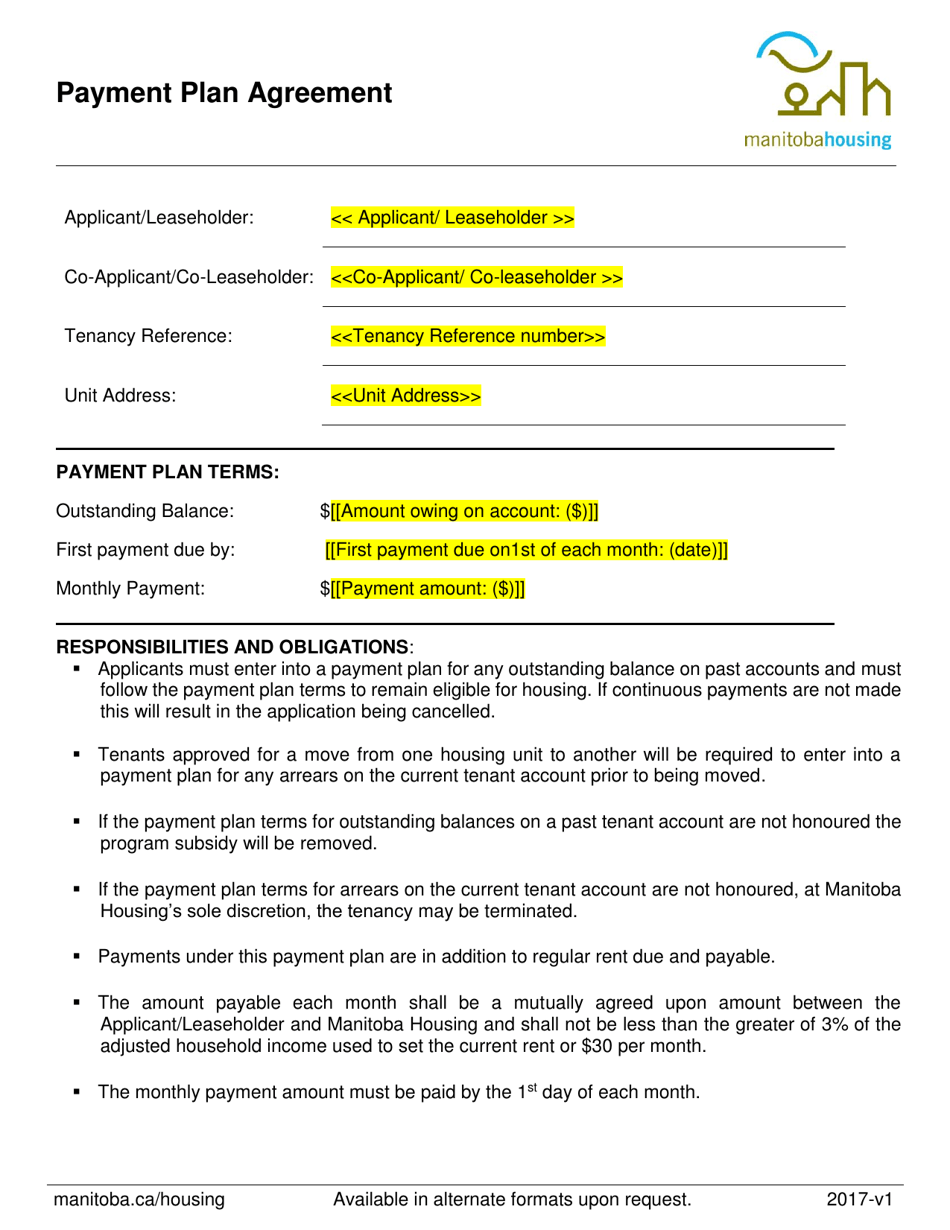

Payment Plan Agreement - Manitoba, Canada

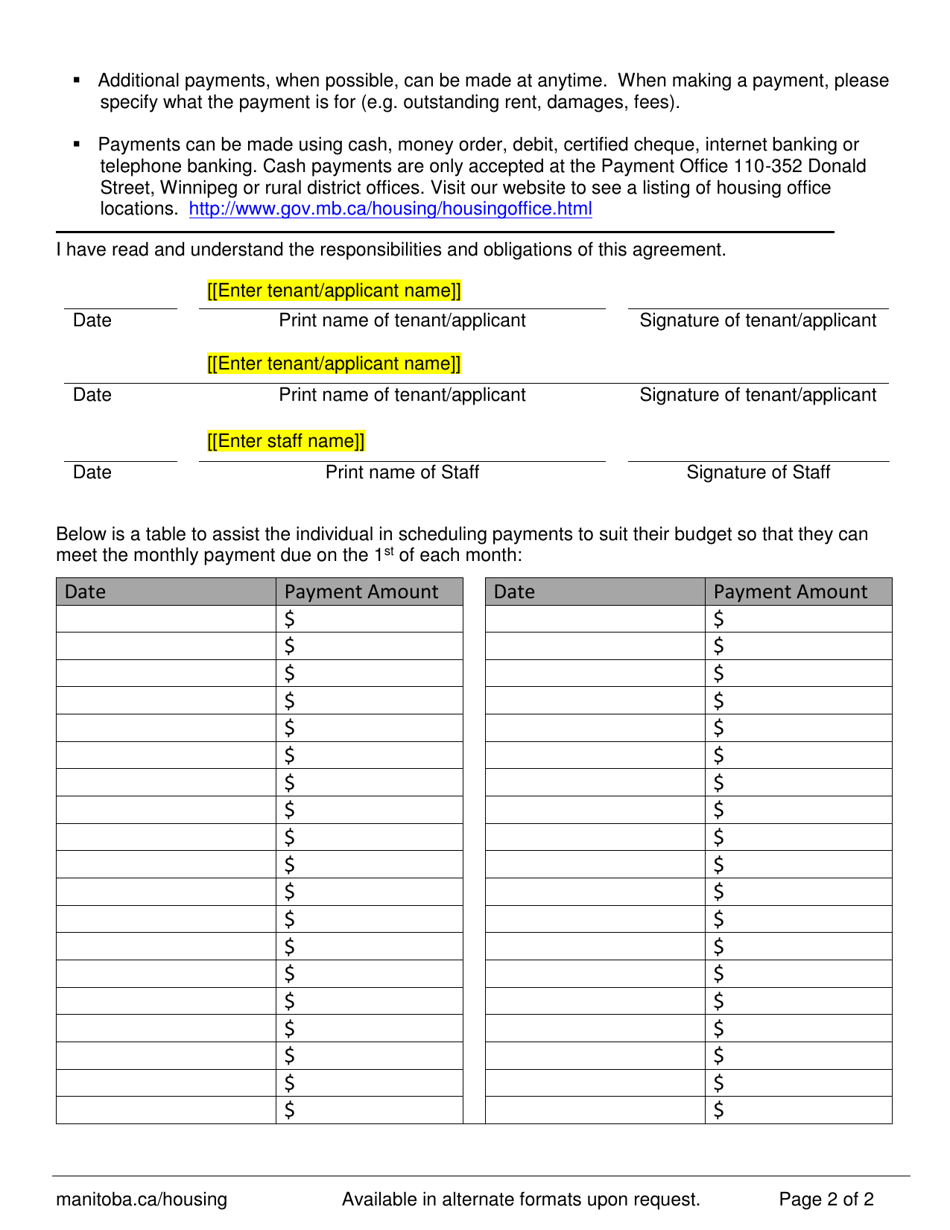

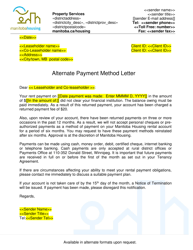

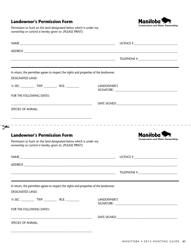

The Payment Plan Agreement in Manitoba, Canada is a document used to formalize an agreement between a debtor and a creditor regarding the repayment of a debt in installments over a specified period of time. It outlines the terms and conditions of the payment plan, including the amount and frequency of payments, interest rates, and any applicable late fees or penalties.

The person or party arranging the payment plan agreement in Manitoba, Canada typically files the agreement themselves.

FAQ

Q: What is a payment plan agreement?

A: A payment plan agreement is a contract between a debtor and a creditor that outlines the terms and conditions for repaying a debt in installments.

Q: Is a payment plan agreement legally binding in Manitoba, Canada?

A: Yes, a payment plan agreement is legally binding in Manitoba, Canada, as long as both parties agree to its terms and it meets the necessary legal requirements.

Q: What should be included in a payment plan agreement in Manitoba, Canada?

A: A payment plan agreement in Manitoba, Canada should include the names of the debtor and creditor, the amount owed, the payment schedule, interest or fees (if applicable), and any consequences for failing to make payments.

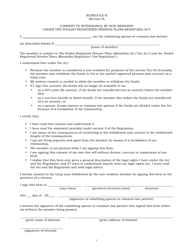

Q: Can a payment plan agreement be modified?

A: Yes, a payment plan agreement can be modified if both parties agree to the changes and they are documented in writing.

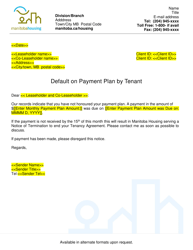

Q: What happens if a debtor fails to make payments according to the payment plan agreement?

A: If a debtor fails to make payments according to the payment plan agreement, the creditor may take legal action to recover the debt, which can include collection efforts or even court proceedings.

Q: Are there any alternatives to a payment plan agreement in Manitoba, Canada?

A: Yes, alternatives to a payment plan agreement in Manitoba, Canada can include debt consolidation, debt settlement, or seeking financial counseling or assistance.