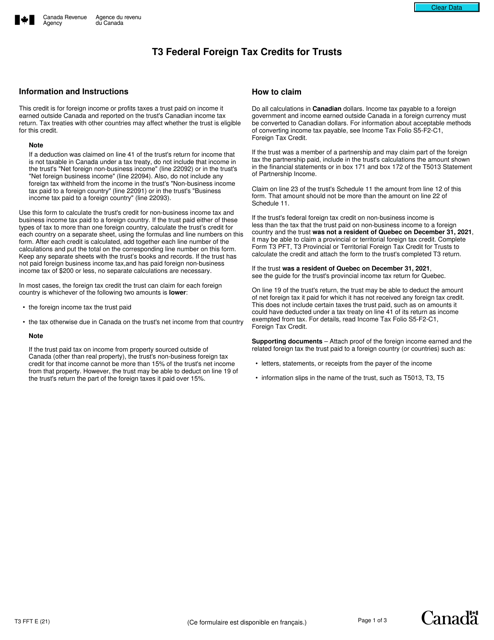

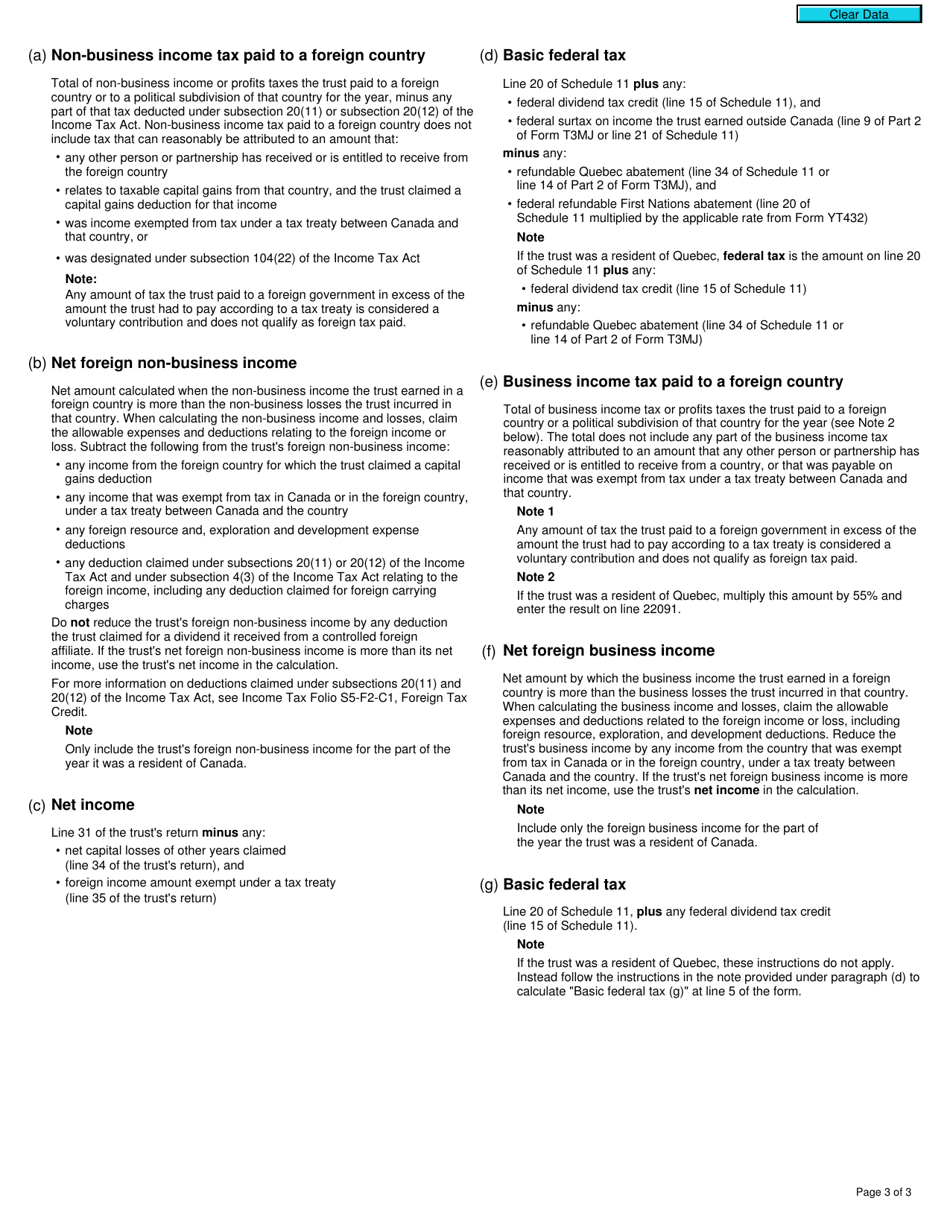

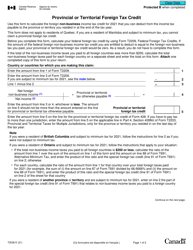

Form T3FFT T3 Federal Foreign Tax Credits for Trusts - Canada

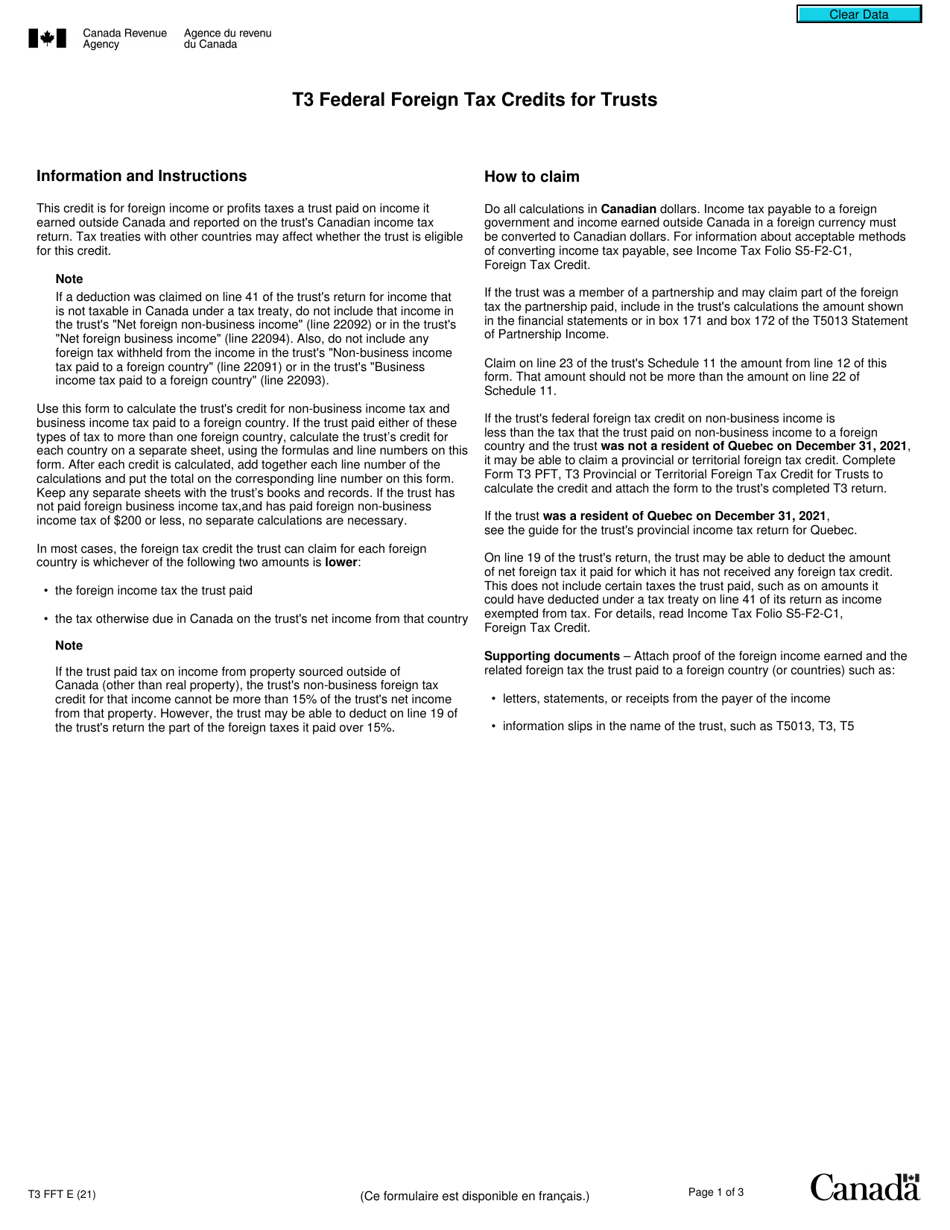

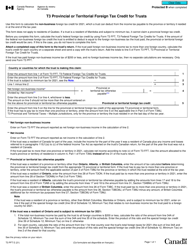

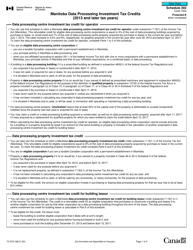

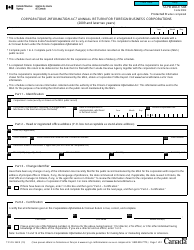

Form T3FFT, also known as the T3 Federal Foreign Tax Credits for Trusts, is used by Canadian trusts to claim tax credits for foreign taxes paid on income earned outside of Canada.

The trustee of the trust files the Form T3FFT T3 Federal Foreign Tax Credits for Trusts in Canada.

FAQ

Q: What is Form T3FFT?

A: Form T3FFT is a tax form specifically designed for trusts in Canada to claim foreign tax credits.

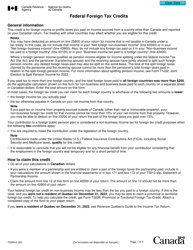

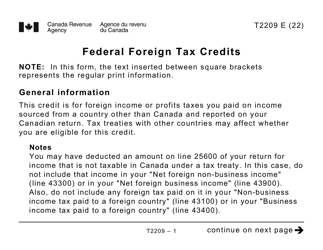

Q: What are foreign tax credits?

A: Foreign tax credits are credits that a taxpayer can claim to offset the taxes they owe in Canada on income earned in another country.

Q: Who needs to file Form T3FFT?

A: Trusts in Canada that have foreign income and are eligible for foreign tax credits need to file Form T3FFT.

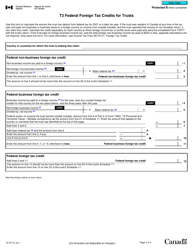

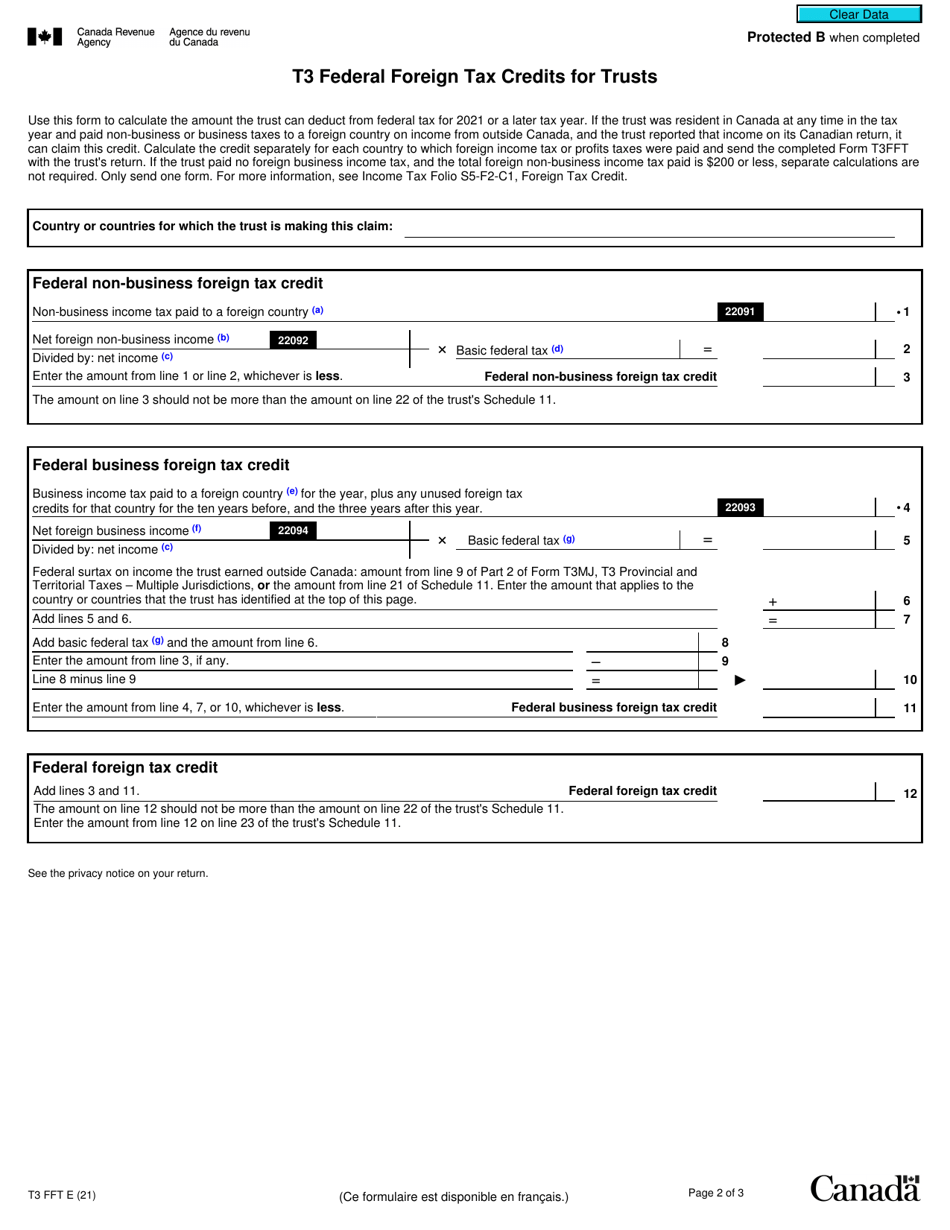

Q: How do I fill out Form T3FFT?

A: You will need to provide information about your trust, the foreign country where the income was earned, and the amount of foreign taxes paid.

Q: When is the deadline to file Form T3FFT?

A: The deadline to file Form T3FFT is the same as the trust's tax return deadline, which is usually March 31st.

Q: Are there any penalties for not filing Form T3FFT?

A: Yes, if you do not file Form T3FFT when required, you may be subject to penalties and interest on the taxes owed.