This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2033

for the current year.

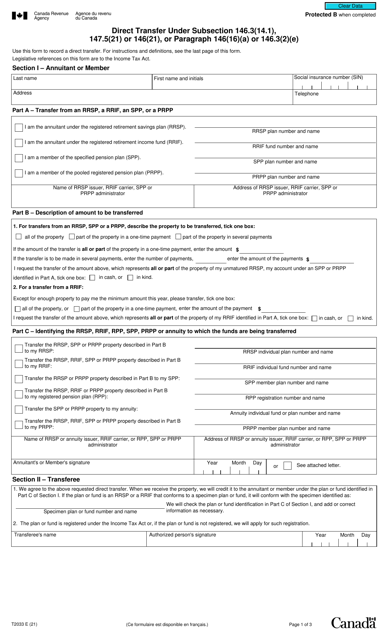

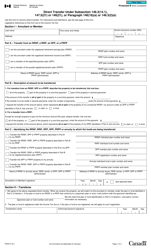

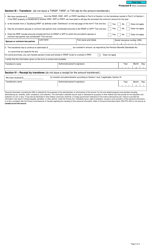

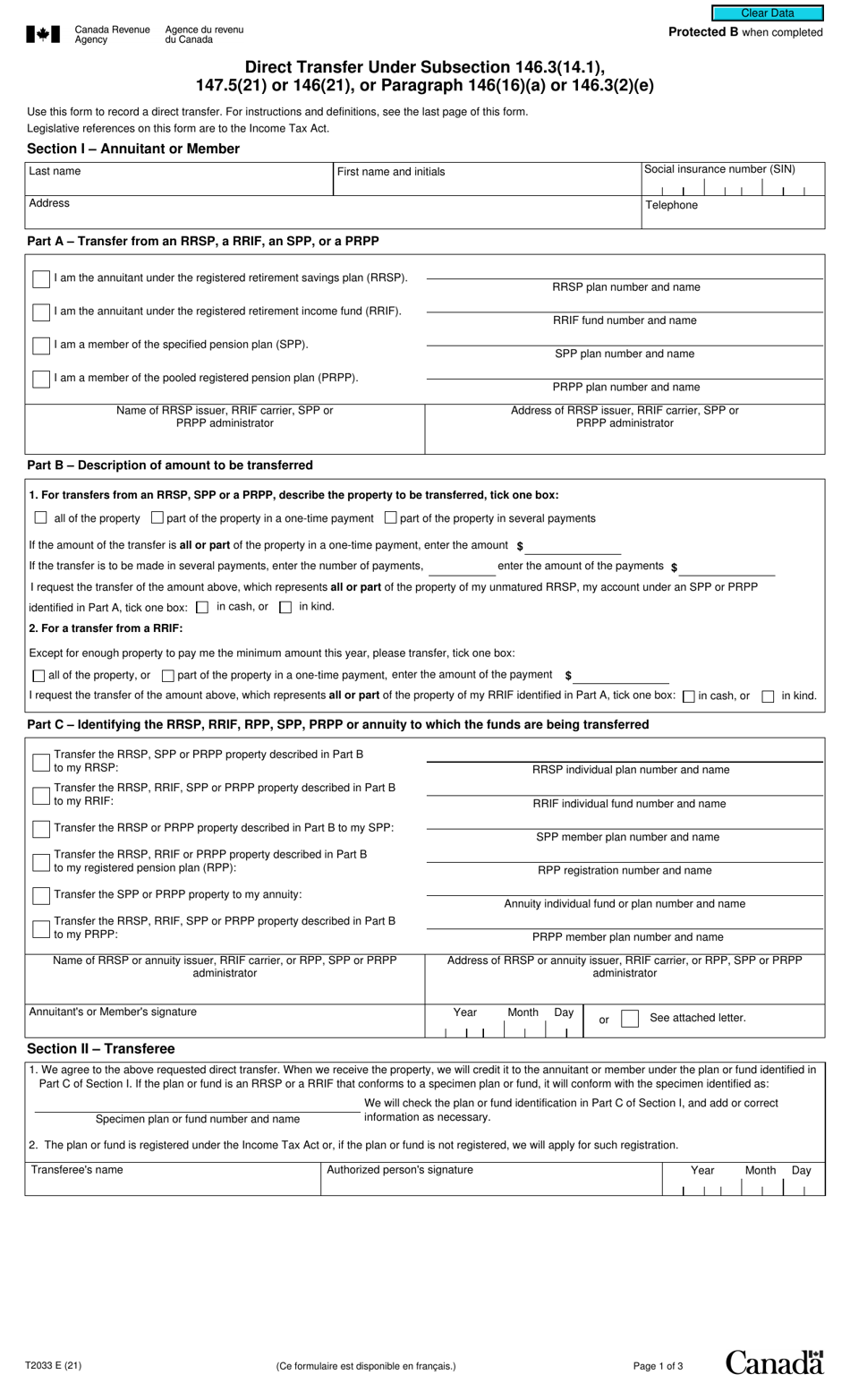

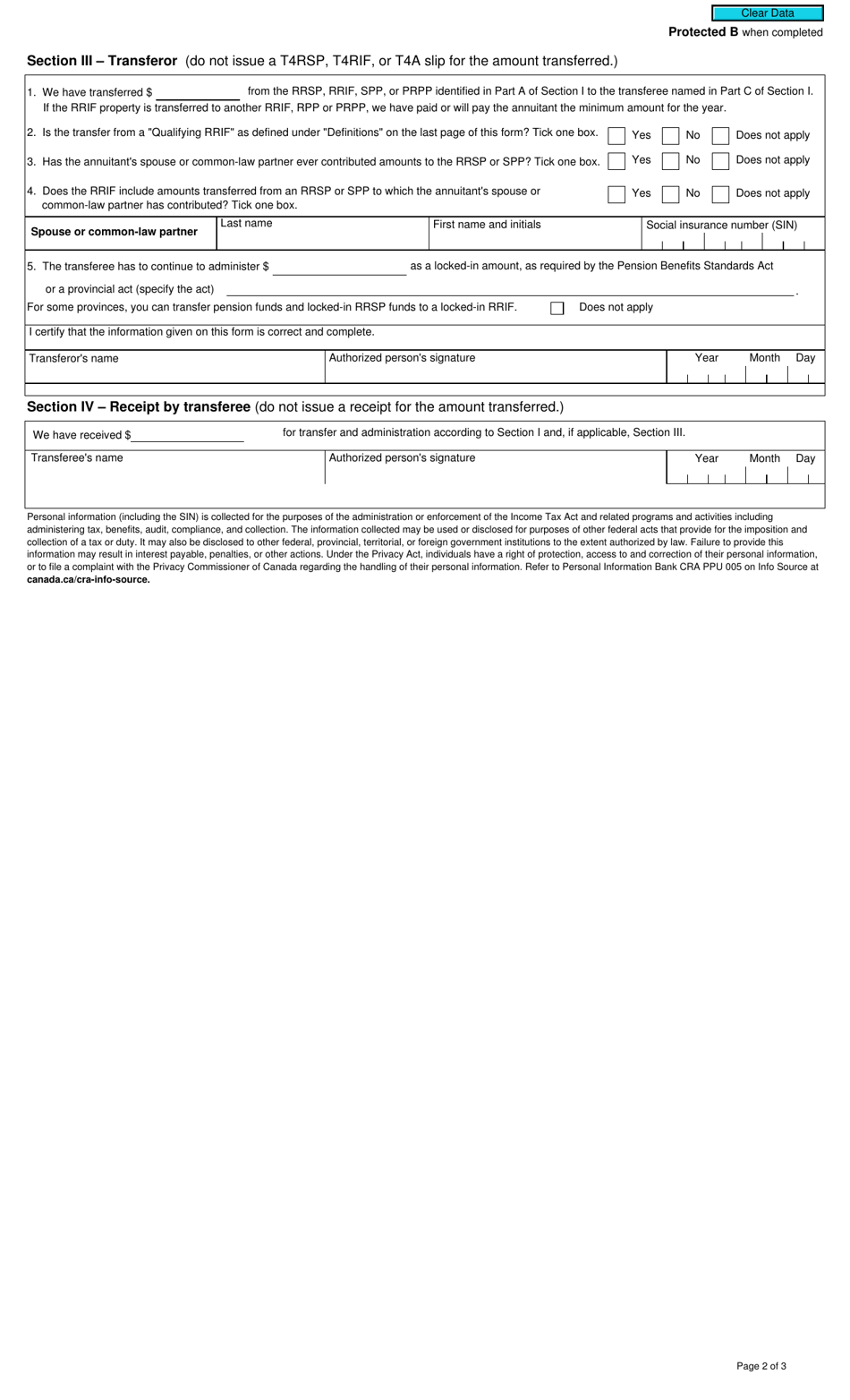

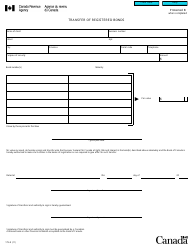

Form T2033 Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) - Canada

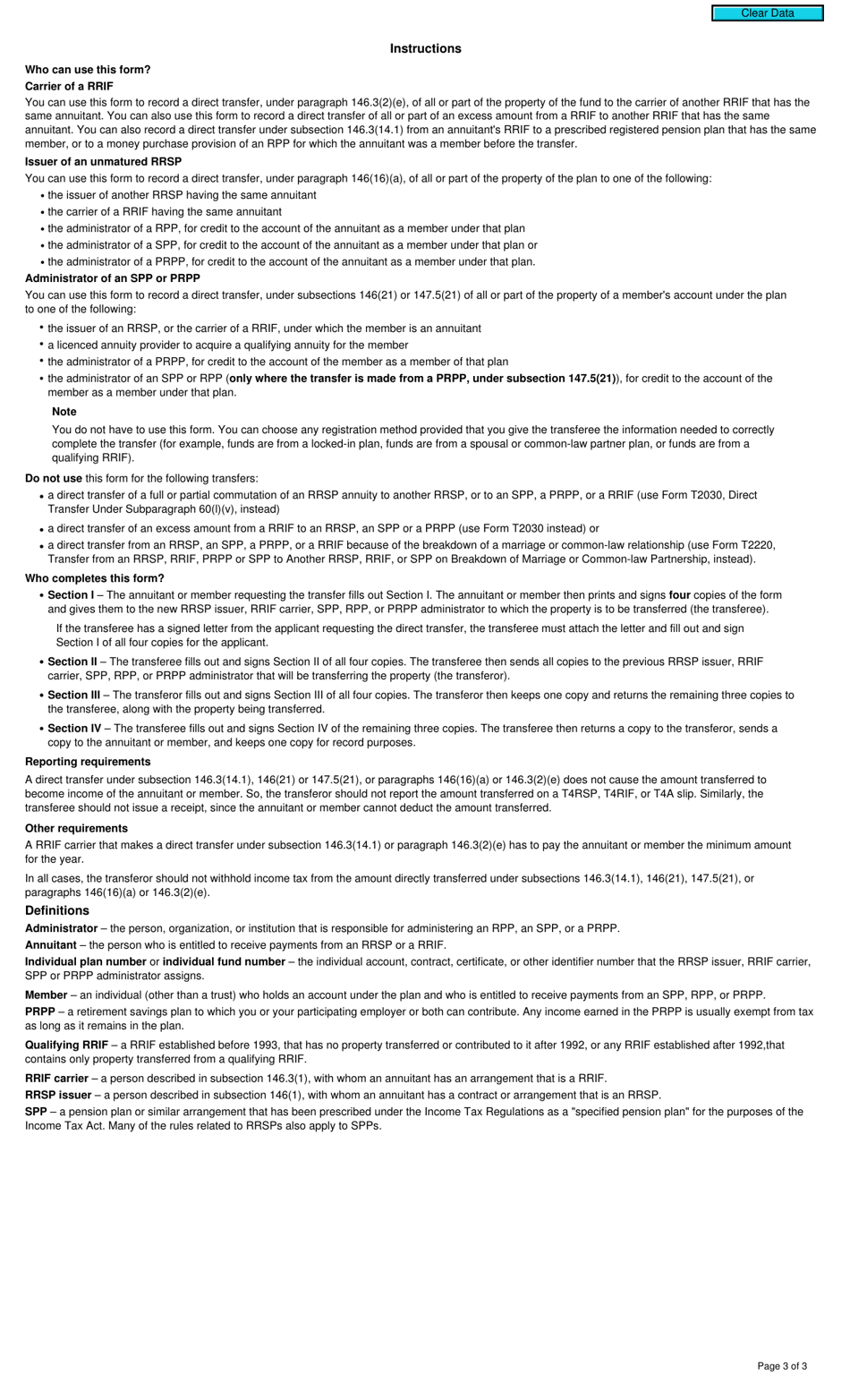

Form T2033, Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E), is used in Canada for transferring certain types of retirement savings between registered plans. This form is typically used when transferring funds from one registered plan to another, such as from a Registered Pension Plan (RPP) to a Registered Retirement Savings Plan (RRSP). It helps ensure the proper transfer and reporting of these funds.

The form T2033 Direct Transfer in Canada is filed by an individual who wants to transfer their registered savings plan or registered retirement savings plan (RRSP) to another financial institution or plan.

FAQ

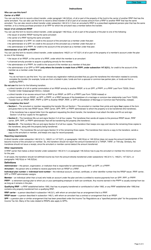

Q: What is Form T2033?

A: Form T2033 is a form used for Direct Transfer under specific sections or paragraphs of the Canadian Income Tax Act.

Q: What is Direct Transfer?

A: Direct Transfer is a tax-free transfer of funds from one registered plan to another.

Q: What are the specific sections and paragraphs applicable for Direct Transfer?

A: The specific sections or paragraphs applicable for Direct Transfer include subsections 146.3(14.1), 147.5(21) or 146(21), and paragraphs 146(16)(A) or 146.3(2)(E).

Q: What is the purpose of Form T2033?

A: The purpose of Form T2033 is to provide the necessary information for the direct transfer of funds between registered plans.

Q: Do I need to fill out Form T2033 for a Direct Transfer?

A: Yes, you need to fill out and submit Form T2033 for a Direct Transfer.