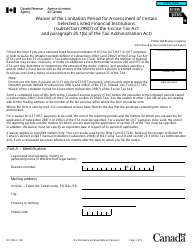

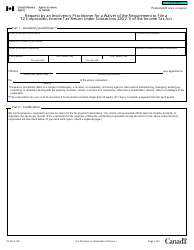

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2152 Schedule 2

for the current year.

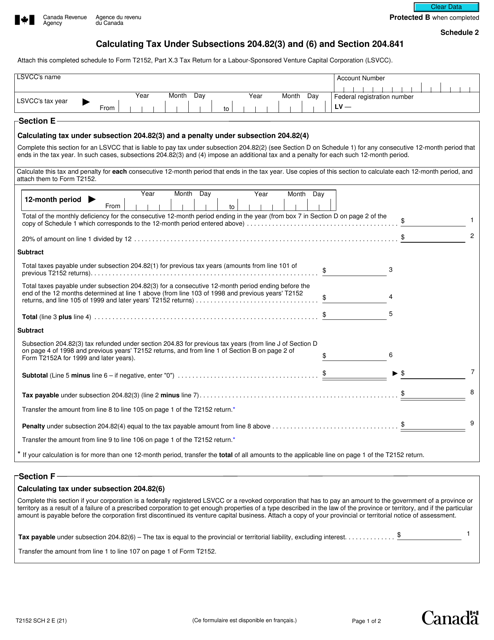

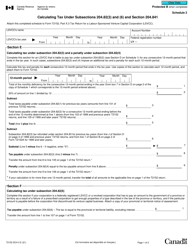

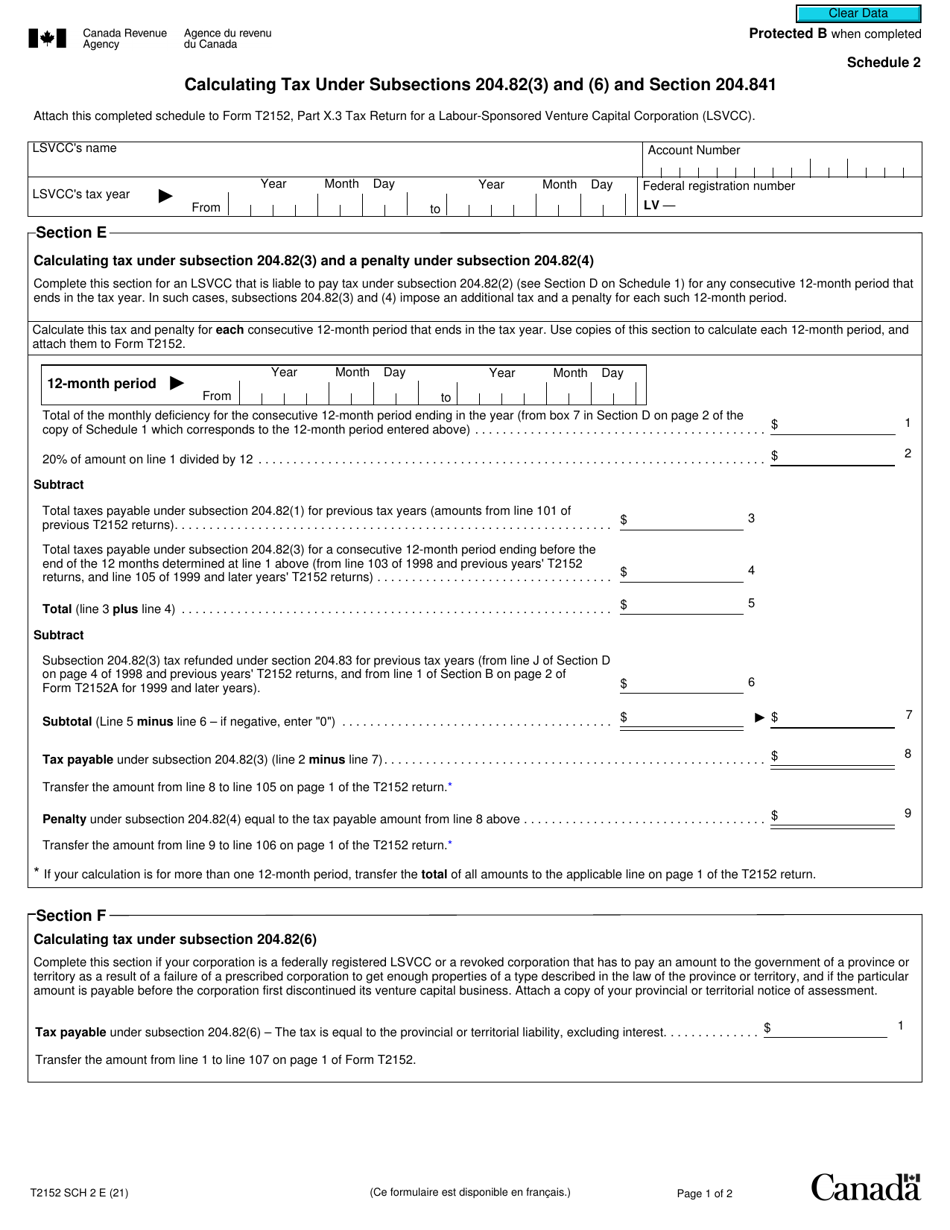

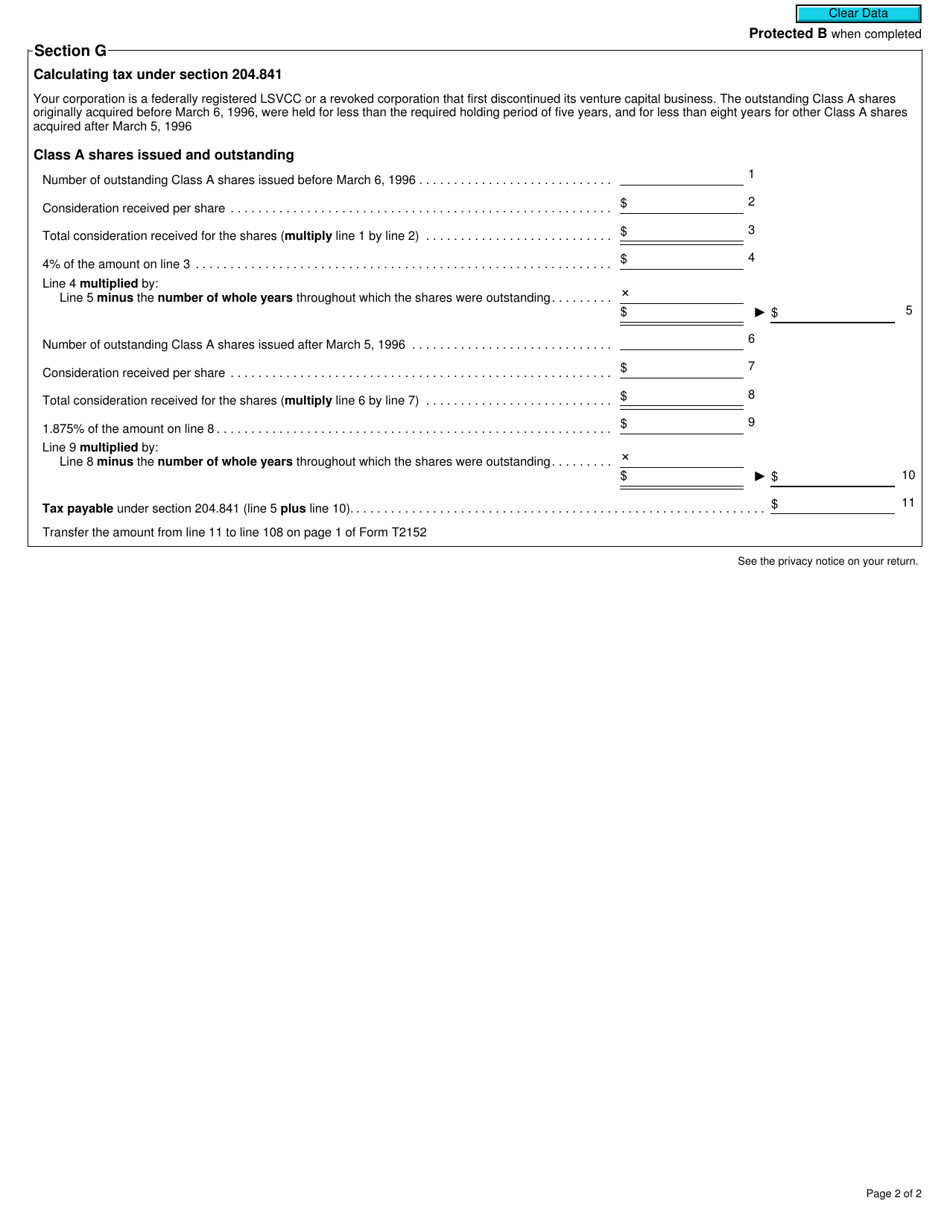

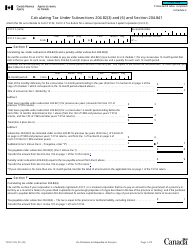

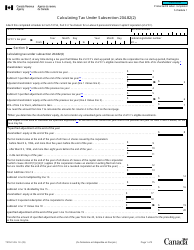

Form T2152 Schedule 2 Calculating Tax Under Subsections 204.82(3) and (6) and Section 204.841 - Canada

Form T2152 Schedule 2, "Calculating Tax Under Subsections 204.82(3) and (6) and Section 204.841," is a form used in Canada for calculating tax related to specific sections and subsections of the Income Tax Act. The form is used to determine the amount of tax owed or any deductions applicable under these specific provisions.

FAQ

Q: What is Form T2152?

A: Form T2152 is a tax form used in Canada to calculate tax under subsections 204.82(3) and (6) and section 204.841.

Q: What does Form T2152 calculate?

A: Form T2152 calculates tax under subsections 204.82(3) and (6) and section 204.841 in Canada.

Q: When is Form T2152 used?

A: Form T2152 is used when calculating tax in Canada under the specified subsections and section.

Q: Can Form T2152 be filed electronically?

A: No, Form T2152 cannot be filed electronically. It must be printed, completed, and submitted by mail.

Q: Are there any fees associated with Form T2152?

A: No, there are no fees associated with Form T2152. It is a free form provided by the CRA.

Q: What happens after I submit Form T2152?

A: After you submit Form T2152, the CRA will review your information and calculate the tax owed based on the provided subsections and section.

Q: Can I amend Form T2152 after submitting it?

A: Yes, you can amend Form T2152 after submitting it by completing a new form and submitting it to the CRA.

Q: What should I do if I have questions about Form T2152?

A: If you have questions about Form T2152, you can contact the CRA directly for assistance.