This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2151

for the current year.

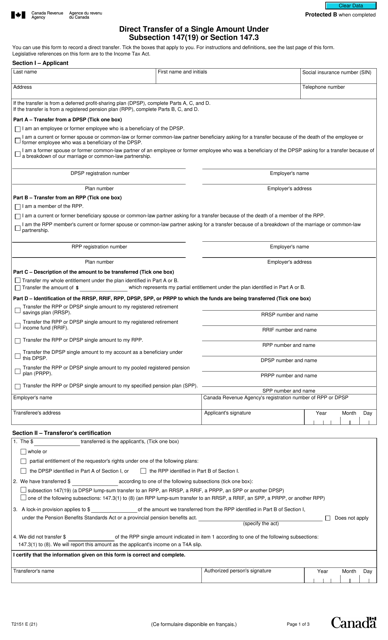

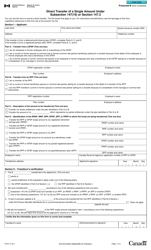

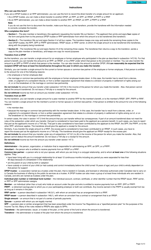

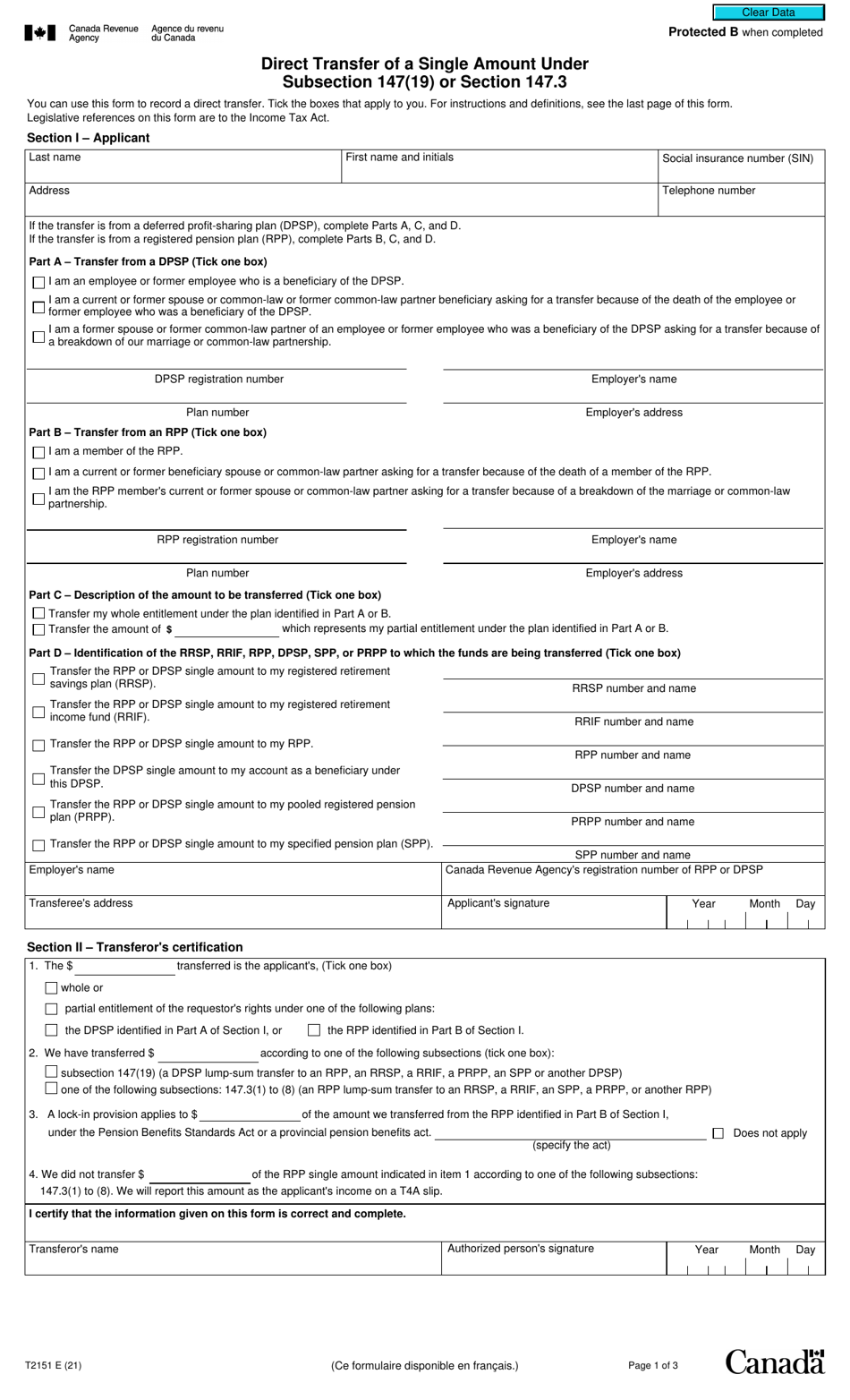

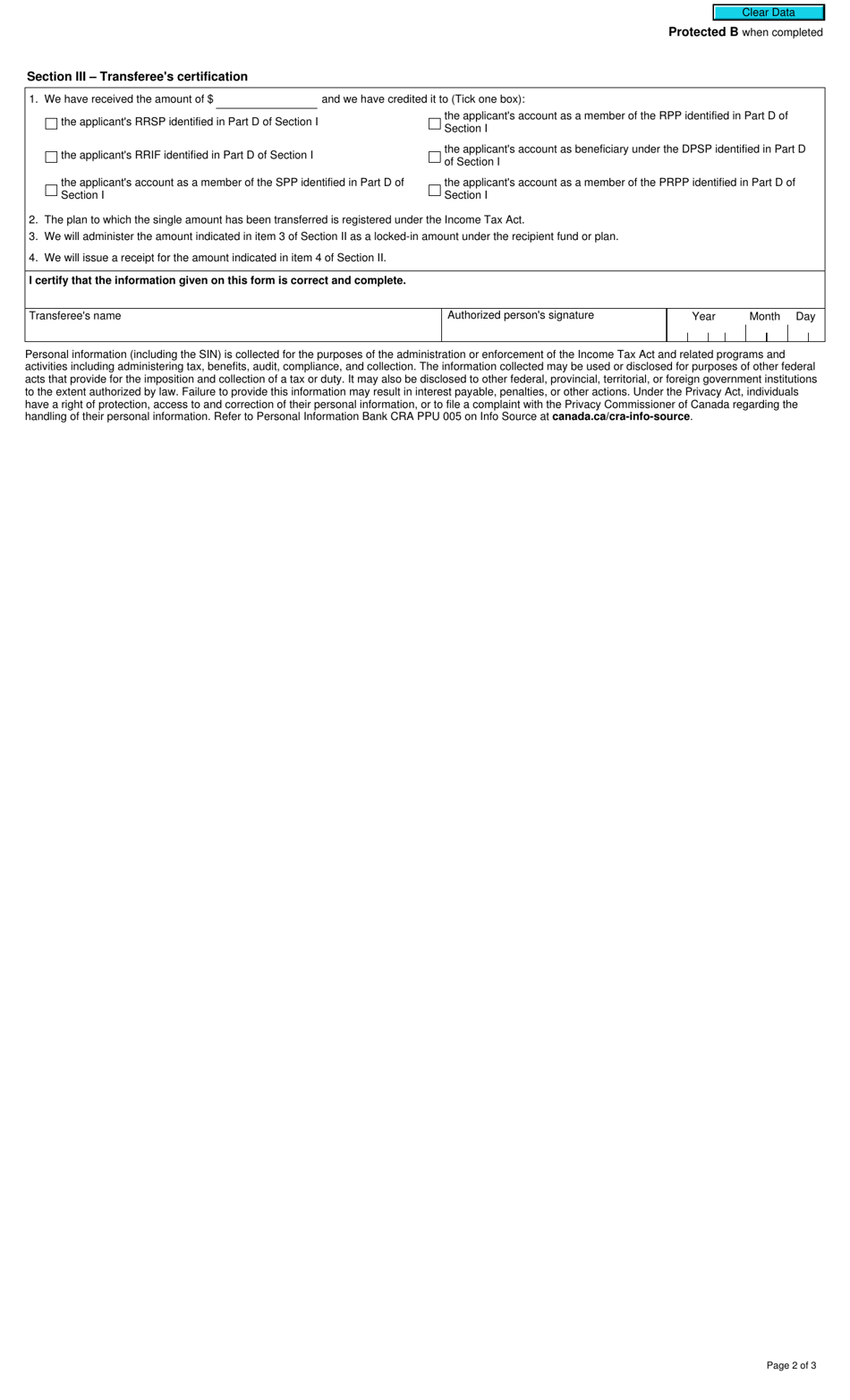

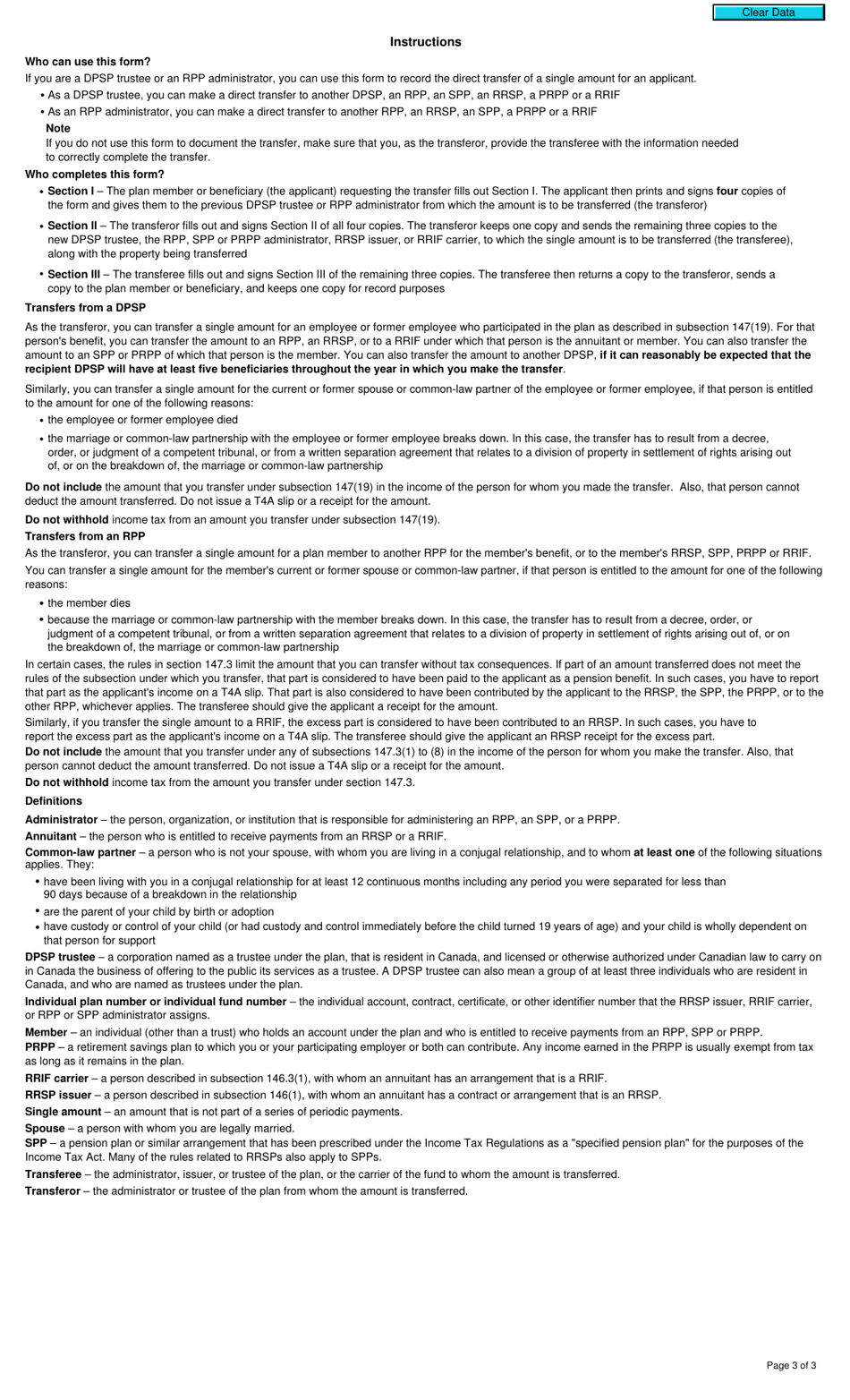

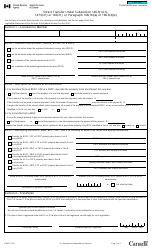

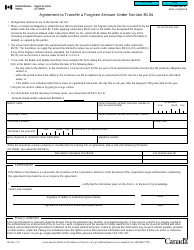

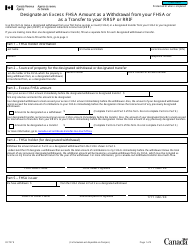

Form T2151 Direct Transfer of a Single Amount Under Subsection 147(19) or Section 147.3 - Canada

Form T2151 Direct Transfer of a Single Amount Under Subsection 147(19) or Section 147.3 in Canada is used to transfer a single amount from one registered account to another, such as transferring funds from one registered retirement savings plan (RRSP) to another RRSP. It helps individuals maintain the tax-deferred status of their retirement savings.

The individual who is transferring a single amount under subsection 147(19) or section 147.3 in Canada files the Form T2151.

FAQ

Q: What is Form T2151?

A: Form T2151 is a document used in Canada for the direct transfer of a single amount under subsection 147(19) or section 147.3 of the Canadian tax code.

Q: When is Form T2151 used?

A: Form T2151 is used when an individual wants to transfer a single amount from one registered retirement savings plan (RRSP) or registered pension plan (RPP) to another.

Q: What is the purpose of Form T2151?

A: The purpose of Form T2151 is to ensure that the transfer of the single amount is eligible for tax-deferred treatment.

Q: Who should complete Form T2151?

A: Both the transferor (the individual transferring the amount) and the transferee (the plan that will receive the amount) should complete and sign Form T2151.

Q: Are there any fees or taxes associated with the transfer?

A: There may be fees or taxes associated with the transfer, depending on the specific circumstances. It is recommended to consult with a tax professional or the CRA for more information.

Q: Are there any deadlines for submitting Form T2151?

A: There are no specific deadlines for submitting Form T2151, but it is recommended to submit it as soon as possible to ensure timely processing of the transfer.

Q: Can Form T2151 be submitted electronically?

A: As of now, Form T2151 cannot be submitted electronically. It must be filled out manually and submitted by mail or in-person to the CRA.