This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7204-1

for the current year.

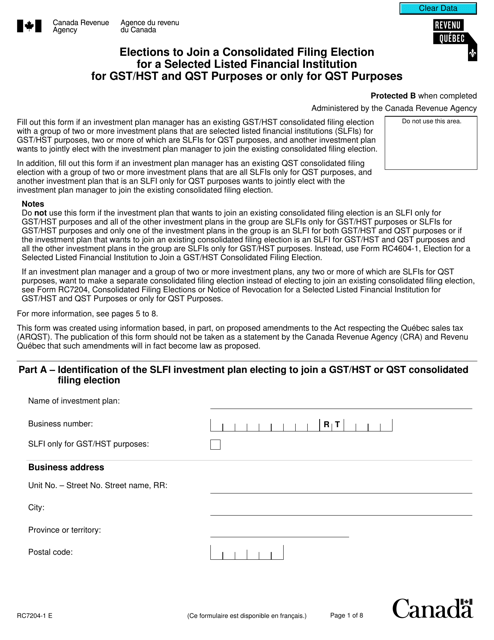

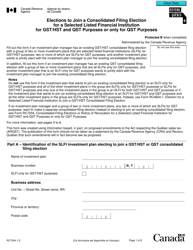

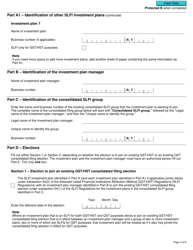

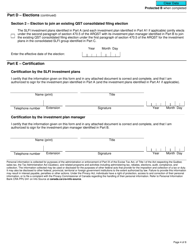

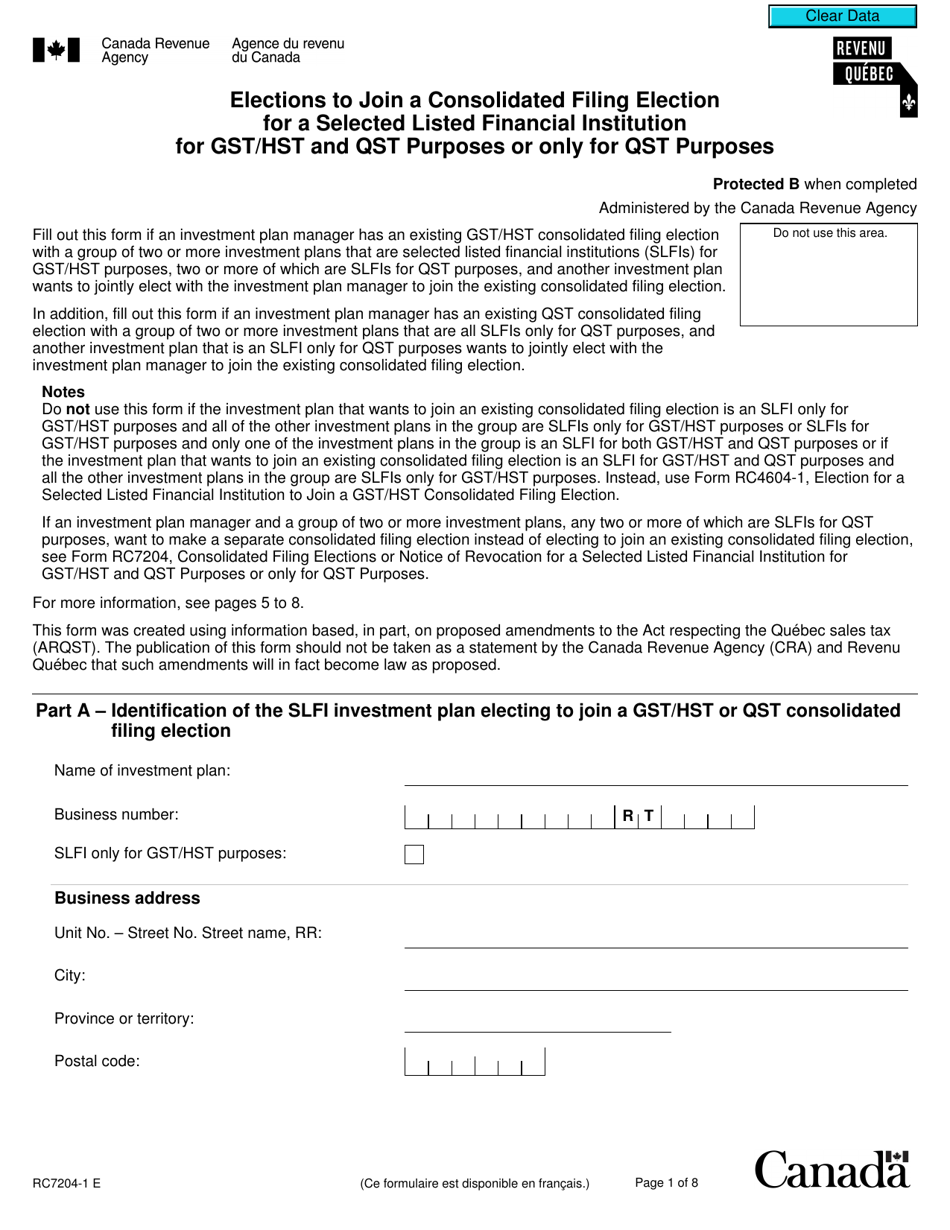

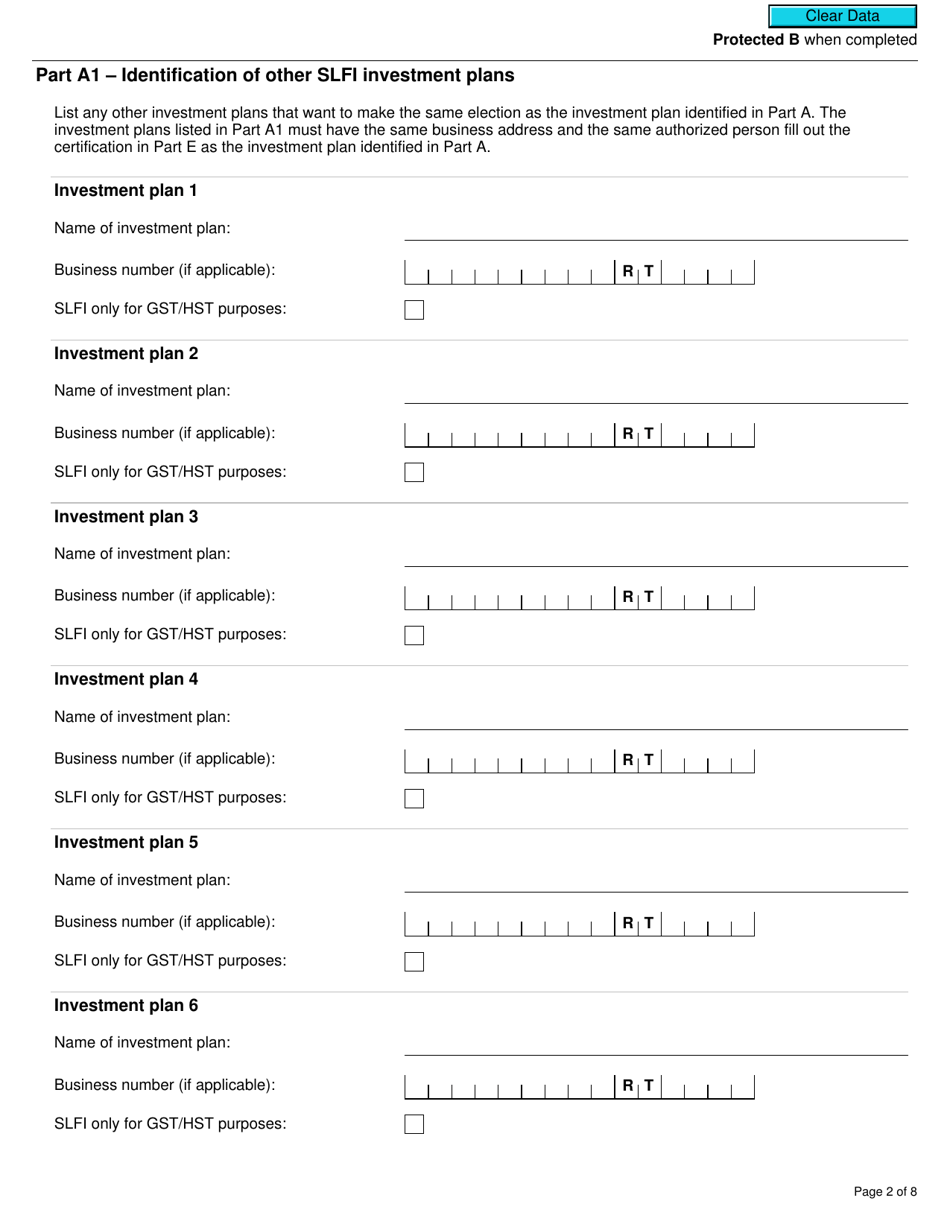

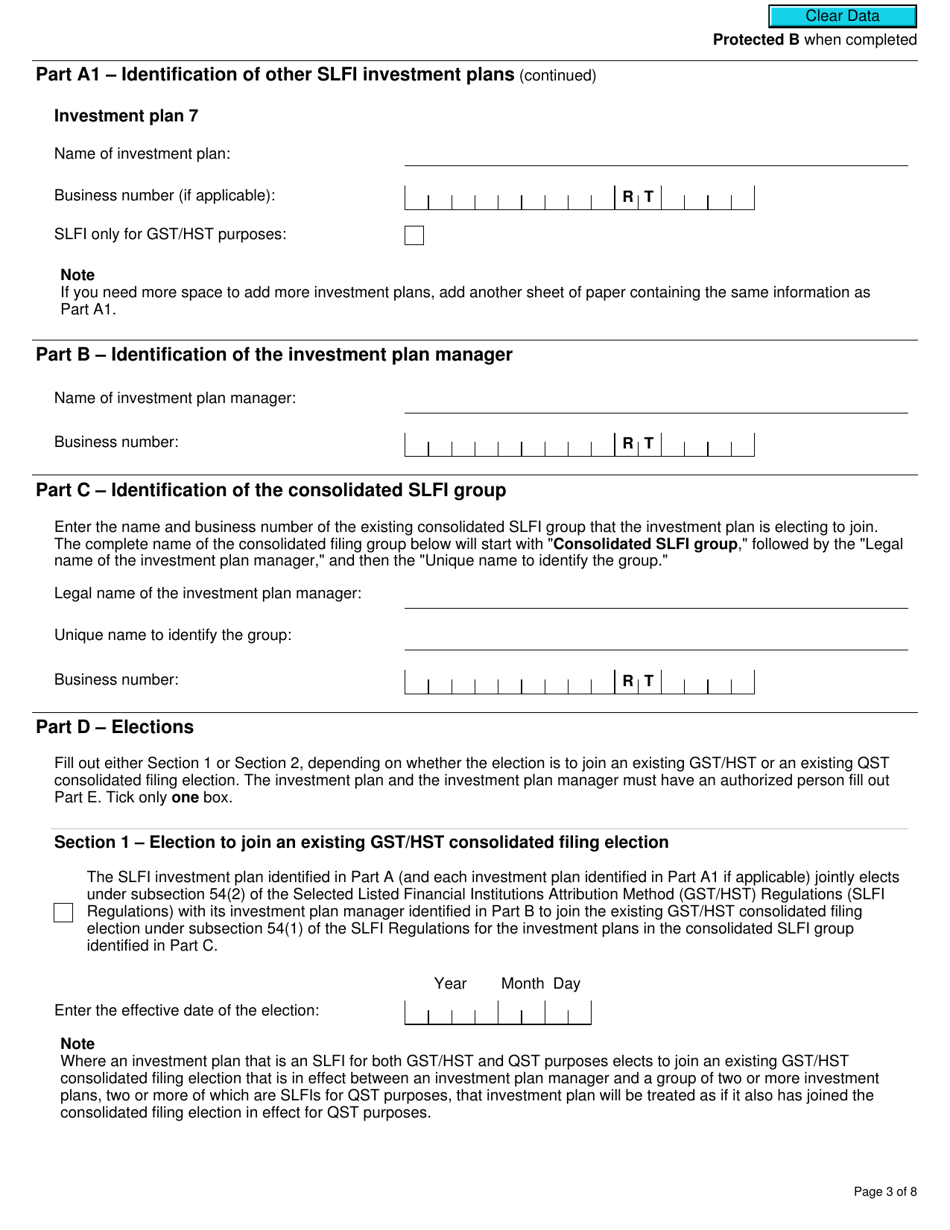

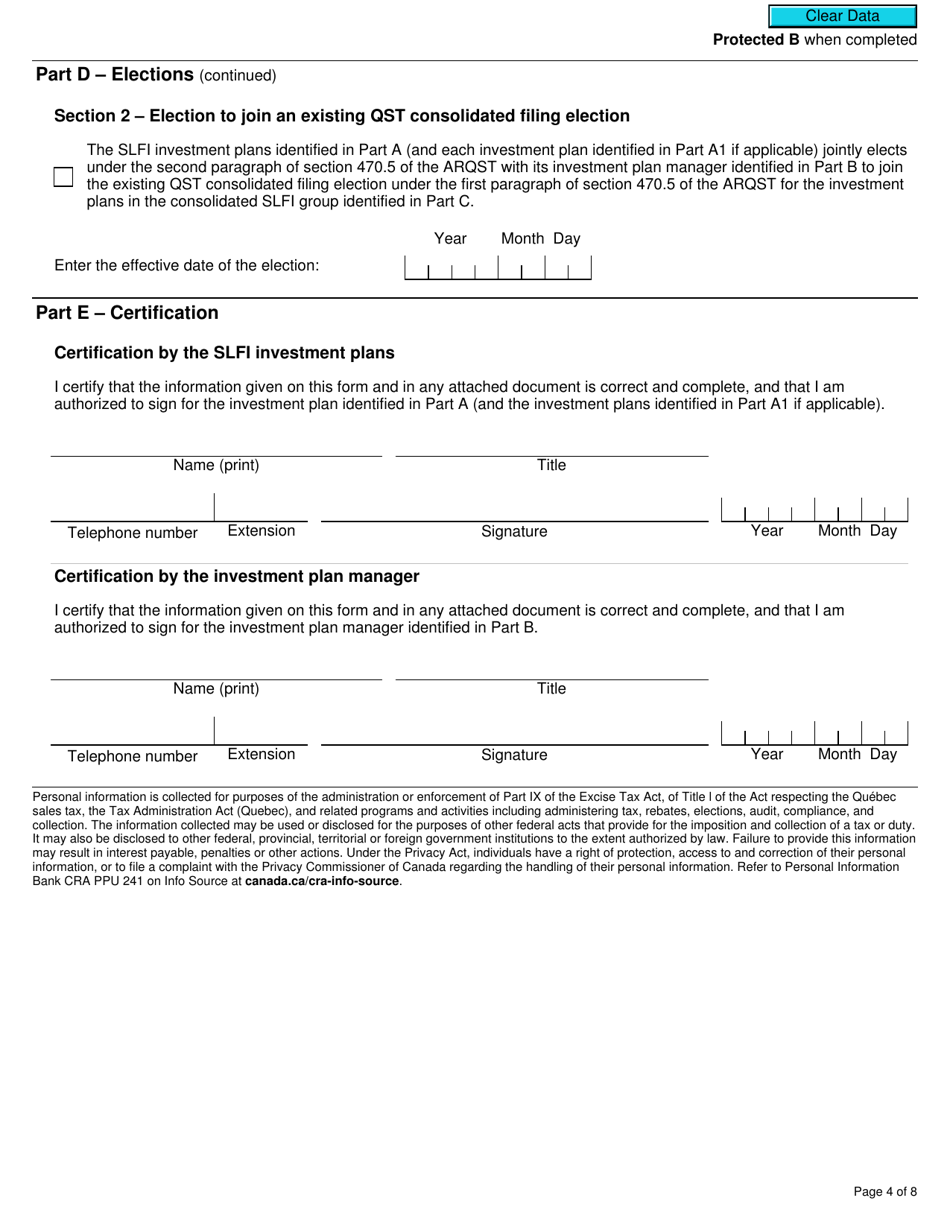

Form RC7204-1 Elections to Join a Consolidated Filing Election for a Selected Listed Financial Institution for Gst / Hst and Qst Purposes or Only for Qst Purposes - Canada

Form RC7204-1, Elections to Join a Consolidated Filing Election for a Selected Listed Financial Institution for GST/HST and QST Purposes or Only for QST Purposes, is a document used in Canada for the purpose of electing to join a consolidated filing election for certain financial institutions. This election allows qualifying financial institutions to file a single GST/HST or QST return on behalf of multiple entities within their organization, instead of each entity filing separate returns. This form is specifically used by financial institutions that are listed and meet certain criteria outlined by the Canadian tax authorities.

The Form RC7204-1 Elections to Join a Consolidated Filing Election for a Selected Listed Financial Institution for GST/HST and QST purposes or only for QST purposes in Canada is filed by selected listed financial institutions who wish to join a consolidated filing election for GST/HST and QST purposes or solely for QST purposes.

FAQ

Q: What is form RC7204-1?

A: Form RC7204-1 is a document used in Canada for elections to join a consolidated filing election for a selected listed financial institution for GST/HST and QST purposes or only for QST purposes.

Q: Who uses form RC7204-1?

A: Form RC7204-1 is used by businesses in Canada that want to make an election to join a consolidated filing election for GST/HST and QST purposes, or only for QST purposes, as a selected listed financial institution.

Q: What is a consolidated filing election?

A: A consolidated filing election allows selected listed financial institutions in Canada to file a single GST/HST and QST return on behalf of the participating financial institution group.

Q: What are GST, HST, and QST?

A: GST (Goods and Services Tax) and HST (Harmonized Sales Tax) are consumption taxes charged in most provinces and territories in Canada. QST (Quebec Sales Tax) is a provincial tax imposed on taxable supplies of goods and services in the province of Quebec.

Q: How does the election for consolidated filing work?

A: By making an election for consolidated filing, a selected listed financial institution in Canada can file a single GST/HST and QST return on behalf of the financial institution group. This simplifies the filing process by consolidating the reporting and remittance of taxes for multiple entities within the group.

Q: Is joining a consolidated filing election mandatory?

A: Joining a consolidated filing election is not mandatory for all businesses in Canada. It is an option available to selected listed financial institutions that meet the eligibility criteria and want to streamline their tax filing process.