This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243

for the current year.

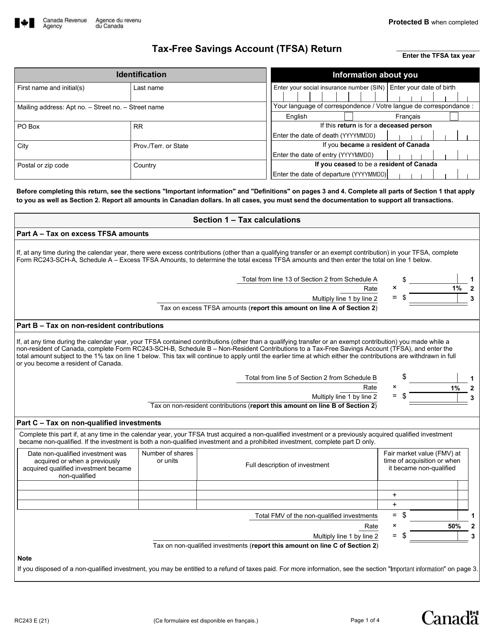

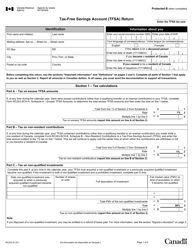

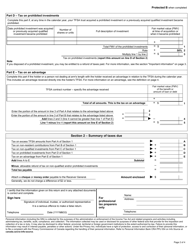

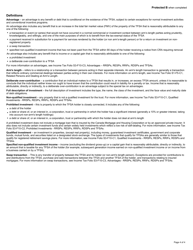

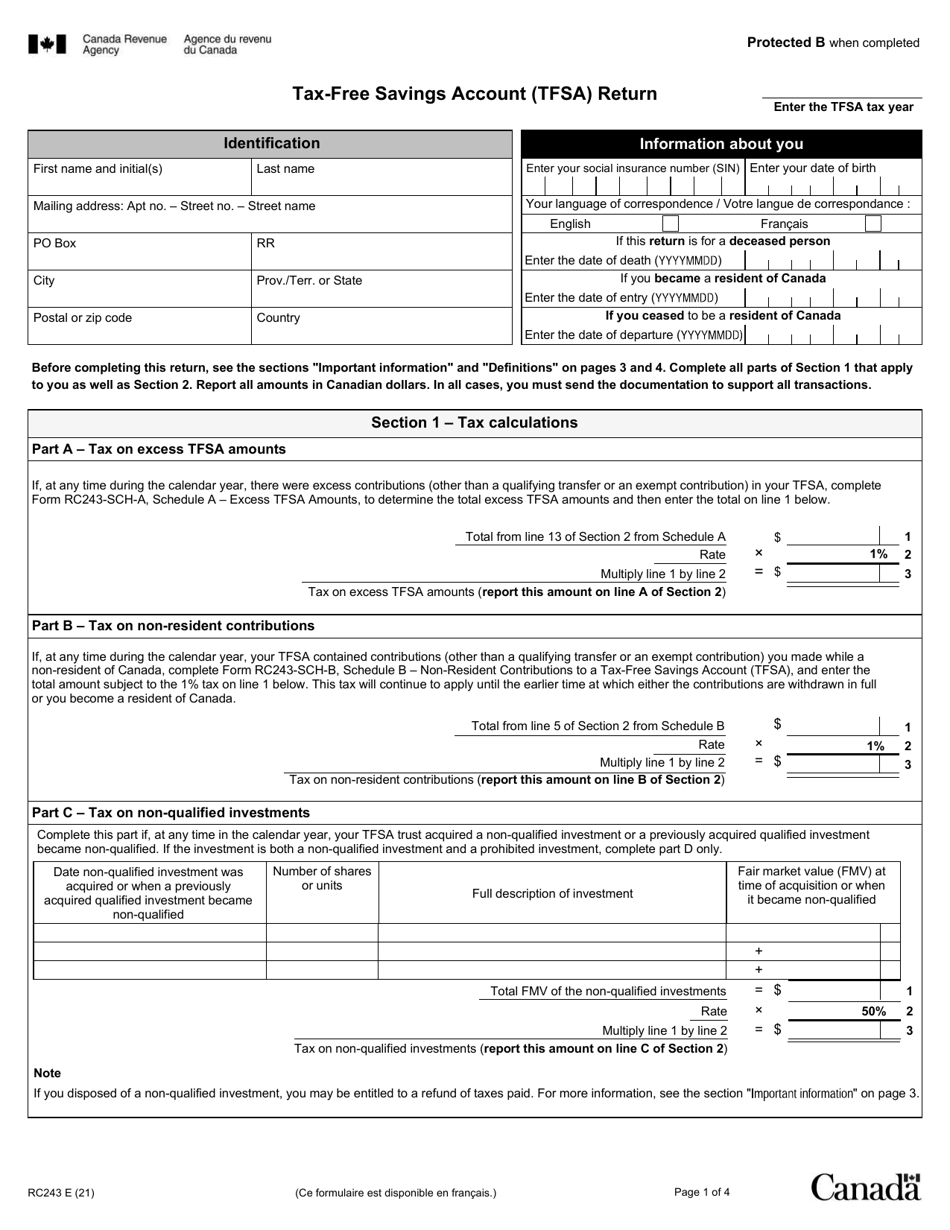

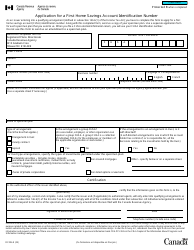

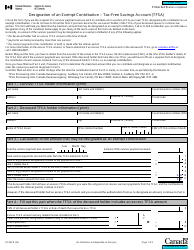

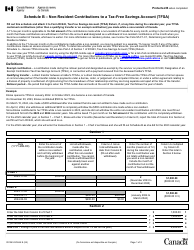

Form RC243 Tax-Free Savings Account (Tfsa) Return - Canada

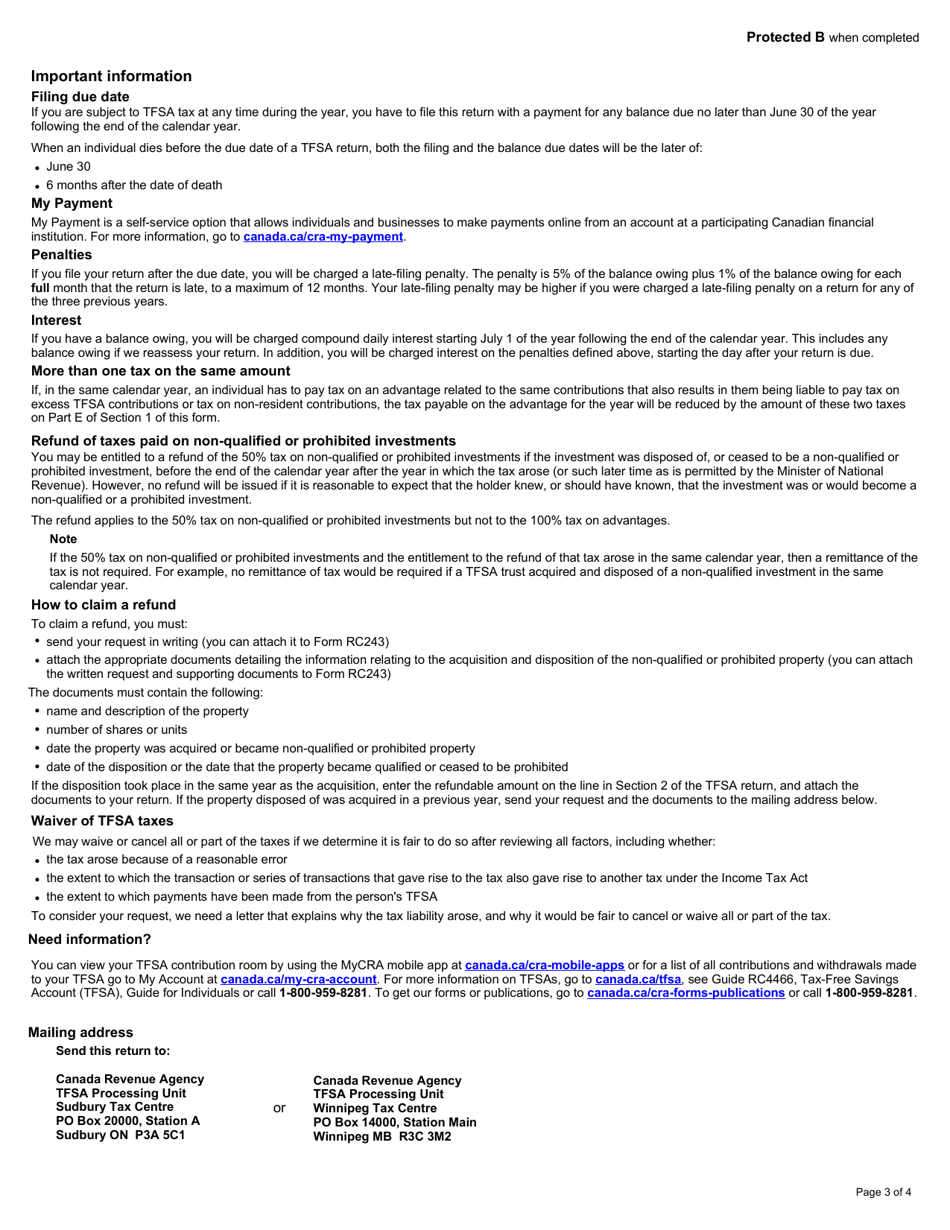

Form RC243 Tax-Free Savings Account (TFSA) Return is used by individuals in Canada to report their contributions and withdrawals made from their Tax-Free Savings Account (TFSA) during a tax year. It helps the Canada Revenue Agency (CRA) track and ensure that individuals are adhering to the TFSA contribution limits and rules.

Individual taxpayers who have a Tax-Free Savings Account (TFSA) in Canada need to file the Form RC243 TFSA Return.

FAQ

Q: What is Form RC243?

A: Form RC243 is the Tax-Free Savings Account (TFSA) Return form in Canada.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a type of savings account in Canada that allows individuals to save and invest money without having to pay taxes on the income earned or withdrawals made.

Q: Who needs to file Form RC243?

A: Individuals who have a Tax-Free Savings Account (TFSA) in Canada need to file Form RC243 to report their TFSA balances and transactions.

Q: What information is required on Form RC243?

A: Form RC243 requires individuals to provide their personal information, TFSA contribution room, TFSA carryforward amounts, TFSA transactions, and other relevant details.

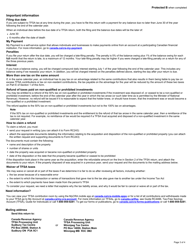

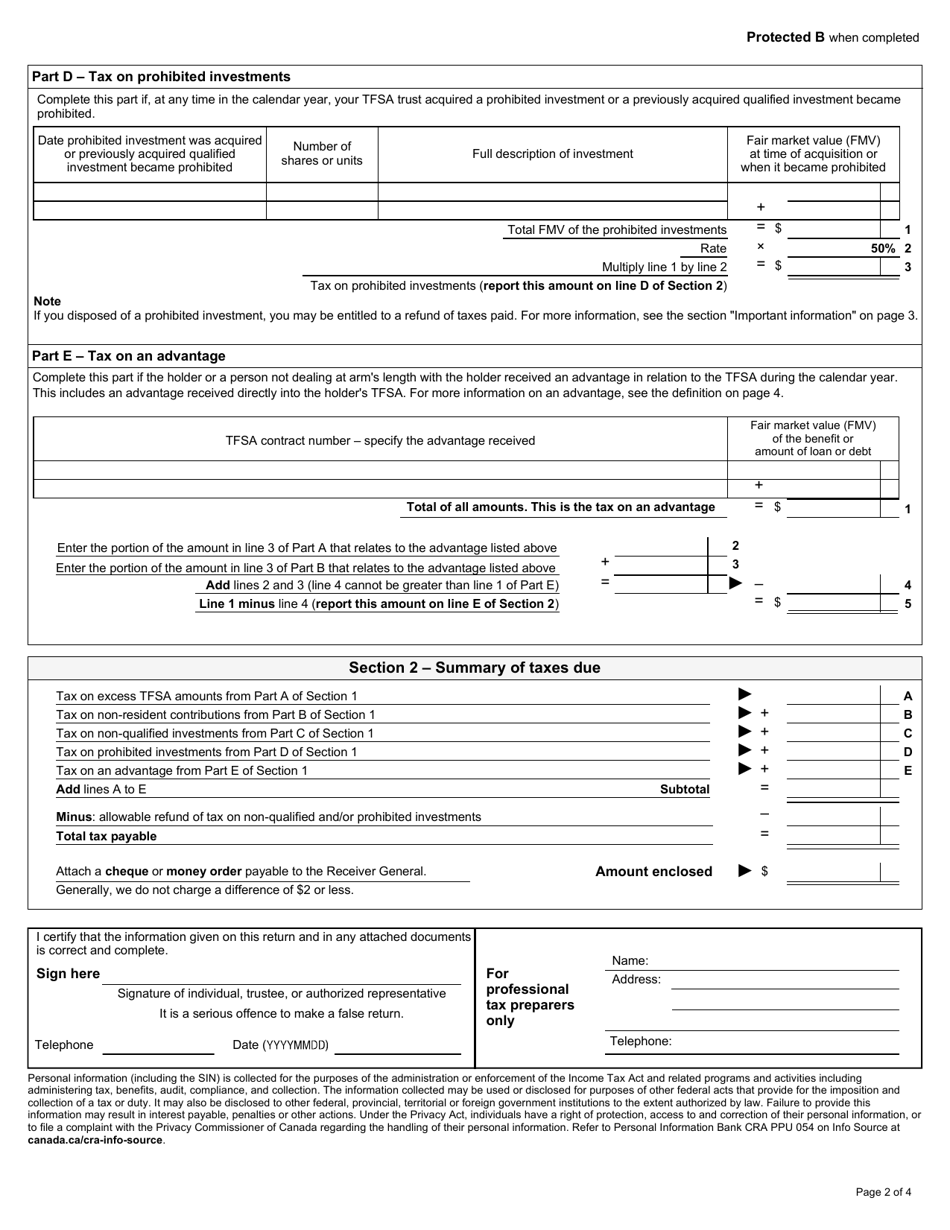

Q: When is the deadline for filing Form RC243?

A: The deadline for filing Form RC243 is usually on or before June 30 of the following year.

Q: Are there any penalties for not filing Form RC243?

A: Yes, there are penalties for not filing Form RC243 or for filing it late. It is important to file the form by the deadline to avoid penalties.

Q: Do I need to include supporting documents with Form RC243?

A: It is generally not required to include supporting documents with Form RC243. However, it is important to keep the necessary records and documents in case the CRA requests for them.

Q: Can I make changes to Form RC243 after filing?

A: If you need to make changes to Form RC243 after filing, you must file an amended return using Form RC243-A. It is recommended to contact the CRA for guidance on filing an amended return.