q: How much financial assistance can be provided?

A: The amount of financial assistance provided through the program can range from 5% to 15% of the purchase price of the home, up to a maximum of $16,000.

Q: Is there any requirement to repay the loan?

A: The loan is forgivable if the homeowner remains in the home for a specified period of time.

Q: Are there any restrictions on the type of home that can be purchased?

A: There are no specific restrictions on the type of home that can be purchased, but it must be located in a rural area.

Q: How can I apply for the program?

A: To apply for the program, you need to contact the Rural Homeownership Program office in Manitoba, Canada.

Q: Are there any other programs available for homeownership in Manitoba?

A: Yes, there are several other programs available for homeownership in Manitoba, such as the First-Time Home Buyers Tax Credit and the Purchase Plus Improvement Program.