This version of the form is not currently in use and is provided for reference only. Download this version of

Form T4A-RCA

for the current year.

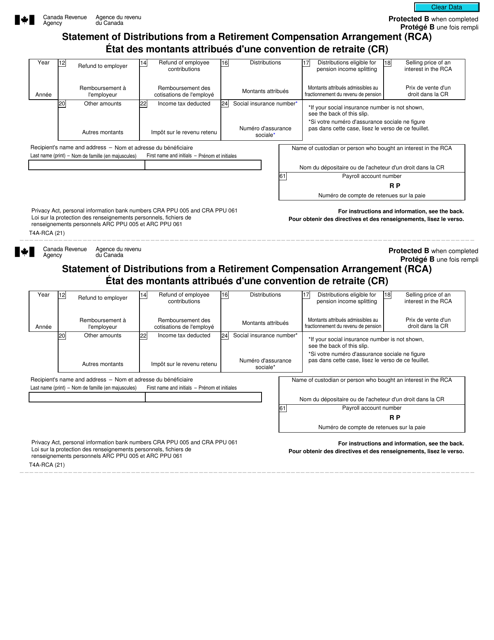

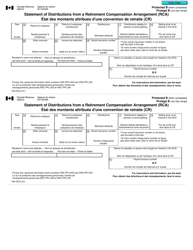

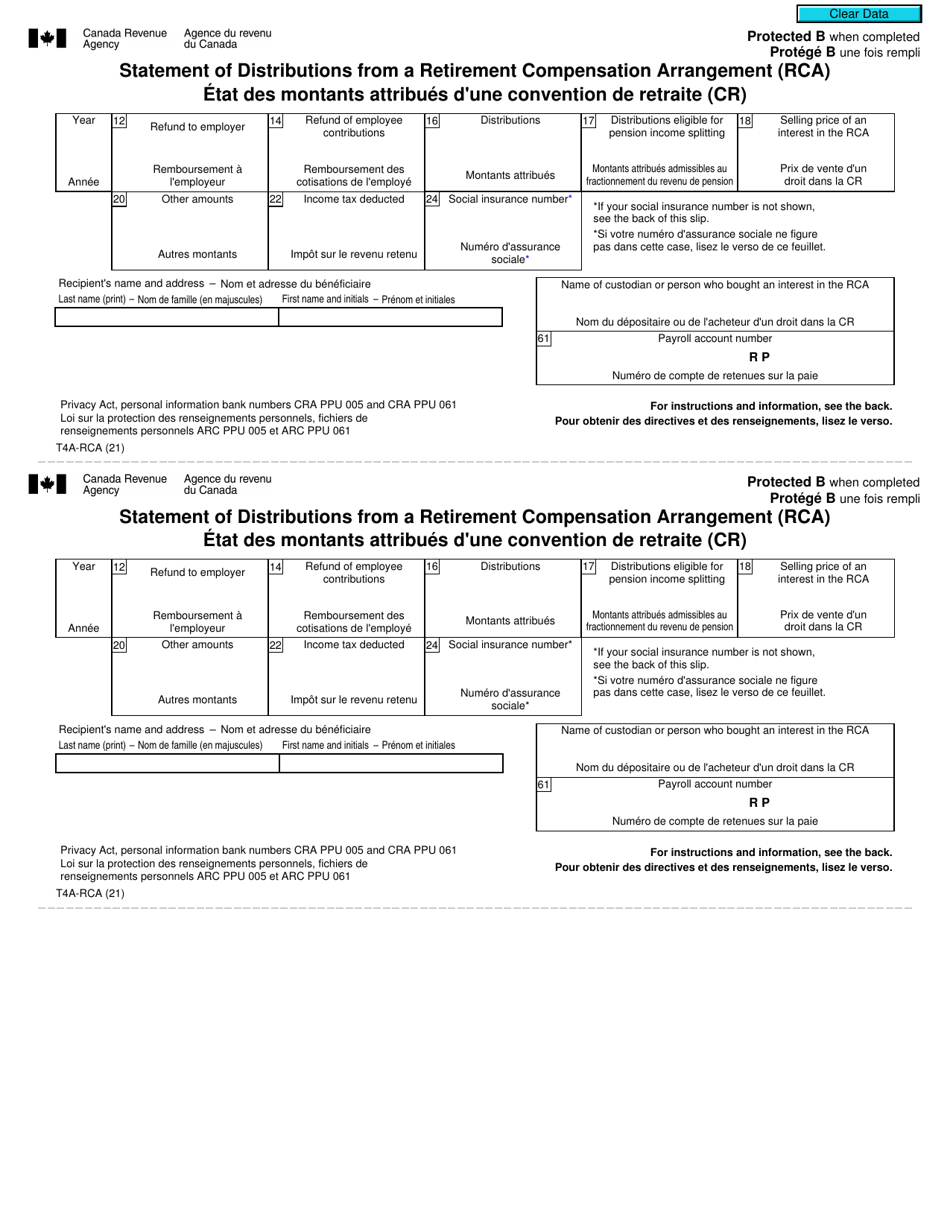

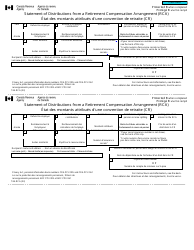

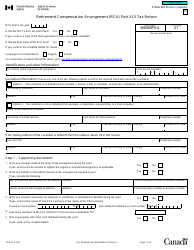

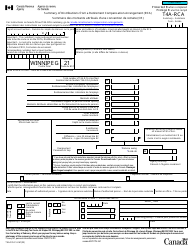

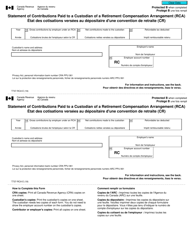

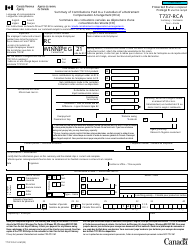

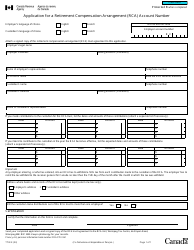

Form T4A-RCA Statement of Distributions From a Retirement Compensation Arrangement (Rca) - Canada (English / French)

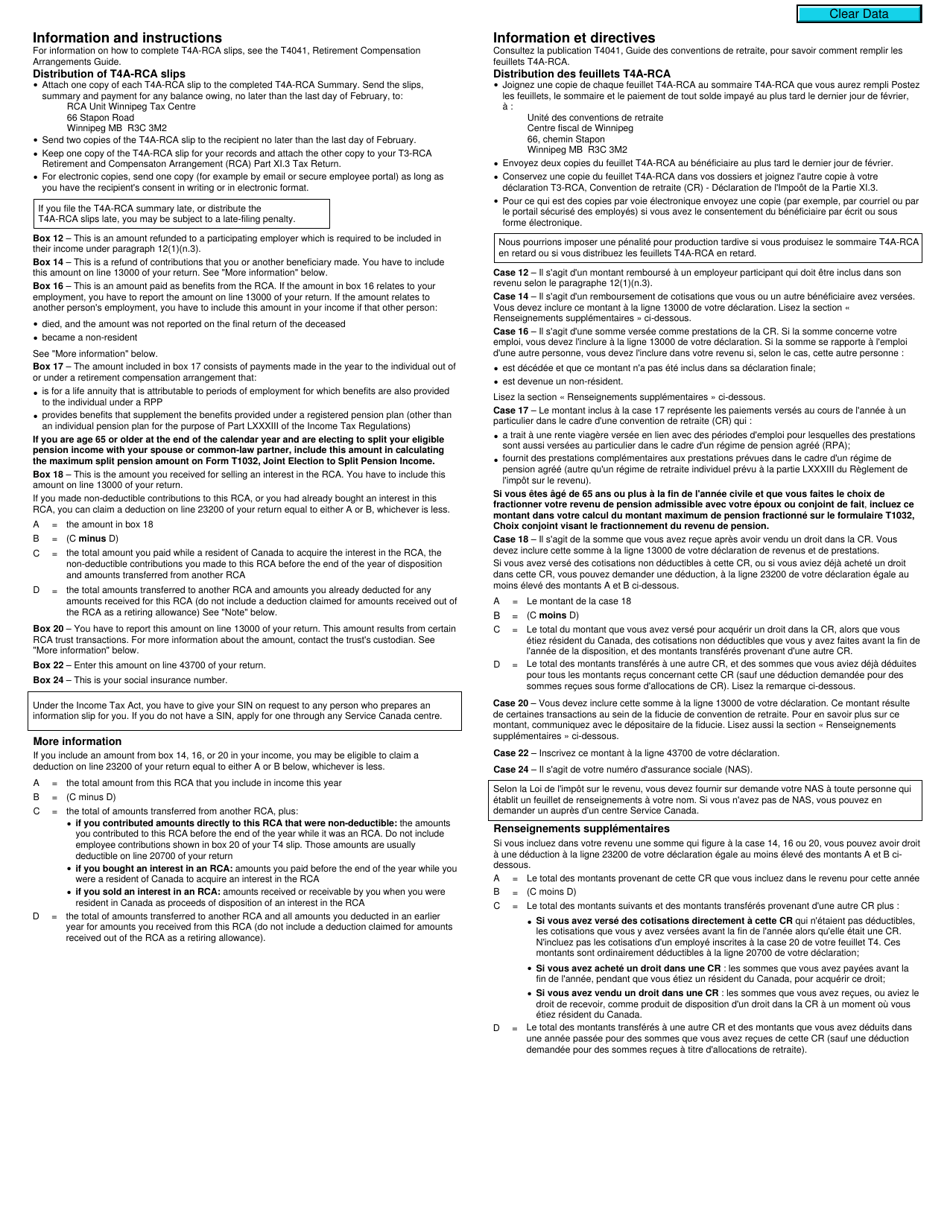

Form T4A-RCA is used in Canada to report the distributions made from a Retirement Compensation Arrangement (RCA). RCA is a type of pension plan for executives and highly paid employees. The form is used to report and declare the amount of distributions received under this arrangement to the Canada Revenue Agency (CRA).

The entity responsible for filing the Form T4A-RCA statement of distributions from a retirement compensation arrangement (RCA) in Canada is the payer or trustee of the RCA.

FAQ

Q: What is Form T4A-RCA?

A: Form T4A-RCA is a statement of distributions from a Retirement Compensation Arrangement (RCA) in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of employer-sponsored retirement plan in Canada.

Q: Who needs to complete Form T4A-RCA?

A: Employers who have made distributions from a Retirement Compensation Arrangement (RCA) need to complete Form T4A-RCA.

Q: What information is included in Form T4A-RCA?

A: Form T4A-RCA includes information about the distributions made from the Retirement Compensation Arrangement (RCA), such as the recipient's name and Social Insurance Number, the amount of the distribution, and any applicable taxes.

Q: When is Form T4A-RCA due?

A: Form T4A-RCA is due on the last day of February following the calendar year in which the distributions were made.

Q: What happens if I don't file Form T4A-RCA?

A: Failure to file Form T4A-RCA can result in penalties and interest charges imposed by the Canada Revenue Agency (CRA).