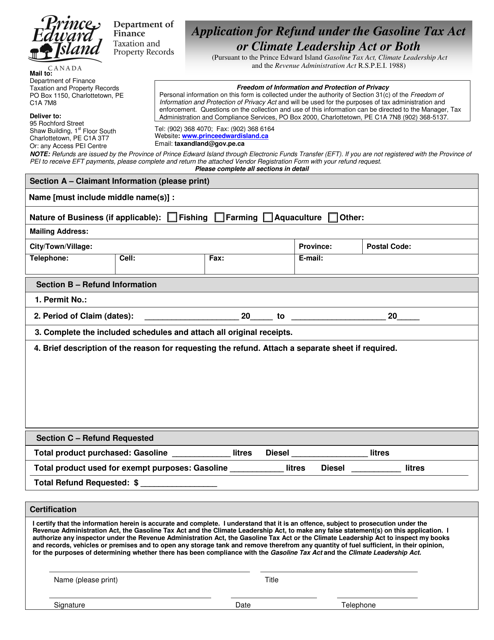

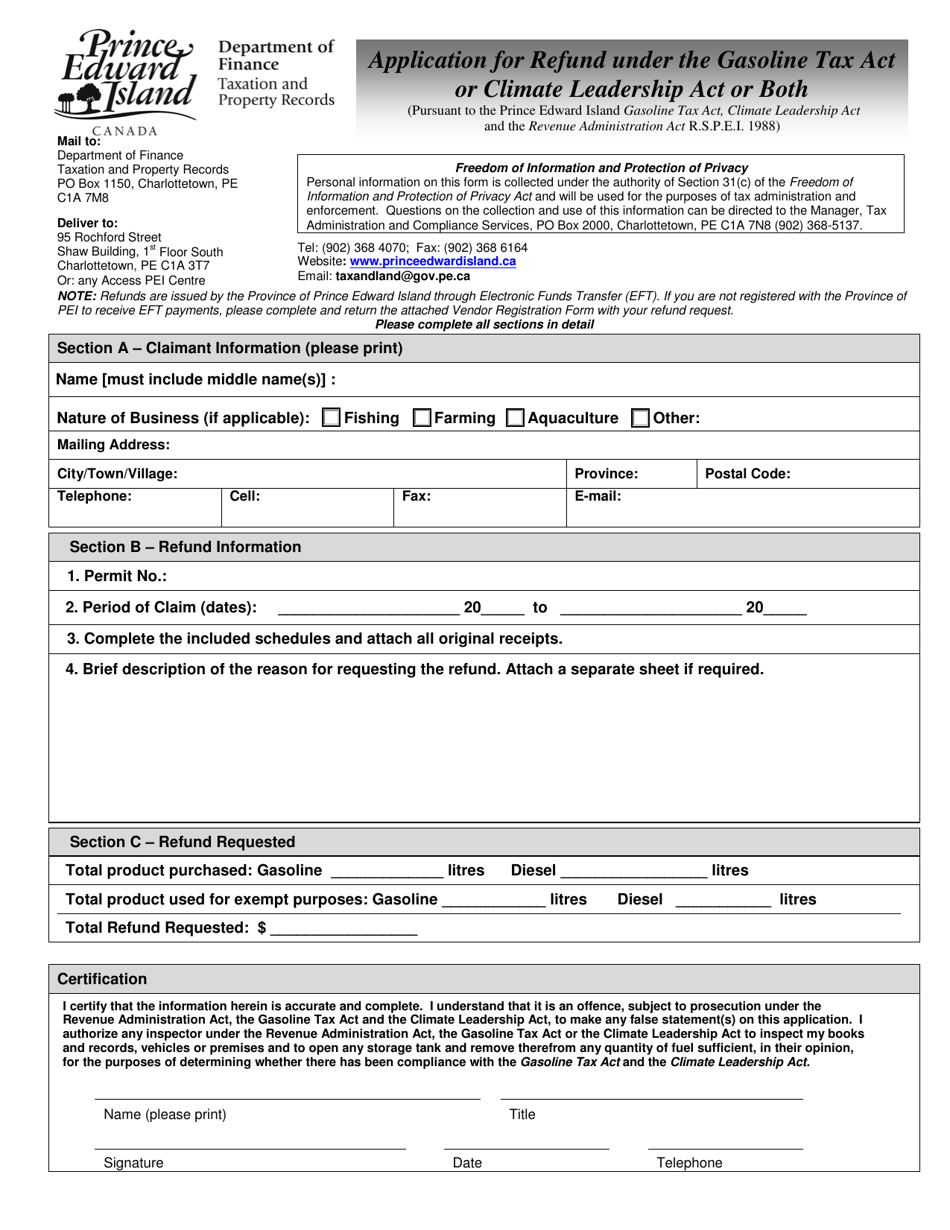

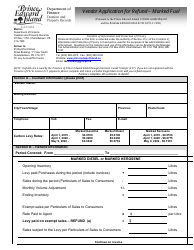

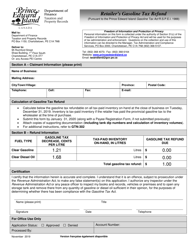

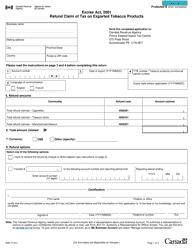

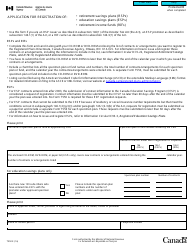

Application for Refund Under the Gasoline Tax Act or Climate Leadership Act or Both - Prince Edward Island, Canada

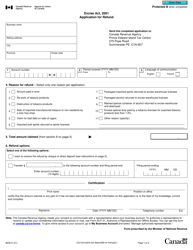

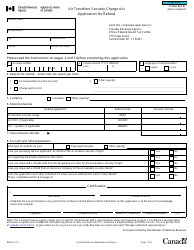

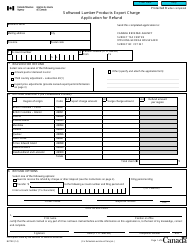

The "Application for Refund Under the Gasoline Tax Act or Climate Leadership Act or Both" in Prince Edward Island, Canada is used to apply for a refund on taxes paid for gasoline under these Acts. This refund may be applicable for various reasons, such as if the gasoline was used for agricultural purposes or if it was consumed off-road.

The application for refund under the Gasoline Tax Act or Climate Leadership Act in Prince Edward Island, Canada is filed by the registered gasoline vendor or the registered distributor, depending on the specific circumstances.

FAQ

Q: What is the Gasoline Tax Act?

A: The Gasoline Tax Act is a law in Prince Edward Island, Canada that imposes a tax on gasoline.

Q: What is the Climate Leadership Act?

A: The Climate Leadership Act is a law in Prince Edward Island, Canada that imposes a tax on greenhouse gas emissions.

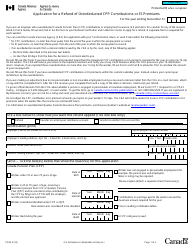

Q: Can I apply for a refund under both acts?

A: Yes, you can apply for a refund under either the Gasoline Tax Act or the Climate Leadership Act, or both if applicable.

Q: What is the purpose of the refund application?

A: The purpose of the refund application is to request a refund of the taxes paid under either the Gasoline Tax Act or the Climate Leadership Act.

Q: Who can apply for a refund?

A: Any individual or business who has paid taxes under either the Gasoline Tax Act or the Climate Leadership Act can apply for a refund.

Q: How can I apply for a refund?

A: You can apply for a refund by completing the refund application form provided by the government of Prince Edward Island.

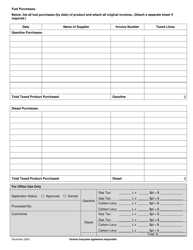

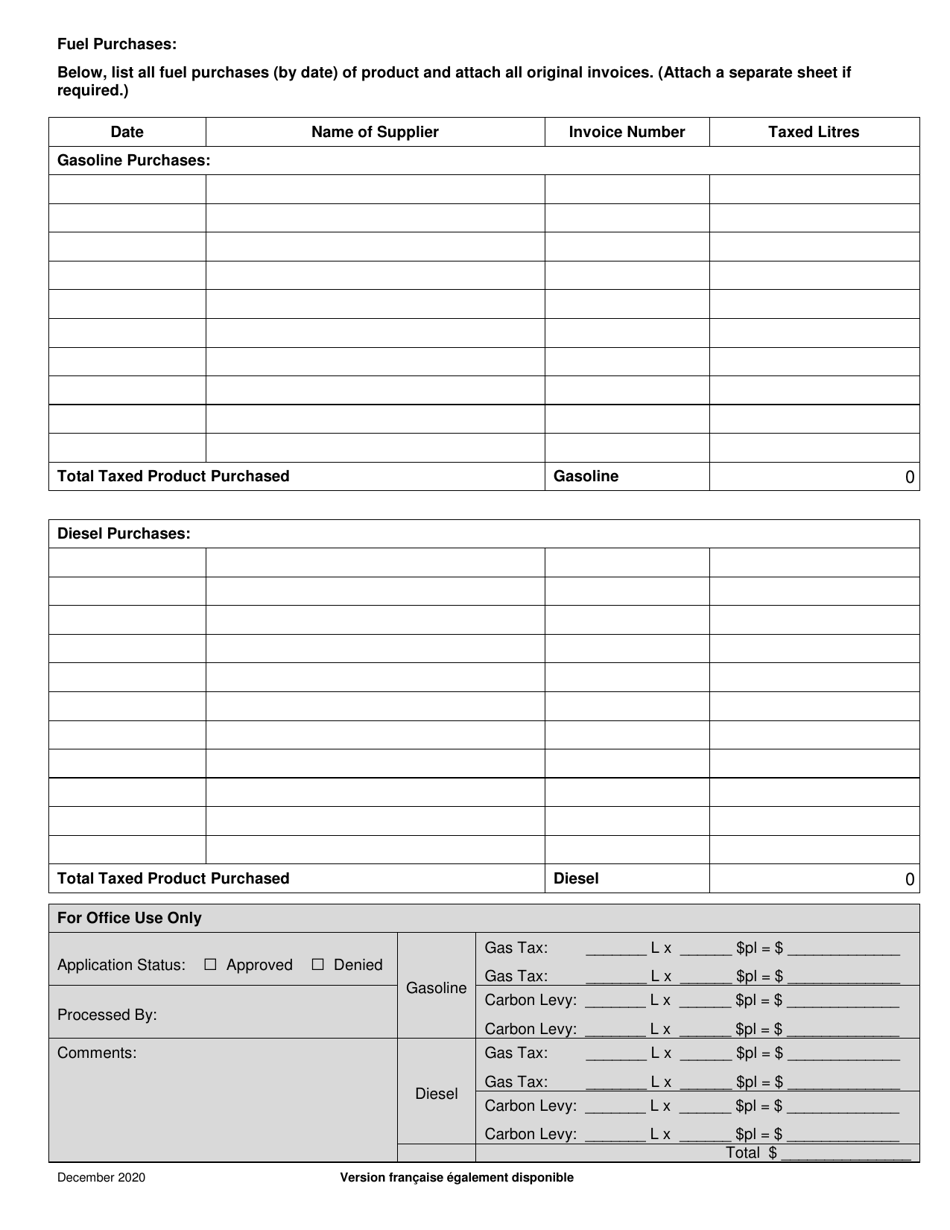

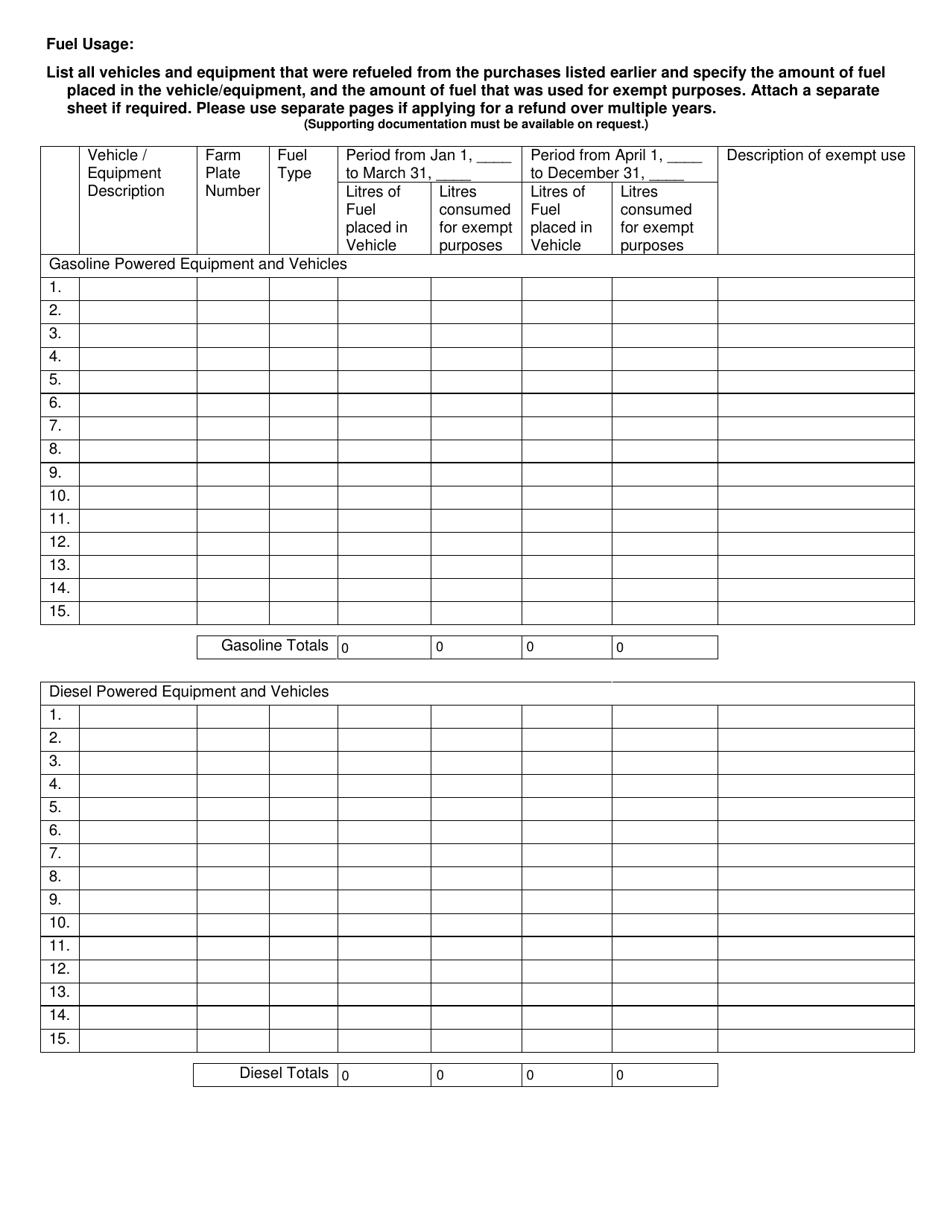

Q: What documents do I need to include with my refund application?

A: You will need to include supporting documents such as receipts or invoices that show the amount of taxes paid.

Q: Is there a deadline for submitting the refund application?

A: Yes, there is a deadline for submitting the refund application. It is typically specified by the government of Prince Edward Island.

Q: How long does it take to process the refund application?

A: The processing time for refund applications may vary. Contact the Department of Finance, Energy and Municipal Affairs for more information.