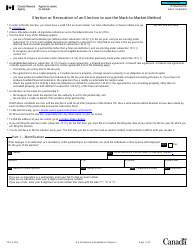

This version of the form is not currently in use and is provided for reference only. Download this version of

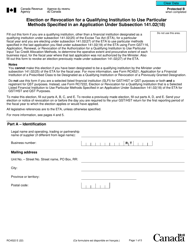

Form GST74

for the current year.

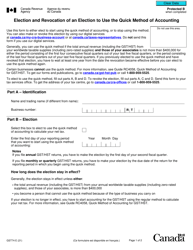

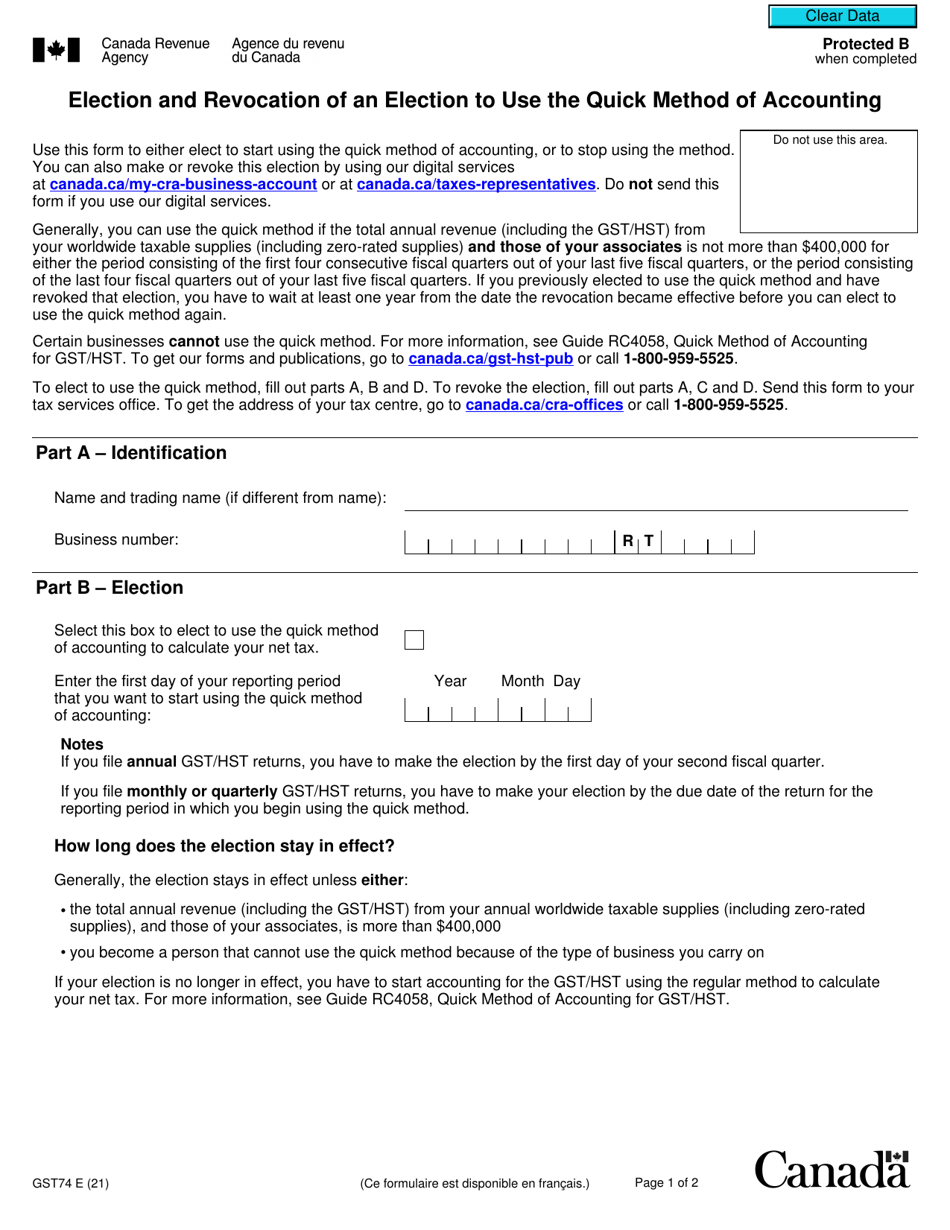

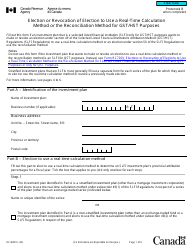

Form GST74 Election and Revocation of an Election to Use the Quick Method of Accounting - Canada

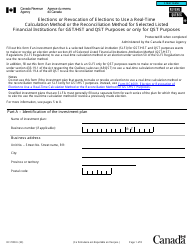

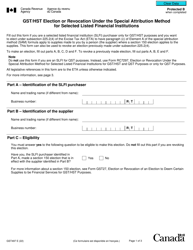

The Form GST74 Election and Revocation of an Election to Use the Quick Method of Accounting in Canada is used to elect or revoke the election to use the quick method of accounting for reporting Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

The Form GST74 Election and Revocation of an Election to Use the Quick Method of Accounting in Canada is filed by businesses that want to elect or revoke their election to use the Quick Method of Accounting for calculating their goods and services tax (GST) liabilities.

FAQ

Q: What is Form GST74?

A: Form GST74 is a document used in Canada to make an election or revoke an election to use the Quick Method of Accounting for Goods and Services Tax (GST).

Q: What is the Quick Method of Accounting?

A: The Quick Method of Accounting is an optional simplified method for calculating and remitting GST in Canada.

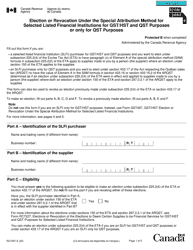

Q: Who can use the Quick Method of Accounting?

A: Small businesses that meet certain eligibility criteria can choose to use the Quick Method of Accounting.

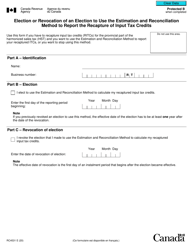

Q: How do I make an election to use the Quick Method of Accounting?

A: To make an election, you need to complete Form GST74 and submit it to the Canada Revenue Agency (CRA).

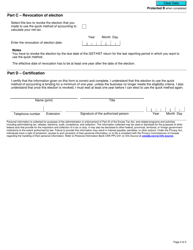

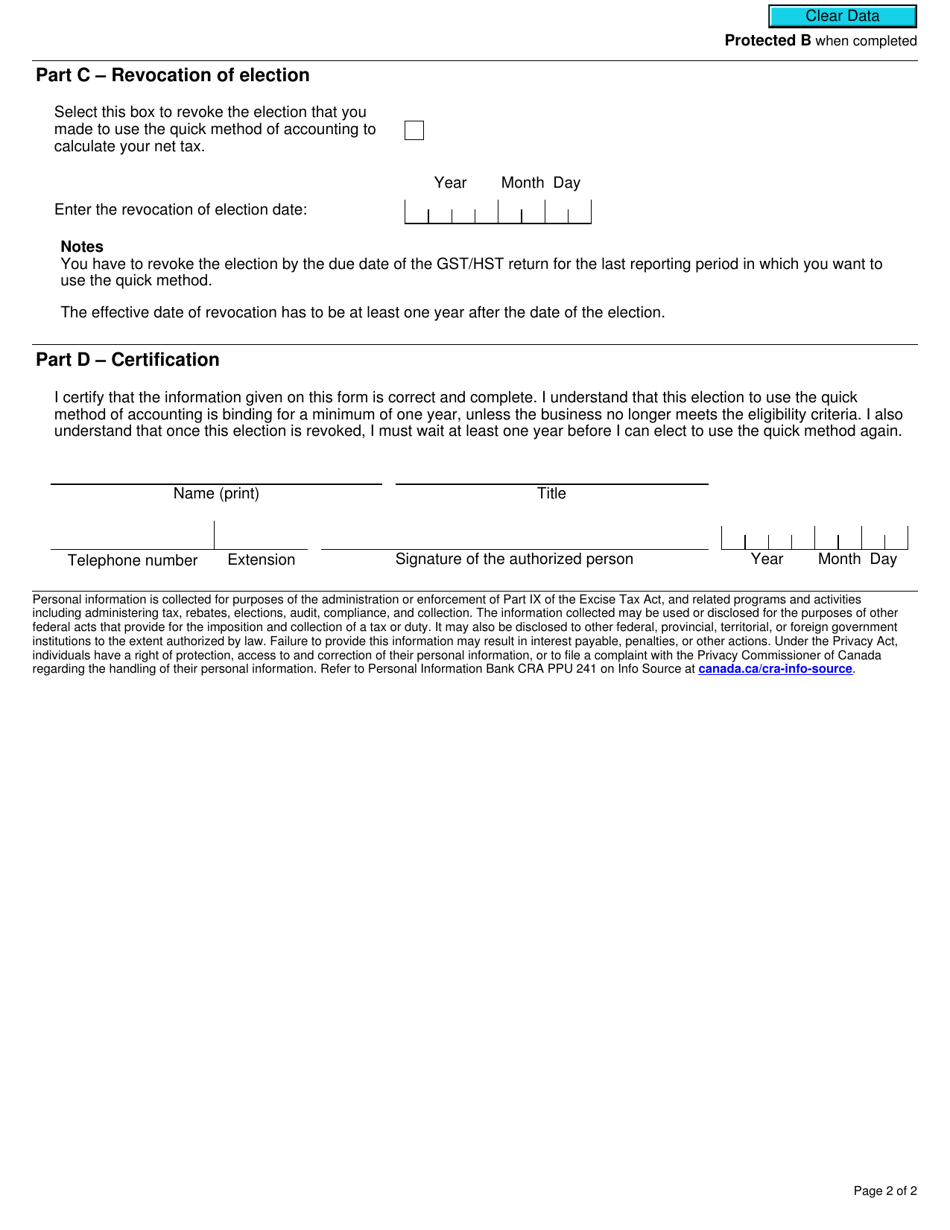

Q: How do I revoke an election to use the Quick Method of Accounting?

A: To revoke an election, you need to complete Form GST74 and submit it to the CRA.

Q: What information is required on Form GST74?

A: Form GST74 requires information about your business, such as your business number, contact information, and details of the election or revocation.

Q: Are there any deadlines for filing Form GST74?

A: Yes, there are specific deadlines for making an election or revoking an election using Form GST74. You should consult the CRA or refer to the instructions on the form for the current deadlines.

Q: Can I use the Quick Method of Accounting for all my business activities?

A: No, there are restrictions on the types of businesses and activities that are eligible for the Quick Method of Accounting. You should check the CRA guidelines to determine if your business is eligible.

Q: Can I change my election from the Quick Method of Accounting to the regular method?

A: Yes, you can change your election, but there are certain conditions and procedures you need to follow. It is advisable to consult the CRA for guidance on changing your election.