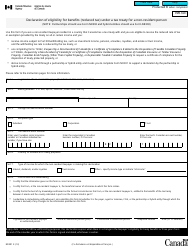

This version of the form is not currently in use and is provided for reference only. Download this version of

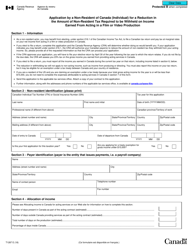

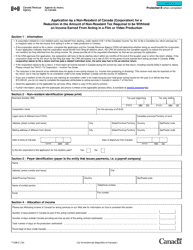

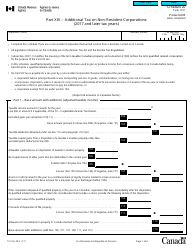

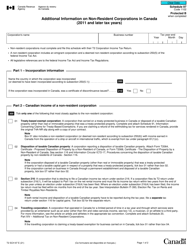

Form NR602

for the current year.

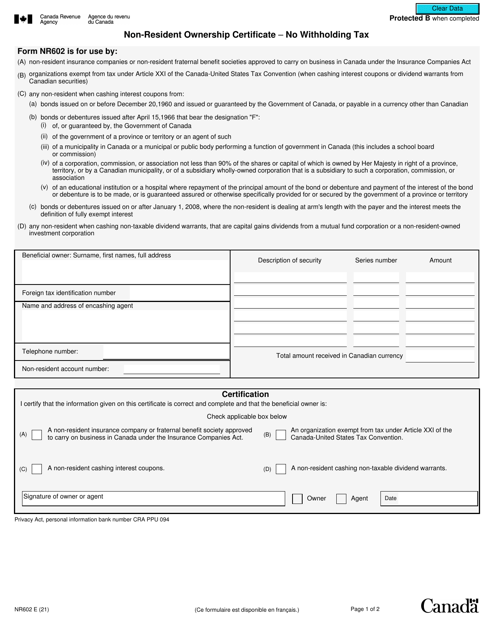

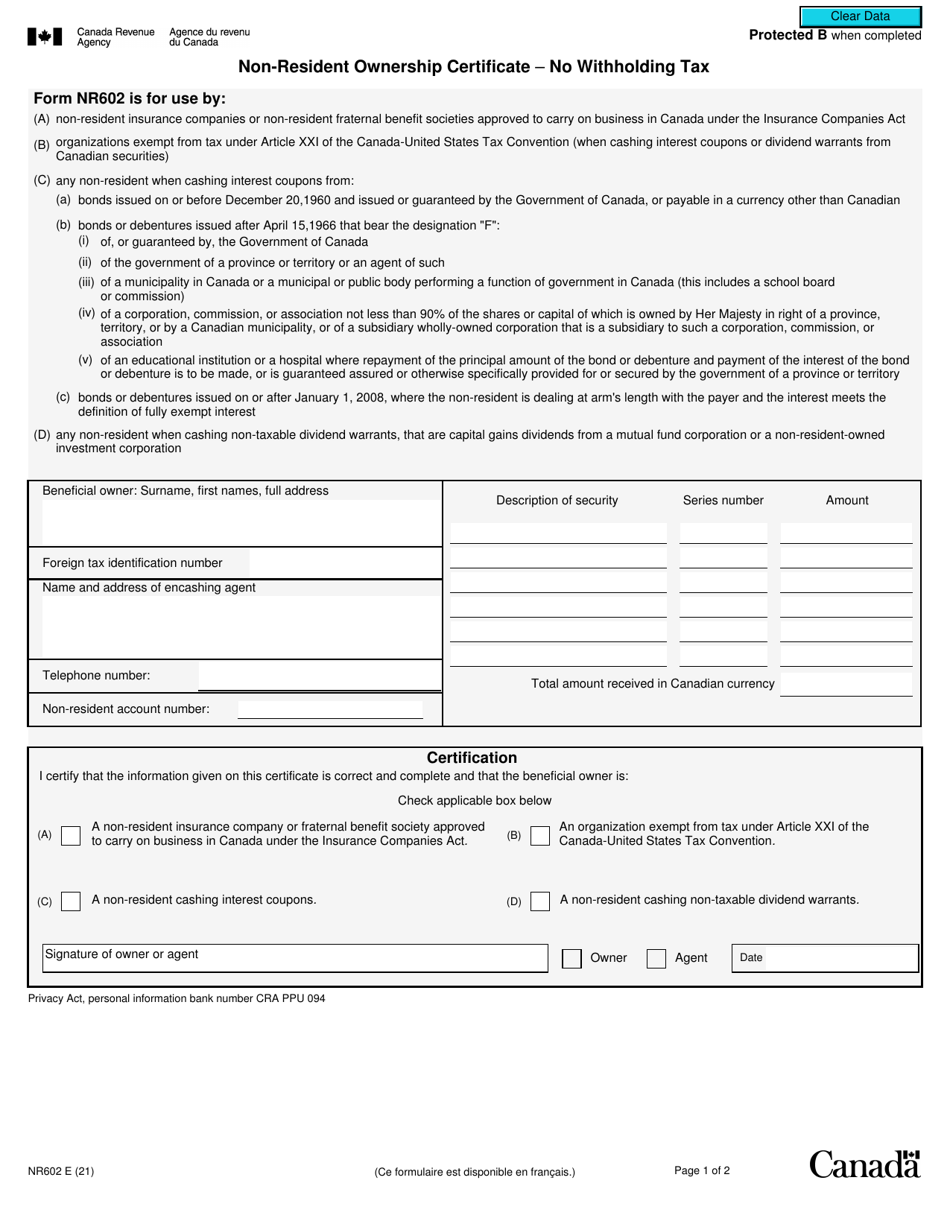

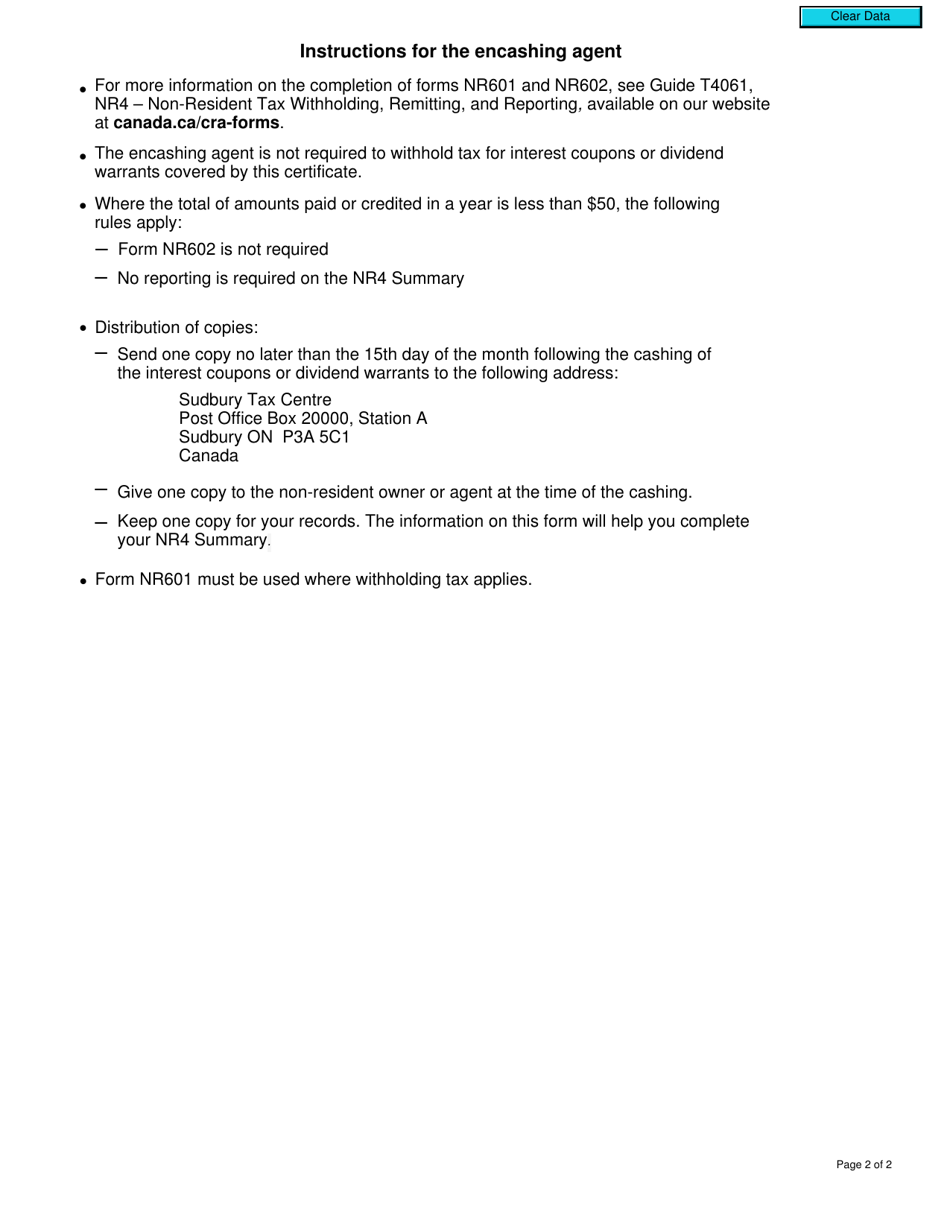

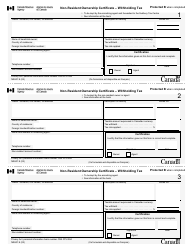

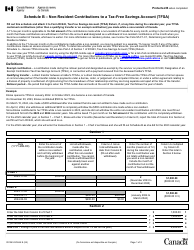

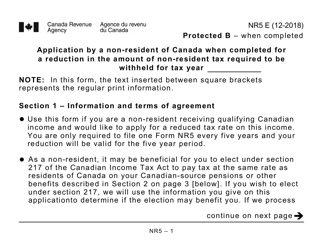

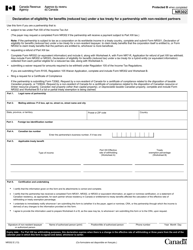

Form NR602 Non-resident Ownership Certificate - No Withholding Tax - Canada

Form NR602 Non-resident Ownership Certificate - No Withholding Tax in Canada is used by non-residents to certify their exempt status from withholding tax on certain types of Canadian income, such as rents, royalties, or dividends. This form is used to claim a reduced or exempt rate of withholding tax under a tax treaty between Canada and the non-resident's country of residence.

The Form NR602 Non-resident Ownership Certificate - No Withholding Tax in Canada is typically filed by non-resident individuals or corporations who own real property in Canada.

FAQ

Q: What is Form NR602?

A: Form NR602 is the Non-resident Ownership Certificate.

Q: What does the Form NR602 certificate signify?

A: The Form NR602 certificate signifies that a non-resident in Canada is exempt from withholding tax.

Q: Who is eligible to use Form NR602?

A: Non-residents who own property in Canada and are exempt from withholding tax can use Form NR602.

Q: What is the purpose of Form NR602?

A: The purpose of Form NR602 is to provide proof of non-resident status and exemption from withholding tax for property owners in Canada.

Q: What is withholding tax?

A: Withholding tax is a tax deducted by the payer (in this case, the property manager or tenant) from the income or payment made to a non-resident.

Q: Can anyone use Form NR602 to avoid withholding tax?

A: No, only non-residents who are exempt from withholding tax can use Form NR602.

Q: Is there a fee for obtaining Form NR602?

A: No, there is no fee for obtaining Form NR602.

Q: How often do I need to submit Form NR602?

A: You need to submit Form NR602 to the property manager or tenant annually, or as requested by the Canada Revenue Agency (CRA).

Q: Are there any penalties for providing false information on Form NR602?

A: Yes, providing false information on Form NR602 can result in penalties, including fines and potential legal consequences.

Q: Can Form NR602 be used for other types of income?

A: No, Form NR602 is specifically for non-resident property owners in Canada and does not apply to other types of income.