This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7204-2

for the current year.

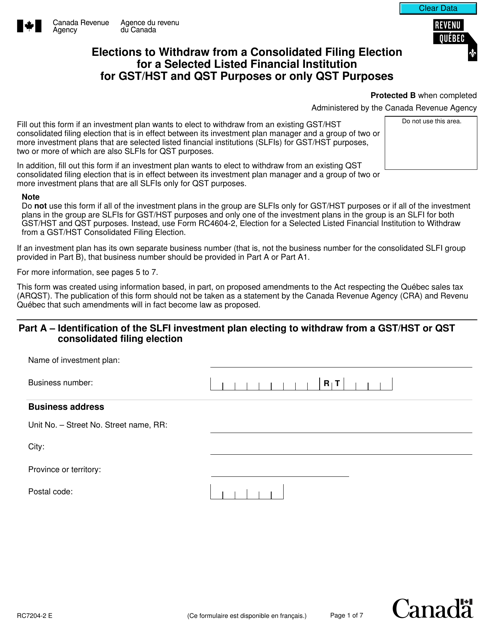

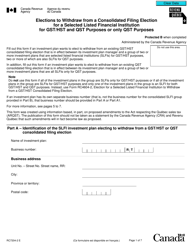

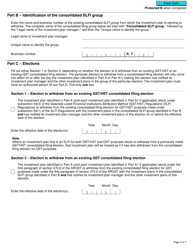

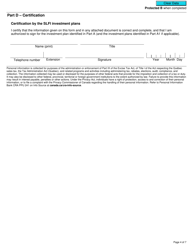

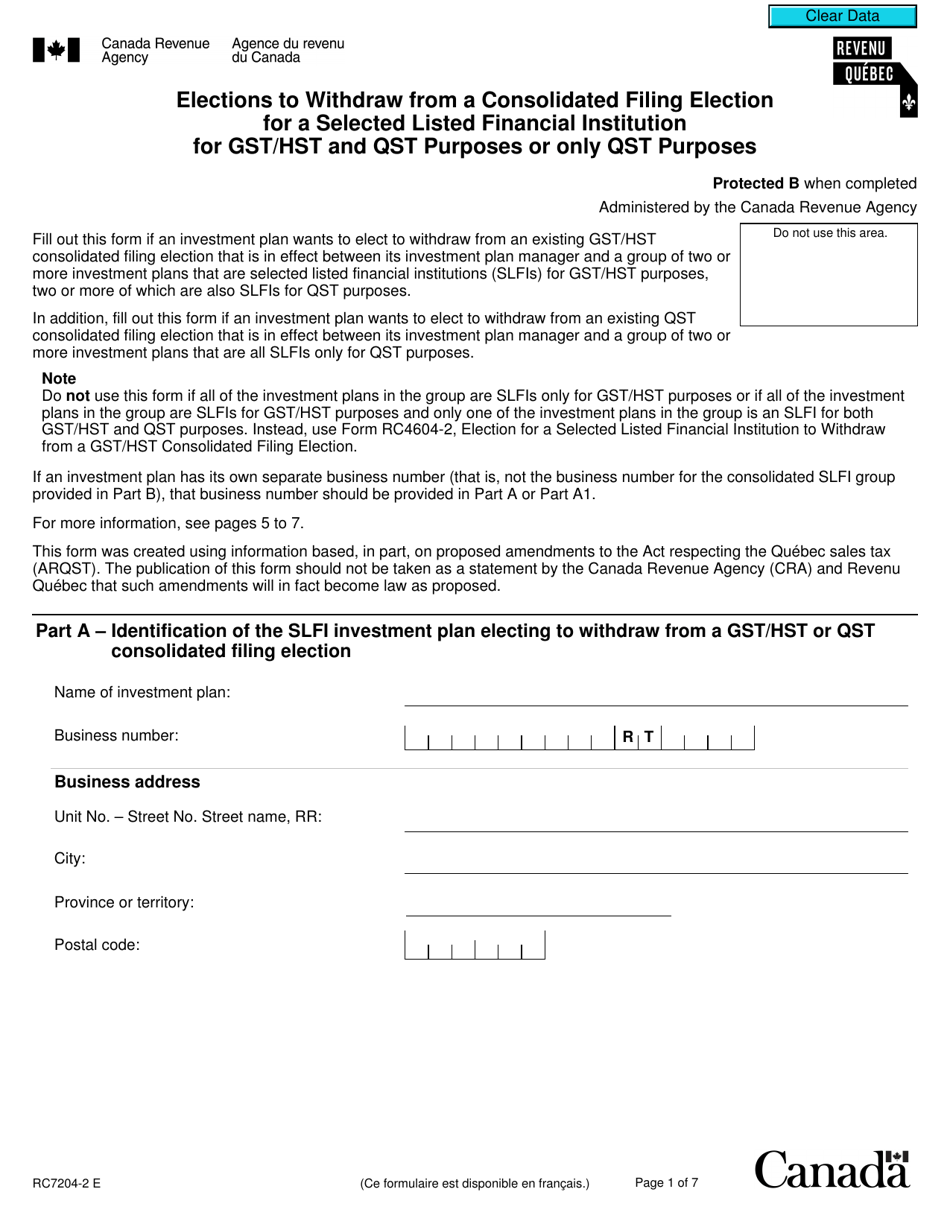

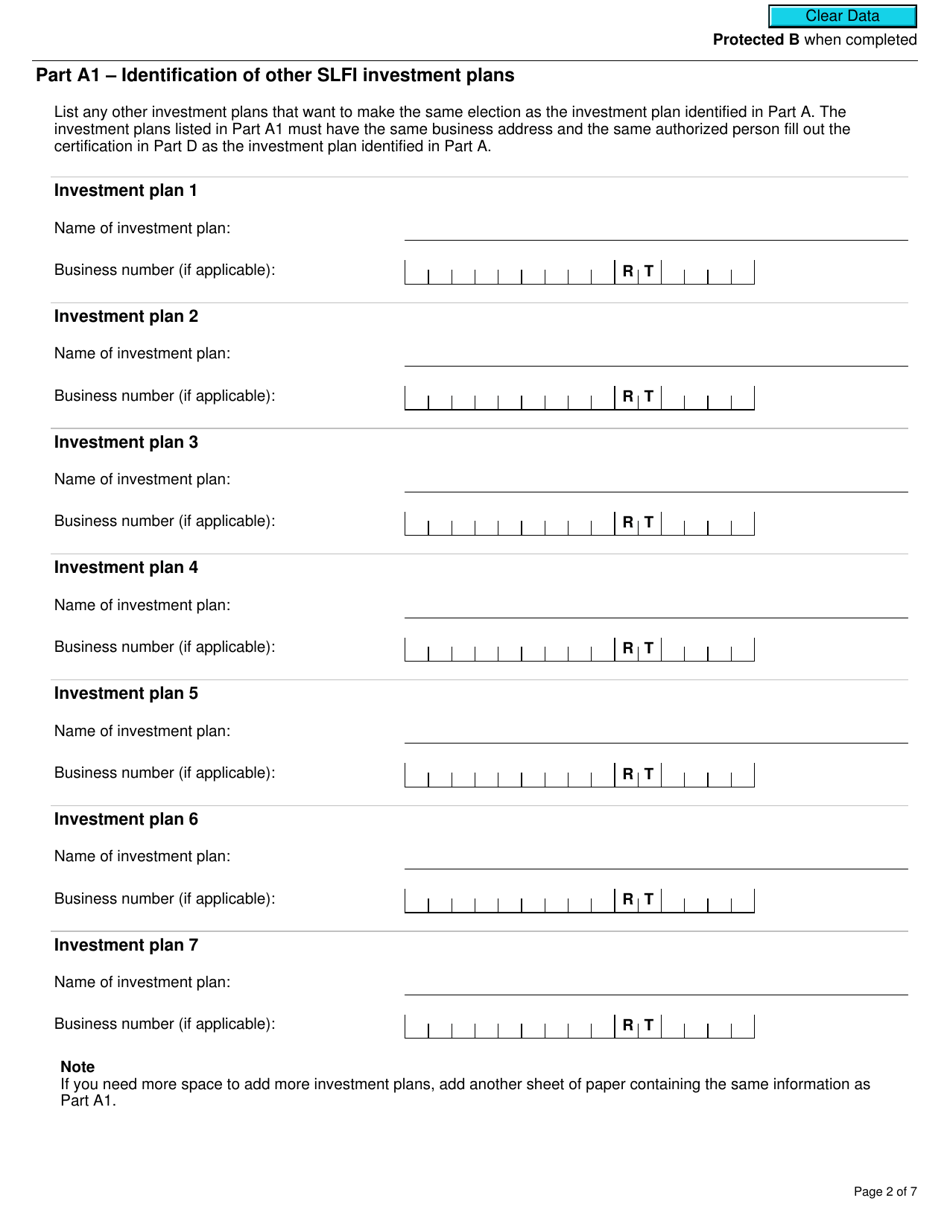

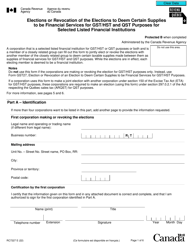

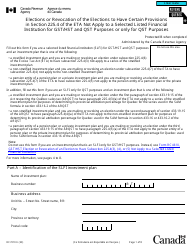

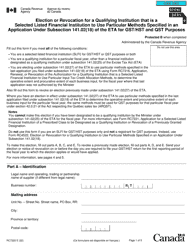

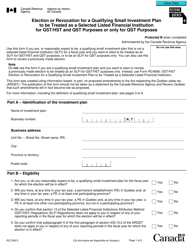

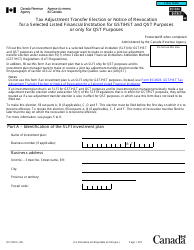

Form RC7204-2 Elections to Withdraw From a Consolidated Filing Election for a Selected Listed Financial Institution for Gst / Hst and Qst Purposes or Only Qst Purposes - Canada

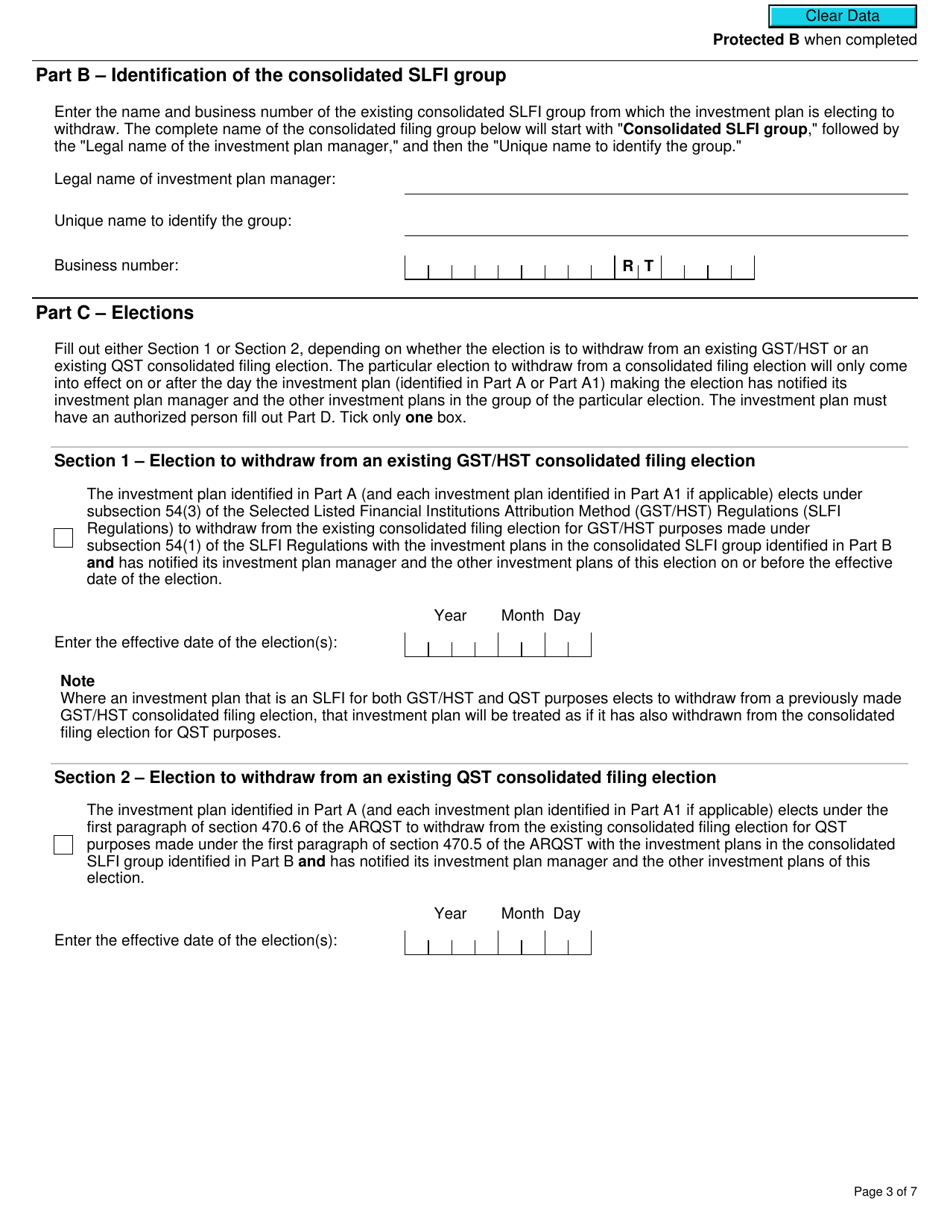

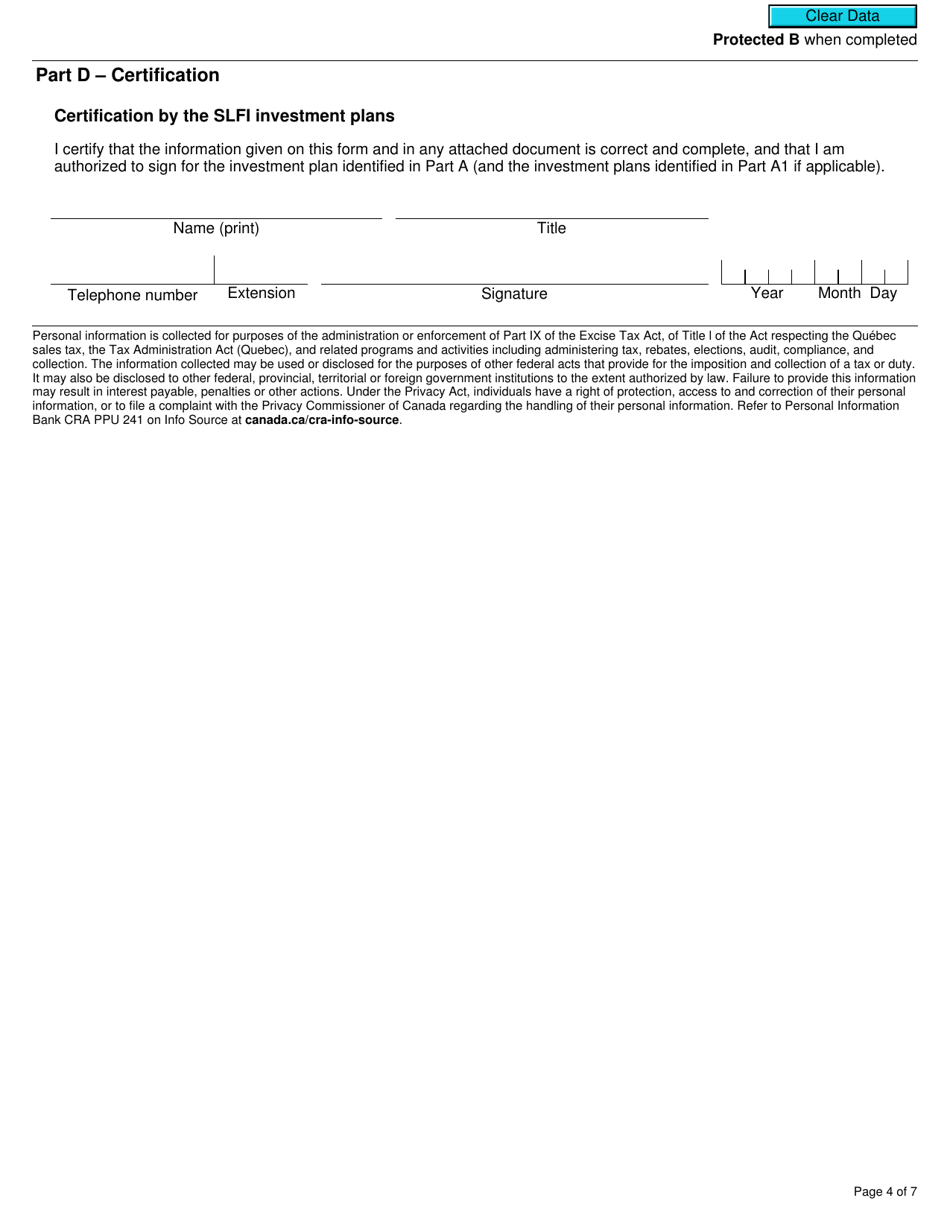

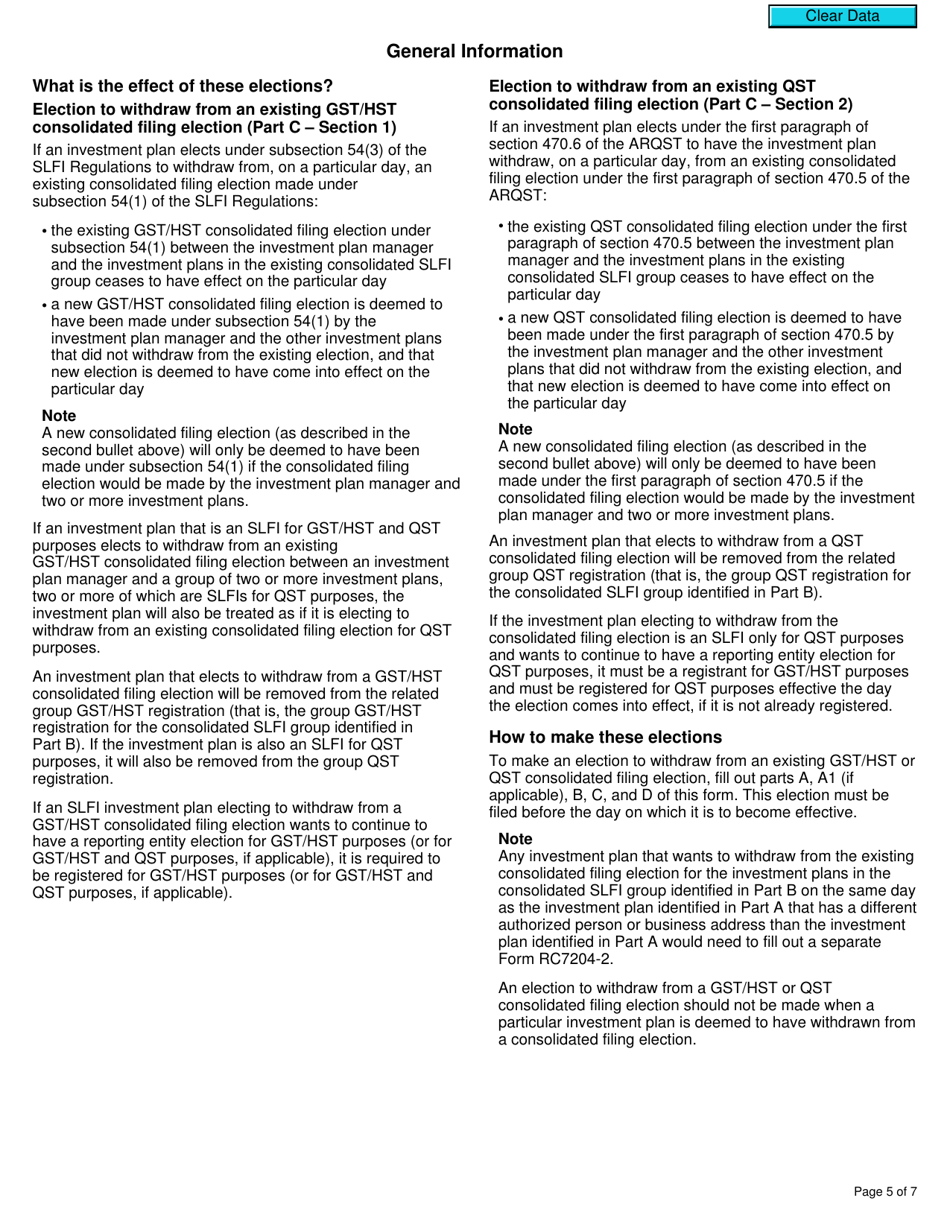

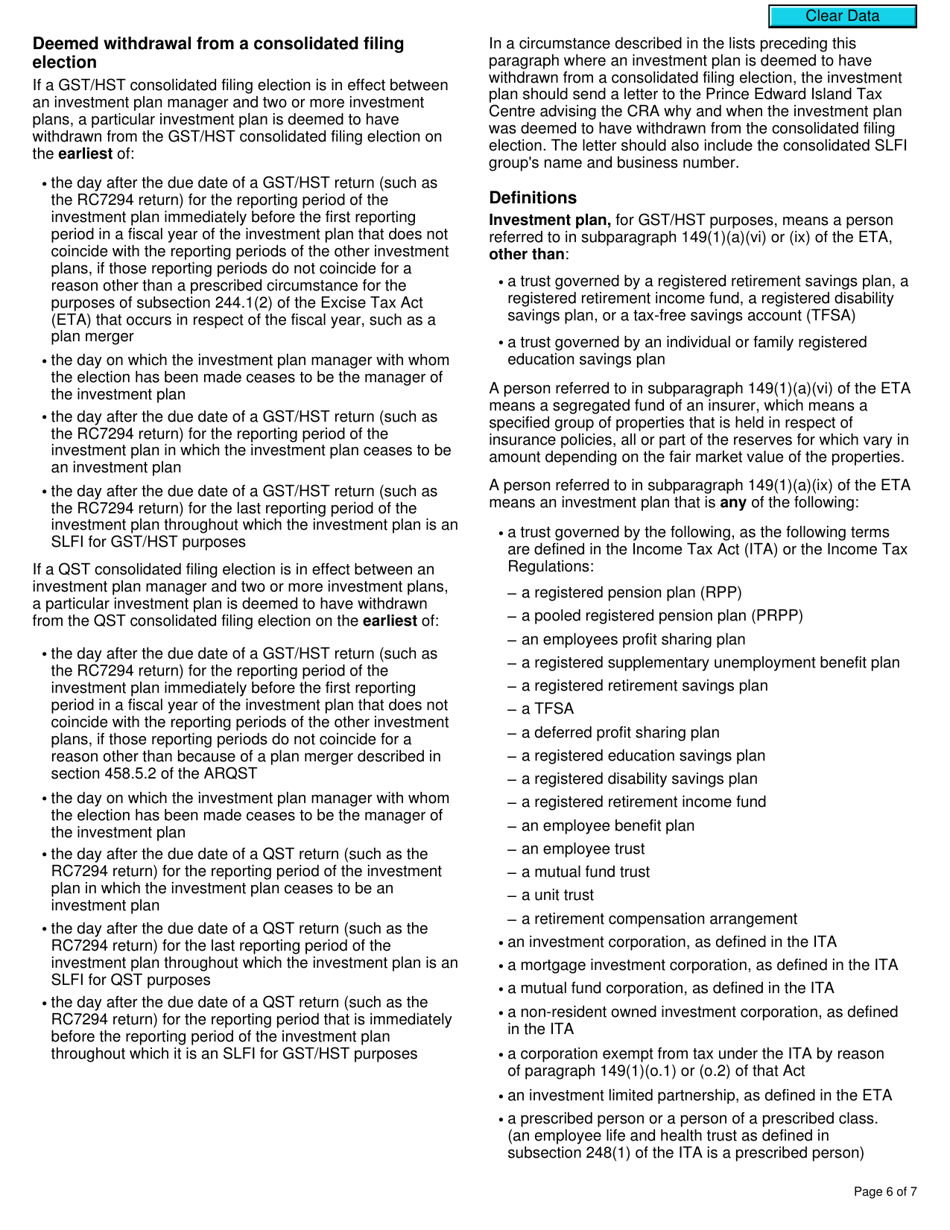

Form RC7204-2 Elections to Withdraw From a Consolidated Filing Election for a Selected Listed Financial Institution for GST/HST and QST Purposes or Only QST Purposes is used in Canada for making an election to withdraw from a consolidated filing election for Goods and Services Tax/Harmonized Sales Tax (GST/HST) and Quebec Sales Tax (QST) purposes, either for both taxes or for QST purposes only.

The financial institution files the Form RC7204-2 Elections to Withdraw from a Consolidated Filing Election for a Selected Listed Financial Institution for GST/HST and QST purposes or only QST purposes in Canada.

FAQ

Q: What is Form RC7204-2?

A: Form RC7204-2 is a form used in Canada for elections to withdraw from a consolidated filing election for GST/HST and QST purposes or only QST purposes.

Q: Who uses Form RC7204-2?

A: This form is used by selected listed financial institutions in Canada.

Q: What is the purpose of Form RC7204-2?

A: The purpose of Form RC7204-2 is to allow selected listed financial institutions to withdraw from a consolidated filing election for GST/HST and QST purposes or only QST purposes.

Q: What does GST stand for?

A: GST stands for Goods and Services Tax, which is a tax applied on the supply of goods and services in Canada.

Q: What does QST stand for?

A: QST stands for Quebec Sales Tax, which is a tax applied on the supply of goods and services in the province of Quebec.

Q: Who needs to file Form RC7204-2?

A: Selected listed financial institutions that want to withdraw from a consolidated filing election for GST/HST and QST purposes or only QST purposes need to file Form RC7204-2.

Q: Are there any deadlines for filing Form RC7204-2?

A: Yes, there are specific deadlines for filing Form RC7204-2. It is important to refer to the instructions provided with the form or consult the CRA for the current deadlines.

Q: What should I do if I need help with Form RC7204-2?

A: If you need help with Form RC7204-2, you can contact the Canada Revenue Agency directly or consult a tax professional for assistance.