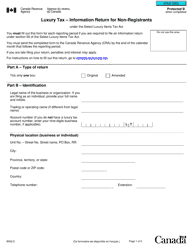

This version of the form is not currently in use and is provided for reference only. Download this version of

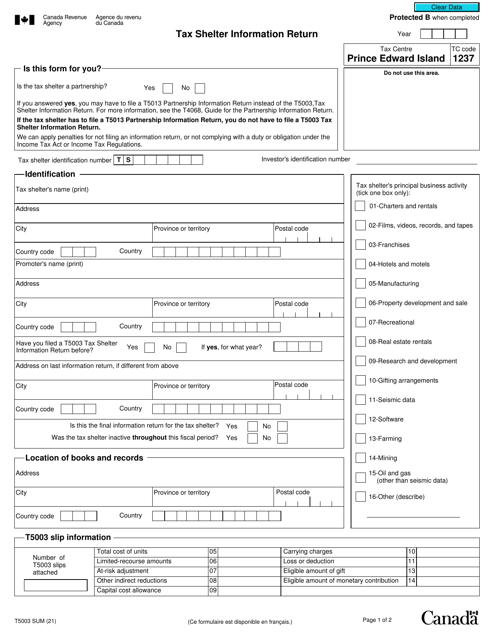

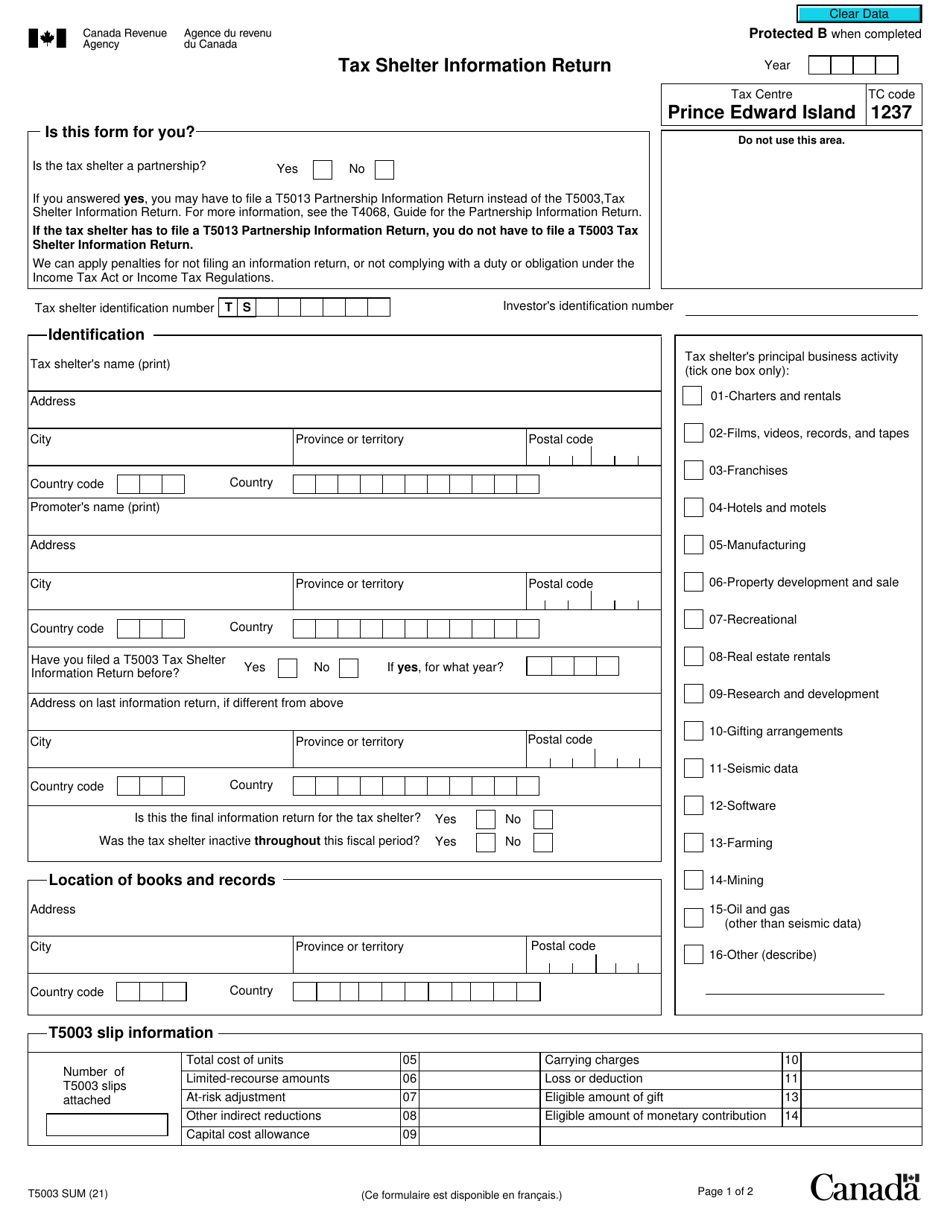

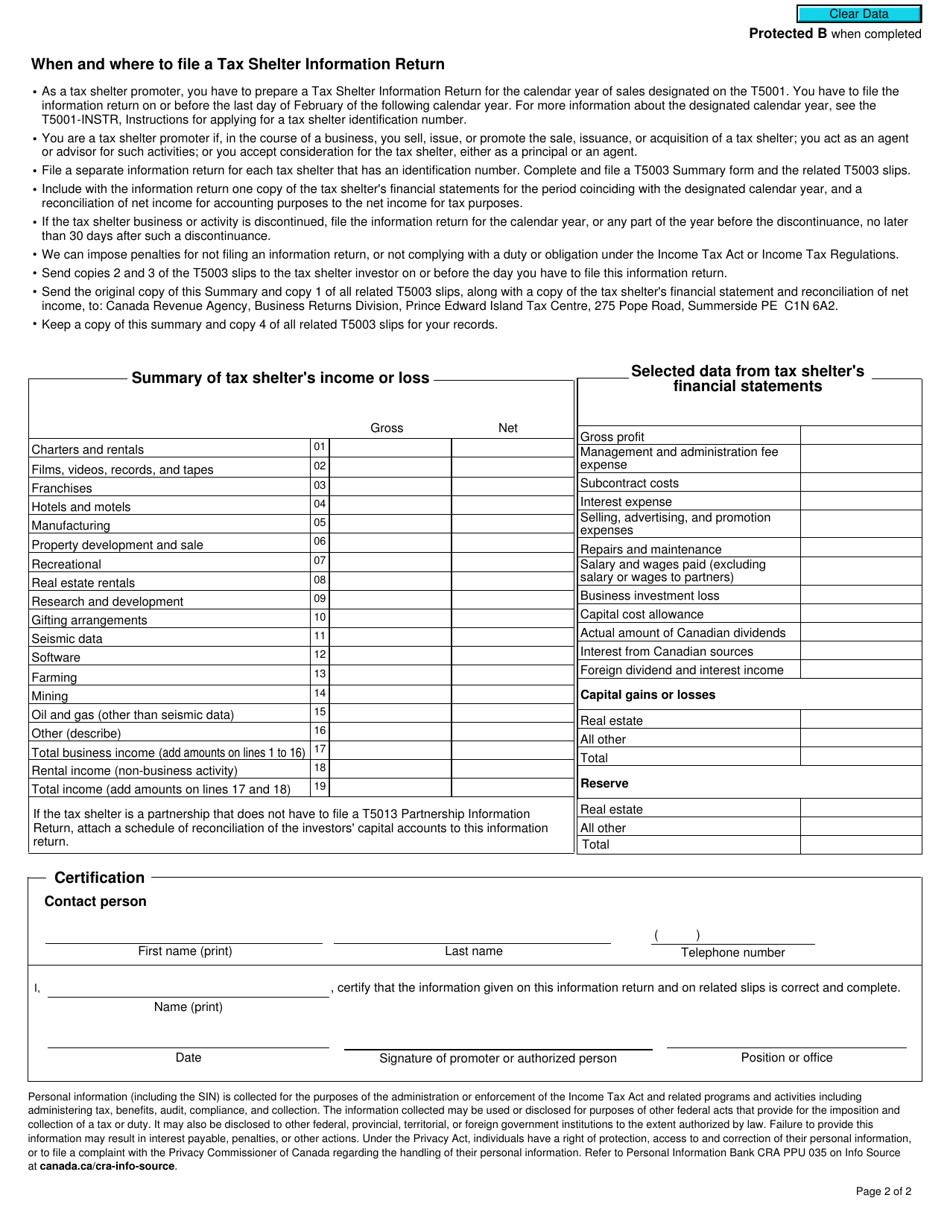

Form T5003 SUM

for the current year.

Form T5003 SUM Tax Shelter Information Return - Canada

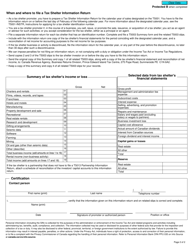

Form T5003 SUM Tax Shelter Information Return is used by tax shelters in Canada to report information about their operations to the Canada Revenue Agency (CRA). It provides details about the tax shelter's structure, investors, and financial activities.

The promoter of the tax shelter files the Form T5003 SUM Tax Shelter Information Return in Canada.

FAQ

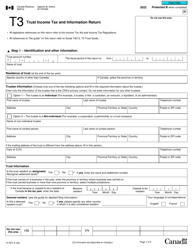

Q: What is Form T5003?

A: Form T5003 is the SUM Tax Shelter Information Return.

Q: Who needs to file Form T5003?

A: Any taxpayer who participated in a tax shelter in Canada needs to file Form T5003.

Q: What information is required on Form T5003?

A: Form T5003 requires information about the tax shelter and your participation, including the receipt number and the amount invested.

Q: When is the deadline to file Form T5003?

A: The deadline to file Form T5003 is within 90 days after the end of the year in which you participated in the tax shelter.

Q: What happens if I don't file Form T5003?

A: If you fail to file Form T5003, you may be subject to penalties and interest.

Q: Can I file Form T5003 electronically?

A: No, Form T5003 can only be filed on paper.

Q: Are there any other forms related to tax shelters in Canada?

A: Yes, in addition to Form T5003, you may also need to file Form T5004 and Form T5013, depending on the type of tax shelter and your involvement.