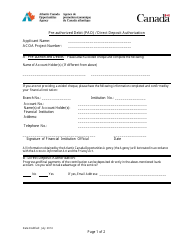

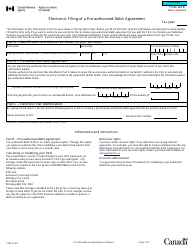

Pre-authorized Payment (Pap) Agreement - Manitoba, Canada

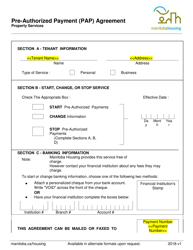

A Pre-authorized Payment (PAP) Agreement in Manitoba, Canada is a payment arrangement between a consumer and a business or organization. It allows the business to automatically withdraw funds from the consumer's bank account for recurring expenses such as utility bills, memberships, or loan payments. It provides convenience for both parties and helps ensure that payments are made on time.

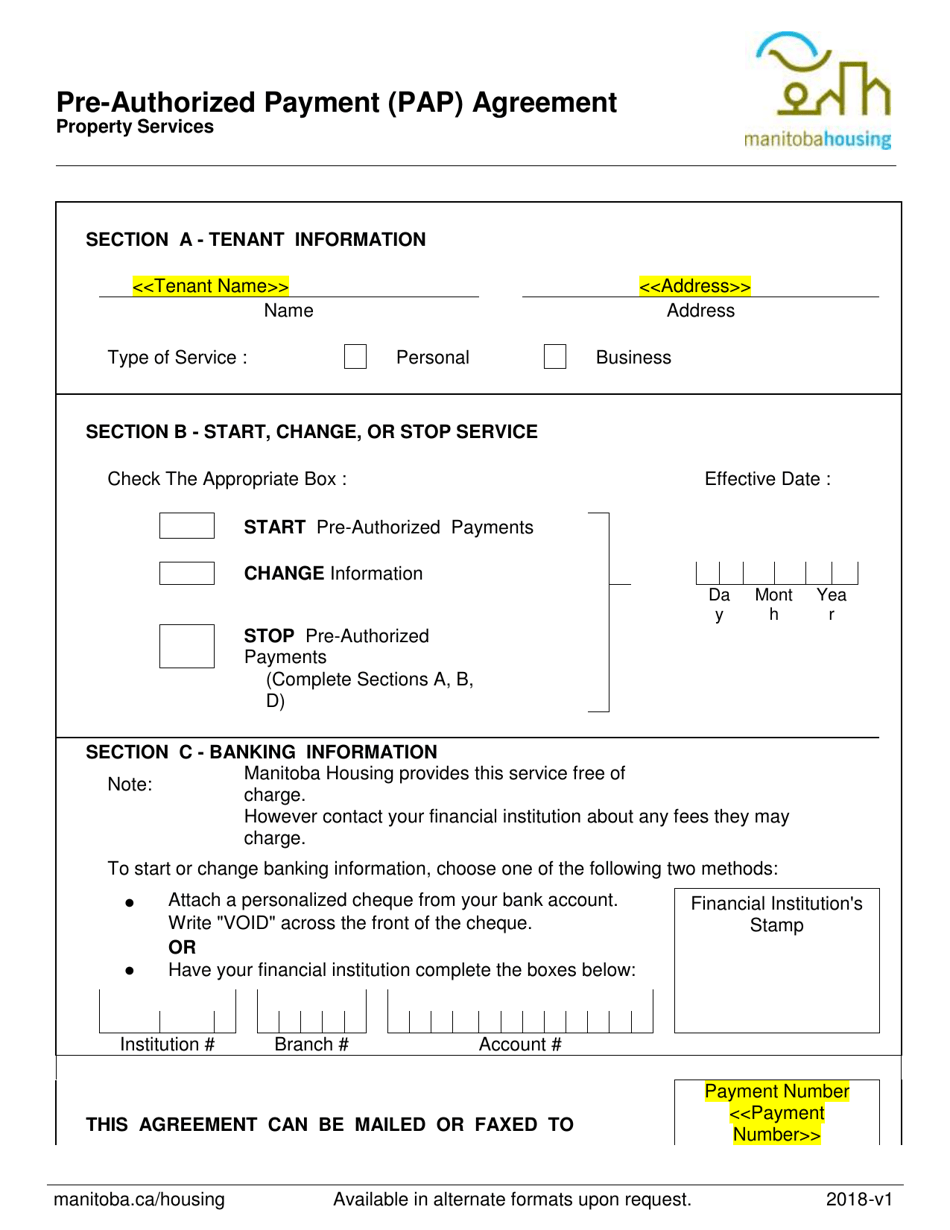

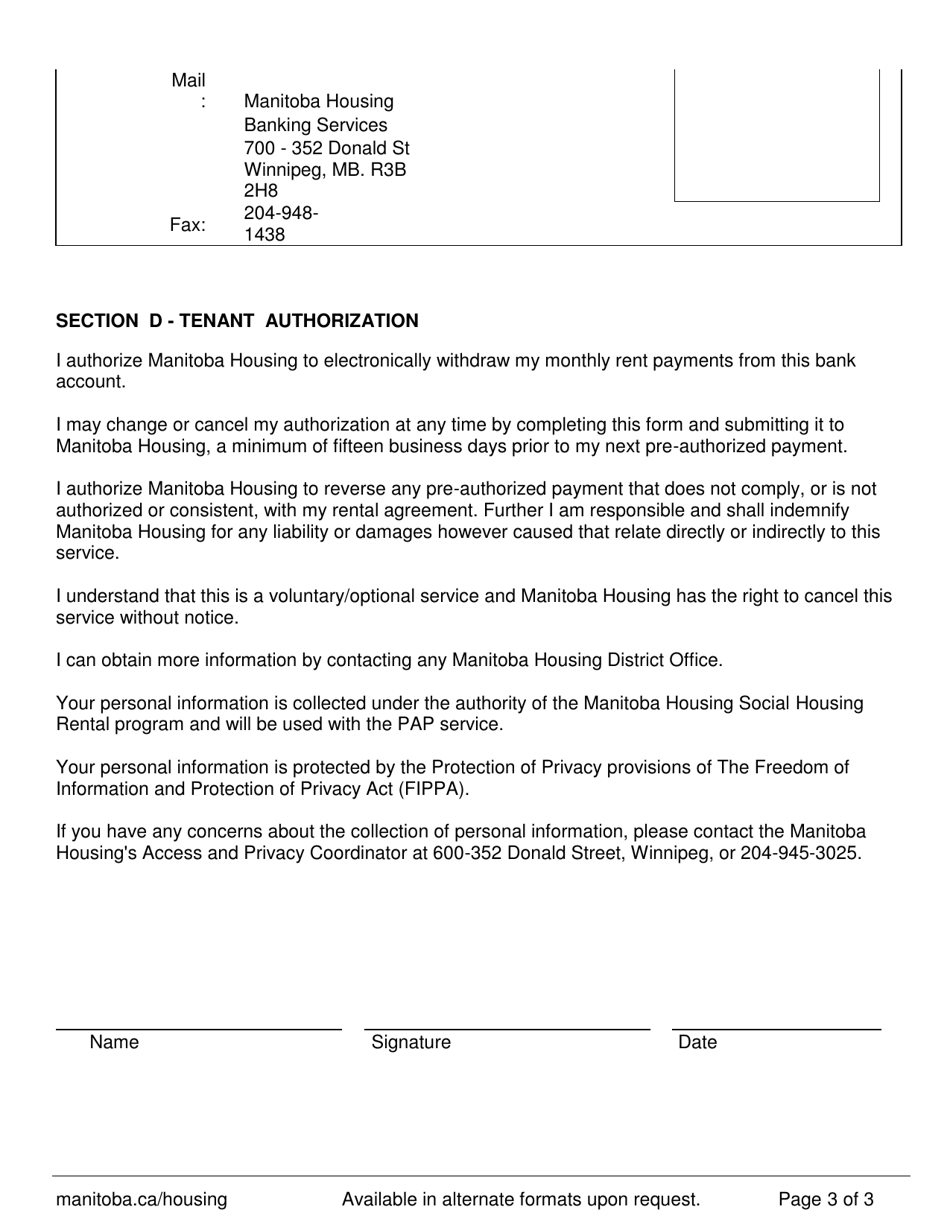

In Manitoba, Canada, the Pre-authorized Payment (PAP) agreement is usually filed by the person or organization who will be making the regular payments.

FAQ

Q: What is a Pre-authorized Payment (PAP) Agreement?

A: A Pre-authorized Payment (PAP) Agreement is a contract between a customer and a merchant which allows the merchant to automatically withdraw funds from the customer's bank account for payment purposes.

Q: Why would I sign a Pre-authorized Payment (PAP) Agreement?

A: Signing a Pre-authorized Payment (PAP) Agreement can provide convenience by ensuring that your payments are made on time and without the need to manually make payments each month.

Q: What types of payments can be made through a Pre-authorized Payment (PAP) Agreement?

A: Typically, recurring bills such as utility bills, mortgage payments, insurance premiums, and membership fees can be paid through a Pre-authorized Payment (PAP) Agreement.

Q: Is a Pre-authorized Payment (PAP) Agreement legally binding?

A: Yes, a Pre-authorized Payment (PAP) Agreement is a legally binding contract between the customer and the merchant.

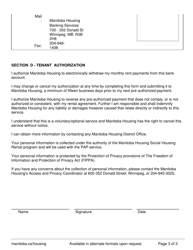

Q: Can I cancel a Pre-authorized Payment (PAP) Agreement?

A: Yes, you have the right to cancel a Pre-authorized Payment (PAP) Agreement at any time by notifying the merchant in writing or through other agreed-upon methods.

Q: What should I do if I want to dispute a charge made through a Pre-authorized Payment (PAP) Agreement?

A: If you want to dispute a charge made through a Pre-authorized Payment (PAP) Agreement, you should contact your bank or financial institution and provide them with the necessary details to investigate the issue.

Q: Are there any risks associated with signing a Pre-authorized Payment (PAP) Agreement?

A: While Pre-authorized Payment (PAP) Agreements can be convenient, there are some risks involved, such as unauthorized charges or the potential for funds to be withdrawn incorrectly. It is important to review the agreement carefully and monitor your bank account for any discrepancies.

Q: Can I set limits on the amount of money that can be withdrawn through a Pre-authorized Payment (PAP) Agreement?

A: Yes, you can set limits on the amount of money that can be withdrawn through a Pre-authorized Payment (PAP) Agreement. This can be done by discussing and agreeing upon the limits with the merchant before signing the agreement.

Q: What happens if I do not have sufficient funds in my bank account for a payment through a Pre-authorized Payment (PAP) Agreement?

A: If you do not have sufficient funds in your bank account for a payment through a Pre-authorized Payment (PAP) Agreement, the payment may be declined or you may be charged a fee by your bank.