This version of the form is not currently in use and is provided for reference only. Download this version of

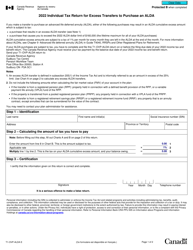

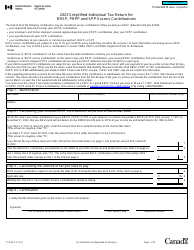

Form T1E-OVP

for the current year.

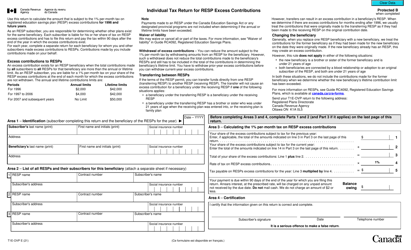

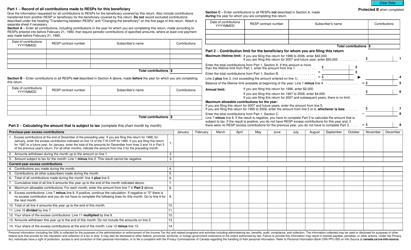

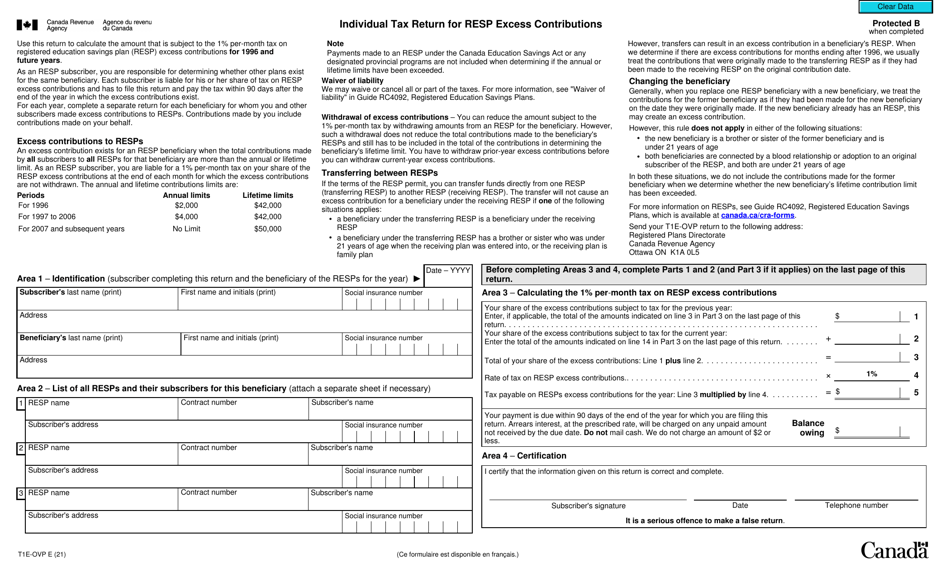

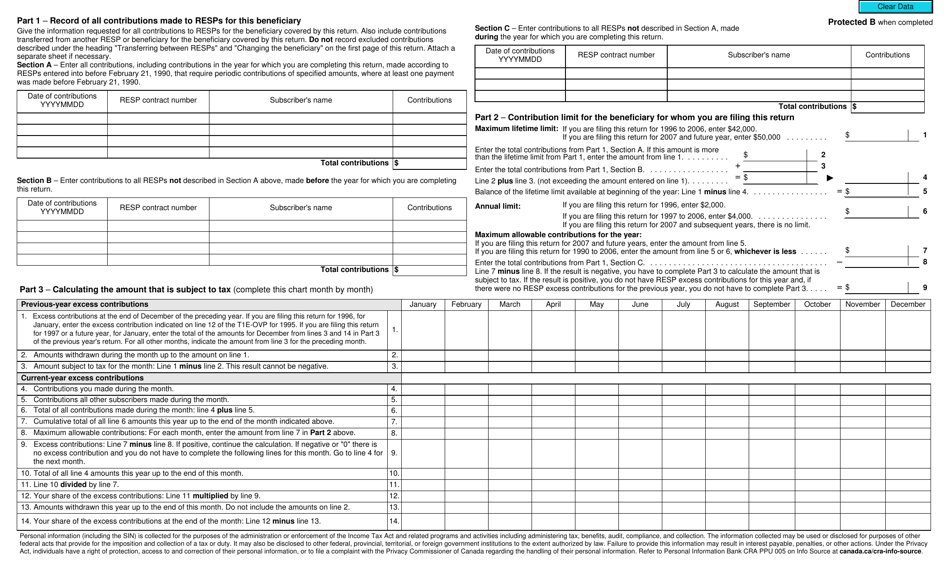

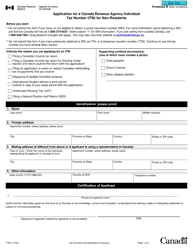

Form T1E-OVP Individual Tax Return for Resp Excess Contributions - Canada

Form T1E-OVP in Canada is used for reporting excess contributions to a Registered Education Savings Plan (RESP) on an individual's tax return. This form helps individuals rectify any excess contributions made to their RESP and avoid penalties.

The individual taxpayer would file the Form T1E-OVP for RESP excess contributions in Canada.

FAQ

Q: What is Form T1E-OVP?

A: Form T1E-OVP is an individual tax return form in Canada specifically used for reporting excess contributions to a registered education savings plan (RESP).

Q: What are excess contributions to an RESP?

A: Excess contributions to an RESP refer to contributions that exceed the lifetime limit set by the government. These excess contributions may incur penalties and should be reported on Form T1E-OVP.

Q: Who needs to file Form T1E-OVP?

A: Any individual who has made excess contributions to an RESP needs to file Form T1E-OVP along with their regular tax return.

Q: How do I report excess contributions on Form T1E-OVP?

A: On Form T1E-OVP, you must provide details about the excess contributions made and calculate the penalty amount owed based on the excess.

Q: When is the deadline to file Form T1E-OVP?

A: The deadline to file Form T1E-OVP is the same as the deadline for your regular tax return, which is usually April 30th.

Q: What happens if I don't file Form T1E-OVP?

A: Failure to file Form T1E-OVP can result in penalties and interest charges on the excess contributions made to an RESP.

Q: Can I amend a previously filed Form T1E-OVP?

A: Yes, if you discover an error on a previously filed Form T1E-OVP, you can file an amended version of the form to correct the mistake.