This version of the form is not currently in use and is provided for reference only. Download this version of

Form T183 TRUST

for the current year.

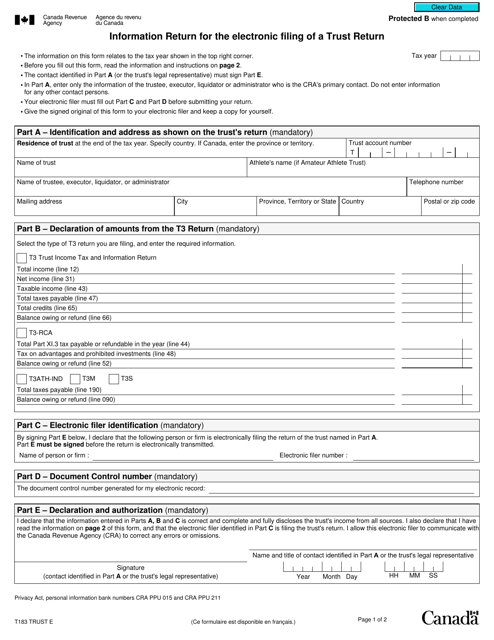

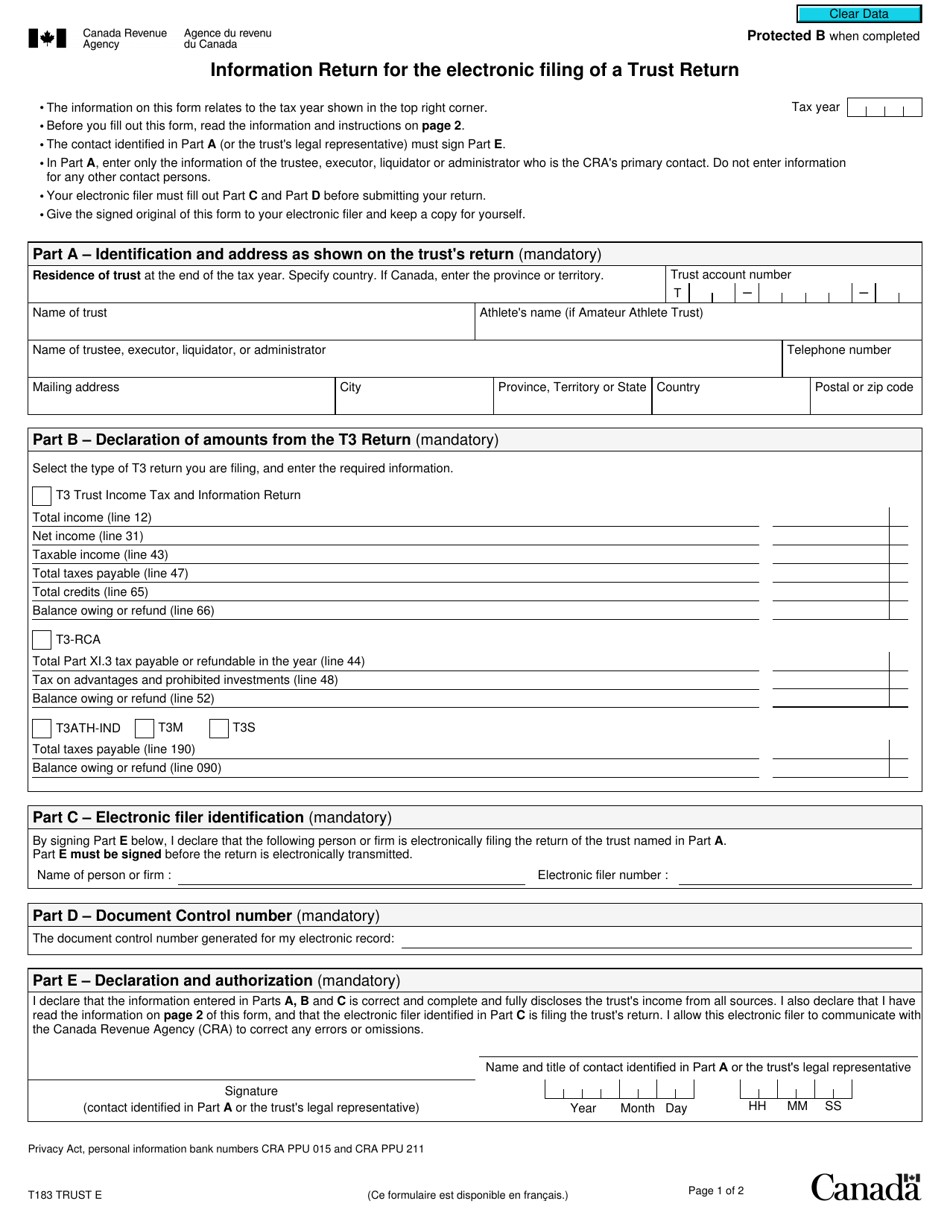

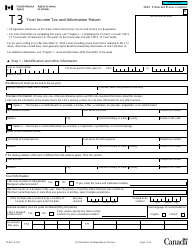

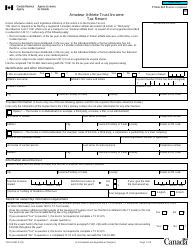

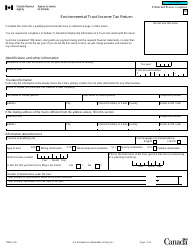

Form T183 TRUST Information Return for the Electronic Filing of a Trust Return - Canada

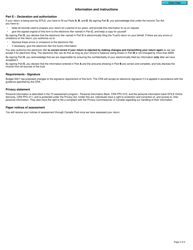

Form T183 TRUST Information Return for the Electronic Filing of a Trust Return in Canada is used to provide information about a trust when filing its tax return electronically. It includes details such as the trust's identification information, income, deductions, and credits.

The trustee or authorized representative files the Form T183 TRUST Information Return for the electronic filing of a Trust Return in Canada.

FAQ

Q: What is Form T183?

A: Form T183 is the Trust Information Return for the electronic filing of a trust return in Canada.

Q: Who needs to file Form T183?

A: Trusts in Canada that are required to file a trust return electronically need to fill out Form T183.

Q: What is the purpose of Form T183?

A: The purpose of Form T183 is to provide the necessary information for filing a trust return electronically.

Q: Is Form T183 mandatory for all trusts?

A: No, only trusts that are required to file a trust return electronically need to fill out Form T183.

Q: What information is required on Form T183?

A: Form T183 requires information such as the trust's identification details, income details, and other relevant details for filing a trust return.

Q: What happens after I submit Form T183?

A: After submitting Form T183, the CRA will process the trust return and notify you of any taxes owed or refunds due.

Q: Is it possible to make changes to a filed Form T183?

A: Yes, you can make changes to a filed Form T183 by submitting an amended Form T183 to the CRA.