This version of the form is not currently in use and is provided for reference only. Download this version of

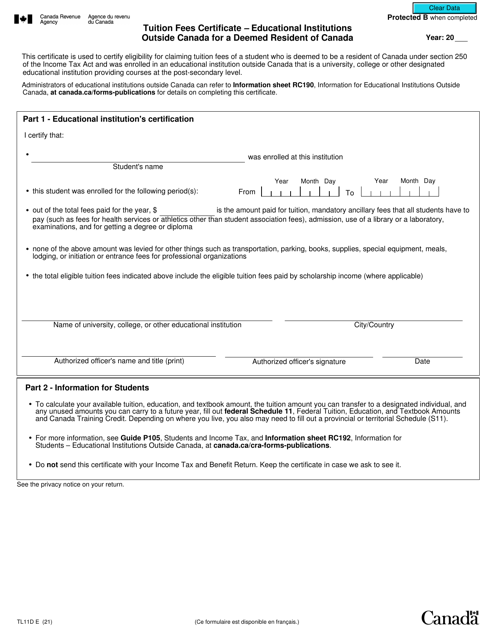

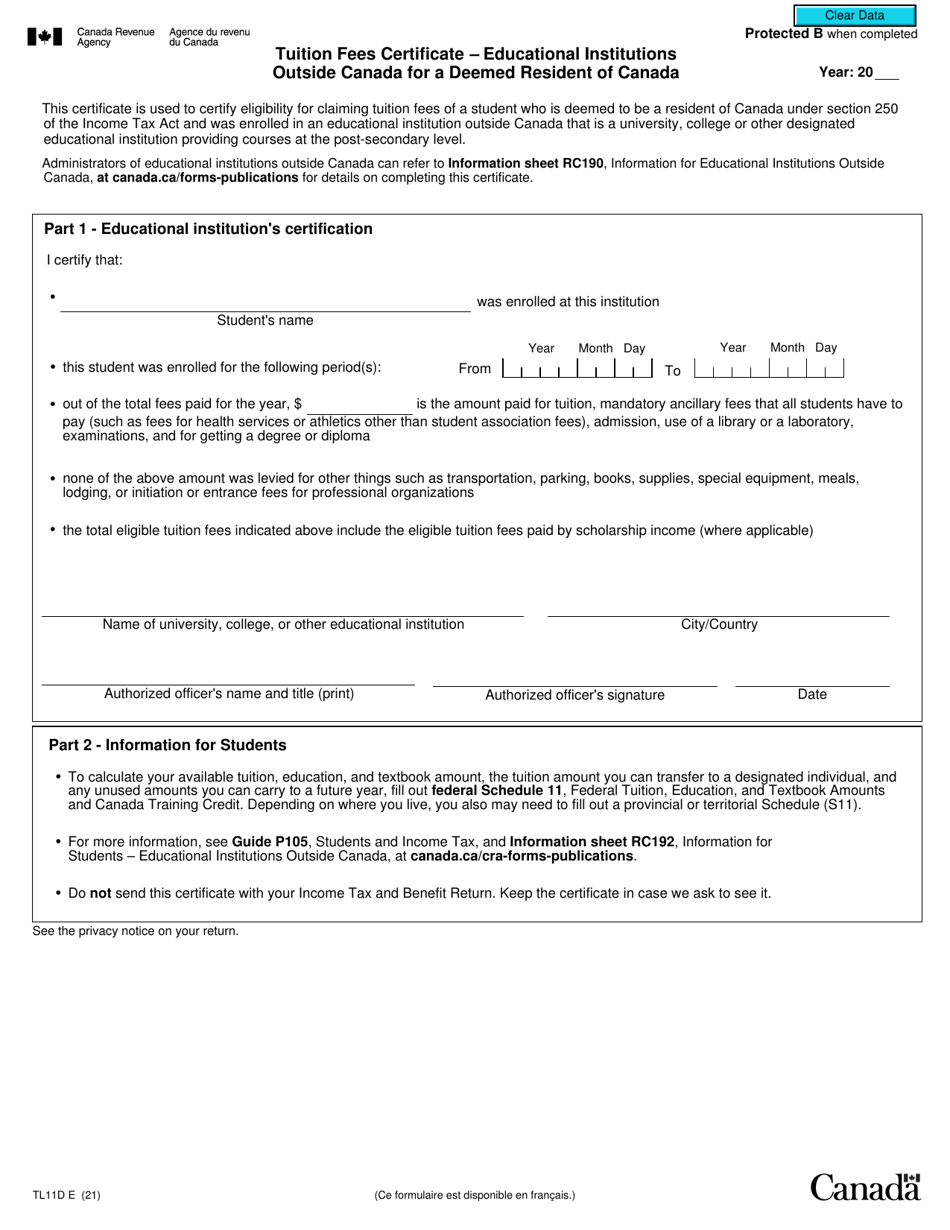

Form TL11D

for the current year.

Form TL11D Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada - Canada

Form TL11D Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada is used to claim a tax credit for tuition fees paid to educational institutions outside of Canada. It is for Canadian residents who attended eligible educational institutions abroad.

The individual who is deemed a resident of Canada is responsible for filing the Form TL11D tuition fees certificate for educational institutions outside Canada.

FAQ

Q: What is form TL11D?

A: Form TL11D is a Tuition Fees Certificate for educational institutions outside Canada.

Q: Who can use form TL11D?

A: Form TL11D is specifically for deemed residents of Canada who have paid tuition fees to educational institutions outside Canada.

Q: What is the purpose of form TL11D?

A: The purpose of form TL11D is to claim the tuition fees paid to educational institutions outside Canada for the purpose of calculating certain tax credits and deductions in Canada.

Q: Do I need to submit form TL11D with my tax return?

A: Yes, you must attach form TL11D to your Canadian tax return when claiming the tuition fees paid to educational institutions outside Canada.

Q: What information is required on form TL11D?

A: Form TL11D requires you to provide details of the educational institution, the amounts paid for tuition fees, and your personal information as a deemed resident of Canada.