This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC519

for the current year.

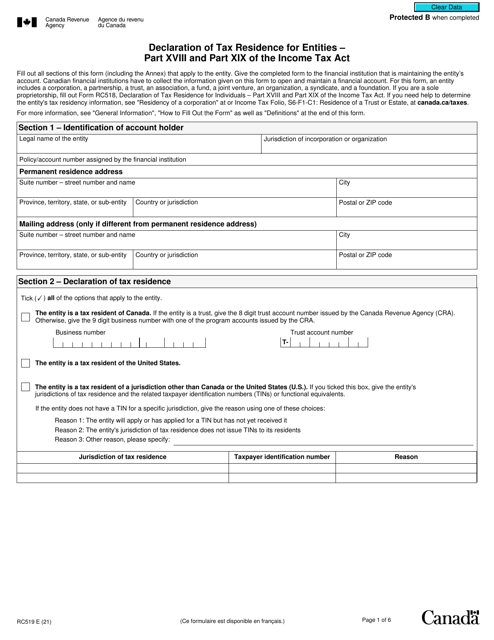

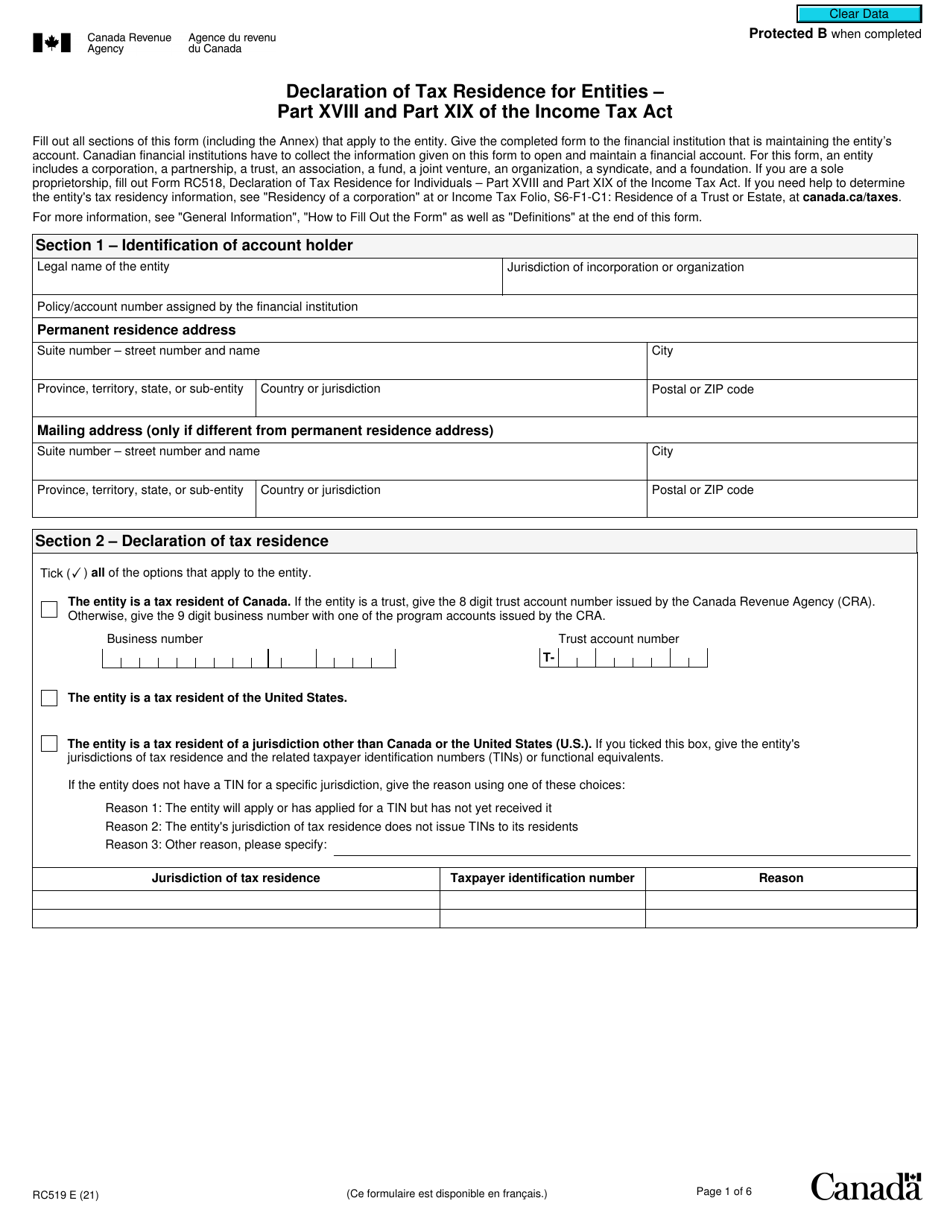

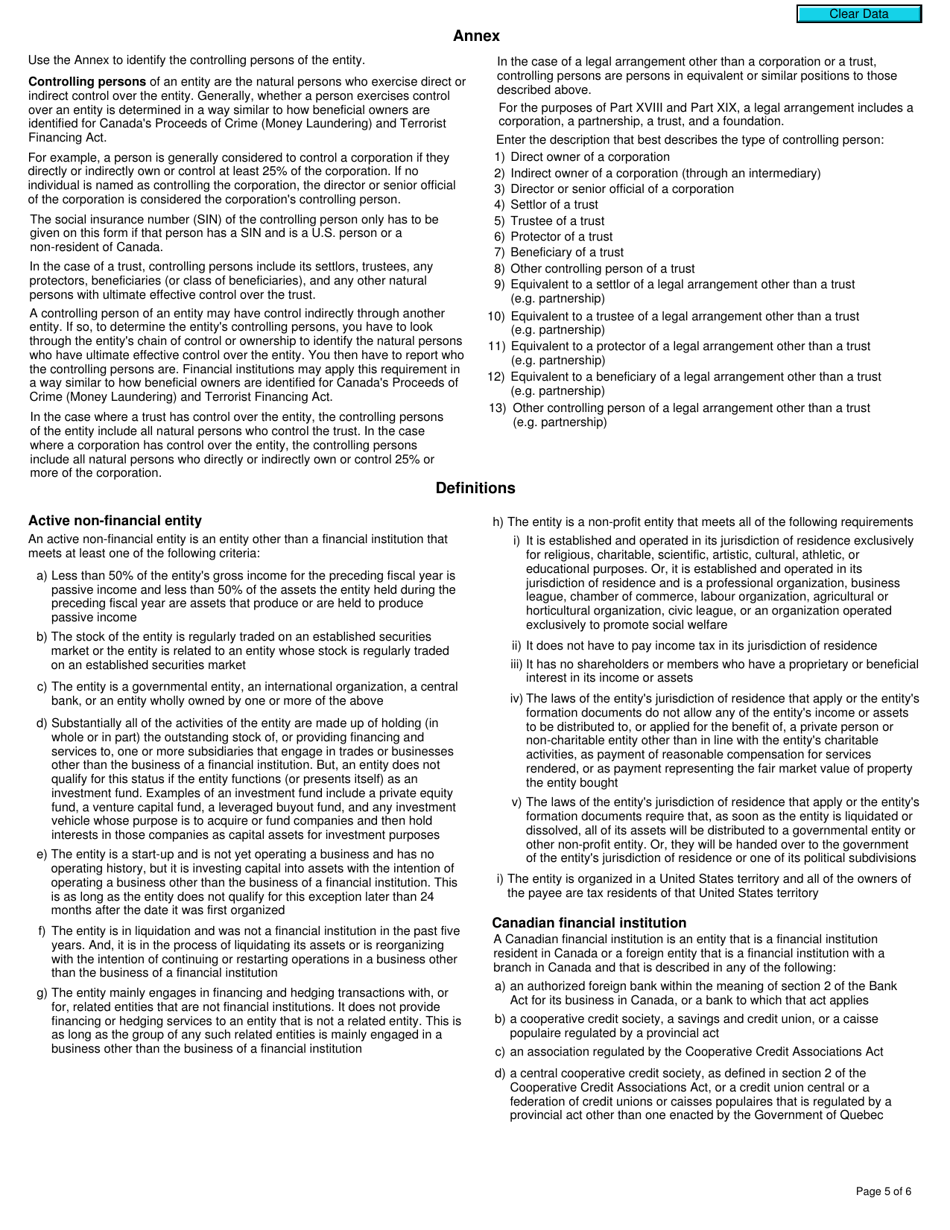

Form RC519 Declaration of Tax Residence for Entities - Part Xviii and Part Xix of the Income Tax Act - Canada

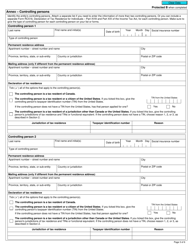

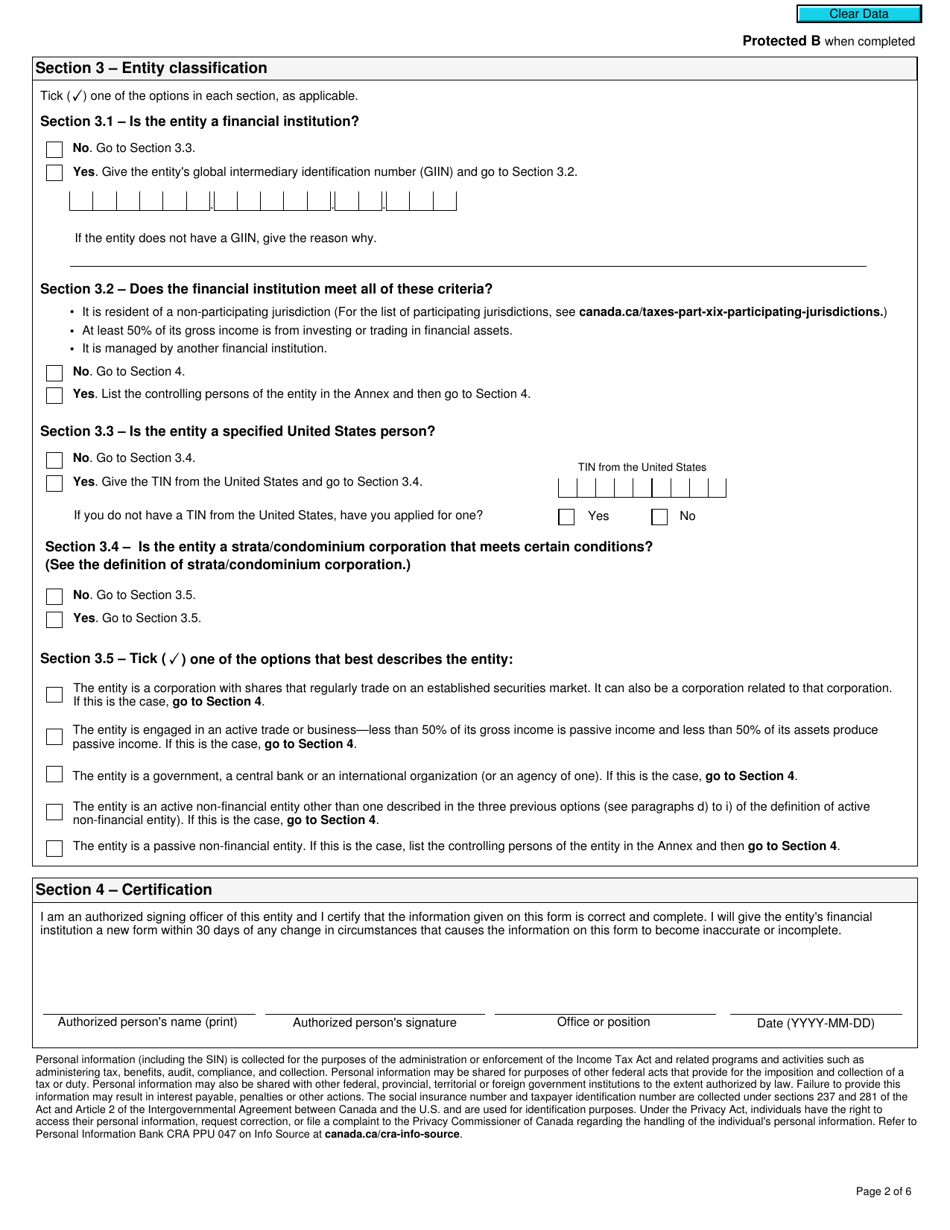

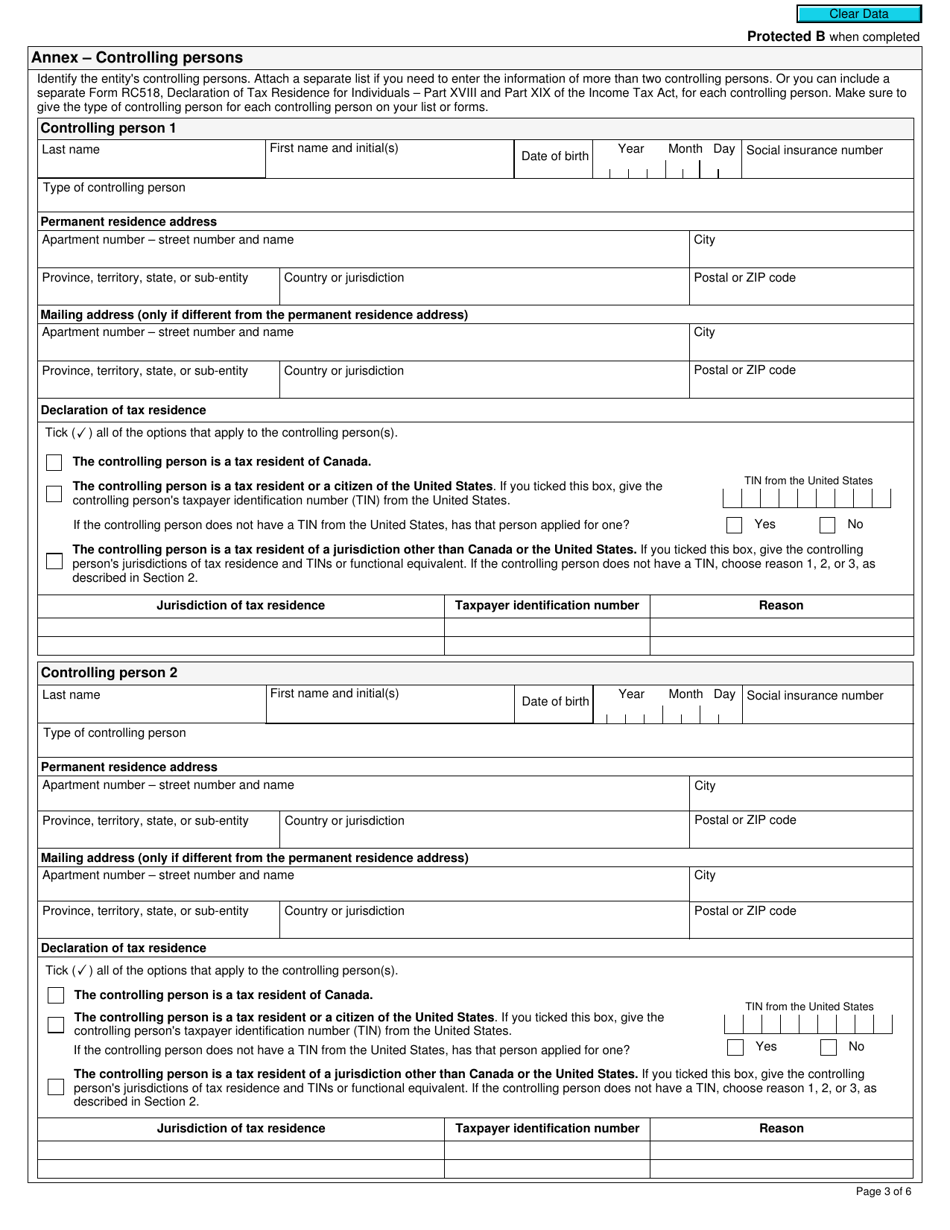

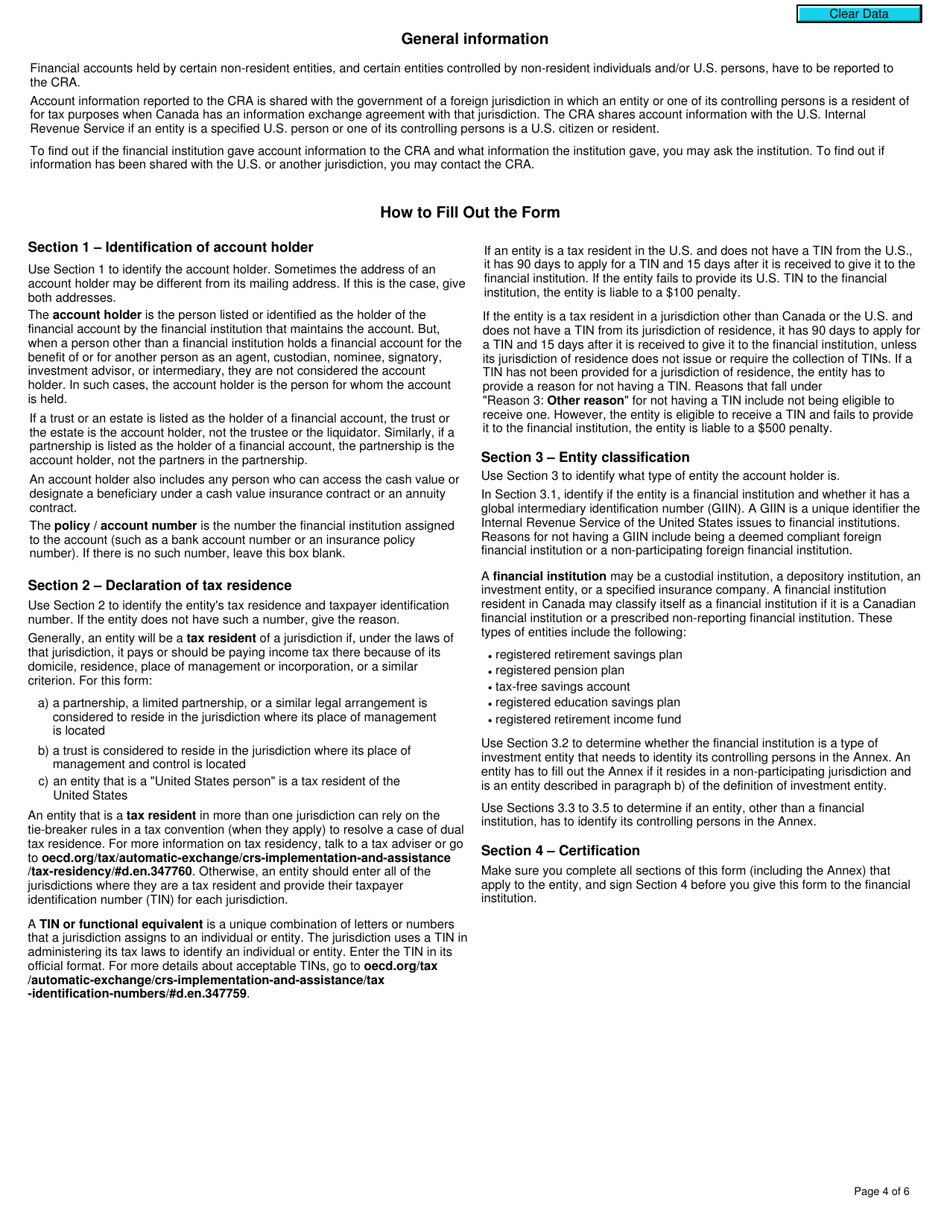

Form RC519 Declaration of Tax Residence for Entities - Part XVIII and Part XIX of the Income Tax Act in Canada is used for declaring tax residence for entities. It is specifically designed for entities that are considered Canadian residents for tax purposes. The form helps entities to provide necessary information related to their tax residence status and declare their eligibility for certain tax benefits or exemptions.

The Form RC519 Declaration of Tax Residence for Entities - Part XVIII and Part XIX of the Income Tax Act - Canada is filed by entities who need to declare their tax residence in Canada.

FAQ

Q: What is Form RC519?

A: Form RC519 is the Declaration of Tax Residence for Entities form.

Q: What does Part XVIII of the Income Tax Act refer to?

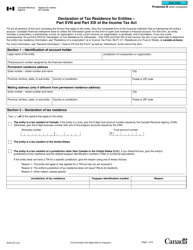

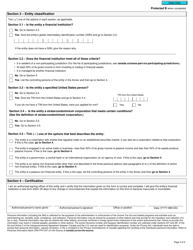

A: Part XVIII of the Income Tax Act refers to the rules regarding withholding tax on certain payments.

Q: What does Part XIX of the Income Tax Act refer to?

A: Part XIX of the Income Tax Act refers to the reporting requirements for certain transactions with non-residents.

Q: Who should complete Form RC519?

A: Entities that are required to prove their tax residency status in Canada should complete Form RC519.

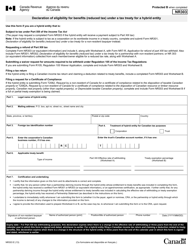

Q: What information is required in Part XVIII of Form RC519?

A: Part XVIII of Form RC519 requires information on the type of payment subject to withholding tax and the applicable tax treaty provisions.

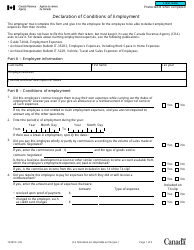

Q: What information is required in Part XIX of Form RC519?

A: Part XIX of Form RC519 requires information on certain transactions with non-residents, including amounts paid or credited and the name of the non-resident.

Q: Is Form RC519 only applicable to Canadian residents?

A: No, Form RC519 can also be used by entities that are not Canadian residents but have tax obligations in Canada.