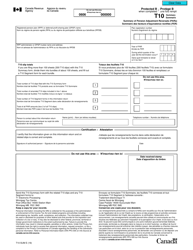

This version of the form is not currently in use and is provided for reference only. Download this version of

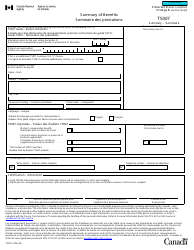

Form T3 SUM

for the current year.

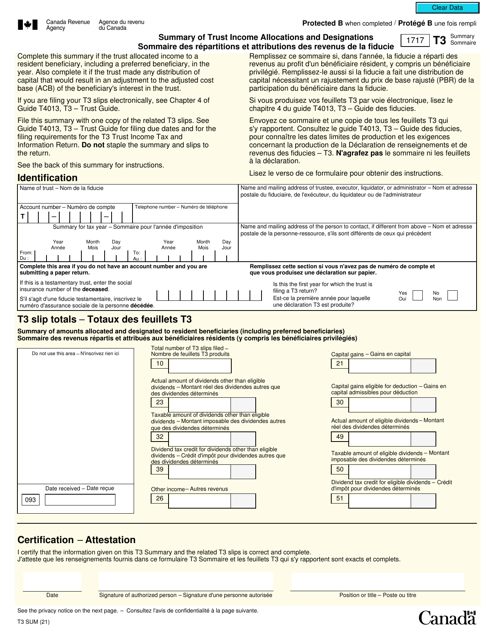

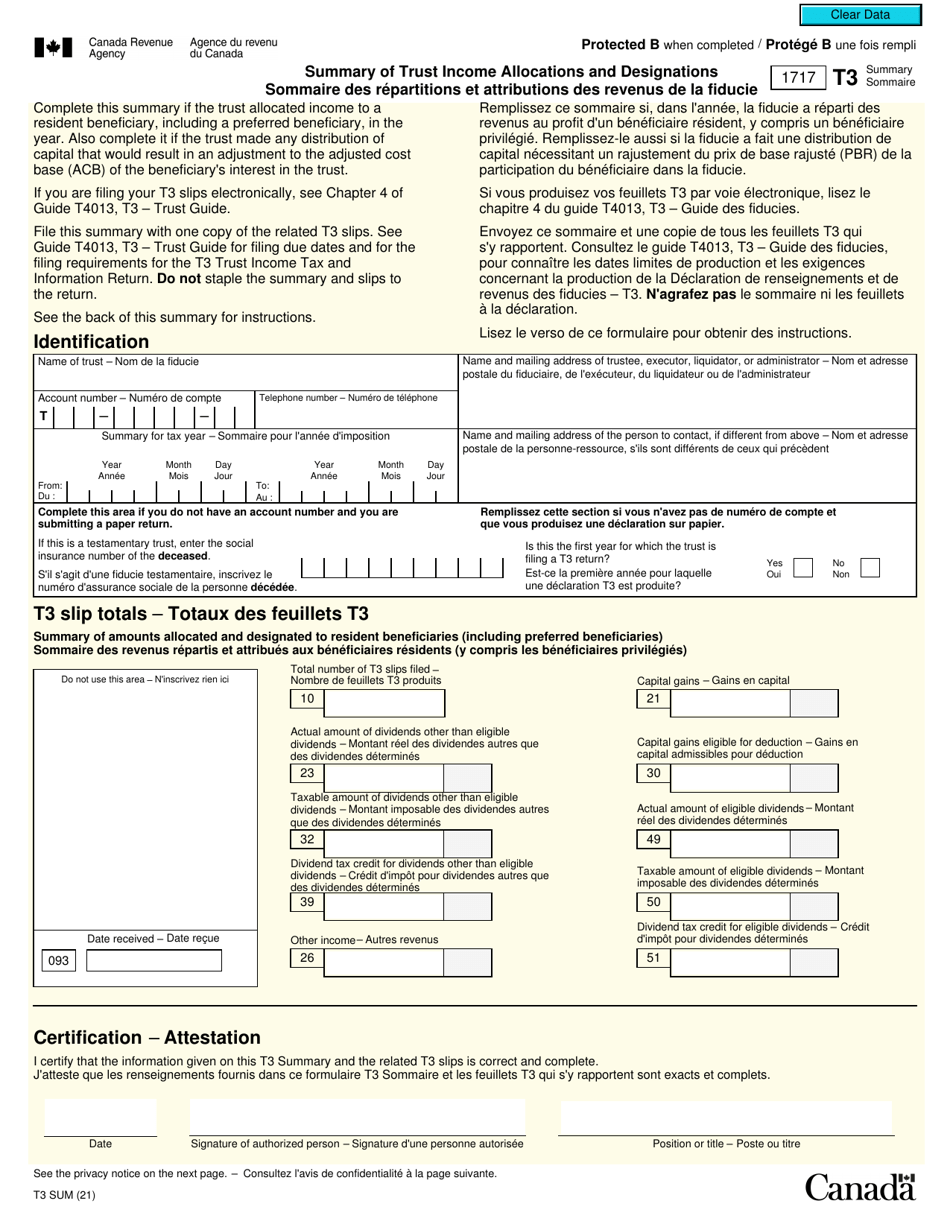

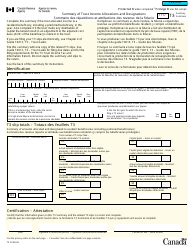

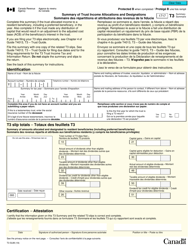

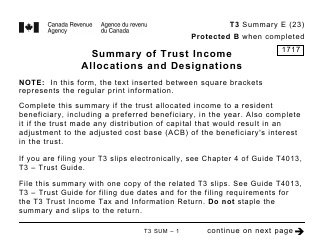

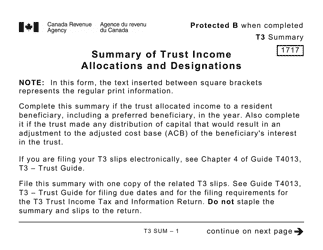

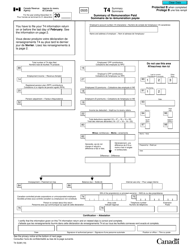

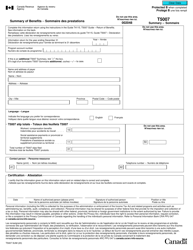

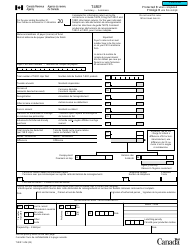

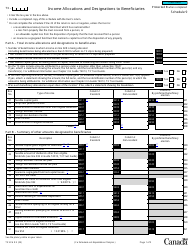

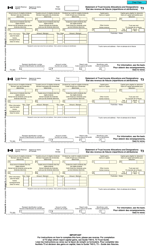

Form T3 SUM Summary of Trust Income Allocations and Designations - Canada (English / French)

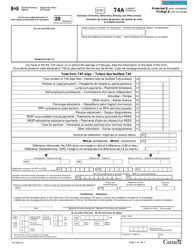

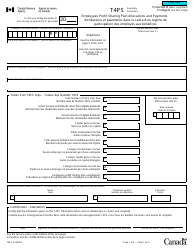

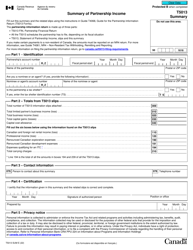

Form T3 SUM, also known as the Summary of Trust Income Allocations and Designations, is used in Canada for reporting trust income allocations and designations. This form is filed by trustees of Canadian trusts to indicate how the trust's income is allocated among the beneficiaries. It provides a summary of the trust's income and how it is distributed to different beneficiaries. The form is available in both English and French to cater to the linguistic requirements of the taxpayers.

The Form T3 SUM Summary of Trust Income Allocations and Designations in Canada is filed by the trustee or the authorized representative of a trust. They may file the form in either English or French, depending on their preference.

FAQ

Q: What is Form T3 SUM?

A: Form T3 SUM is a tax form used in Canada to summarize the income allocations and designations of a trust.

Q: Who needs to file Form T3 SUM?

A: Form T3 SUM is required to be filed by trusts in Canada that have allocated and designated income to their beneficiaries.

Q: What information is required to complete Form T3 SUM?

A: To complete Form T3 SUM, you will need to provide details about the trust and its beneficiaries, including their names, social insurance numbers, and the amount of income allocated to them.

Q: When is the deadline to file Form T3 SUM?

A: The deadline to file Form T3 SUM is 90 days after the end of the trust's taxation year.

Q: What happens if I don't file Form T3 SUM on time?

A: If you fail to file Form T3 SUM by the deadline, you may be subject to penalties and interest charges imposed by the CRA.

Q: Do I need to send any supporting documents with Form T3 SUM?

A: In most cases, you do not need to send supporting documents with Form T3 SUM. However, you should keep them for your records in case the CRA requests them.

Q: Can I make changes to Form T3 SUM after filing?

A: If you need to make changes to Form T3 SUM after filing, you must submit an amended return using Form T3ADJ.