This version of the form is not currently in use and is provided for reference only. Download this version of

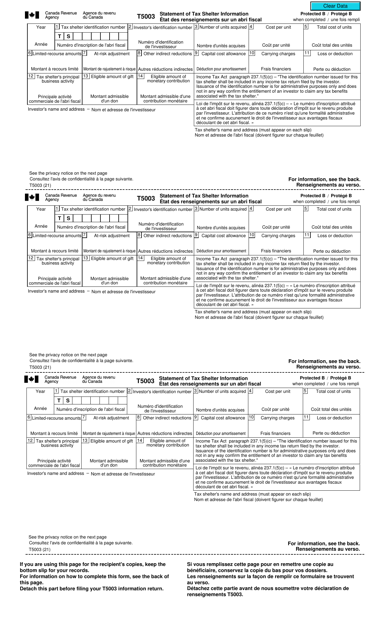

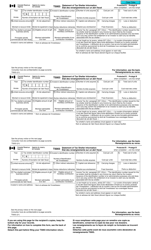

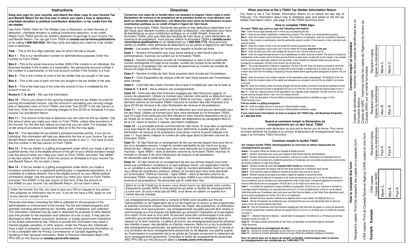

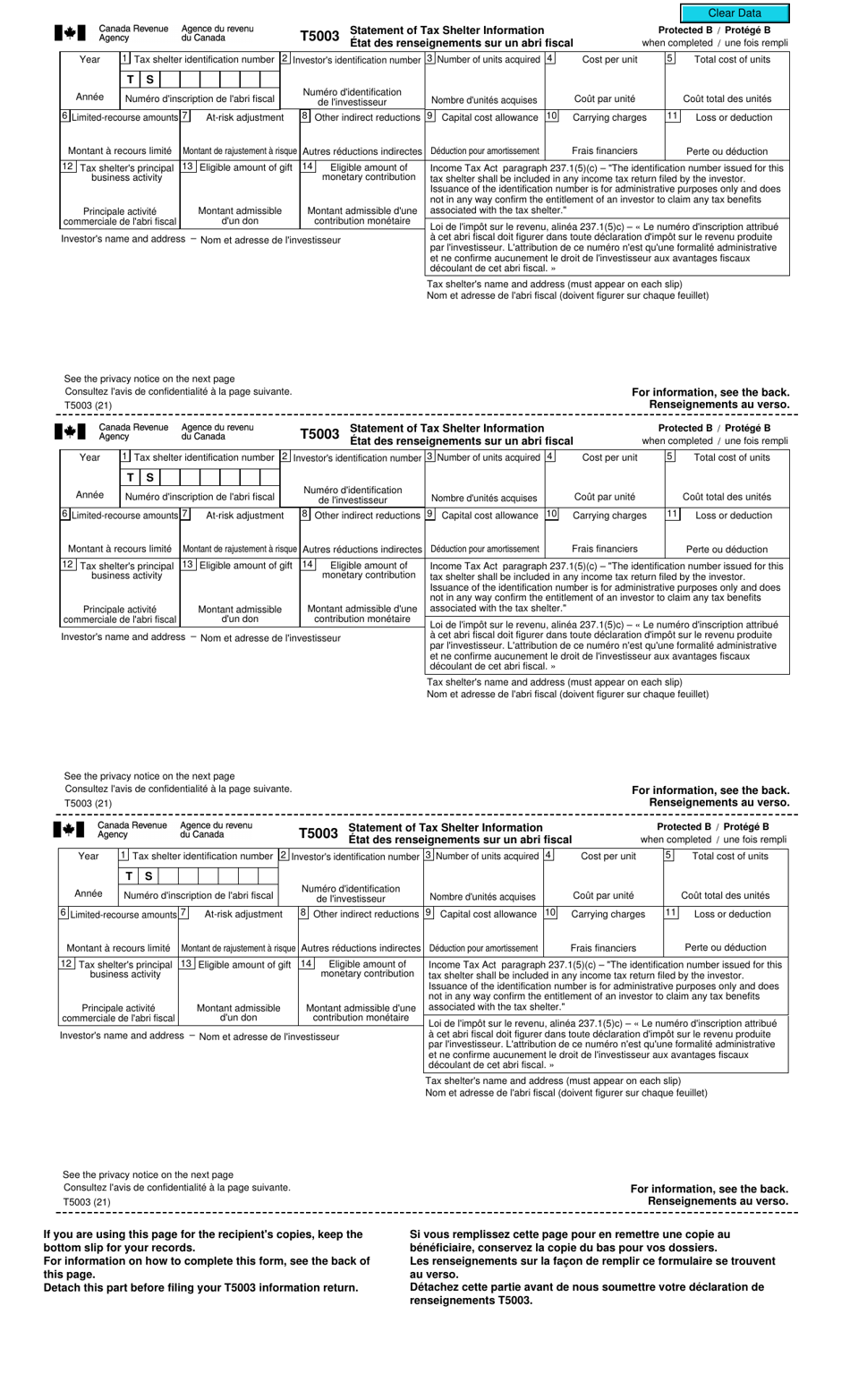

Form T5003

for the current year.

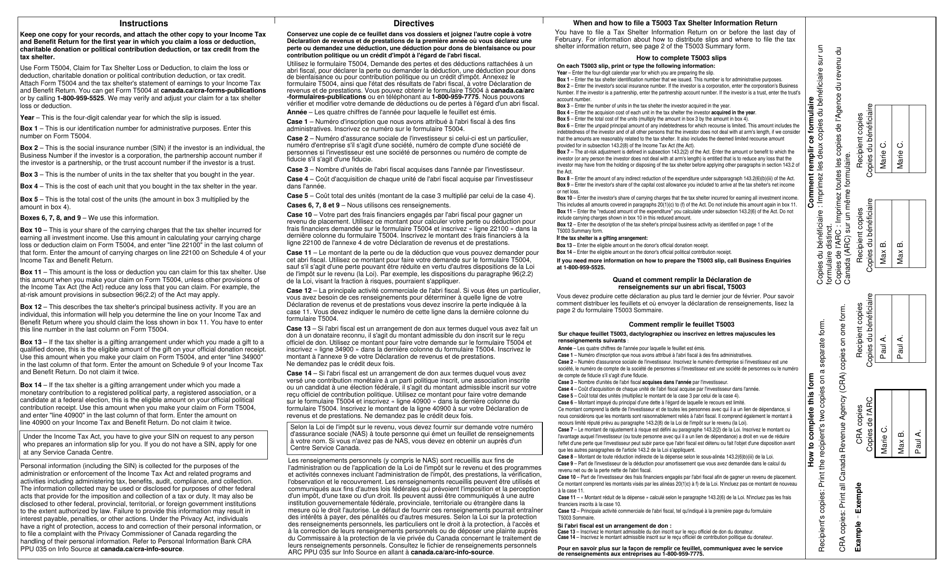

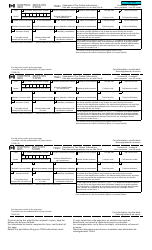

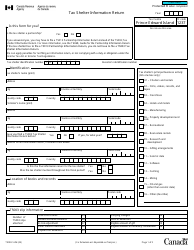

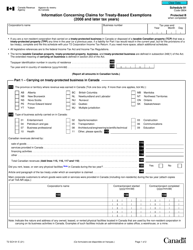

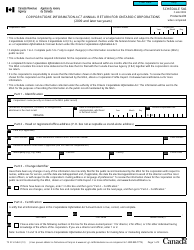

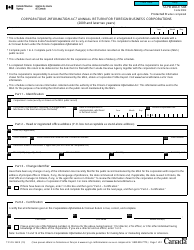

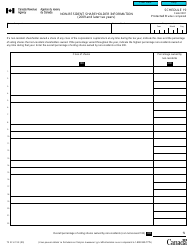

Form T5003 Statement of Tax Shelter Information - Canada (English / French)

Form T5003 Statement of Tax Shelter Information is used in Canada to report details of tax shelter arrangements to the Canada Revenue Agency (CRA). It provides information about the tax shelter and the participants involved. This form helps the CRA identify and monitor potentially abusive or non-compliant tax shelters.

The entity promoting the tax shelter files the Form T5003 in Canada.

FAQ

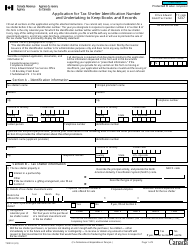

Q: What is Form T5003?

A: Form T5003 is a statement of tax shelter information in Canada.

Q: Who needs to file Form T5003?

A: Individuals or entities who have participated in a tax shelter in Canada need to file Form T5003.

Q: What is the purpose of Form T5003?

A: The purpose of Form T5003 is to report information about tax shelter investments to the Canada Revenue Agency (CRA).

Q: What information is required on Form T5003?

A: Form T5003 requires information about the tax shelter promoter, the tax shelter identification number, and details about the tax shelter investment.

Q: When is Form T5003 due?

A: Form T5003 is due on or before the prescribed filing deadline, which is generally within 90 days after the end of the tax year in which the individual or entity participated in the tax shelter.

Q: What happens if I don't file Form T5003?

A: Failure to file Form T5003 can result in penalties imposed by the Canada Revenue Agency (CRA). It is important to comply with the filing requirements.

Q: Is Form T5003 only available in English and French?

A: Yes, Form T5003 is available in both English and French as it is used in Canada, which is a bilingual country.