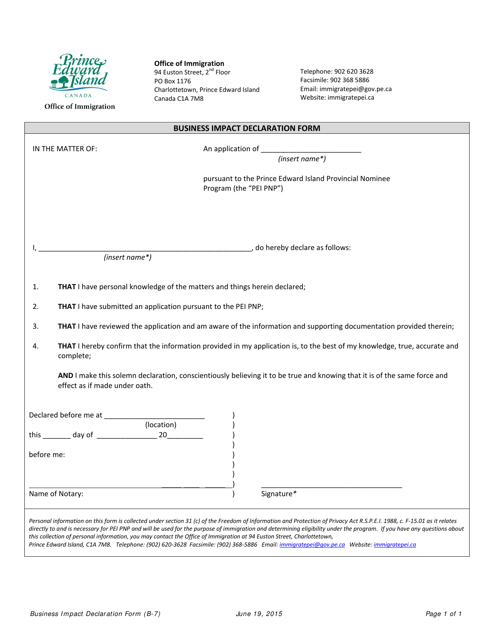

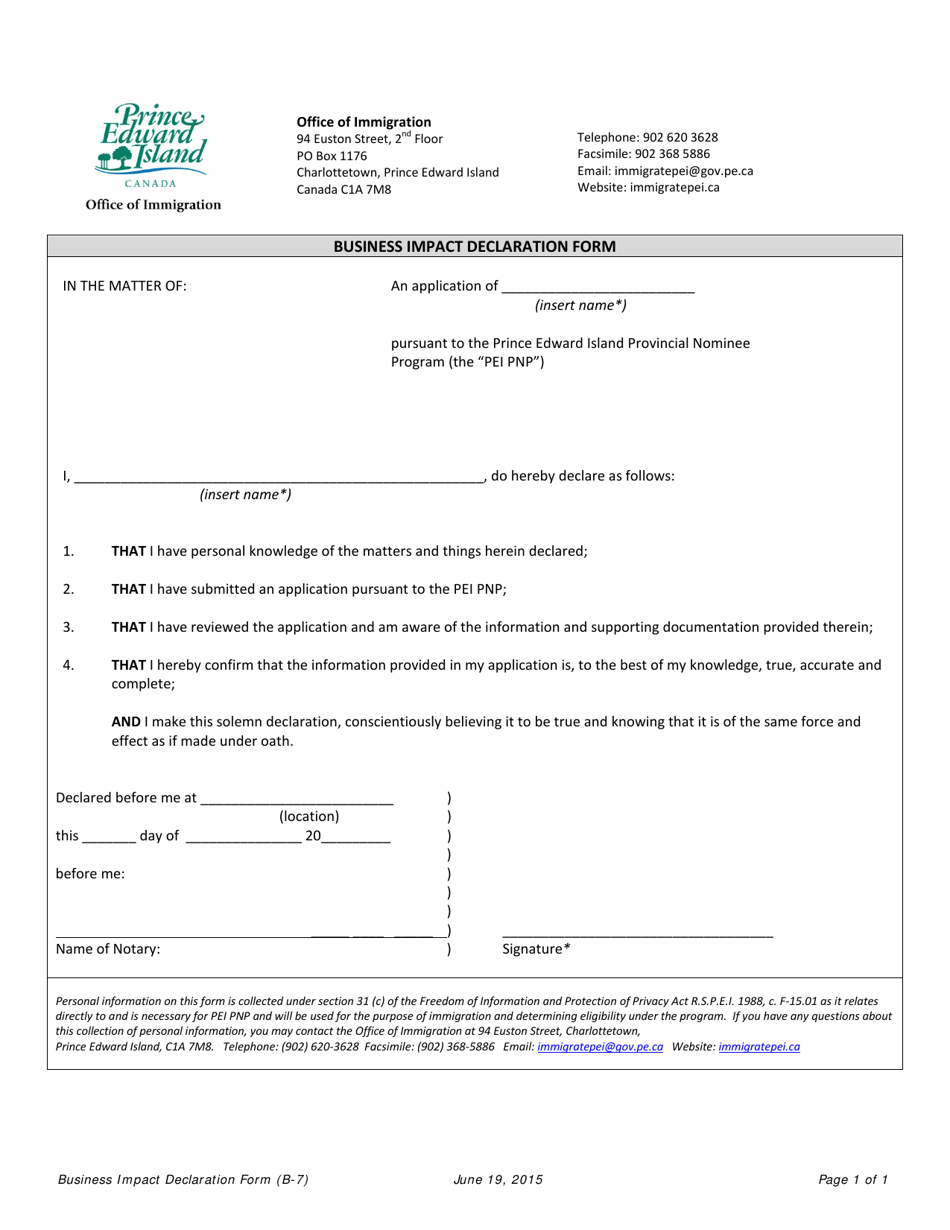

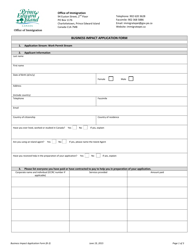

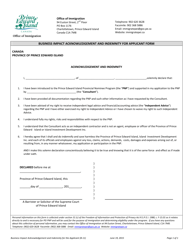

Form B-7 Business Impact Declaration Form - Prince Edward Island, Canada

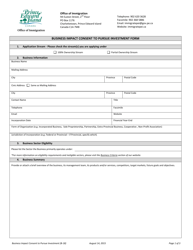

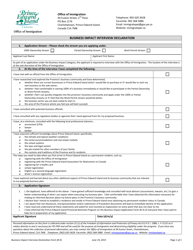

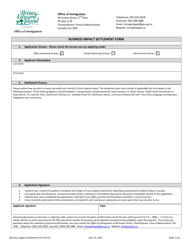

Form B-7 Business Impact Declaration Form in Prince Edward Island, Canada is used by businesses to declare their economic impact and demonstrate the need to hire foreign workers through the Prince Edward Island Provincial Nominee Program. It allows businesses to provide information about their economic activities, job creation, and the potential benefits of hiring foreign workers.

The business owner or authorized representative files the Form B-7 Business Impact Declaration Form in Prince Edward Island, Canada.

FAQ

Q: What is Form B-7?

A: Form B-7 is the Business Impact Declaration Form in Prince Edward Island, Canada.

Q: What is the purpose of Form B-7?

A: The purpose of Form B-7 is to assess the potential impact of a business proposal on the economy of Prince Edward Island.

Q: Who needs to fill out Form B-7?

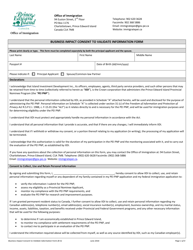

A: Anyone who wishes to apply for a business-related program or funding in Prince Edward Island needs to fill out Form B-7.

Q: Are there any fees associated with Form B-7?

A: Yes, there are fees associated with Form B-7. The specific amount depends on the type of business proposal.

Q: What information is required in Form B-7?

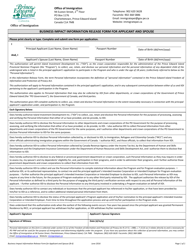

A: Form B-7 requires information such as business details, financial projections, employment plans, and economic benefits to Prince Edward Island.

Q: What are the consequences of providing false information on Form B-7?

A: Providing false information on Form B-7 can result in the rejection of the application or legal consequences.

Q: Is assistance available for filling out Form B-7?

A: Yes, assistance is available for filling out Form B-7. You can seek guidance from the Prince Edward Island government or business development organizations.

Q: How long does it take to process Form B-7?

A: The processing time for Form B-7 can vary depending on the complexity of the business proposal, but it typically takes several weeks to a few months.