This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4625

for the current year.

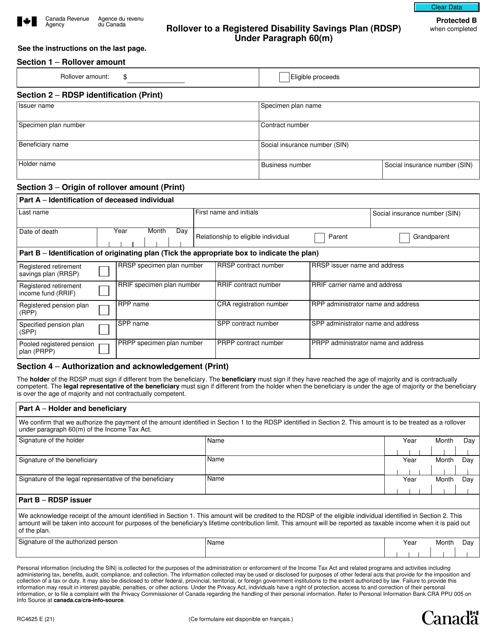

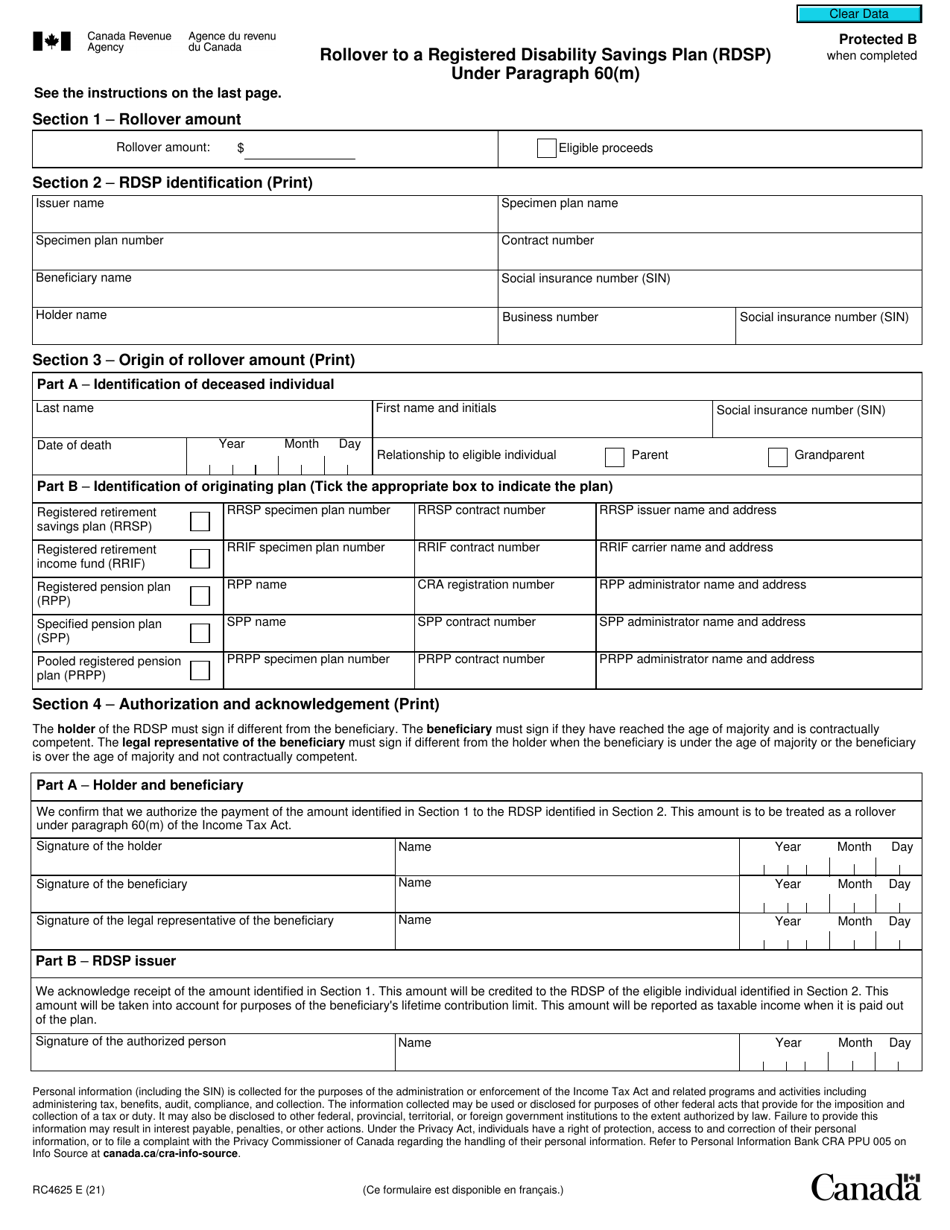

Form RC4625 Rollover to a Registered Disability Savings Plan (Rdsp) Under Paragraph 60(M) - Canada

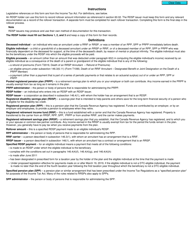

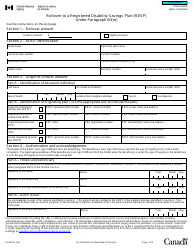

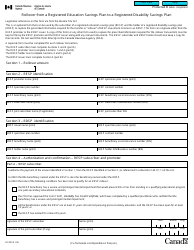

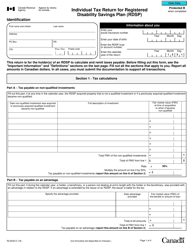

Form RC4625, Rollover to a Registered Disability Savings Plan (RDSP) under paragraph 60(m), is used in Canada to facilitate the transfer of funds from a Registered Retirement Savings Plan (RRSP) or a Registered Retirement Income Fund (RRIF) to an RDSP. This form is specifically designed for individuals who have received a Disability Tax Credit and want to move their funds into an RDSP, which is a tax-sheltered savings plan for individuals with disabilities.

The form RC4625 Rollover to a Registered Disability Savings Plan (RDSP) under paragraph 60(m) is filed by the individual who wants to make a rollover contribution to their RDSP.

FAQ

Q: What is Form RC4625?

A: Form RC4625 is a document used for rolling over funds to a Registered Disability Savings Plan (RDSP) under Paragraph 60(M) in Canada.

Q: What is a Registered Disability Savings Plan (RDSP)?

A: A Registered Disability Savings Plan (RDSP) is a long-term savings plan designed to help individuals with disabilities and their families save for the future.

Q: What is Paragraph 60(M) in Canada?

A: Paragraph 60(M) in Canada refers to a specific provision of the Income Tax Act that allows for the rollover of funds to an RDSP.

Q: Who can use Form RC4625?

A: Form RC4625 can be used by individuals who are eligible for an RDSP and want to roll over funds from another registered plan or certain government programs.

Q: What is the purpose of rolling over funds to an RDSP?

A: Rolling over funds to an RDSP allows individuals with disabilities to save for their long-term financial security and access government grants and bonds.

Q: Are there any eligibility requirements for an RDSP?

A: Yes, there are eligibility requirements for an RDSP, including being a Canadian resident, being eligible for the Disability Tax Credit, and having a valid Social Insurance Number (SIN).

Q: What other documents may be required along with Form RC4625?

A: Along with Form RC4625, other documents such as proof of disability eligibility and identification may be required.

Q: Is there a deadline for filing Form RC4625?

A: There is no specific deadline for filing Form RC4625, but it is recommended to submit the form as soon as possible to initiate the rollover process.