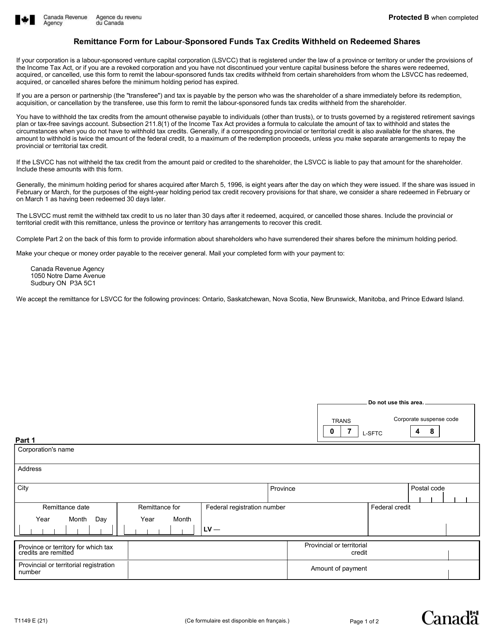

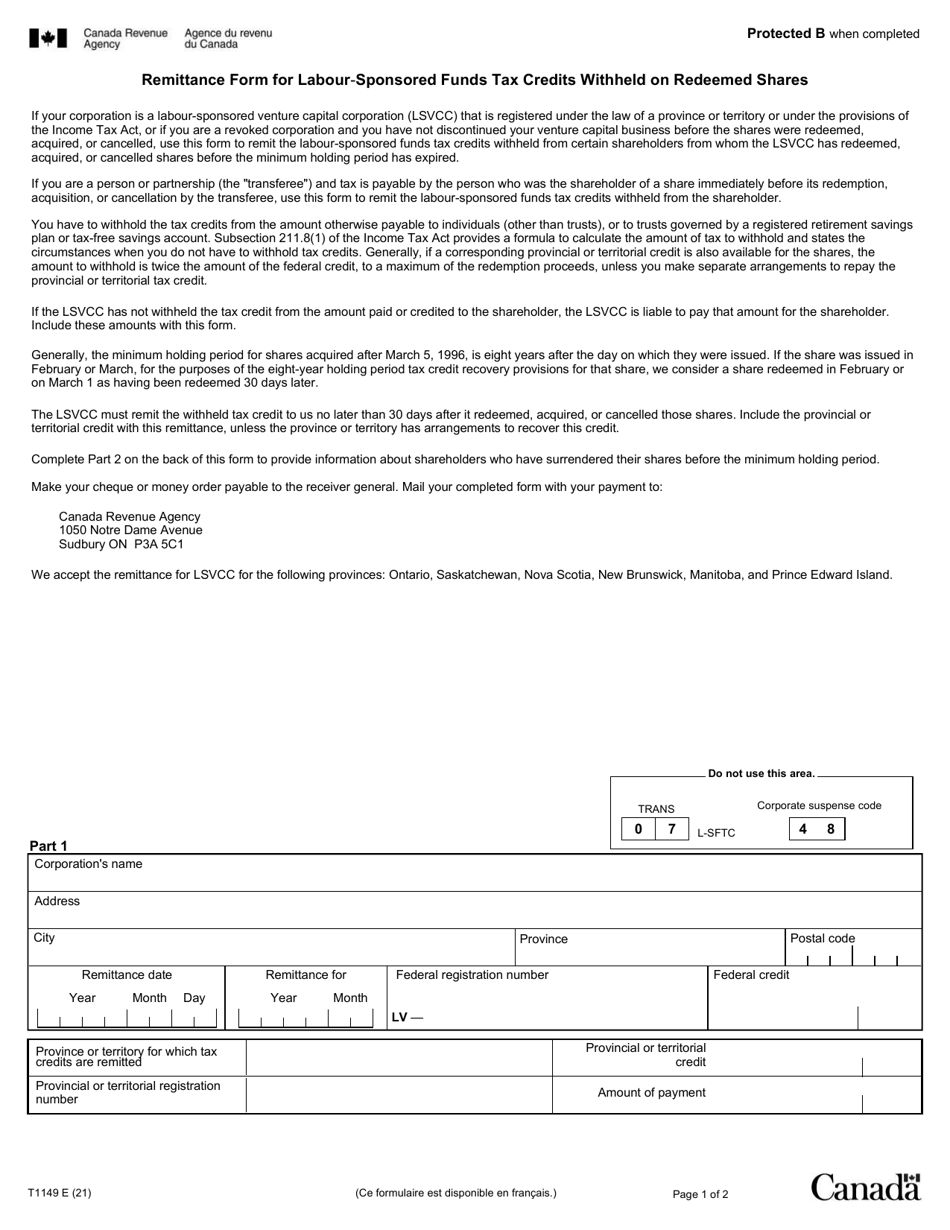

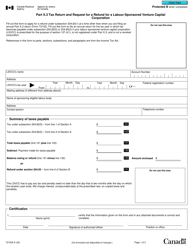

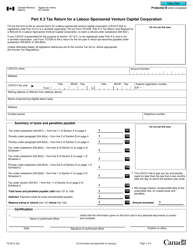

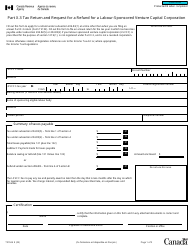

Form T1149 Remittance Form for Labour-Sponsored Funds Tax Credits Withheld on Redeemed Shares - Canada

Form T1149 is used in Canada for reporting and remitting the taxes withheld on redeemed shares of Labour-Sponsored Funds.

The taxpayer who redeemed the shares files the Form T1149 Remittance Form for Labour-Sponsored Funds Tax Credits withheld on redeemed shares in Canada.

FAQ

Q: What is Form T1149?

A: Form T1149 is the Remittance Form for Labour-Sponsored Funds Tax Credits Withheld on Redeemed Shares in Canada.

Q: What is the purpose of Form T1149?

A: The purpose of Form T1149 is to remit the tax credits withheld on redeemed shares of labour-sponsored funds in Canada.

Q: Who needs to complete Form T1149?

A: Anyone who has withheld tax credits on redeemed shares of labour-sponsored funds in Canada needs to complete Form T1149.

Q: How do I complete Form T1149?

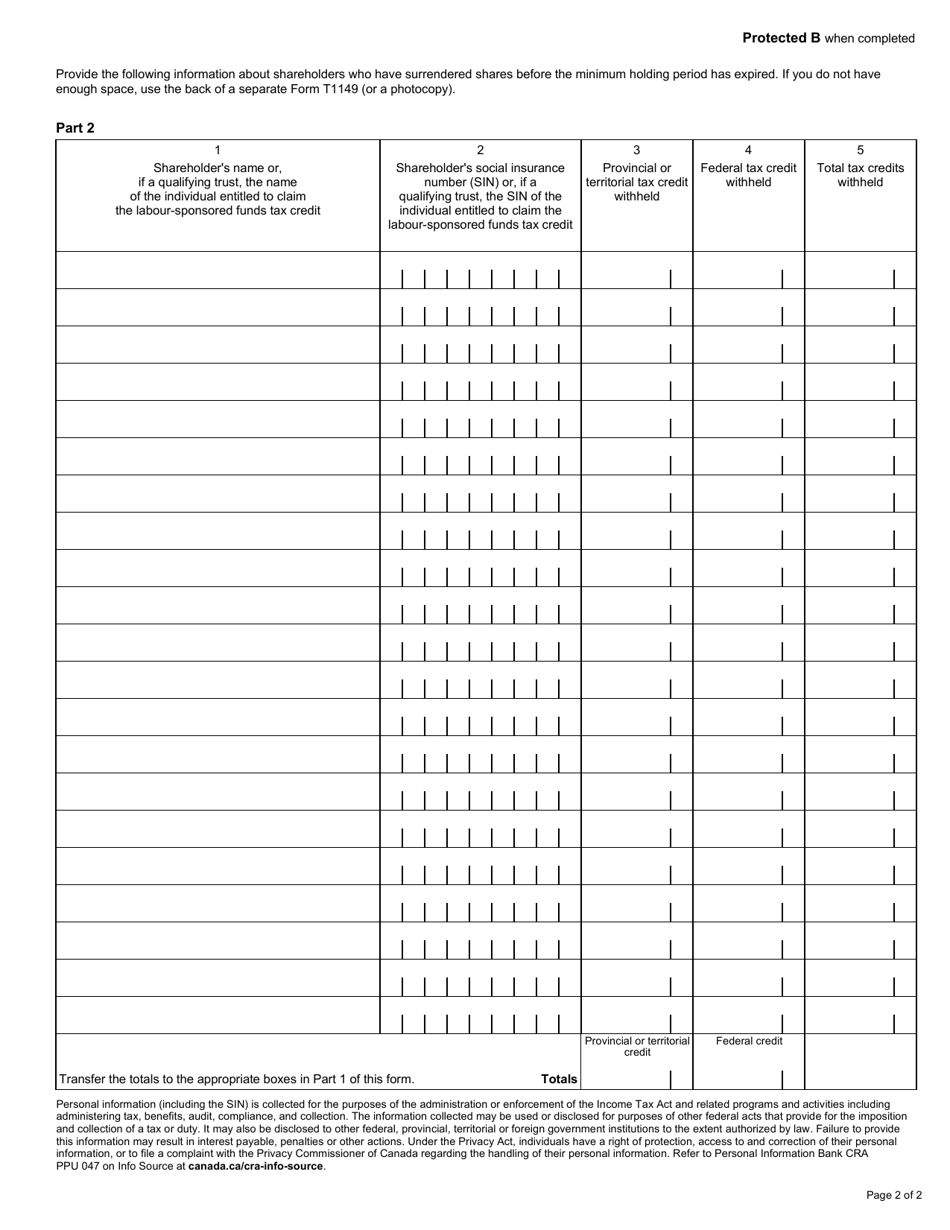

A: To complete Form T1149, you need to provide the required information, including the amount of tax credits withheld, the name of the labour-sponsored fund, and your contact information.

Q: When is Form T1149 due?

A: Form T1149 is due on or before the last day of the month following the month in which the tax credits were withheld on redeemed shares.

Q: What happens if I don't file Form T1149 on time?

A: If you don't file Form T1149 on time, you may be subject to penalties and interest charges.

Q: Are there any specific instructions for completing Form T1149?

A: Yes, there are specific instructions provided by the CRA on how to complete Form T1149 correctly. Make sure to review these instructions before filling out the form.