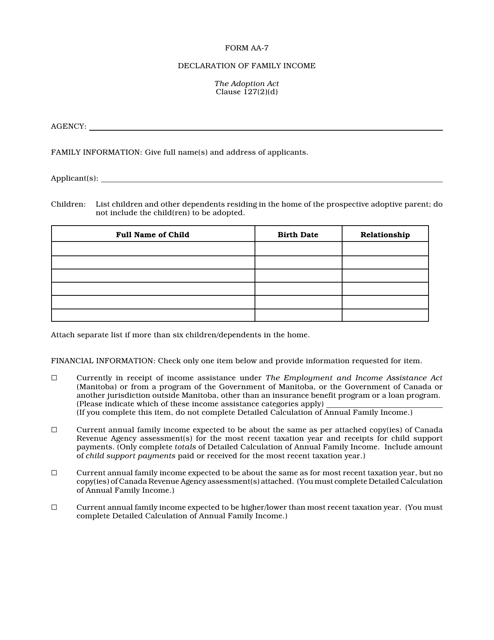

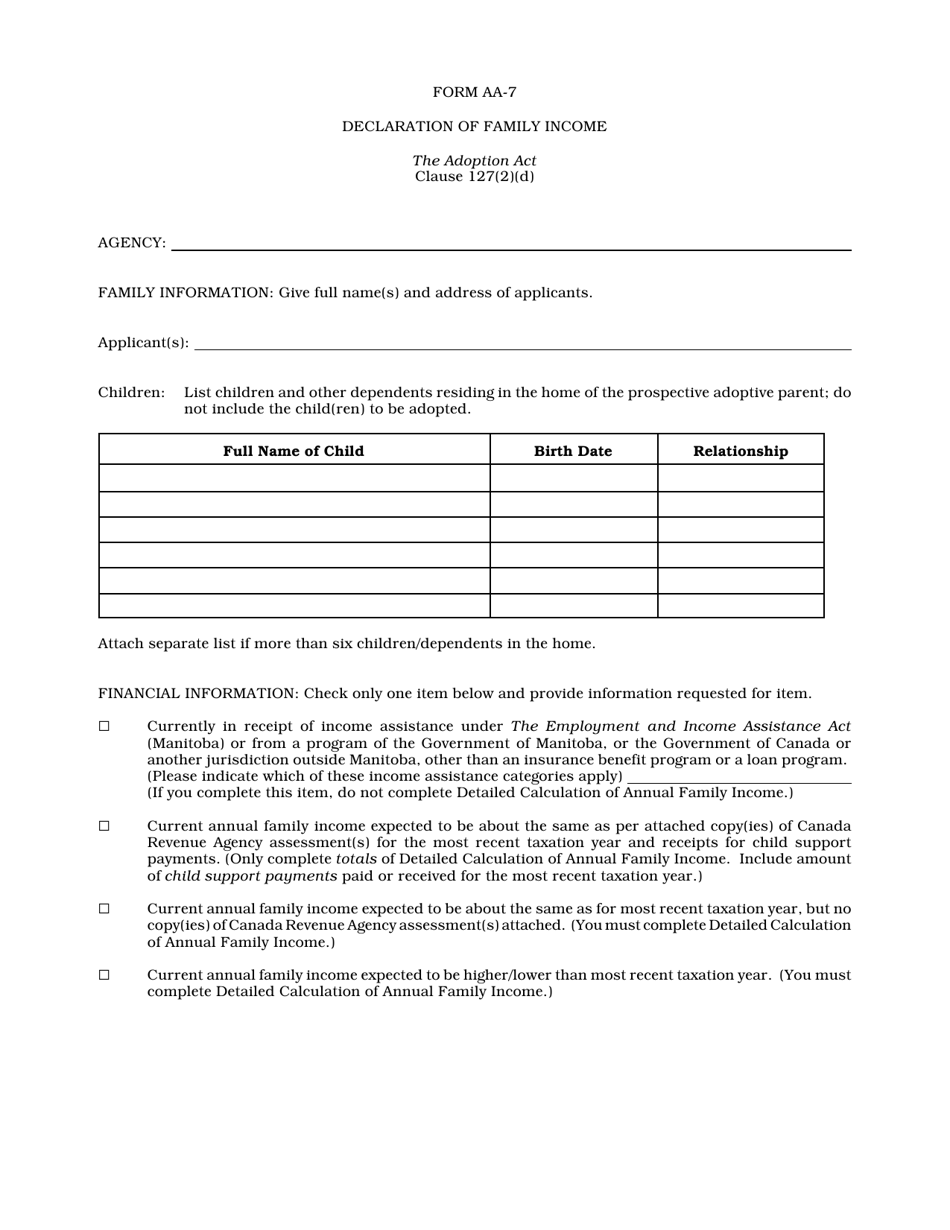

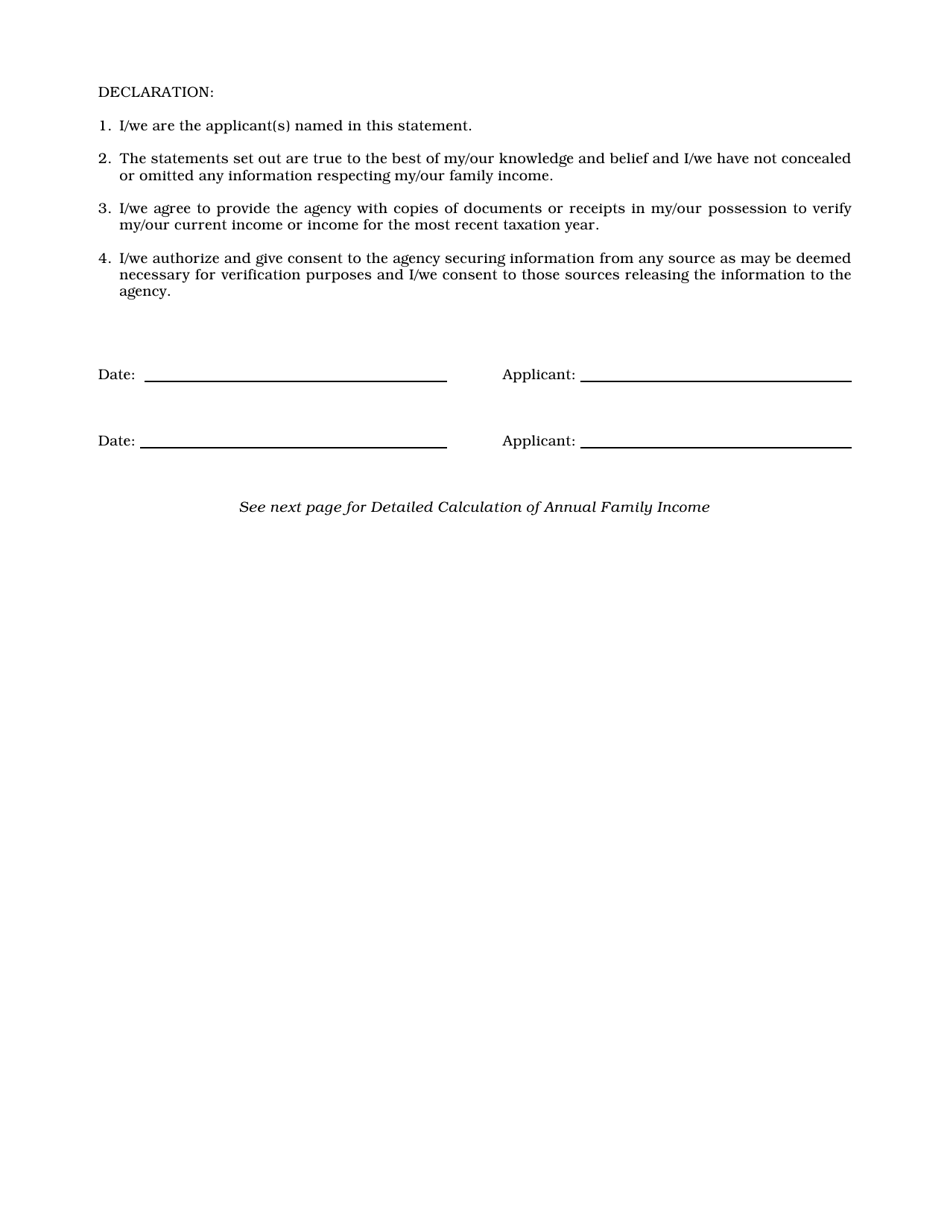

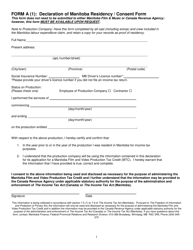

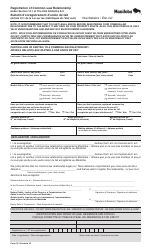

Form AA-7 Declaration of Family Income - Manitoba, Canada

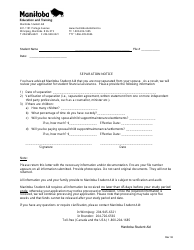

Form AA-7 Declaration of Family Income in Manitoba, Canada is used to assess the income of a family or individual to determine eligibility for government assistance programs, benefits, or subsidies.

The Form AA-7 Declaration of Family Income in Manitoba, Canada is typically filed by individuals or families who are applying for income-based government assistance programs.

FAQ

Q: What is Form AA-7?

A: Form AA-7 is the Declaration of Family Income form.

Q: Who needs to fill out Form AA-7?

A: Residents of Manitoba, Canada who are applying for social assistance programs may need to fill out Form AA-7.

Q: What is the purpose of Form AA-7?

A: The purpose of Form AA-7 is to declare the income of the applicant's family for the purpose of determining eligibility for social assistance programs.

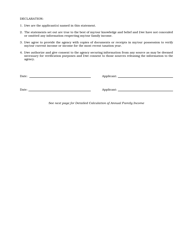

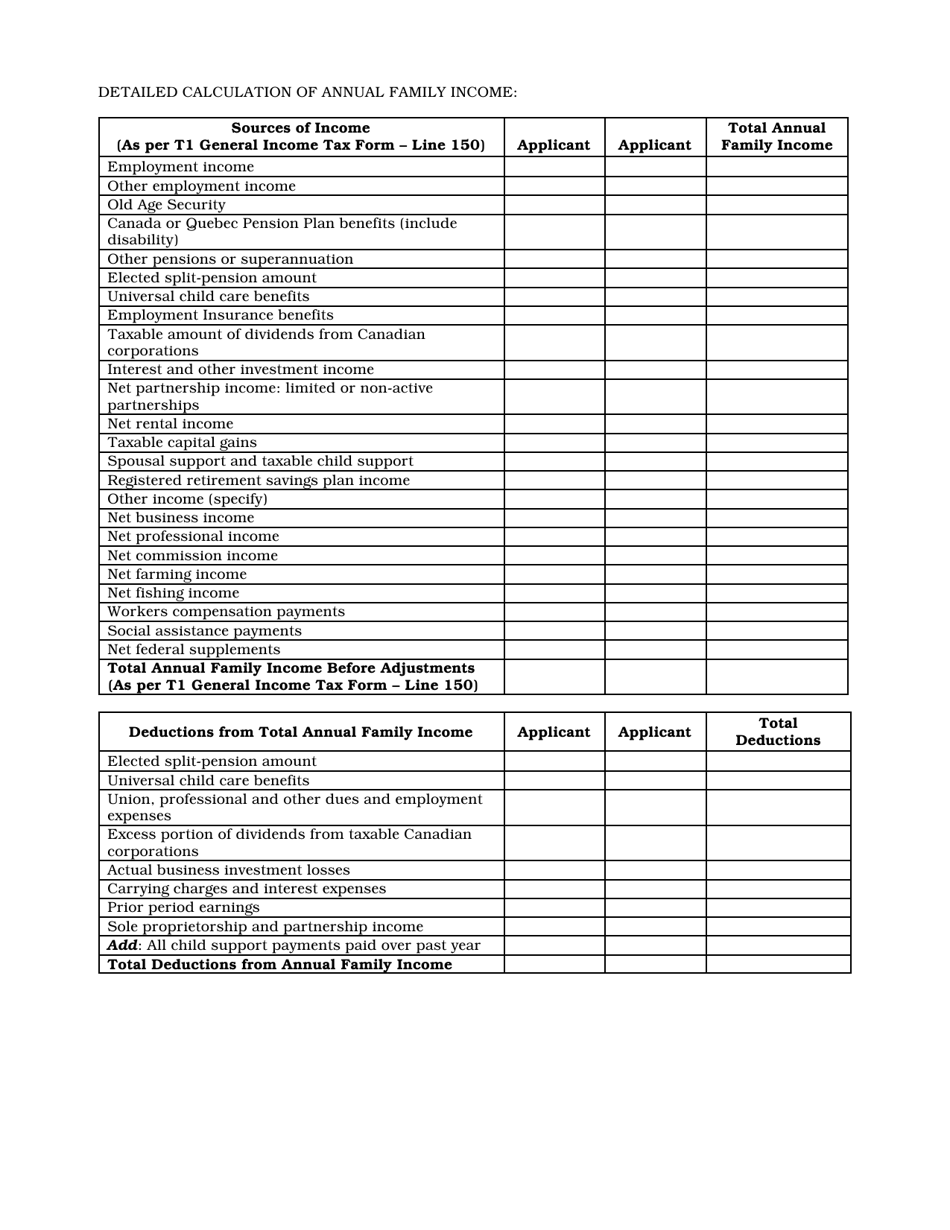

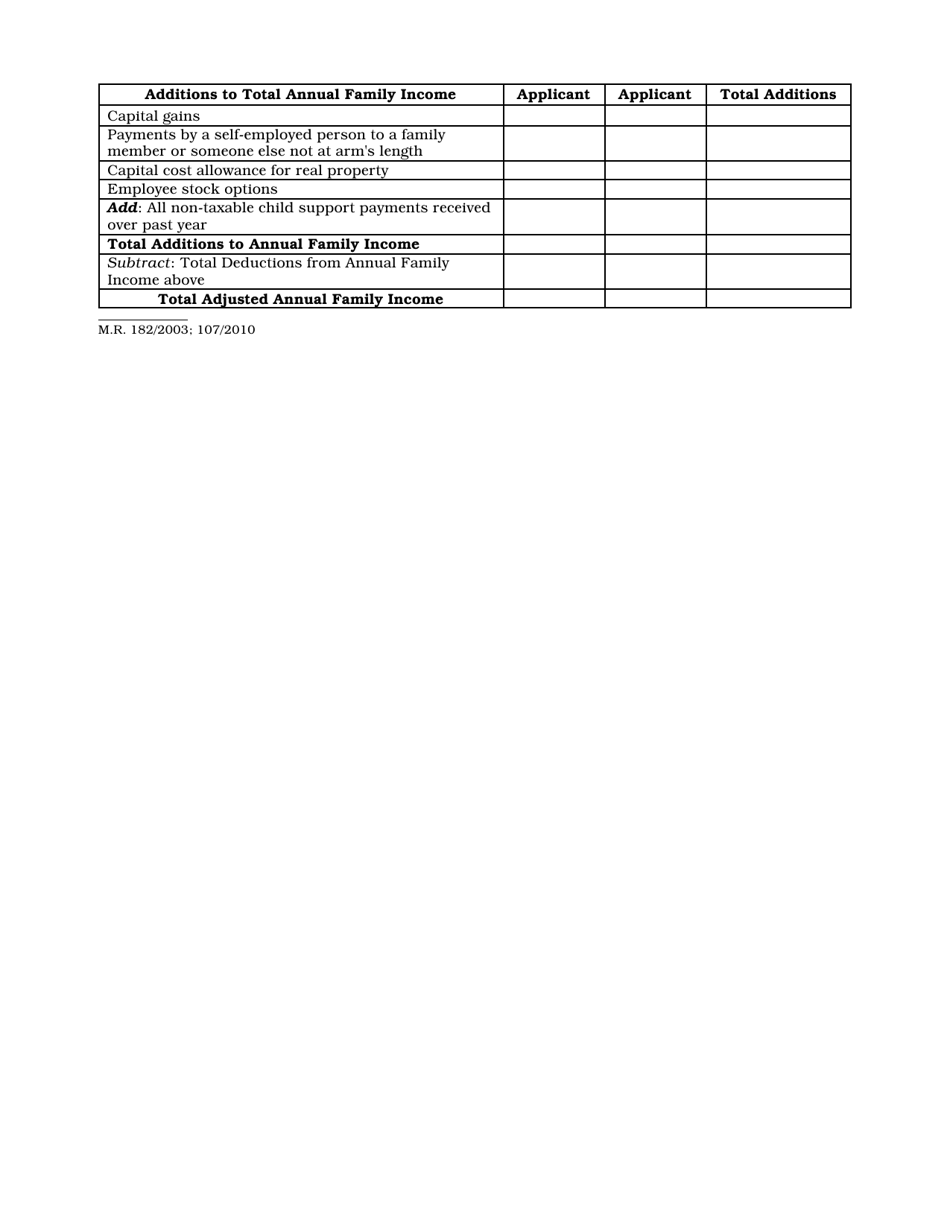

Q: What information is required on Form AA-7?

A: Form AA-7 requires information such as the names of family members, their income sources, and the total family income.

Q: Are there any documents I need to submit along with Form AA-7?

A: You may need to submit supporting documents such as pay stubs, tax returns, and proof of other income sources along with Form AA-7.

Q: When should I submit Form AA-7?

A: You should submit Form AA-7 as soon as possible when applying for social assistance programs.

Q: Who can help me fill out Form AA-7?

A: You can reach out to the social assistance office or a community organization for assistance in filling out Form AA-7.

Q: Is there a deadline to submit Form AA-7?

A: There may be a deadline to submit Form AA-7, so it's important to check the specific requirements of the social assistance program you are applying for.